Trading frauds in India rarely start with pressure or threats. They start with confidence.

A WhatsApp message that sounds professional. A Telegram group that looks active. Screenshots that show profits. Someone who “guides” you patiently.

By the time doubt sets in, the money is already gone.

This blog breaks down how trading frauds actually work in India, backed by real cases and real user experiences, and explains how to identify, prevent, and report them properly.

What Are Trading Frauds?

Trading frauds involve deception linked to stock market investing or trading, where money is taken through false promises, misrepresentation, impersonation, or manipulation.

These frauds often:

- misuse SEBI or exchange names

- operate through WhatsApp, Telegram, Instagram, and LinkedIn

- show fake profits on apps or dashboards

- block withdrawals and demand extra “fees.”

They target beginners and experienced investors alike.

Common Types of Trading Frauds in India

1. WhatsApp & Telegram Trading Groups

Victims are added to groups claiming:

- “institutional trading”

- “sure-shot intraday calls”

- “IPO allotment hacks.”

- “AI-based trading systems”

Initial profits are shown. Withdrawals later fail.

2. Fake Trading Apps & Dashboards

Users are asked to install unknown apps or log into web dashboards that:

- show manipulated profits

- allow deposits easily

- block withdrawals unless “tax” or “service fees” are paid

Once payments stop, the platform disappears.

3. Fake Research Analysts & Tip Providers

Scammers claim SEBI registration, charge subscription fees, and push aggressive trades.

Losses are blamed on “market conditions.” Refunds are refused.

4. Impersonation of Brokers, Exchanges, or Regulators

Fraudsters pose as:

- broker support staff

- exchange officials

- SEBI representatives

They ask for OTPs, login access, or “verification payments.”

Trading Fraud in India: Real Cases

These are verified cases reported by major Indian news outlets, showing how large and organised trading frauds have become.

Case 1: Mysuru Man Duped of ₹1.8 Crore via WhatsApp Trading Scam

A man from Mysuru was added to a WhatsApp group promising expert trading guidance and high returns.

He was told a foreign institution could not hold Indian accounts and was asked to transfer funds to multiple local accounts.

Over 19 days, he lost ₹1.8 crore before realising it was a scam.

Case 2: Tutor Loses ₹32.85 Lakh After Installing Fake Trading App

A private tutor from Bhuj joined a WhatsApp group promoting stock investments and IPO opportunities.

He was asked to install a trading app and transfer money.

Although the app showed profits, withdrawals failed, and ₹32.85 lakh was lost.

Case 3: Trader Duped of ₹1.37 Crore in Crypto/Forex Scam

A trader from Yavatmal was contacted by a woman claiming to be a finance expert.

After initial “profits,” he invested heavily through a trading app.

Withdrawals were blocked, and communication stopped, resulting in a ₹1.37 crore loss.

Case 4: Thane Retired Man Loses ₹6.44 Crore After Fake Portfolio Display

A 70-year-old man was shown a fake ₹34-crore trading portfolio inside a WhatsApp group.

Trusting the displayed profits, he transferred ₹6.44 crore. Withdrawal attempts were blocked, exposing the scam.

Trading Frauds in India: Real User Experiences

These are first-person accounts shared by users, showing how frauds unfold before police cases or news coverage.

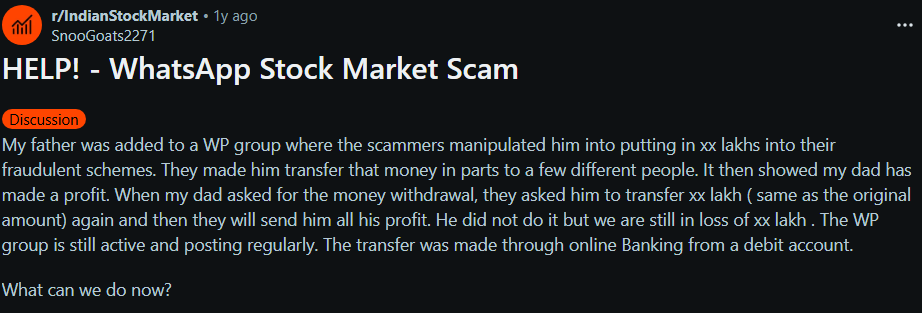

User Story 1: Father Duped via WhatsApp Group

A Reddit user wrote that their father was added to a WhatsApp stock group. Profits were shown daily.

When he tried to withdraw, he was asked to send more money to “release profits.” Communication stopped after the refusal.

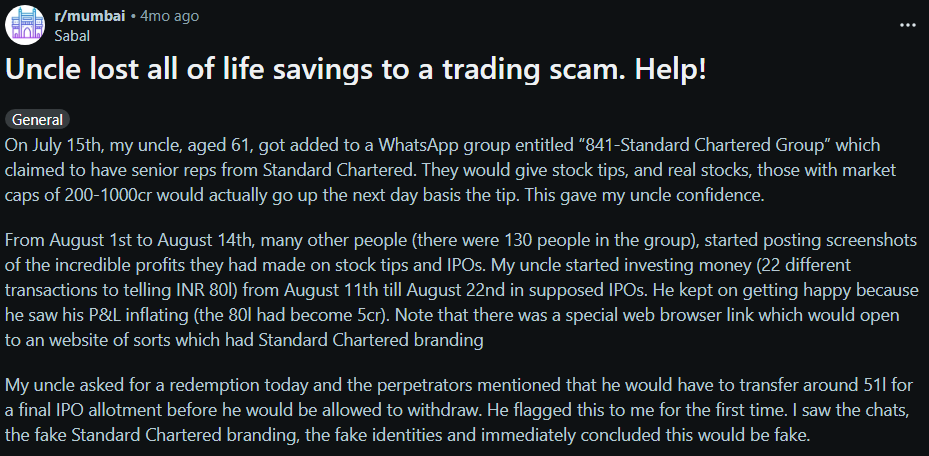

User Story 2: Uncle Lost Life Savings

Another user shared that their 61-year-old uncle joined a WhatsApp group claiming to be linked to a reputed bank. Initial trades looked genuine.

Over time, large sums were invested and later vanished.

How to Identify Trading Frauds?

Most trading frauds give signals early. The problem is that these signals are often ignored because they don’t look like scams at first.

Here’s how to identify fraud before money is lost:

1. Guaranteed Returns

If anyone promises:

- Fixed monthly returns

- “no-loss” strategies

- guaranteed intraday profits

It is a red flag. In regulated markets, guarantees are illegal, even for registered entities.

2. Unsolicited Contact

Frauds usually begin with:

- WhatsApp messages

- Telegram invites

- Instagram ads

- LinkedIn DMs posing as analysts or fund managers

Legitimate brokers and SEBI-registered professionals do not cold-message investors.

3. Fake Proof and Screenshots

Scammers often share:

- Screenshots of huge profits

- edited trading dashboards

- fake client testimonials

These are easy to fabricate.

Always ask: Can this be independently verified?

4. Unknown Apps or Dashboards

If you’re asked to:

- Install an app not on the Play Store / App Store

- Log in to a web dashboard you’ve never heard of

- trade on platforms without clear ownership

Stop immediately. Most frauds use custom-built fake interfaces.

How to Prevent Trading Frauds?

Prevention is about process, not intelligence. Even experienced traders fall for fraud when rules aren’t followed.

1. Verify Registration Independently

If someone claims to be:

- a SEBI-registered research analyst

- a portfolio manager

- an advisory firm

Verify their registration directly on SEBI’s website.

Never trust screenshots or certificates sent on WhatsApp.

2. Avoid Social Media Trading Groups

WhatsApp and Telegram are the biggest entry points for fraud.

- No legitimate trading operation runs public tip groups.

- No SEBI-registered entity offers “group-based trading guidance.”

If trading advice starts in a group chat, walk away.

3. Never Share Login Details or OTPs

No broker, exchange, or regulator will ever ask for:

- OTPs

- passwords

- screen-sharing access

Sharing these once can empty your account.

4. Don’t Chase Recovery

Many victims lose more money trying to “recover” losses.

Scammers often:

- Pose as recovery agents

- promise to retrieve lost funds for a fee

This is usually a second scam layered on the first.

5. Use Only Regulated Platforms

Stick to:

- well-known brokers

- regulated exchanges

- platforms with clear grievance mechanisms

If a platform avoids transparency, it’s not worth the risk.

How to Report Trading Scams?

1. Collect Evidence

- Payment proofs

- Bank statements

- Chat screenshots

- App screenshots

- Transaction timelines

2. Inform the Bank First

- This step is time-sensitive.

3. File a Cyber Crime Complaint

- Provide exact transaction details and dates.

4. File on SEBI SCORES (If Applicable)

- Mention registration details and attach all documents.

5. In Case of Unregistered Entity

- File a complaint with SEBI by sending an email with all the proof.

6. Track and Follow Up

- Save complaint numbers.

- Respond promptly to requests for clarification.

- Avoid emotional language. Stick to facts. Regulators work on evidence, not narratives.

Need Help?

Many trading fraud cases fail not because they’re weak, but because they’re poorly documented or escalated incorrectly.

We help investors with:

- identifying the correct complaint route

- structuring complaints properly

- filing on SEBI SCORES, cybercrime portals, and regulatory channels

- managing follow-ups so cases don’t stall

The aim isn’t conflict.

It’s proper recording, review, and resolution. Register with us to file a proper complaint for trading scam recovery.

Conclusion

Trading frauds in India are not rare accidents. They are organised, repeatable, and evolving.

They rely on trust, urgency, and silence.

Awareness is the first defence. Timely, structured action is the second.If something feels off, don’t wait for certainty.

In trading frauds, delay is often the biggest loss.