The Indian stock market is touching record highs in 2025, and while that sounds like great news, there’s a shadow story unfolding alongside it.

Scroll through Telegram for a few minutes, and you’ll see it everywhere: “Jackpot calls,” “Double your money in 48 hours,” “Operator-confirmed tips.” These flashy promises aren’t just noise anymore.

They’re pulling thousands of retail investors into a parallel economy that thrives on hype, secrecy, and misplaced trust.

Telegram’s biggest strength, privacy and instant reach, has quietly turned into its biggest weakness. Behind sleek channel names and screenshots of fake profits, unregistered advisors are running full-fledged tip factories.

Even more troubling, a few registered market participants are also crossing legal lines, using Telegram to bypass regulations and lure investors into illegal schemes.

What looks like a harmless trading group often turns out to be a carefully designed trap.

So if you’ve ever wondered, “Is this legal?”, “Can I report a Telegram tipster?”, or “File SEBI complaints against Telegram Channel?” You’re in the right place.

This guide walks you through exactly how to take action, cut through the noise, and turn the tables on Telegram scams in India.

When Should You File a SEBI Complaint Against Telegram Channel?

Following stock tips from an unregulated and unregistered Telegram channel may look exciting at first. But beneath the flashy messages and “guaranteed profits” lies a web of serious risks that many investors realise only after losing money.

Imagine this: your phone buzzes with an urgent Telegram alert, “Buy NOW! Stock about to explode”. Hundreds, sometimes thousands, of people receive the same message at the same time. This is where the classic Pump and Dump trap begins.

The channel admin, who already owns the stock, uses their massive follower base to artificially push the price up. As retail investors rush in, the price spikes. But while followers are busy buying, the admin is silently selling.

Within minutes, the stock crashes, and those who trusted the tip are left staring at losses. Often, this is combined with scalping, where the tipster profits from the very price movement they created, without ever telling followers they planned to exit early.

What makes it even more dangerous is Telegram’s structure itself. Unlike what many users believe, Telegram channels do not have default end-to-end encryption. Messages and data are stored on cloud servers, making them vulnerable to breaches. Fake admins take advantage of this environment by impersonating SEBI-registered analysts, using stolen photos, fabricated credentials, and professional-looking profiles. Once they earn your trust, the real game begins.

They may ask for “advance fees” for IPO allotments, promise insider access, or worse, request your trading account login details. At that point, your entire capital can vanish in seconds.

Let’s be clear, losing money in the stock market is not always fraud. Markets go up, markets go down. That’s risk. But when certain things happen on Telegram, WhatsApp, or social media, it crosses the line from market risk to market misconduct.

So how do you know when it’s time to take action?

If you spot any of these red flags, you should seriously consider filing a complaint with SEBI.

- Guaranteed Returns are the Biggest Red Flag

Did someone promise you fixed profits, “sure-shot calls,” or assured returns in stocks or options? That’s illegal.

There are no guarantees in equity or derivatives trading. Anyone claiming otherwise is misleading investors, plain and simple.If it sounds too good to be true, it usually is.

- Unregistered Advisory is Equal to Unauthorised Advice

Getting clear Buy/Sell/Hold calls? Now ask yourself: Did they share a valid SEBI Registration Number? If the answer is no, they are not legally allowed to give investment adviceno matter how confident or popular they look on Telegram.

No registration = No authority = File a complaint.

- Pump and Dump Schemes

Ever noticed this pattern? A Telegram channel hypes a little-known stock.

Urges everyone to buy immediately. The price spikes and then crashes within minutes.

Congratulations, you’ve witnessed a pump-and-dump scheme. These schemes are designed to benefit the channel owner, while retail investors are left holding losses.

This is a serious violation and should be reported.

- Fees Asked for in Personal Bank Accounts

This one’s subtle but dangerous. If a so-called “registered” advisor asks you to:

- Transfer fees to a personal bank account, UPI, or wallet

- Instead of a company account with a proper invoice

This is a Red alert.

Even SEBI-registered entities must follow strict compliance and accounting norms. Personal accounts often mean misrepresentation or fraud.

SEBI Action Against Telegram Channel

SEBI has recently taken major legal actions against well-known Telegram channels to show that finfluencer fraud will not be allowed.

Refund and market ban

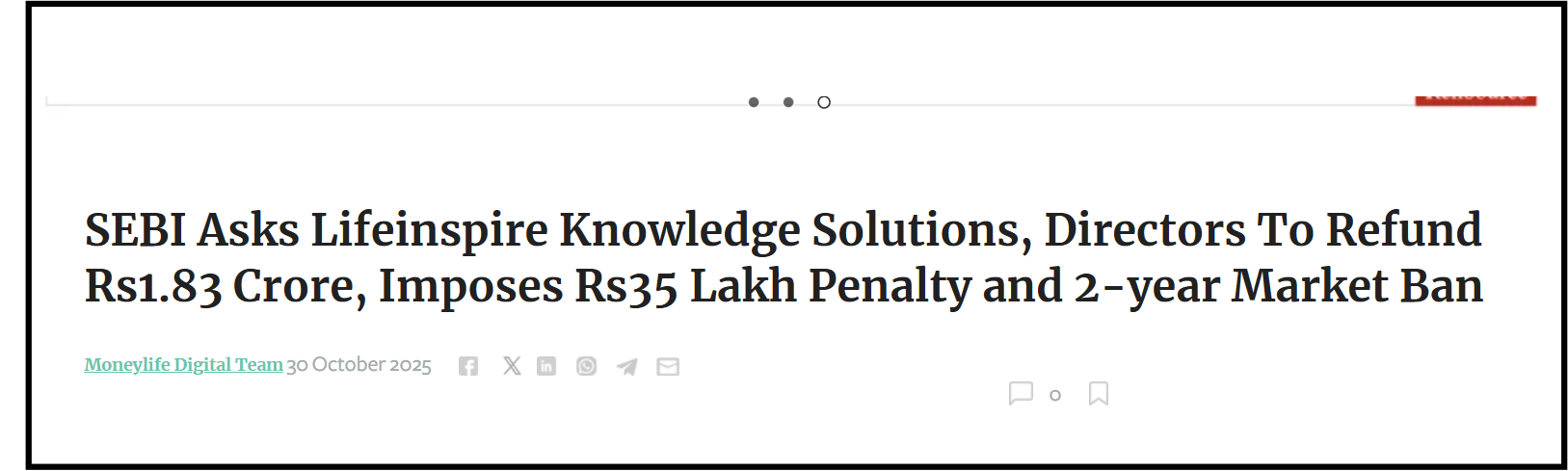

SEBI has dropped the hammer on Lifeinspire Knowledge Solutions Private Limited (LKSPL), and the details are eye-opening.

The market regulator has ordered LKSPL and its directors, M.S. Ahammed Ali and M.S. Mohammed Ali, to refund a whopping ₹1.83 crore collected from unsuspecting clients. Why? SEBI found that the company was running an investment advisory business without mandatory registration, a clear violation of regulatory norms.

What makes this case more concerning is SEBI’s finding that misleading and false information was allegedly presented to investors, giving them the impression of a legitimate and compliant advisory service. In reality, the operation was neither authorized nor transparent.

This action sends out a strong message—no registration, no credibility. For investors, it’s a timely reminder to always verify whether an advisor is SEBI-registered before trusting them with hard-earned money. One quick check today can save lakhs tomorrow.

SEBI Penalised Baap of Chart for Unauthorised Advisory

The Securities and Exchange Board of India (SEBI) has initiated recovery proceedings of ₹18.41 crore against finfluencer Mohammad Nasiruddin Ansari, known as “Baap of Chart,” along with Rahul Rao Padamati and Golden Syndicate Ventures Pvt Ltd.

This action follows their failure to comply with earlier directives to pay fines and refund money collected from investors for running unregistered investment advisory services under the guise of “educational training.”

SEBI found that Ansari and his associates were providing specific stock “buy” and “sell” recommendations and promising high or assured returns without being registered as investment advisers with the regulator.

Nonetheless, SEBI looked into complaints about unsolicited MTM profit screenshots and charges for advice. The violations included not registering as a SEBI investment advisor and providing advice without proper registration, which broke SEBI rules.

How To File Stock Market Fraud Complaint?

Filing a complaint against a fake Telegram channel is simple and helps protect your money. Here is how to report these scams to SEBI and the police:

- Gather Evidence: Before the admin deletes the channel or blocks you, take screenshots.

- File a Complaint in SCORES: SEBI has launched a new version of its complaint system. If a telegram scam is done by a registered entity, then report direclty on SCORES.

To file, select the category “Investment Adviser” or “Research Analyst.” If the entity is unregistered, select the “Others” or “Unregistered Entity” section. - Direct Reporting to SEBI: For serious fraud or large-scale scams, you can send an email with all the evidence.

Need Help?

If you’ve been scammed through a fake Telegram tip channel or an unregistered influencer, you don’t have to deal with the recovery process on your own. We understand how frustrating and vulnerable it can feel when a guaranteed tip leads to a financial loss.

Register with us. Our team is committed to helping people who have fallen victim to digital investment scams. We help you take control of your situation by following a clear plan to hold the anonymous scammers accountable and restore your financial security.

Conclusion

The growth of digital messiahs on Telegram has turned a strong communication platform into a risky place where people can cheat and manipulate the market. However, the power to stay safe is up to you.

SEBI’s strong action against groups like Baap of Chart and Profit Guruji shows that if a deal sounds too good to be true, it likely is.

By changing your thinking from chasing quick profits to focusing on real, verified growth, and by using official tools like the SCORES 2.0 portal, where you can also check your SEBI Complaint status, you protect not just your money but also your sense of security.

Keep in mind that a real expert will never use a secret name or force you to make a trade. Always check if a professional is approved on the official SEBI website before letting their advice affect your hard-earned money.