You search for trading calls. A name keeps appearing, Streetgains.

You see structured recommendations. App-based alerts. Performance claims that look confident. Maybe even testimonials that make it sound consistent.

And naturally, a thought crosses your mind: “Are the reviews genuine? What are real users actually experiencing?”

Because here’s the truth.

Before subscribing to any research analyst service, registration and marketing don’t matter as much as real user experience does. What matters is what happens after you pay.

So in this blog, let’s calmly look at Streetgains reviews, the positive feedback, the complaints, the red flags, and what investors should actually pay attention to before making a decision.

Is Streetgains SEBI Registered?

Yes, Streetgains is registered with SEBI as a Research Analyst.

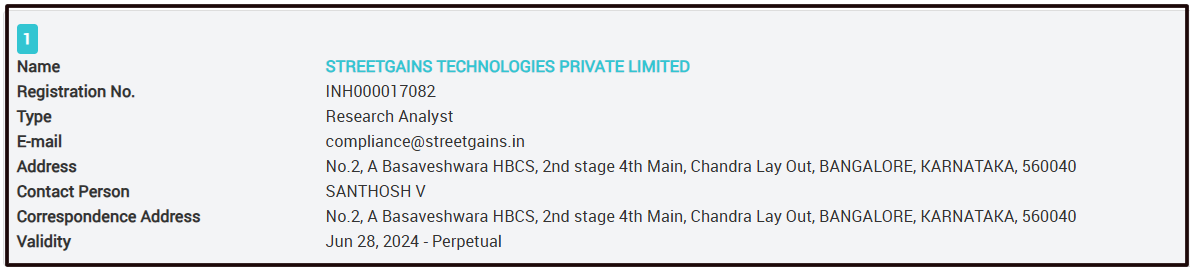

As visible in the official SEBI database screenshot above:

-

Name: Streetgains Technologies Private Limited

-

Registration Number: INH000017082

-

Type: Research Analyst

-

Contact Person: Santhosh V

-

Validity: Jun 28, 2024 – Perpetual

-

Registered Address: Basaveshwara HBCS, 2nd Stage, Bangalore, Karnataka

This confirms that Streetgains holds an active SEBI Research Analyst registration.

Now, what does this mean for investors?

SEBI registration means the entity is legally authorised to provide research recommendations under the SEBI (Research Analyst) Regulations, 2014.

It also means the entity is required to follow compliance norms relating to communication, performance reporting, documentation, and client dealings.

However, registration should not be confused with guaranteed performance.

SEBI registration:

-

Confirms regulatory oversight

-

Confirms legal authorisation

-

Requires adherence to compliance standards

But it does not:

-

Guarantee profits

-

Eliminate trading risk

-

Prevent future regulatory action

Even SEBI-registered entities can face inspections and penalties if violations are found.

So while registration is an important starting point, investors should also look at user reviews, regulatory history, and communication practices before making a decision.

Now that we’ve established its registration status, let’s look at what users are actually saying.

Is Streetgains Safe?

Streetgains is a SEBI-registered Research Analyst, which means it is legally authorized to provide research recommendations.

Registration indicates the RA has to follow SEBI Guidelines for Research Analyst, regulatory oversight and compliance requirements under SEBI regulations.

However, safety in advisory services is not just about registration, it is also about communication practices, performance transparency, and regulatory history.

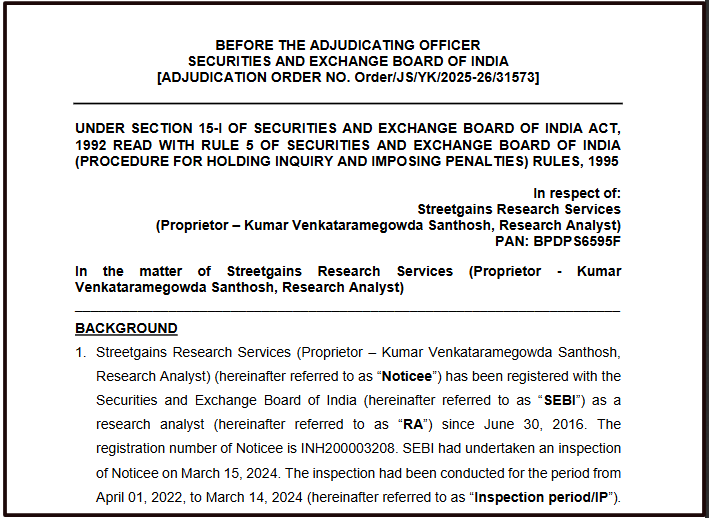

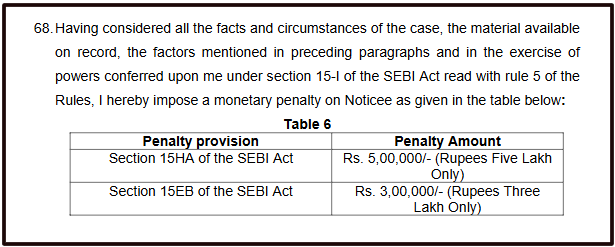

In 2025, SEBI passed an adjudication order against Streetgains after conducting an inspection of its operations.

The order examined WhatsApp communications, social media performance posts, sales incentive structures, and research documentation practices.

SEBI identified concerns relating to:

-

Assured return-type communication

-

Selective display of profitable trades on social media

-

Incentive-driven sales practices

-

Generic research rationale and documentation gaps

After reviewing the findings and responses, SEBI imposed a monetary penalty.

SEBI imposed a penalty of ₹8,00,000 on the Noticee for the violations established in the order. The registration was not cancelled, but the penalty formally recorded regulatory non-compliance.

It is important to understand that a penalty does not automatically mean a shutdown. However, it does indicate that regulatory standards were not fully met during the inspected period.

Lessons for Investors

The order highlights some practical takeaways:

-

Registration alone does not eliminate compliance risks.

-

Be cautious of communication that creates fixed-return expectations.

-

Evaluate how performance is presented; consistent transparency matters.

-

Pay attention to how risk suitability is assessed before taking higher-risk trades.

-

Always review an advisory service’s regulatory history before subscribing.

-

Understand that even SEBI-registered entities can face action if norms are breached.

Safety is not about labels. It is about transparency, communication clarity, and alignment with regulatory standards.

Streetgains User Reviews

Streetgains is a SEBI-registered research analyst platform that provides stock, options, and intraday trading recommendations through its app and communication channels. It positions itself as a structured, data-driven advisory service for active traders.

But beyond registration and marketing, what most investors really want to know is simple: what are real users experiencing after they subscribe?

When you go through one-star reviews, certain themes start repeating. The complaints are not about one unlucky trade.

They focus on accuracy claims, risk-reward structure, upgrade pressure, fees, execution timing, and communication clarity.

Let’s look at them one by one.

Accuracy Claims vs Actual Profitability

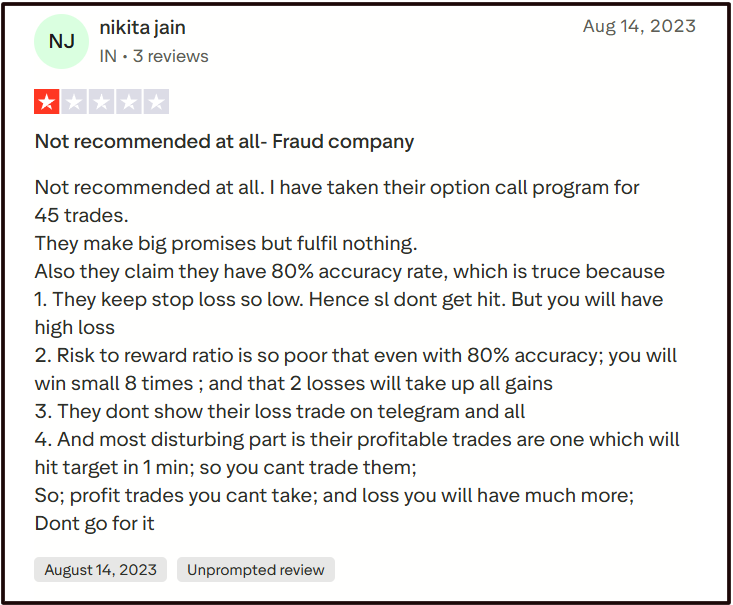

One of the strongest concerns raised relates to the advertised high accuracy rate.

In this review, the user questions the claimed 80% accuracy. According to them, stop losses are kept tight, which may help maintain a high win percentage, but the risk-reward ratio is poor.

The reviewer argues that even if several trades close in small profits, a few larger losses can wipe out those gains.

The review also alleges that losing trades are not shown prominently on Telegram and that profitable trades sometimes hit targets so quickly that retail traders struggle to execute them.

This brings up an important distinction.

A high accuracy percentage does not automatically mean overall profitability. Risk-reward balance and practical execution matter just as much as win rate.

Quality of Recommendations

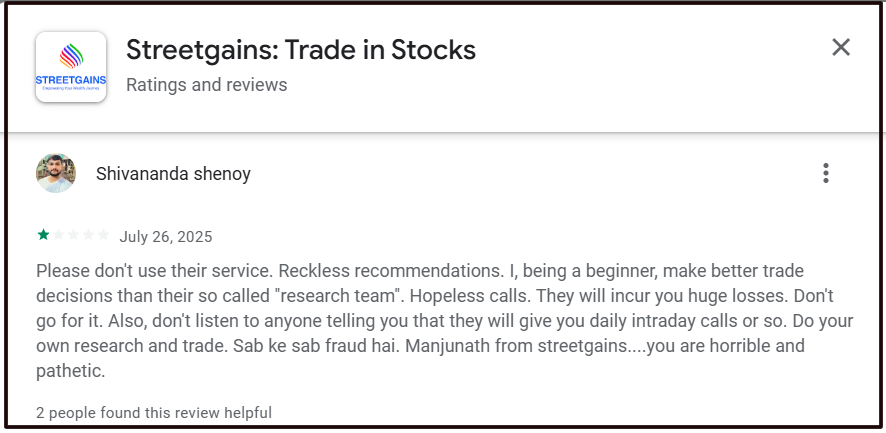

Another reviewer described the trade recommendations as reckless and expressed disappointment with the advisory service.

The concern here appears to be about consistency and reliability rather than a single bad trade.

The reviewer implied that expectations created during subscription did not match the actual experience of following the calls.

The user alleged:

-

Significant losses occurred

-

Trade quality did not feel professionally structured

-

Confidence in the service declined over time

It is important to acknowledge that trading always involves risk. However, dissatisfaction often arises when risk exposure feels higher than initially understood.

Before subscribing, traders should assess whether the advisory style matches their own risk tolerance and trading strategy.

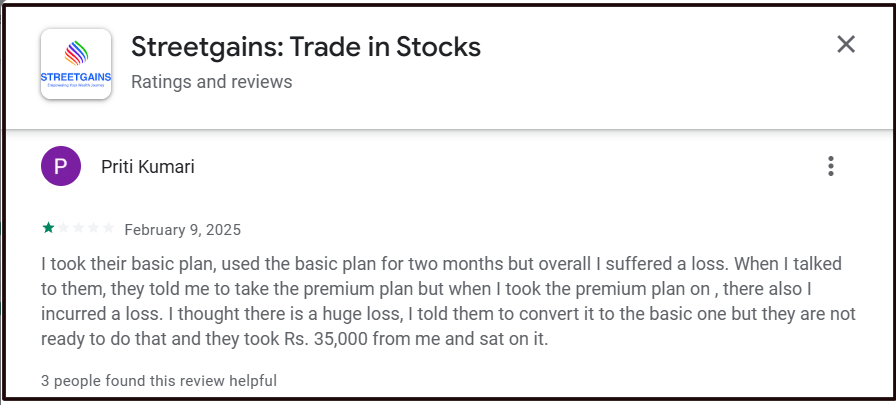

Upgrade Pressure After Losses

A common theme among complaints involves being encouraged to upgrade plans after facing losses.

One reviewer mentioned starting with a basic plan, incurring losses, and then being advised to switch to a premium subscription.

The expectation, according to the complaint, was that a higher plan would produce better results.

The user stated:

-

Losses occurred under the basic plan

-

Premium upgrade was suggested

-

Losses reportedly continued

-

Downgrade or refund was allegedly not permitted

Situations like this can lead to financial strain, especially when expectations are not aligned with outcomes.

Investors should always review plan terms, refund policies, and risk disclosures before upgrading any advisory package.

Subscription Fees vs Overall Loss

Another review focused on the financial impact of combining subscription fees with trading losses.

The user expressed dissatisfaction not only with trade outcomes but also with the total cost incurred.

According to the complaint:

-

Subscription fees of ₹15,000 + GST were paid

-

Trading losses added further financial impact

-

Total loss crossed ₹20,000

When evaluating advisory services, investors should consider total cost exposure, not just advertised returns.

Fees, capital allocation, drawdown risk, and execution quality together determine real profitability.

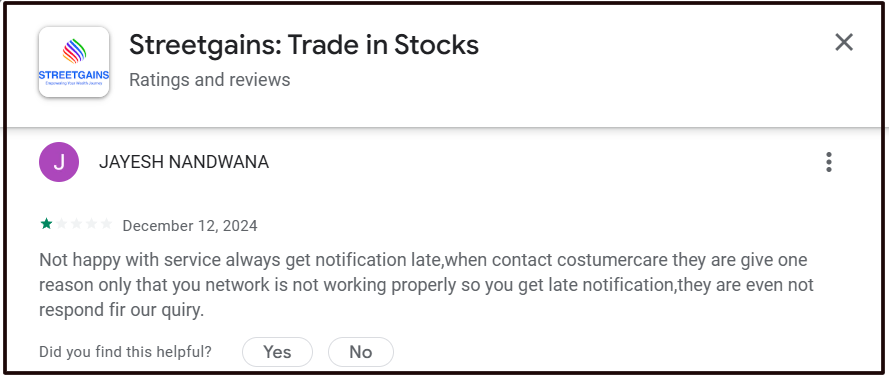

Late Notifications & Customer Support Issues

Timely execution is crucial in intraday trading.

One reviewer claimed that notifications were received late and that customer support attributed the issue to network problems.

The complaint suggests frustration with responsiveness and accountability.

In active trading environments, even small delays can affect entry prices and risk–reward dynamics. Operational efficiency and communication clarity are essential components of any advisory service.

Investors should test execution feasibility before deploying significant capital.

In fast-moving trades, even small delays can impact entry price and profitability.

If users consistently feel that alerts are not actionable by the time they receive them, it naturally affects trust in the service.

Additional Complaints Reported by Users

Beyond the five specific reviews shown above, broader feedback across platforms reflects a few more recurring concerns.

Mostly those complaints are:

- Confusing or unclear trade instructions – Several users feel the alerts lack clarity, making execution harder.

- Performance summaries that highlight winners only – Some believe losing trades are not shown in performance snapshots.

- Lack of explanation or rationale behind calls – Users who want to learn as they trade find this disappointing.

- Perceived bias toward high-risk trades – A few report more aggressive trade recommendations than expected.

- Mixed experiences across subscription plans – Quality of calls sometimes feels inconsistent.

- Slow customer support response times – Complaints about long wait times for help, even when queries are serious.

Now, it’s important to pause.

Every trading platform will have dissatisfied users. Markets are volatile, and losses are part of trading. Negative reviews alone do not automatically indicate wrongdoing.

However, when multiple reviews raise similar concerns, around risk-reward balance, execution timing, upgrade pressure, performance presentation, and support responsiveness, it becomes something investors should examine carefully before subscribing.

The next logical question then becomes: does registration alone make a service safe?

How to File a Complaint Against RIA

If you believe a research analyst has misled you, failed to follow proper disclosure standards, or caused financial harm due to misrepresentation, you are not without options.

Before filing a complaint, the first step is documentation.

Save everything.

Keep screenshots of:

- Trade recommendations

- Performance claims

- Telegram or WhatsApp messages

- Payment receipts

- Subscription invoices

- Email conversations

Clear evidence strengthens your case.

1. Filing a Complaint with SEBI SCORES

If the issue relates to a SEBI-registered Research Analyst, you can file a complaint through the SEBI SCORES (SEBI Complaints Redress System) portal.

On the SCORES platform, you can:

- Select the intermediary category (Research Analyst)

- Describe your grievance clearly

- Upload supporting documents

Once submitted, the complaint is forwarded to the concerned entity, and they are required to respond within a specified time frame.

If you are dissatisfied with the response, the matter can escalate within the regulatory process.

2. Reporting Financial Fraud

If the situation involves suspected fraud, misrepresentation, or financial deception, you may also consider:

- Informing your bank immediately (especially if transactions were recent)

Time matters in financial disputes. The earlier you report, the stronger your position.

Not every trading loss qualifies as misconduct. Markets are volatile, and risk is inherent in trading.

But if you believe there has been:

- Misleading communication

- False performance representation

- Pressure tactics around subscription upgrades

- Non-disclosure of material information

then raising the issue formally is your right as an investor.

Need Help?

If you’ve experienced losses and feel something wasn’t communicated clearly, you don’t have to handle it alone.

Many investors struggle not just with financial loss, but with confusion of what went wrong, whether it was market risk, or whether something was misrepresented. The first step is bringing clarity to your situation.

Register with us and we will assist you in:

- Organising evidence properly; screenshots, payment proofs, trade history, and communication records

- Drafting structured complaints that clearly explain the issue

- Guiding you on how to file your SEBI complaints

- Filling arbitration in the stock market

- Understanding whether the matter involves regulatory non-compliance or simply market risk

When complaints are structured clearly and supported with documentation, they carry more weight than emotional messages or scattered screenshots.

Conclusion

Streetgains, like many trading advisory platforms, presents itself as a structured, research-driven service backed by SEBI registration. On paper, that offers a layer of regulatory legitimacy.

But reviews tell a more layered story.

Some users report dissatisfaction around accuracy claims, risk-reward structure, upgrade pressure, execution timing, and support responsiveness. Others may have neutral or positive experiences.

As with most advisory services, outcomes vary, and trading itself carries inherent risk.

The key takeaway is this: registration alone should not be the deciding factor. Nor should one negative review.

Before subscribing to any research analyst, take time to:

Understand the strategy being offered. Evaluate whether the risk profile matches your own.

Read both positive and negative reviews carefully and most importantly, invest only what you can afford to risk.

In trading, clarity and due diligence matter more than promises.