Is “Investors Ka Dost” Really Your Friend?

If you are an enthusiastic trader, you might have been dreaming of that one stock that will change our fortunes.

You see a flashy reel explaining a “multibagger” opportunity, and suddenly, you feel like you’re missing out on the next big thing.

In a market flooded with “experts” promising the moon, it’s hard to tell who is actually looking out for your portfolio and who is just looking out for their own pocket.

But have you ever stopped to ask: if these tips are so golden, why are they being sold to you?

This brings us to Stockifi, a firm that markets itself as the “Investor’s Friend” (Investors Ka Dost). They have grabbed the attention of many retail investors.

But does the service actually deliver on its promises? Or is it another classic case of “over-promise and under-deliver”? Before you swipe your card for their subscription, let’s peel back the layers and see what’s really going on.

Stockifi Review

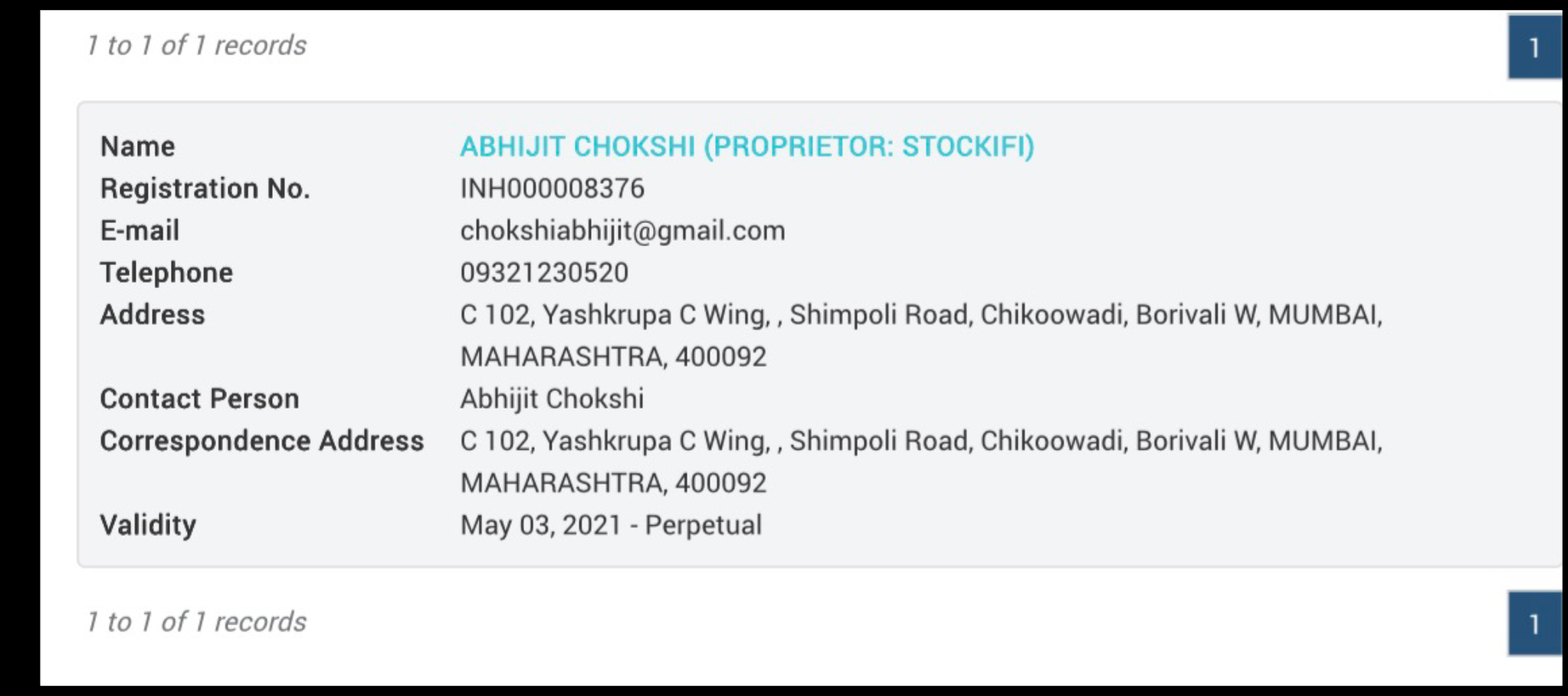

Stockifi is a research analyst firm primarily operated by Abhijit Chokshi, who serves as the proprietor.

The firm is registered with the Securities and Exchange Board of India (SEBI) under the registration number INH000008376.

Their primary service revolves around providing detailed equity research reports and stock recommendations to retail investors.

They target the “middle-class Indian investor,” the kind who invests via SIPs and wants to break free from the slow lane of wealth creation.

Through their website and social media channels, they offer various subscription plans that promise access to high-growth stock ideas.

They often share free educational content on scams and market traps to build trust, positioning themselves as the “good guys” in a bad industry.

Stockifi positions itself as a research-backed advisory service that focuses on “multibagger” ideas.

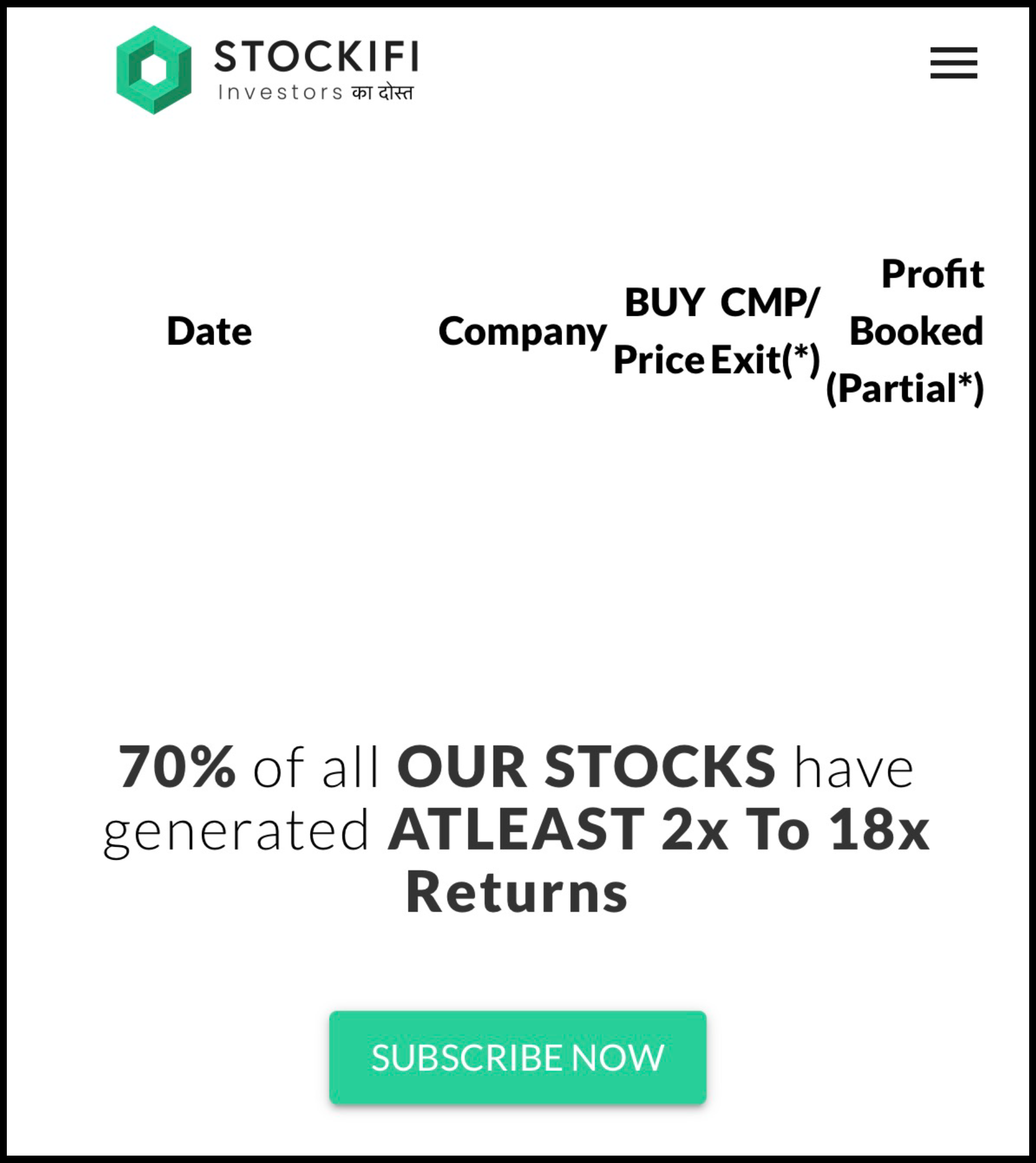

Their website is slick, professional, and filled with aggressive marketing claims, such as “70% of all our stocks have generated at least 2x to 18x returns.” This is a huge red flag, as according to SEBI guidelines. A research analyst cannot guarantee profits or mention return percentage on their website.

However, behind the shiny face that is available on the website lies a reality that many customers have found to be far less glamorous.

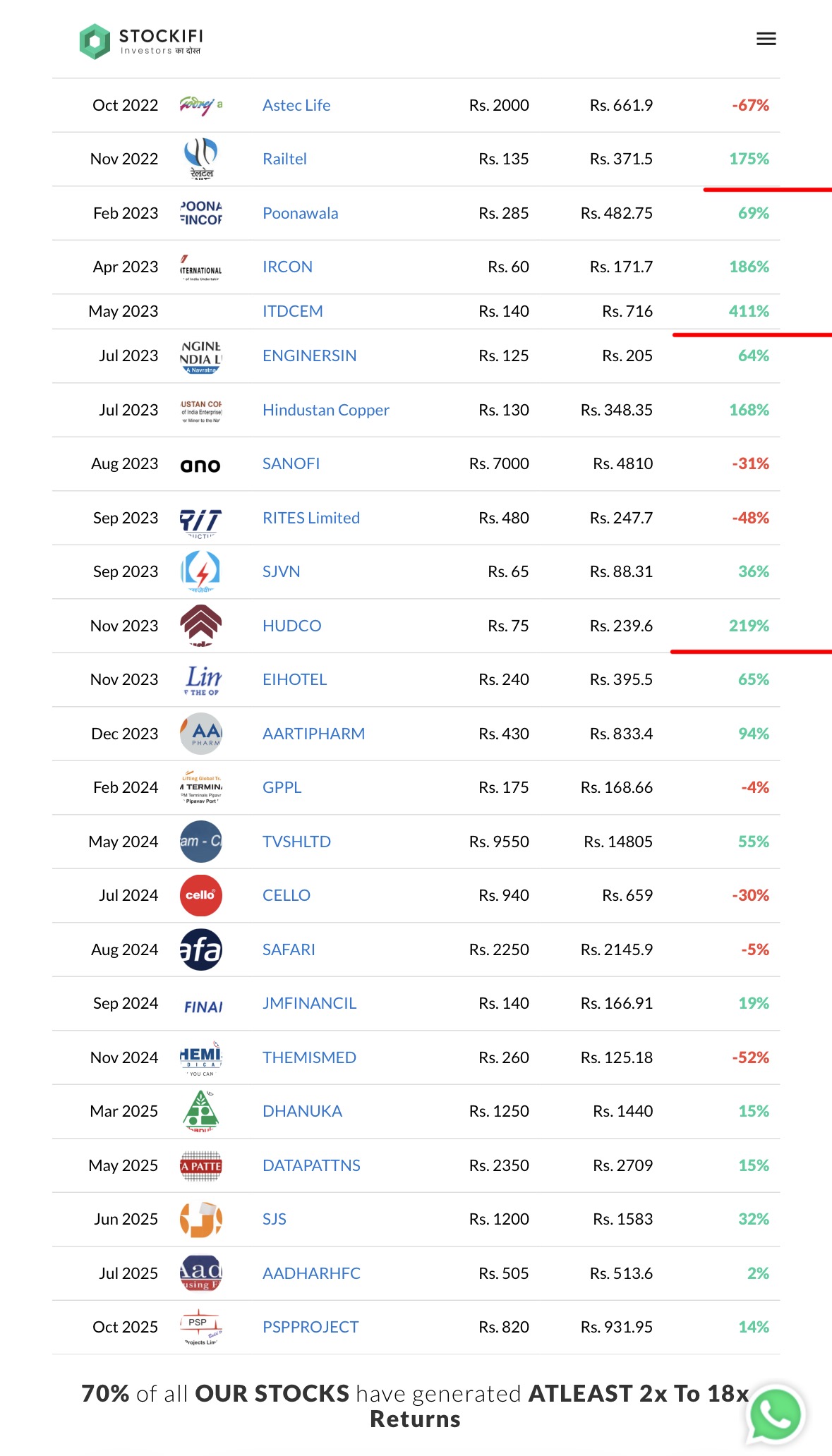

It is a common tactic in the advisory industry to lure clients in with “past performance” data that highlights only the winners while conveniently burying the losers.

When you see their preview year data track record, you can find current profits in green. It’s their hype machine to hook you into paid subscriptions for more “investor dost” magic.

Still, it’s a red flag!

Wondering how?

SEBI’s ad code frowns on flaunting past performance like this: it screams “jackpot every time!” when markets are more like random roulette tomorrow.

In short, it is a clear violation of SEBI guidelines for a research analyst.

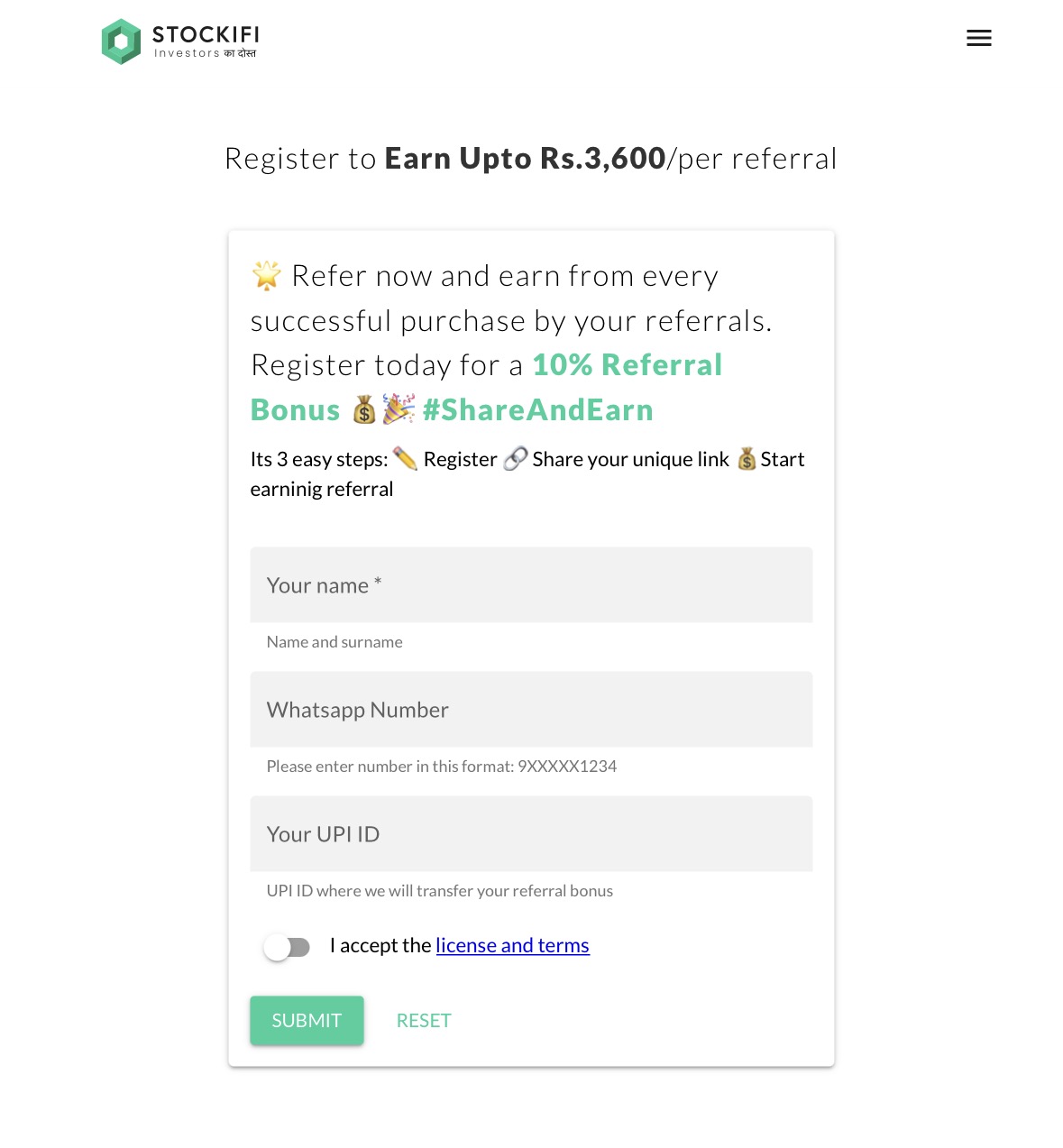

If you notice their website carefully, you can see their referral scheme. This is a red flag again because a research analyst cannot have a direct referral scheme.

When the market is green, everyone is a genius, but when the recommended “multibagger” starts tanking by 20% or 30%, that is when you need your “dost” the most.

Unfortunately, this is exactly where many such firms go silent, leaving investors holding heavy bags with no exit strategy in sight.

Common Complaints About Stockifi

If you dig deeper into the user experience, you start to see a pattern of dissatisfaction that contrasts sharply with their marketing.

Don’t just take our word for it. Have a look at the Google Reviews. While they may try to curate their image on their own website with glowing testimonials, Google Reviews often tell the unfiltered story.

While most of the reviews are positive, you will find some users warning others about their experiences.

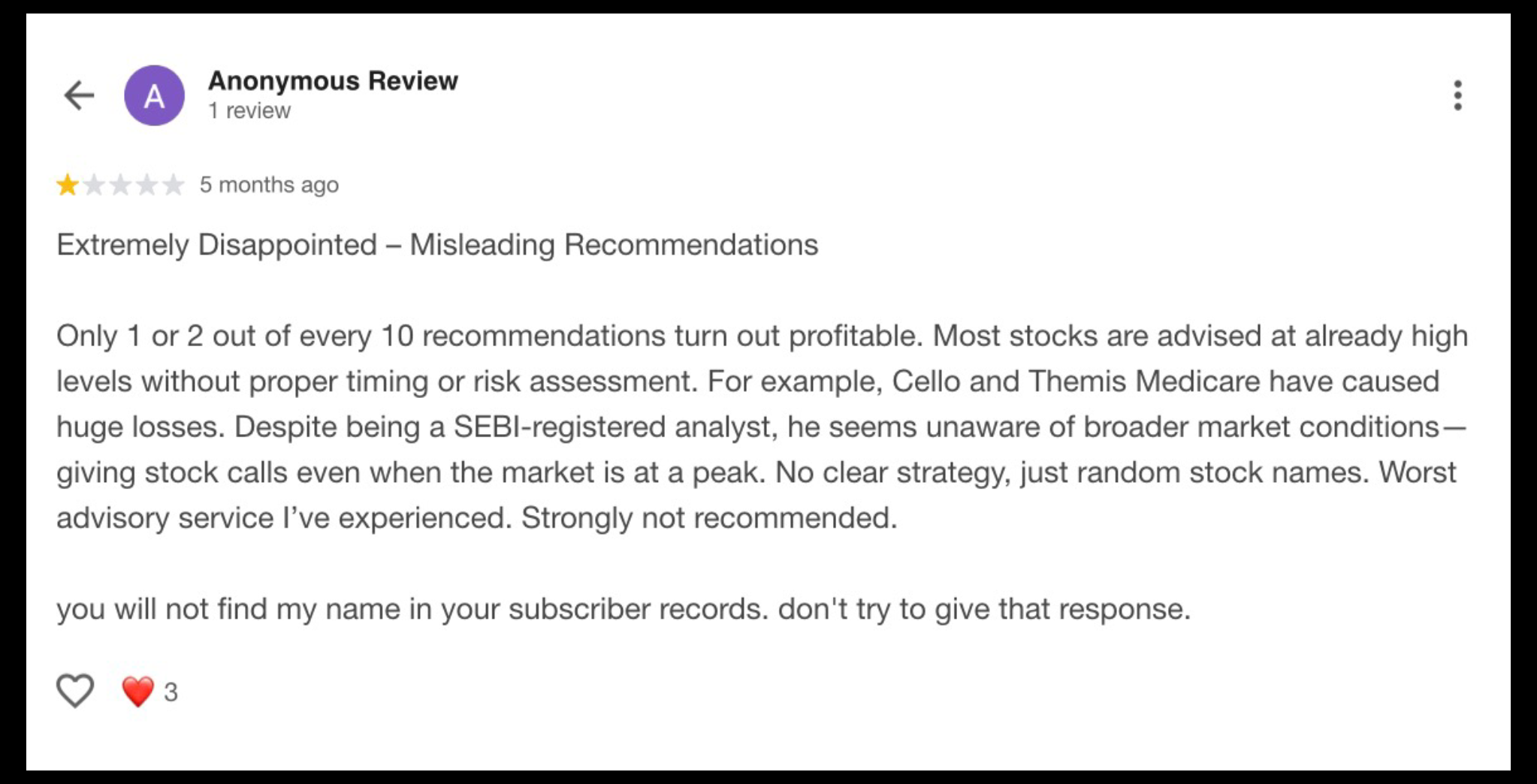

First up, that fiery 1-star from “Anonymous” calls out “extremely disappointing, misleading recommendations.” They slam picks like Celgene and Themis Medicare for causing huge losses because they were already at peaks with zero risk assessment.

This gives classic buy-high, cry-later vibes. And they even warn, “You won’t find my name in your subscriber records,” hinting at some shady response tactics.

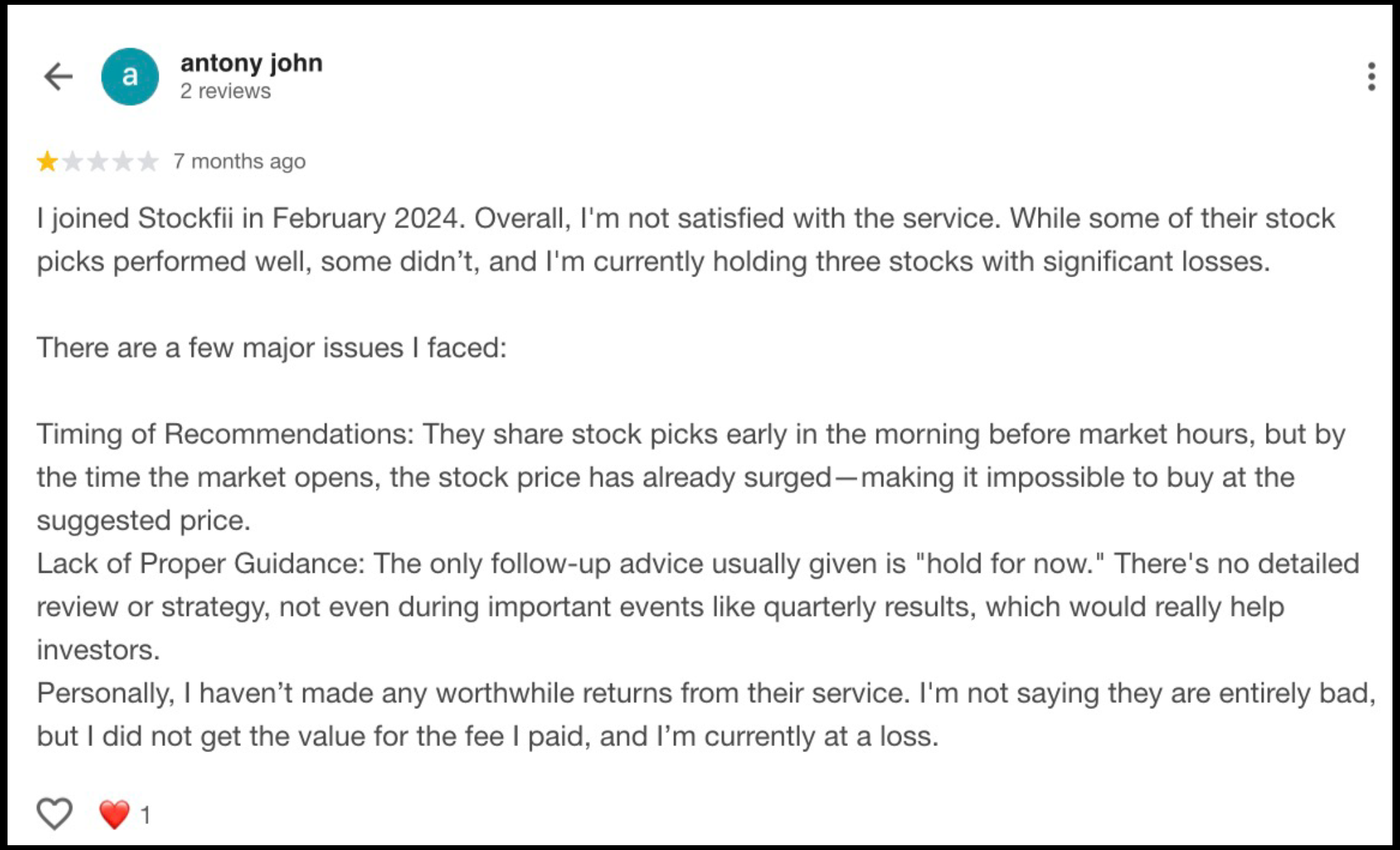

Then Anthony John chimes in with 2 stars, joining Stockifi back in Feb 2024 and now nursing three stocks in the red.

His beef? Stocks tipped right before the market opened when prices were already surged, zero proper guidance beyond “hold now,” and no real quarterly updates despite big events.

“Not getting value for the fee,” he says. It is a straight talk from someone regretting that subscription.

Prashant Nair seals the deal with another 1-star, complaining “Extremely poor service, if you like your hard-earned money, stay away.”

He’s furious about endless calls pushing subscriptions and begging to be removed from records. It is a raw frustration from someone who got spammed into oblivion.

Overall, these paint Stockifi as a service where the shiny “multibagger” promises crash into reality: late tips, no hand-holding during dips, aggressive sales, and picks that leave wallets lighter.

If you’re eyeing them, these reviews scream “proceed with caution,” What do you think? Is it worth the risk?

Note: Always be skeptical of 5-star reviews that lack detail, as these are often solicited or fake.

How to File a Complaint Against a Research Analyst?

If you encounter problems with Stockifi or any other research analyst, follow these straightforward steps to seek resolution.

Step 1: Register Your Complaint With Us

Contact us right away and provide all the details of your issue with the research analyst. We take care of documenting your case thoroughly and accurately from the start.

Step 2: Consult Our Case Manager

We set up a dedicated call with one of our experienced case managers. They review your unique circumstances, assess the strength of your complaint, and walk you through the full path to resolution.

Step 3: Draft a Strong Complaint

Our experts assist in preparing a detailed and well-structured complaint letter. Every key fact, evidence, and supporting document gets included to make your case compelling.

Step 4: Engage the Research Analyst

We support you in reaching out to the research analyst directly. This ensures clear communication and opens the door for an amicable solution.

Step 5: Submit via SEBI SCORES

We provide hands-on guidance for on how to lodge complaint on the SEBI SCORES platform. All details are verified for accuracy, with proper attachments and submission protocols followed.

Step 6: Access SMART ODR Assistance

Should SCORES not yield results, we step in for SMART ODR support. This includes helping you sign up on the ODR portal, gathering required documents, aiding in conciliation sessions, and advocating strongly on your behalf.

Step 7: Navigate Arbitration if Needed

For cases requiring arbitration, we offer complete support. This covers preparing the application, assembling solid evidence, and accompanying you through every phase until closure.

Conclusion

Stockifi markets itself as a sanctuary for the common investor, a “friend” who will guide you to wealth. Their SEBI registration adds a layer of legitimacy that many Telegram scammers lack. But it does not guarantee profits or ethical conduct.

The aggressive marketing of “18x returns” should be a red flag for any prudent investor. Real wealth is built through patience and due diligence, not by following the herd into the latest “multibagger” tip.

Before you subscribe to Stockifi or any similar service, ask yourself: if they have the secret to 18x returns, why do they need your subscription fee?

Always do your own research, read the negative reviews first, and remember that in the stock market, the only person truly responsible for your money is you. Stay safe, and happy investing.