Give me ₹1.5–2 lakh in capital and 1.5–2 months of time, and I will recover all your losses.”

Sent via WhatsApp by Trade Nexa Research Investment Advisor, this promise reads like a lifeline for investors worn down by market losses—simple, confident, and reassuring. For many, it sounds almost too good to ignore.

Such claims, however, raised regulatory red flags. SEBI’s assessment told a different story.

Trade Nexa Research Review

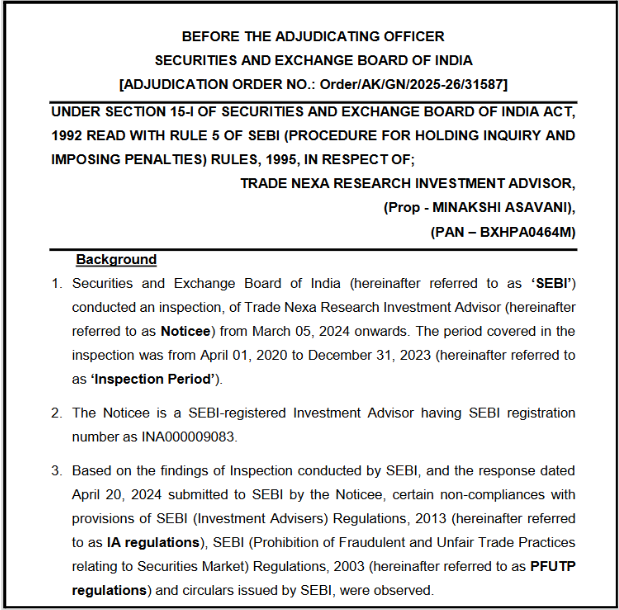

Trade Nexa Research Investment Advisor operated as a SEBI-registered investment advisory firm.

Registration Details:

- SEBI Registration Number: INA000009083

- Business Structure: Proprietorship

- Proprietor: Minakshi Asavani

- Primary Services: Stock market investment advisory

The firm claimed to provide investment advice for equity shares, futures, options, and commodities.

They marketed themselves through Google ads and their website, attracting clients organically through online channels.

Their Service Packages:

- Basic Service: ₹6,000 per month

- Premium Service: ₹25,000 per month (₹60,000 quarterly)

- HNI Service: ₹55,000 for high-net-worth individuals

On paper, everything looked legitimate.

But beneath the surface, serious violations were taking place.

Let’s uncover the details of Minakshi Asavani, the face behind Trade Nexa Research.

Minakshi Asavani is directly responsible for all operations, client communications, and regulatory compliance.

SEBI’s investigation revealed that under her leadership, the firm systematically violated investment advisory regulations between April 2020 and December 2023.

Call recordings, WhatsApp chats, and missing agreements painted a clear picture of non-compliance.

Now, let’s examine what actually happened with the clients.

Trade Nexa Research Complaints

Now, if you check reviews on forums and websites, you will find multiple complaints that are highly concerning and raise a lot of red flags.

Some of those complaints are:

- Several customers have alleged that TradeNexa operates misleadingly and that its team lacks even basic knowledge of trading.

- According to multiple reviews, once users complete the registration process, the promised support from assigned relationship managers or executives is either delayed or completely absent.

- Many reviewers have also described the staff as highly unprofessional and deceptive in their dealings.

- Some users claim that TradeNexa provides buy/sell (call/put) recommendations without proper research or market analysis, which has reportedly led to consistent losses.

- A significant number of customers have further stated that they suffered substantial financial losses after enrolling in TradeNexa’s services. It raises serious concerns about the credibility and reliability of the company.

Among those complaints, there is one that includes reviews with WhatsApp chats directed toward violations of SEBI RIA guidelines.

In the chat above, it is clear that the adviser’s messages were often unclear, especially when they referred to market movements with terms like “Expry bale din up down” and “Ese hi hota h.”

This lack of clarity is problematic, especially for clients who may be new to investing or trading, leading to potential confusion.

Not once did the adviser mention any potential risks associated with the advice given.

According to SEBI regulations, advisers are obligated to provide clear risk warnings, especially when discussing the volatility and unpredictability of the market.

The failure to include such disclaimers is a violation of those guidelines.

Trade Nexa Research SEBI Order

Based on certain complaints, SEBI released an order in 2024 against Trade Nexa Research Investment Adviser.

Below is the detail of SEBI findings, penalty and how such violations impact traders & investors.

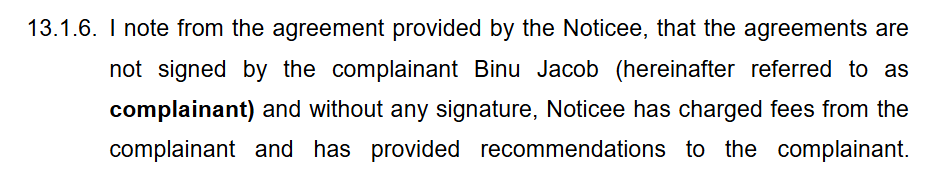

1. The Documentation Problem

Multiple clients received services without signed agreements. They paid fees, received recommendations, but had no legal documentation protecting their interests.

One client, as documented by SEBI, never signed any agreement but still paid and received advice.

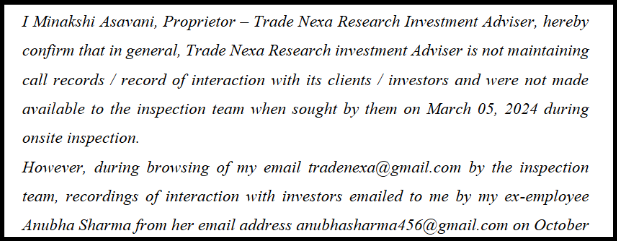

2. The Communication Gap

Trade Nexa claimed to maintain records of client communications through email and SMS. But when SEBI inspectors asked for call recordings, the firm admitted:

“Trade Nexa Research Investment Adviser is not maintaining call records/record of interaction with its clients/investors.”

Clients had no way to verify what promises were made during phone conversations.

3. The Promise-Reality Gap

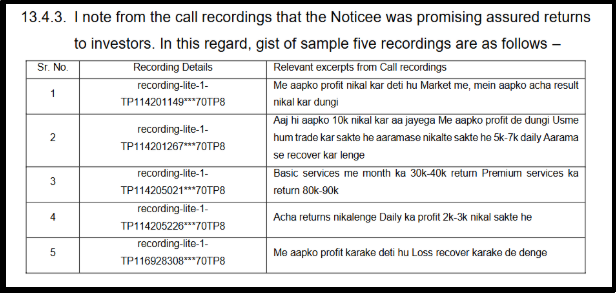

Call recordings obtained by SEBI revealed the disconnect between marketing and reality.

Recording 1 (translated from Hindi): “I will get you profit in the market, I will get you good results.”

Recording 2: “Today itself you’ll get 10k… I will give you profit… 5k-k daily… We’ll easily recover.”

More Recordings as mentioned in the order:

These weren’t cautious projections. They were explicit promises that no legitimate advisor can make.

Interestingly, some of the most damaging evidence came from Trade Nexa’s own ex-employee.

Anubha Sharma, a former employee who interacted with clients on behalf of Trade Nexa, sent call recordings to Minakshi Asavani’s email in October 2023.

When SEBI inspectors stumbled upon these recordings during their email review, they discovered the full extent of false promises being made to clients.

This suggests:

- Employees were making unauthorized promises

- The proprietor either knew or should have known about these practices

- Quality control and compliance monitoring were nonexistent

Key Violations & Findings

- Charging Fees Without Agreement / Before Agreement

- Finding: In 90 instances, the Noticee charged fees either without any signed agreement or before the agreement was executed.

- Evidence:

- 74 cases: No client signature or no agreement provided.

- 15 cases: Fees collected before the agreement date.

- 1 case: Fees charged and advice given without any agreement.

- Impact: This violates client protection norms, undermines transparency, and exposes investors to unregulated advisory services without clear terms.

- Failure to Maintain Call Records

- Finding: The Notice did not maintain call recordings or interaction records with clients.

- Evidence: During inspection, the Notice admitted that they do not maintain call records. Only a few recordings were provided, forwarded by an ex-employee.

- Impact: Lack of audit trails makes it impossible to verify advice given, assess miss-selling, or investigate client disputes fairly.

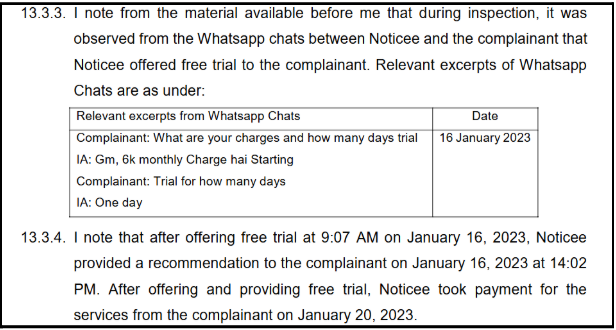

- Offering Free Trials

- Finding: The Notice offered a one-day free trial to a client via WhatsApp.

- Evidence: WhatsApp chat dated January 16, 2023, shows the offer: “One day trial.”

Trade Nexa provided an actual stock recommendation during the supposed “free trial”.

The client made a payment for services after experiencing the trial.

- Impact: Free trials are prohibited as they can lure clients into unverified services and encourage mis-selling.

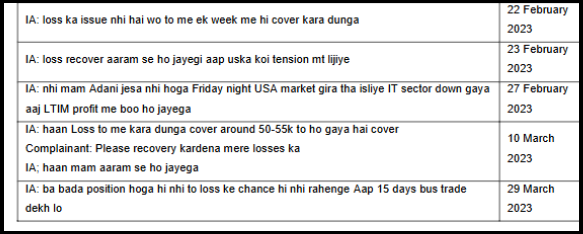

- Assurance of Returns / Loss Recovery & Mis-selling

- Finding: The Notice promised guaranteed profits, fixed returns, and loss recovery to clients.

- Evidence:

- Call recordings with statements like:

- “Mein aapko profit nikal kar deti hu”

- “Daily ka profit 2k–3k nikal sakte he”

- “Loss recover karake de denge”

- WhatsApp chats assuring loss recovery and fixed returns.

- Call recordings with statements like:

- Impact: Such promises mislead investors, create false expectations, and constitute fraudulent and unfair trade practices. This can lead to significant financial loss and erode trust in the market.

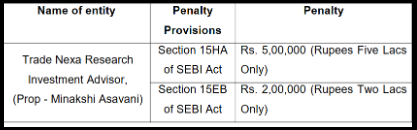

SEBI Penalty on Trade Nexa Research

Based on the above findings, the Securities and Exchange Board of India (SEBI) has imposed a total penalty of ₹7,00,000 (Seven Lakh Rupees) on Trade Nexa Research Investment Advisor for multiple violations of investment advisory regulations.

This enforcement action sends a strong message about the importance of regulatory compliance and ethical conduct in the financial advisory industry.

What Investors Can Learn From Such Cases?

Here are some of the key learnings from such cases for investors & traders who get trapped in such fake promises of registered advisories:

- “Guaranteed Returns” or “Loss Recovery” Promises

If an advisor says, “I will recover your losses” or “You will earn ₹X daily,” walk away immediately.

The stock market is inherently risky, and no one can guarantee profits. This is the #1 sign of a fraudulent scheme.

- Pressure to Pay Before Signing

Never pay any fee before you have read and signed a formal agreement.

A legitimate advisor will never rush you to pay first. The agreement is your legal protection.

- Free Trials or “Test” Services

SEBI bans free trials in investment advice. If it’s offered, it’s a trap to hook you.

Professional advice isn’t a “try before you buy” product.

- Proper Paperwork

If your advisor communicates only through informal WhatsApp messages and doesn’t provide signed agreements or official reports, it’s a sign of unprofessional and non-compliant operations.

“Don’t Worry, Just Trust Me” Attitude

A good advisor will always explain risks, never hide them. If they dismiss your questions or avoid giving clear, recorded advice, be very cautious.

What Can You Do In Such Cases?

If you are a client or investor who faced issues with Trade Nexa Research Investment Advisor or Minakshi Asavani, you are not alone.

Our dedicated team specialises in supporting investors in situations like these.

We provide end-to-end guidance to ensure your grievance is clearly documented and effectively escalated.

Our Step-by-Step Support Process:

- Initial Consultation & Case Assessment

We arrange a confidential discussion with a dedicated Case Manager who will listen carefully to your full experience with Trade Nexa Research.

- Professional Case Documentation & Drafting

We help you prepare a structured, persuasive, and legally sound complaint that outlines:

- The misconduct you experienced

- Any financial losses incurred

- Specific SEBI rule violations (such as charging fees without an agreement, false promises of returns, or lack of call recordings)

- Direct Engagement & Escalation

- Reaching out to Trade Nexa Research / Minakshi Asavani: We guide you in formally communicating your complaint to the advisor, which is often a required step before approaching SEBI.

- Filing on SEBI SCORES: We assist you in how to lodge complaint in SCORES portal and help you track its status and respond to SEBI queries.

- Exploring SEBI Smart ODR: If eligible, we can guide you through the SEBI Online Dispute Resolution platform for a faster resolution.

- Advisory & Strategic Counselling

Our experts provide realistic advice on potential outcomes, possible recovery avenues, and expected timelines based on similar cases against investment advisors.

- Arbitration & Further Legal Options

If responses from Trade Nexa Research or initial SEBI actions are unsatisfactory, we help you explore further options, including Arbitration in Stock Market.

Your Money Matters. Your Complaint Matters.

Take the First Step Today

Reach out to us today, and let our experienced team guide you toward a fair resolution.

Conclusion

This case represents more than just one firm’s regulatory violations. It’s a stark reminder that financial advice is built on trust, and when that trust is betrayed through false promises and poor practices, everyone suffers.

The ₹7 lakh penalty might seem modest compared to the potential damage done to client trust and market integrity.

But perhaps its real value lies in the public documentation of what went wrong and the clear message it sends: the rules exist for a reason, and they will be enforced.

For investors, the lesson is clear: be sceptical of promises that sound too good to be true. No legitimate advisor can guarantee returns in securities markets.

Your best protection is knowledge, documentation, and the willingness to walk away from deals that raise red flags.

The securities market thrives on informed decision-making, fair dealing, and trust. Trade Nexa’s violations undermined all three. The penalty serves as both punishment and warning: protect investors, or face the consequences.