When disputes arise in the world of trading, one way to resolve them is through arbitration in stock market. This process is particularly prevalent on the National Stock Exchange (NSE) in India, where trading-related issues are brought before an arbitrator for resolution.

The NSE arbitration case against Angel One highlights the tension between a trader, Aasnik Kirti Shah, and his trading member, Angel One Ltd., and the steps both parties took to seek justice.

So, here we assist you on how to complain against Angel One.

NSE Arbitration Against Angel One: Case Detail

At the heart of this case is a trader, Aasnik Kirti Shah, whose accounts were blocked by Angel One Ltd.

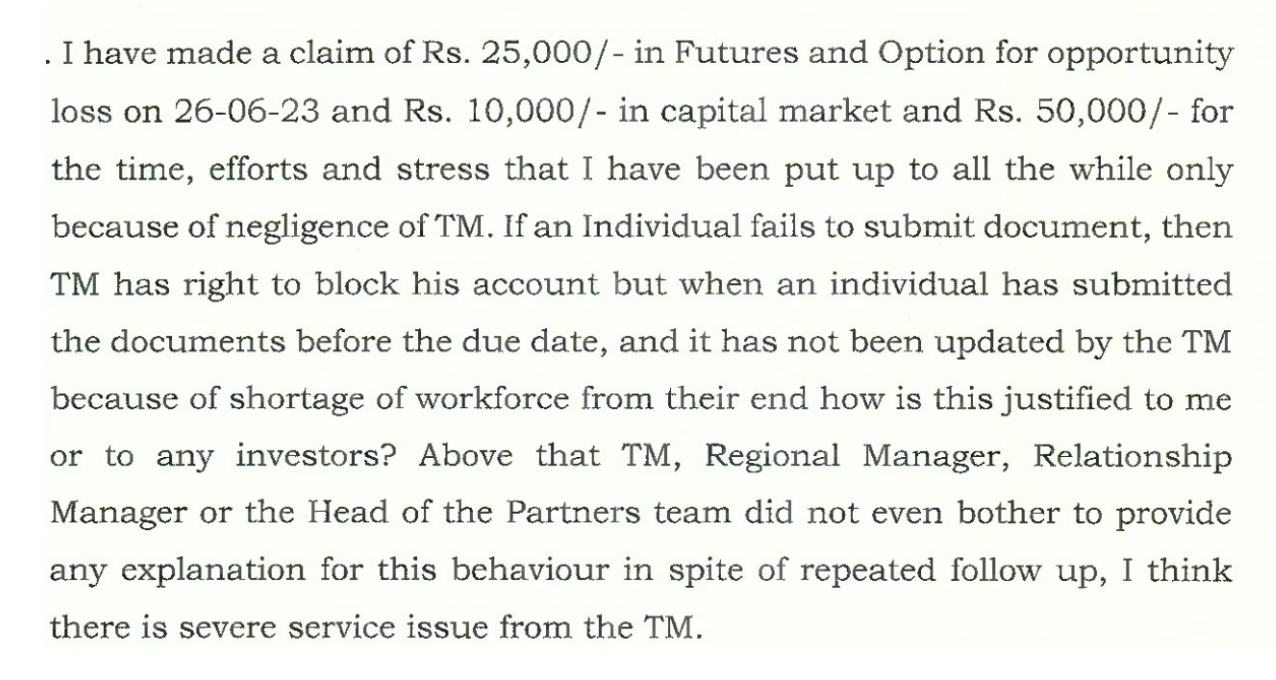

Despite providing the necessary documentation, including a family declaration, Shah’s accounts remained inaccessible. Shah filed for arbitration, seeking compensation for his opportunity losses in futures and capital markets.

He also sought damages for the mental stress and harassment he felt due to Angel One’s actions. The total claim was for Rs. 35,000 – ₹25,000 for opportunity losses and ₹10,000 for capital market losses.

Here is the timeline of events reported by the client:

1. Shah’s troubles began on June 26, 2023, when his accounts were blocked by Angel One.

2. According to Shah, despite submitting all required documents, like the family declaration, the block remained in place. He made several attempts to contact Angel One for clarification but reported receiving no response.

3. By July 2023, he escalated the issue, reaching out to the Grievance Redressal Committee (GRC) of NSE. However, he remained dissatisfied with the GRC’s findings. They concluded that some of the information he provided was inaccurate, including his mobile number.

Angel One’s Defence

On the other side of the dispute, Angel One Ltd. defended its actions, stating that Shah’s accounts were blocked for noncompliance with certain documentation requirements, particularly the family declaration.

Angel One claimed that Shah had failed to submit the necessary documents in time, resulting in the blocking of his accounts.

Angel One further emphasised that Shah had not provided proof of his claim and that his accounts were functioning properly as of June 27, 2023.

They also argued that some of the accounts under dispute were not even Shah’s, claiming that he had filed for arbitration on behalf of accounts not linked to him.

The Grievance Redressal Committee’s (GRC) Findings

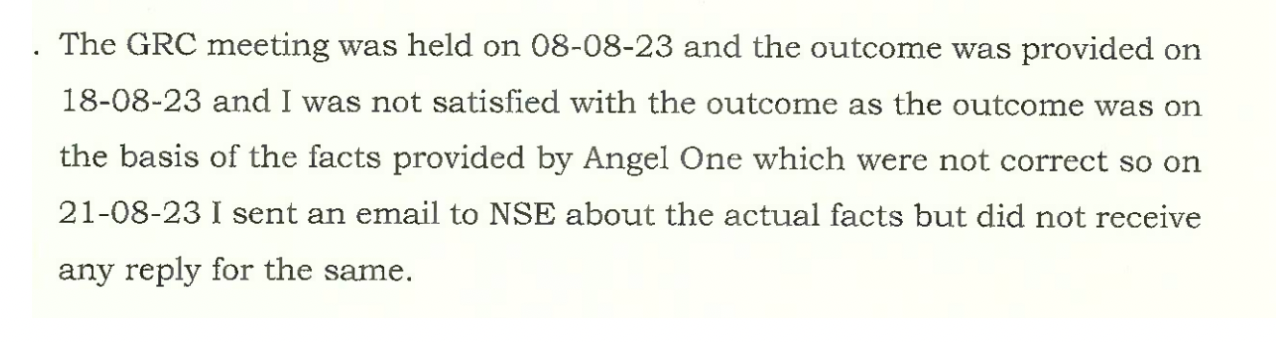

The GRC’s meeting on August 8, 2023, delved deeper into Shah’s claims.

The GRC concluded that the Applicant (Shah) had failed to follow the exchange’s required guidelines. Additionally, the GRC pointed out that Shah had inconsistently used mobile numbers across accounts, creating discrepancies in the documentation process.

While Shah contested the findings, asserting that the information presented by Angel One was inaccurate, the GRC upheld Angel One’s position on most points and concluded that Shah had not adhered to the required steps to unblock his accounts.

Arbitration Award

On February 26, 2024, the arbitration hearing took place with Rajesh L. Shah as the sole arbitrator.

Shah contended that his financial losses and the stress caused by the blocking of his accounts should entitle him to compensation, while Angel One maintained that it had acted in compliance with NSE’s regulations and had no obligation to release the blocked accounts without proper documentation.

The arbitration proceedings also involved discussions of jurisdictional issues, with the respondent (Angel One) arguing that certain accounts, particularly those with different client codes, were outside the scope of this case.

After hearing both sides, Rajesh L. Shah, the sole arbitrator, ruled in favour of Angel One Ltd., rejecting the claim made by Aasnik Kirti Shah.

In addition to rejecting the claim, the arbitrator also ordered that both parties bear their own costs.

What This Means for Traders and Investors in India?

This Angel One Fraudulent Trading case serves as an important reminder for traders, especially those involved in disputes with their trading members, to maintain accurate and up-to-date documentation.

It also sheds light on the arbitration process, which can be a crucial tool for resolving such disputes when they arise. However, this case also highlights the challenges of providing sufficient evidence for claims of financial loss and mental distress.

The NSE arbitration process, while designed to provide a quick and efficient resolution to trading disputes, requires strict adherence to rules and regulations. Traders must ensure they are fully compliant with documentation and procedural requirements to avoid issues like blocked accounts and subsequent arbitration proceedings.

What to do If You’ve Encountered Issues With Your Broker?

If you’ve faced similar issues, like blocked accounts or unresolved disputes with your trading platform, there are steps you can take. Here’s how we can assist you through the process:

- Document Collection: We help you organise essential documents, such as contract notes, call logs, screenshots, and emails, to build a solid case.

- Complaint Drafting: Our team prepares clear, professional complaint drafts that meet the requirements of NSE, BSE, SEBI SCORES, and SMART ODR.

- Platform Filing Support: We guide you through the complaint submission process on the appropriate platforms, ensuring everything is completed correctly.

- Escalation Assistance: If your complaint needs to be taken further, we provide clear steps, whether it’s with the exchange or other regulatory bodies.

- End-to-End Case Management: From reminders to tracking deadlines, we’ll keep you on track and ensure your case progresses smoothly.

- Counselling & Arbitration Support: If the case reaches arbitration, we help prepare your documents and statements for a confident presentation.

We simplify the process, ensuring faster resolutions and better outcomes so you can focus on recovery while we manage the details.

Conclusion

In conclusion, the NSE arbitration against Angel One Ltd. was a complex case involving several layers of documentation issues, compliance failures, and jurisdictional challenges. Although Shah’s claims were not upheld, the case provides valuable insights into how arbitration works in the trading world and the importance of adhering to exchange rules.

If you are a trader or investor dealing with similar issues, it’s crucial to follow all the prescribed procedures and maintain proper documentation. The arbitration process is there to help resolve disputes, but the onus of proving the case rests heavily on the individual.