Searching for “Parag Salot Research Analyst” usually means you’re trying to answer one question that matters more than anything else: Can this person be trusted with your money decisions?

Because in the stock market, trust is rarely built by bold claims. It is built on verifiable facts like SEBI registration, transparent disclosures, and a clean compliance record.

And to be honest, retail investors don’t go looking for research analysts when everything is calm. They search when they’re chasing a better income, trying to recover losses, or hoping someone else has the “perfect entry-exit” that will finally change the game.

That’s exactly why the most important habit is not “finding tips”, it’s doing a proper background check before paying a single rupee.

Who is Parag Salot?

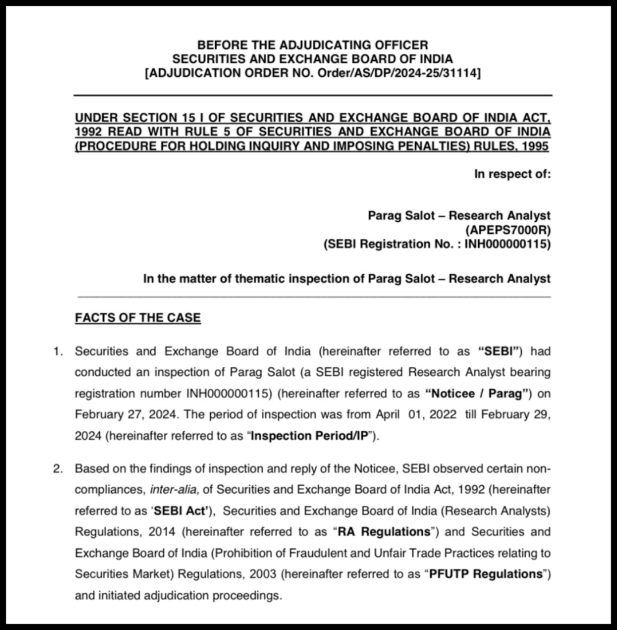

Parag Salot is referenced in SEBI enforcement documentation as a Research Analyst (RA), with SEBI registration number INH000000115.

He has a website called shareideas. But why did his website mention him as “India’s youngest Investment Advisor? And why did it lead to a 17lakh penalty?”

SEBI’s order text indicates he has been registered as a Research Analyst since March 02, 2015.

This is the part many investors skip: they jump from “someone is SEBI registered” straight to “so it must be safe.” SEBI registration is important, but it’s not a lifetime guarantee that every marketing claim, process, or recommendation practice stays compliant over time.

That’s why complaints matter, not as gossip, but as signals that push you toward official records like SEBI proceedings, inspection findings, and enforcement orders.

If you’re reading this and thinking, “This sounds serious… should I be worried?” That reaction is valid. But before concluding anything from a single screenshot, a review, or a forwarded message, it’s smarter to look at what the complaints and SEBI’s findings actually say, in black and white.

Parag Salot SEBI Orders

SEBI functions as the market watchdog by inspecting intermediaries, issuing show-cause notices, conducting hearings, and passing orders when it finds potential violations or investor-risk conduct.

SEBI inspected Parag Salot and issued the following orders:

Order 1: SEBI Slaps Rs. 17 Lakh Penalty on Parag Salot

SEBI inspected Parag Salot from April 1, 2022, to Feb 29, 2024 and found multiple compliance lapses plus misleading “profit/assured return” type claims while marketing services.

The key concern: if a research analyst is saying things like fixed/assured profits, how will a normal investor know the real risk of loss?

Key violations

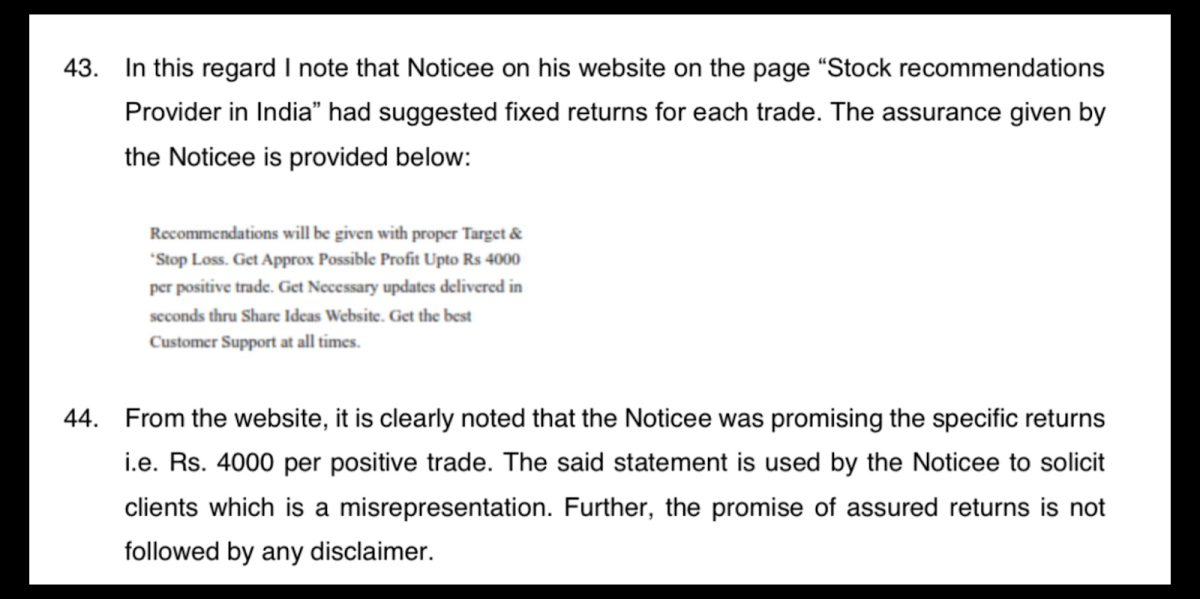

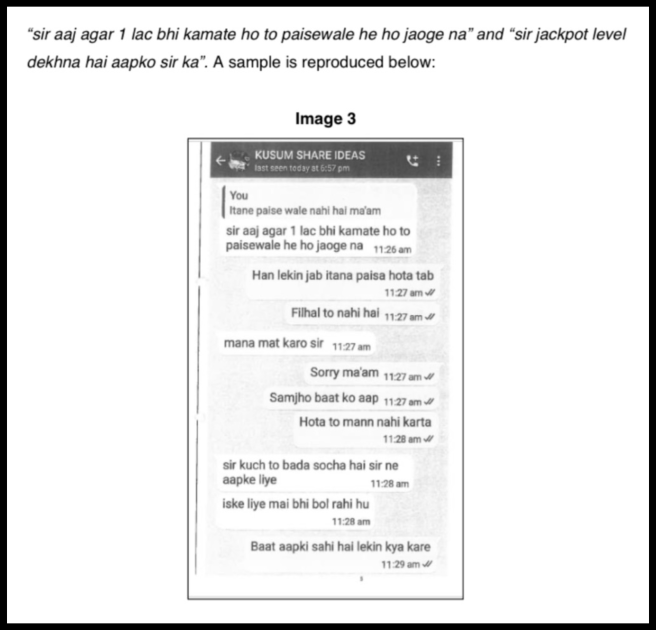

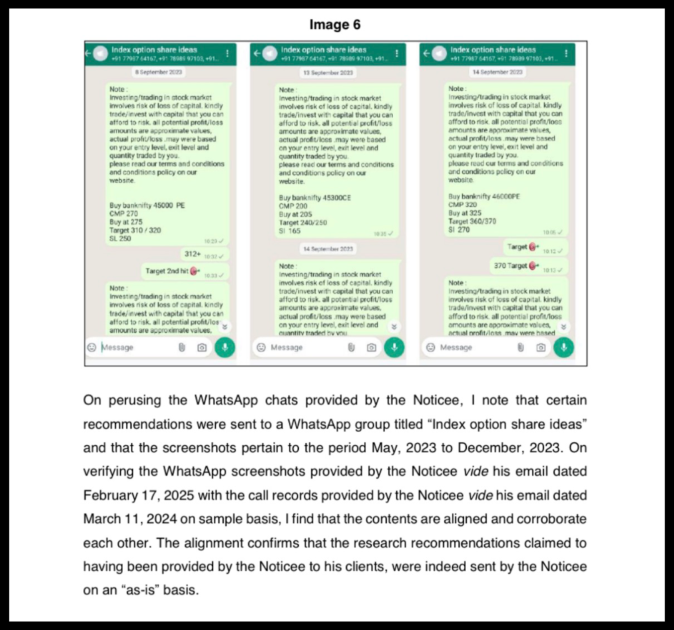

Alleged mis-selling and misleading profit/return assurance to clients, including WhatsApp-style inducement and website content like “Rs. 4000 per positive trade” and “profit assured,” treated as violations linked to PFUTP + SEBI Act provisions.

Not conducting annual compliance audits for multiple years (Regulation 25(3) of RA Regulations).

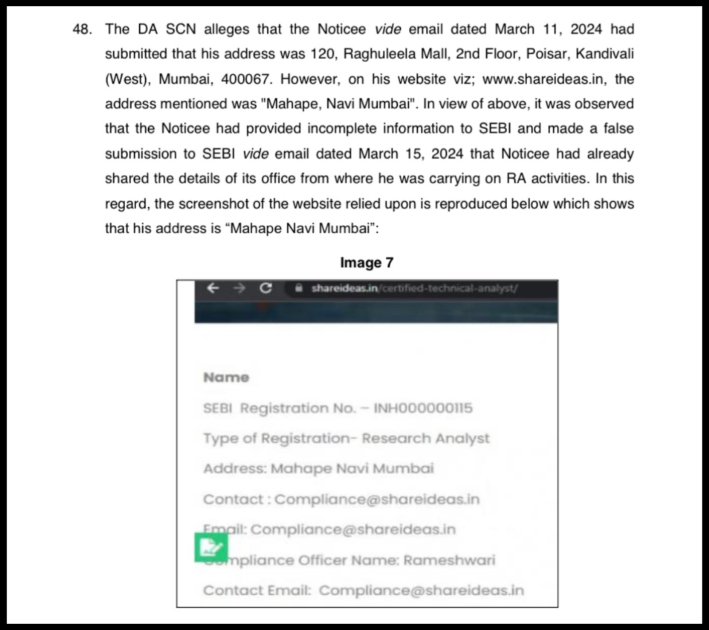

Not promptly updating SEBI about the office address change; also the website showed a Navi Mumbai address while submissions said Mumbai.

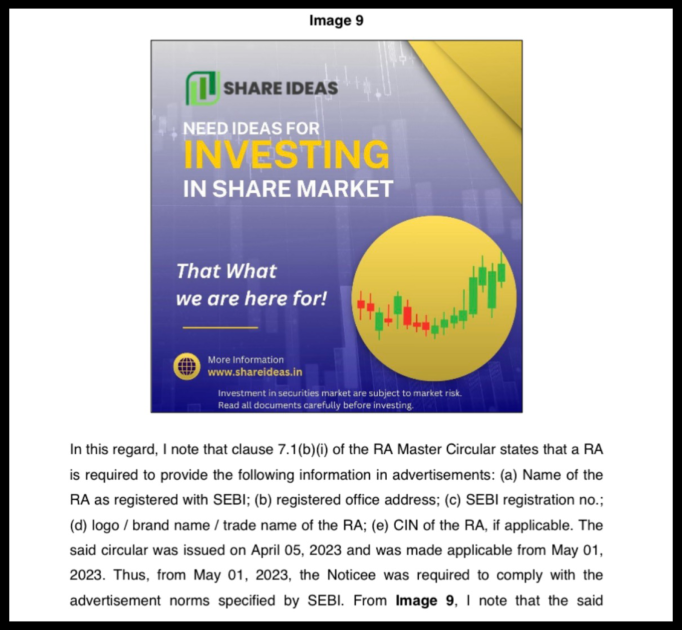

Ads missing mandatory disclosures (RA name, office address, SEBI registration number) for a period when ad rules applied.

Not displaying investor charter and complaint data on the website; not maintaining email records/data needed for inspection; working without a valid NISM certification for a long period.

What did SEBI do?

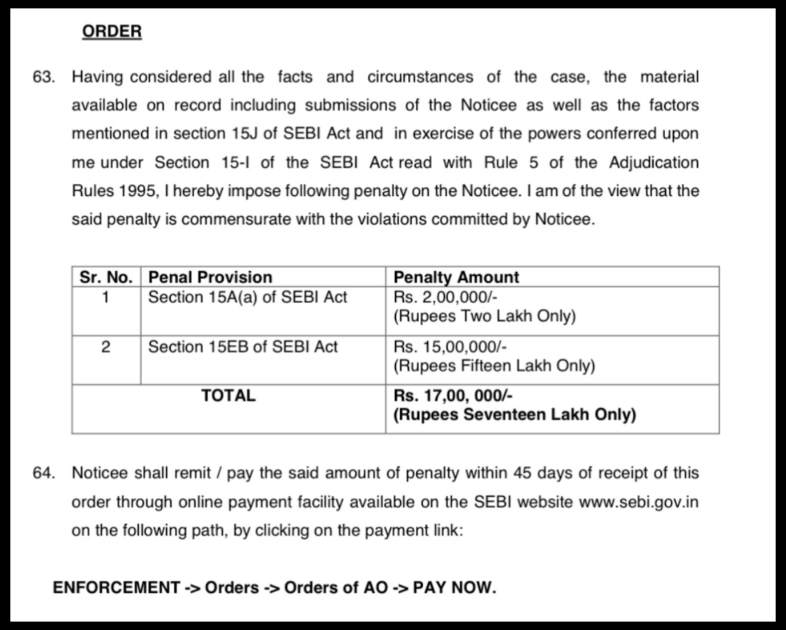

SEBI imposed a total monetary penalty of Rs. 17,00,000 (Rs. 2 lakh + Rs. 15 lakh under different penalty sections) and directed payment within 45 days (else recovery).

What can you learn from this order?

If someone sells market tips, can they promise a “fixed profit per trade”? SEBI’s action signals that such claims can be treated as misleading and punitive.

For intermediaries: even if business is “closed,” if registration is active, compliances (audit, disclosures, records) still matter. Make sure to check: are records and websites being maintained properly?

Order 2: Assured Returns Marketing Leads to Censure for Parag Salot RA

After the same inspection cycle, SEBI ran intermediary enforcement proceedings and examined whether Parag Salot mis-sold services, assured profits, and breached multiple Research Analyst compliance requirements.

Key violations

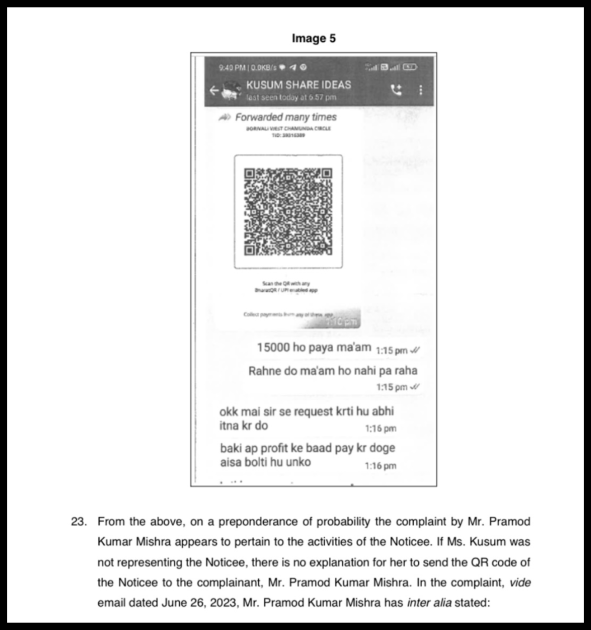

SEBI held that the complaint evidence was credible on “preponderance of probability,” noting linkages like the QR code directing to the notice’s account and matching client/payment timing.

Notice how they use “profit ke bad aur kar dena?”

Well, we all know that the stock market is always unpredictable and is subject to risks. You can lose or gain money, and no one can predict that. This is a major violation of the rules made by SEBI.

It was also found out that their team members constantly pressured the investors to invest with them, luring them with false promises.

This is completely banned by SEBI. And if you see someone selling themselves to you, promising profits, you should definitely run!

SEBI found failure to conduct annual audits for FY 2014-15 to FY 2023-24, delay in updating office address, false/incomplete office information, ad disclosure lapses, not sharing investor charter/complaints properly, not maintaining email details/records, and operating without a valid NISM certification for a long period.

When the wrong address was found, you know what the company replied?

They replied with a formal letter stating that the website content was copied from a third-party website, so the company address was wrong.

Well, a legitimate company would never do such a thing because websites contain crucial data for users to know what the company is.

And if the information stated is false, how can a normal investor like you trust it?

What SEBI Did?

SEBI issued a regulatory censure and a warning to be careful and diligent, effective immediately.

SEBI also recorded that a separate Adjudicating Officer had already imposed a Rs. 17,00,000 penalty (paid), so this order focused on regulatory action under the intermediary framework rather than fresh monetary punishment.

How To Report Parag Salot Research Analyst?

If you face problems with advice from Parag Salot, Research Analyst, follow these clear steps to protect your investments and seek a resolution.

1. Collect All Evidence

Save all records, such as emails, chat messages, research reports, portfolio statements, screenshots of advice, and call notes if available. This evidence is essential for any claim against incorrect research or tips.

2. Register Your Complaint

Submit your grievance through official channels first. Contact the compliance team, where Parag Salot is listed as grievance officer, via email or their contact page. This creates an official record.

3. Assistance with Documentation and Drafting

Get help to prepare a clear formal complaint. It should explain the issue and include all evidence. A well-written complaint increases the chances of a quick resolution.

4. Escalate to Regulatory Channels

File your Parag Salot Research Analyst complaint online at SEBI’s portal for regulatory action.

For unresolved cases, use SEBI’s Online Dispute Resolution platform for faster mediation.

5. Arbitration in Stock Market

Seek support for counselling or NSE/BSE arbitration hearings. Experts can present your case strongly to help recover your funds.

These steps ensure your Parag Salot Research Analyst complaint is handled seriously.

Register with us to avoid complex procedures. We assist with drafting, filing, and follow-up so you can focus on recovery.

Conclusion

Even if everything seems to be working smoothly with Parag Salot for many users, the SEBI findings show a few areas that are worth paying attention to.

Breaking SEBI rules that are made to protect investors like you is something worth understanding and considering.

These do not automatically mean something harmful happened, but they do highlight gaps in compliance and transparency that any user should be aware of.

Being cautious simply means taking a moment to verify details, avoiding decisions based on excitement or promises, and ensuring that the service you’re dealing with follows the rules meant to protect investors.

Staying aware helps you make safer, more confident choices, just informed decision-making.