Groww is one of India’s most widely used investment platforms.

Launched in 2016, it allows users to invest in mutual funds, stocks, ETFs, and digital gold through a mobile-first interface designed for beginners.

While Groww is popular and legally registered, increasing technical glitches and other issues have raised SEBI complaints against Groww.

Let’s get into the details to check what the major concerns of the users are and what you can do to report the issue.

Groww Complaints

Here’s where things get concerning. Despite being legal, Groww faces numerous complaints across multiple platforms.

Users report issues that go beyond simple technical glitches.

| Complaint Category | Share of Complaints | Key Issues Reported |

| Technical Issues | 38% | App crashes during trading hours; failed transaction processing; login authentication errors; slow app performance during volatile markets |

| Financial Problems | 20% | Delayed fund withdrawals (7–14 days); wrong deductions and duplicate charges; missing transaction records; folio creation issues |

| Support & Service Issues | 42% | Extremely slow response time (5–15 days); unhelpful automated responses; no direct phone support; unresolved complaint tickets. |

Based on the user reviews, here are the main problems people face with Groww:

1. Groww App Technical Glitch

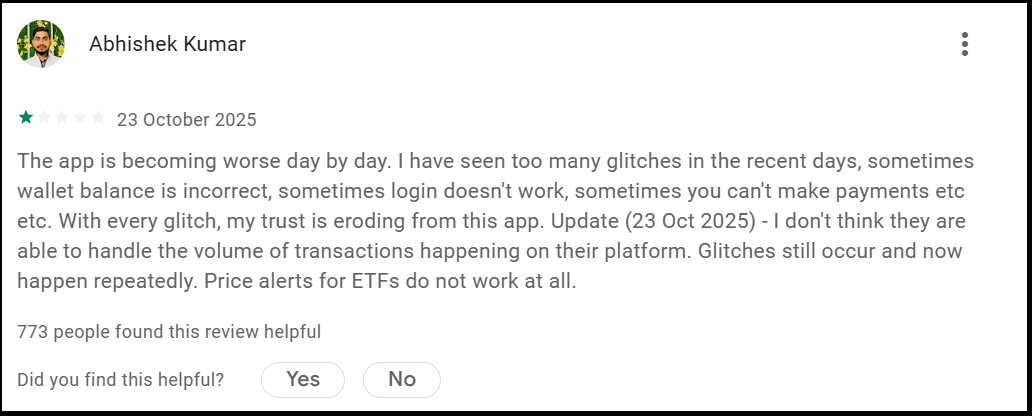

Complaint 1: The User raised the most concerning issue about the Groww platform, highlighting unreliable system behaviour.

The user reports frequent glitches, incorrect wallet balances, login failures, and payment issues. Even more worrying is the update added later, stating that the problems continued and worsened over time.

The user specifically mentions that price alerts for ETFs do not work at all, which is critical. Alerts are not a luxury feature; they help investors react to market movements.

When they fail, users can miss exit opportunities or enter trades too late.

The biggest red flag here is trust erosion. Once users start questioning whether balances are accurate or whether the platform can handle transaction volume, confidence collapses.

In trading, even small technical errors can lead to real financial losses.

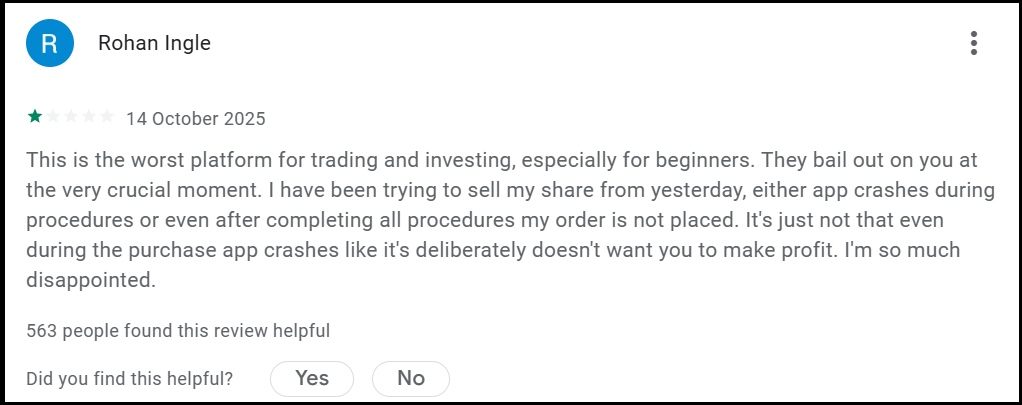

Complaint 2: Another review raises a serious operational concern: app crashes during crucial trading moments.

The user describes repeated failures while trying to sell shares; either the app crashes mid-process, or the order simply isn’t placed even after completion.

What makes this alarming is the timing.

Trading apps are most critical during fast market movements. If the app crashes exactly when you’re trying to exit a position, you’re left helpless while prices move against you.

Whether intentional or not, the impact is the same: missed trades, lost profits, or increased losses. For beginners, especially, this kind of experience can be financially and emotionally damaging.

2. Groww Withdrawal Issues

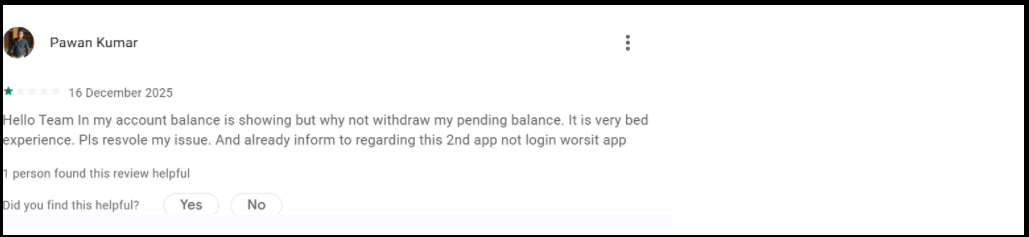

Complaint 3: This complaint touches one of the most sensitive issues in any financial app: withdrawal problems.

The user says the account balance is visible, yet withdrawals remain pending with no resolution.

The frustration is clear; funds appear available, but access is blocked.

To make matters worse, the user also reports login issues on another linked app, suggesting broader system instability.

When users can see their money but cannot access it, anxiety naturally increases.

Delayed or blocked withdrawals, especially without clear explanations, are one of the biggest reasons people lose trust in investment platforms.

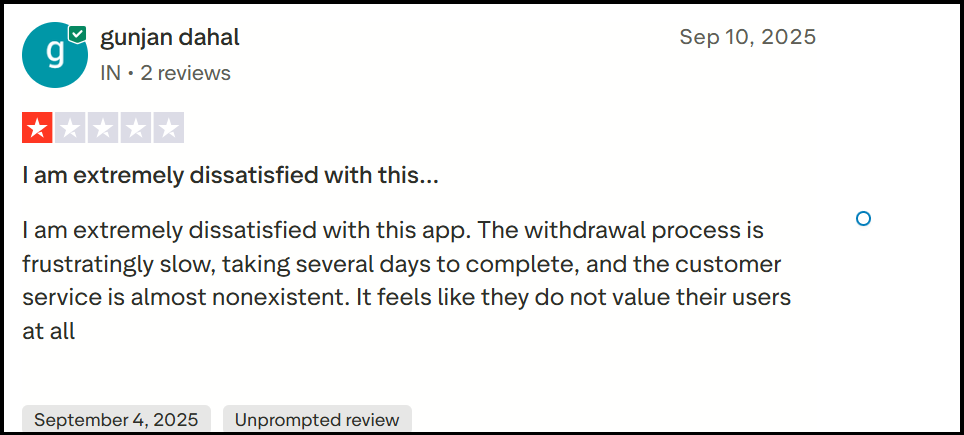

Complaint 4: Slow withdrawals combined with poor customer support. The user reports that withdrawals take several days and that customer service is almost nonexistent.

In financial platforms, delays may happen occasionally. But when delays become routine and support is unreachable, users begin to feel ignored and undervalued.

The review reflects emotional exhaustion, a feeling that the platform simply does not care once money is deposited. For investors, this is a major warning sign.

3. Groww Customer Support

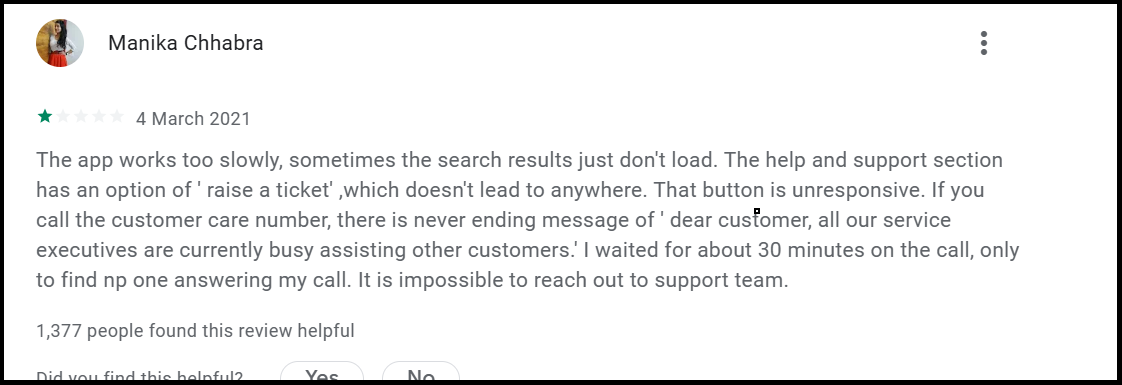

Complaint 5: This older review shows that support-related issues are not new.

The user describes an app that works slowly, search results that don’t load, and a “raise a ticket” option that leads nowhere.

Even more concerning is the phone support experience, endless automated messages and no human response, despite waiting for extended periods.

When help channels exist only on paper and not in practice, users are left stranded during emergencies. In trading, a lack of timely support can directly translate into financial loss.

4. Trading & Order Execution Losses

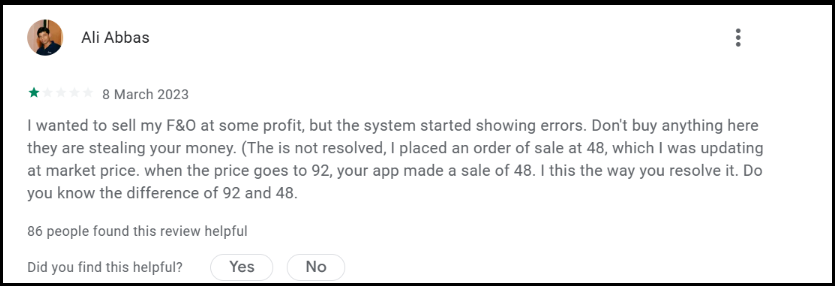

Complaint 6: This review raises one of the most alarming issues an investor can face: a trade executed at a drastically incorrect price.

The user explains that while trying to sell an F&O position in profit, the system started showing errors. Instead of resolving the issue properly, the platform executed the sell order at ₹48, even though the market price had moved to ₹92.

That’s not a small difference; it’s a massive gap that directly translates into a significant financial loss.

What makes this especially concerning is that the error occurred during an active trade, when timing and price accuracy are critical. In derivatives trading, even slight delays or price mismatches can wipe out profits.

A difference like ₹92 versus ₹48 is not a minor glitch; it fundamentally changes the outcome of the trade.

The frustration in the review is understandable. When users trust a trading platform to execute orders at market price, and the system fails at that moment, confidence in the platform breaks instantly.

No investor expects perfection, but they do expect fair execution, transparency, and accountability when something goes wrong.

5. Groww Account & Security Problems

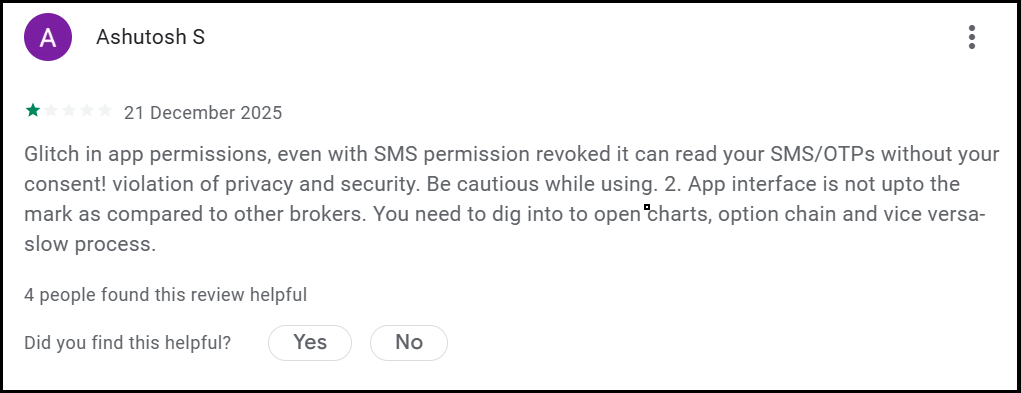

Complaint 7: One user, Ashutosh S, raised serious concerns around privacy and app usability after noticing that the app could still read SMS and OTP messages even after SMS permissions were revoked.

According to the complaint, this behaviour suggests a critical permissions glitch that potentially violates user privacy and security.

The reviewer cautioned users to be careful while using the app, highlighting a loss of trust due to this issue. In addition to privacy concerns, the user criticised the app’s interface, stating that it falls short when compared to other brokerage platforms.

Navigating between essential features such as charts and the option chain was described as inconvenient and slow, which can negatively impact time-sensitive trading decisions.

6. Groww Loan Service Issues

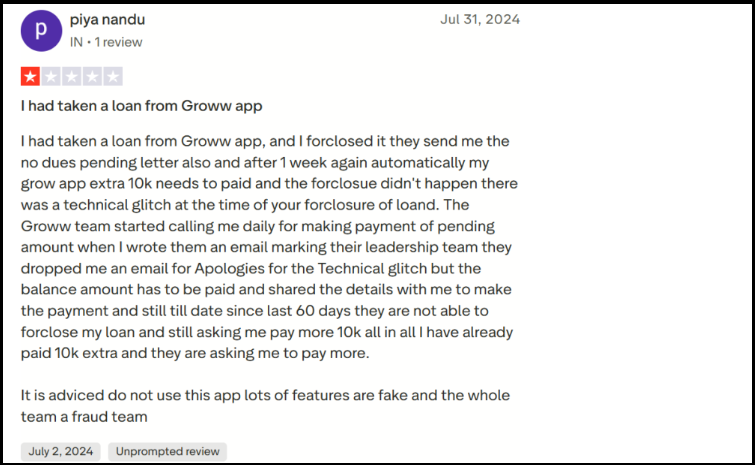

Complaint 8: Another complaint, posted by Piya Nandu, highlights serious issues related to a loan taken through the app.

The user stated that after foreclosing the loan, they received a no-dues confirmation, only to later discover that the foreclosure had not been completed due to a so-called technical glitch.

Despite this, an additional ₹10,000 was allegedly added to the outstanding amount, and repeated payment demands followed.

Even after paying more than the extra amount, the user claims they continued receiving daily calls for pending dues, with the issue remaining unresolved for over 60 days.

Although the leadership team reportedly acknowledged the technical error and issued an apology via email, the demand for further payment continued.

Frustrated by the experience, the user advised others against using the app, alleging misleading features and calling the overall loan handling process untrustworthy.

Based on user reviews, Groww faces widespread criticism for persistent technical glitches, failed transactions, and poor customer support, causing direct financial losses and locking users out of their funds.

Additionally, users report security concerns, slow performance during market hours, and unresolved account issues, creating an overall frustrating and unreliable experience.

SEBI Action on Groww

Here’s the shocking part. Groww recently settled two major legal cases with SEBI. They paid a total of ₹82,97,500 (around ₹82.98 lakhs) to settle these cases.

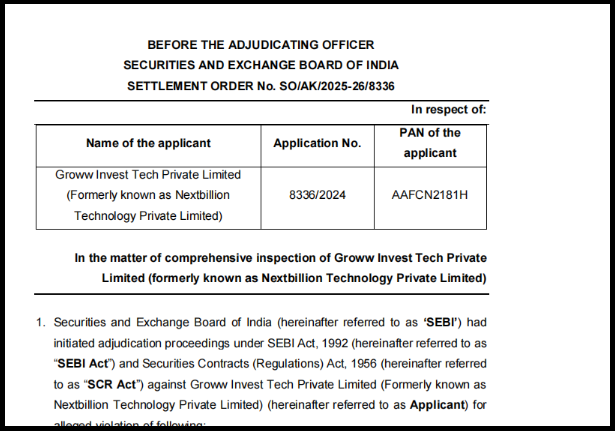

Settlement 1: ₹47.85 Lakh for Investor Safety Lapses

This shows that SEBI found serious problems in how Groww was operating and protecting its investors. The company settled without admitting it was guilty, which is a common legal step.

1. Incorrect Account Statements Sent to Clients

Groww issued monthly account statements containing errors. In at least 38 cases, the balance shown did not match the actual margin money available.

Impact on investors:

- Trading decisions are based on account statements

- Incorrect balances can cause you to trade beyond your actual capacity

- Risk of margin shortfall penalties

- Positions may be forcefully squared off without warning

2. Faulty App Design & Price Display Issues

The Groww app failed to clearly display the best available market price.

It automatically selected the same exchange (NSE or BSE) previously used by the investor, instead of offering price comparison.

There was also poor interoperability between clearing corporations.

Impact on investors:

- You may not receive the best execution price

- Trades could be routed inefficiently

- Funds may remain unnecessarily blocked

3. Mixing Trading With Banking & Payment Services

Groww integrated UPI payments, loans, and bill payments within the same trading application.

Impact on investors:

- Blurring lines between banking and trading increases systemic risk

- A UPI or loan dispute could compromise your trading account

- Regulatory best practices require the strict separation of trading and payment services

4. No Backup Systems During App Failures

During app crashes or outages, Groww had:

- No alternative desktop trading terminal

- No phone-based order placement

- No manual support for urgent trades

Impact on investors:

- Complete loss of market access during outages

- Unable to buy, sell, or exit open positions

- In fast-moving markets, this can lead to significant and unavoidable losses

5. Regulatory Settlement

Based on SEBI’s findings, Groww entered into a settlement.

- Settlement amount: ₹47,85,000

- Date of payment: February 21, 2025

- Recommended by: SEBI’s High Powered Advisory Committee

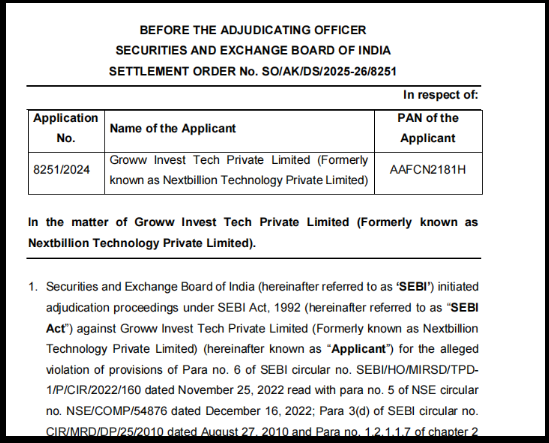

Settlement 2: ₹34.12 Lakh for Tech Failure

1. Not Sharing Data with Exchange

Groww failed to send the required trading and surveillance data to the stock exchange monitoring system, which is essential for detecting irregular and illegal market activity.

Impact on investors:

- Makes it harder for exchanges and regulators to catch manipulation or fraud

- Weakens market surveillance mechanisms

- Reduces the overall security and transparency of your trades

2. Complete Platform Shutdown With No Contingency Plan

During a major technical failure, Groww had no functional backup systems in place:

- No phone-based order placement

- No alternative trading terminal

- No staff support to execute or manage trades

Impact on investors:

- Investors had zero access to markets during the outage

- Unable to stop losses or book profits

- Confirms a serious failure of basic broker responsibilities

This represents one of the highest operational risks for any retail investor.

3. Weak Cybersecurity & Ineffective VAPT

Groww’s Vulnerability Assessment and Penetration Testing (VAPT) was found to be ineffective, exposing critical cybersecurity weaknesses.

Impact on investors:

- Increased risk of hacking and system breaches

- Exposure of personal data, login credentials, and funds

- Higher chances of unauthorised trading in Groww or financial theft

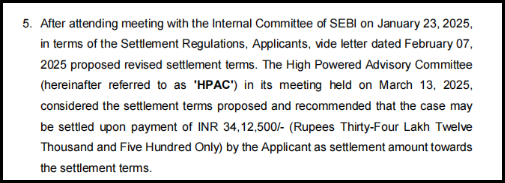

4. Regulatory Settlement

Following these violations, Groww entered into a regulatory settlement.

- Settlement amount: ₹34,12,500

- Revised settlement terms submitted: February 7, 2025

- Settlement payment date: March 13, 2025

How to Complaint Against Groww App?

Facing issues with Groww?

Here’s your step-by-step complaint-filing process. Don’t stay silent. Your rights matter.

Step 1: Complain to Groww First

Before going to SEBI, you must first complain directly to Groww. This is a regulatory requirement.

In-app: Go to Profile → Help & Support → Raise a Ticket

Step 2: File Complaint with SEBI

SCORES stands for SEBI Complaints Redress System. This is the official platform for investor complaints.

Complete Process to File SEBI Complaint:

- Lodge a complaint in SCORES by logging in to their portal.

- Click on the “Lodge Complaint” option

- Select complaint category: “Stock Broker.”

- Choose entity name.

- Upload supporting documents:

- Screenshots of transactions

- Email correspondence with Groww

- Bank statements showing deductions

- Any other relevant proof (PDF format, max 2MB each)

- Click “Submit Complaint”

Step 3: Other Complaint Channels

Step 4: Legal Action

Consumer Court

- File a case in the District Consumer Forum

- For claims up to ₹1 crore

Need Help?

Are you a Groww user facing problems? You’re not alone. Thousands of investors struggle with similar issues daily.

Register with us if you’re experiencing:

- Withdrawal delays exceeding 7 days

- Account blocking or suspension

- Wrong deductions or missing transactions

- Folio number issues

- Any financial irregularities or losses

Our services include:

- Complete complaint filing assistance

- SEBI SCORES registration and follow-up

- Documentation and evidence compilation

- Arbitrations in stock market against Groww on your behalf

- Regular updates on your case status

Don’t suffer in silence. Your money deserves professional protection. Get expert help today. Time is critical in financial matters.

Conclusion

Groww is SEBI-registered and operates legally in India, as verified through SEBI records. The platform holds proper licenses from NSE, BSE, and CDSL. On paper, everything looks legitimate.

However, the reality is far more troubling. Groww paid ₹82.98 lakhs to settle two major SEBI cases in early 2025, revealing serious investor safety lapses and technical failures.

Withdrawal delays, wrong account statements, app crashes without backup systems, and poor customer support aren’t just user complaints anymore. SEBI officially found these same problems.

If you’re considering Groww, proceed with extreme caution. Start with minimal amounts, never invest emergency funds, and maintain detailed transaction records of everything.

For existing users facing problems, use SEBI’s SCORES portal immediately. Don’t wait for Groww’s slow support system. Your financial security deserves proactive protection and proper regulatory oversight.

Stay informed, document everything, stay vigilant, protect yourself.