Investors often trust long-established, SEBI-registered brokers. That trust feels reasonable.

But even regulated brokerage names like SMC Global appear in unauthorised trading disputes; not always because the broker itself trades without consent, but because individuals misuse access, authority, or the broker’s brand.

This blog explains how such disputes arise in the context of SMC Global Securities Ltd., a SEBI-registered brokerage firm.

It starts with what SMC states on its website, examines a reference case (paraphrased from a client complaint), adds verified external cases and regulatory history, and then explains what investors should do when things go wrong.

The focus stays on process, evidence, and accountability, not assumptions.

SMC Global Unauthorised Trading Case Explained

In one complaint, an investor described a chain of events that gradually shifted control of their trading activity away from them without any formal safeguards in place.

According to the complaint, the investor was approached by an individual who claimed to be connected with SMC-related trading operations and offered to “professionally manage” trading accounts.

The pitch included verbal assurances of fixed annual returns, with profit-sharing discussed casually.

However, no written agreement, risk disclosure, or official documentation was ever provided, despite the investor requesting clarity multiple times.

As the arrangement progressed, the investor alleges that trading accounts were opened in the names of other individuals, described as part of a sub-broking setup.

Email IDs and mobile numbers linked to these accounts were allegedly created and controlled by the operators themselves.

The investor states that they never retained direct access to login credentials and were instructed to misrepresent the account arrangement if contacted by the broker’s office.

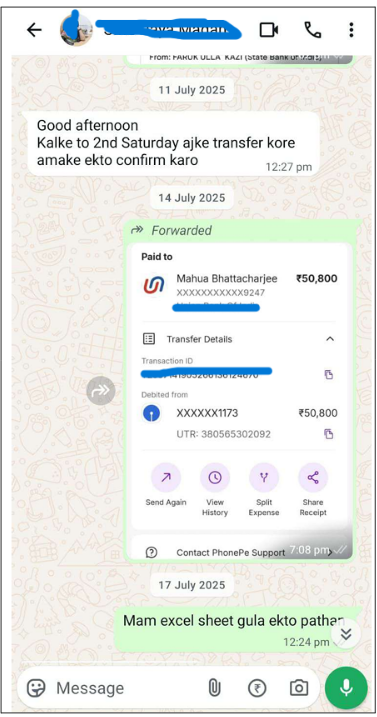

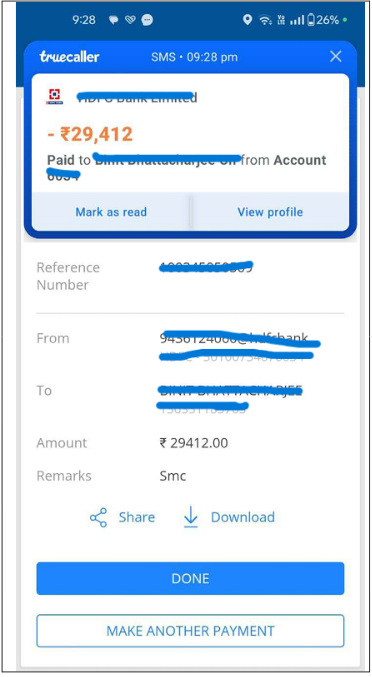

Over time, approximately ₹24 lakh was deposited into one such account. The investor claims that payouts were routed through cash withdrawals and UPI transfers to personal accounts belonging to the individuals involved.

No formal account statements, trade justifications, or performance reports were shared during this period.

When the investor later visited the office seeking clarity, they alleged that only about half of the deposited funds remained.

The rest was reportedly lost through trading activity that the investor neither authorised nor monitored.

The complaint further states that the investor never received real-time updates on losses, was repeatedly told that profits were being generated, and still does not have access to the account credentials or complete transaction records.

It is important to note that this reference case does not allege that SMC Global itself executed trades without consent.

Instead, it illustrates how individuals claiming association with a registered broker can obtain effective control over accounts, operate outside formal systems, and leave investors exposed, often before any red flags become obvious.

How To File a Complaint Against a Broker?

If somehow a broker misleads you or misuses your login information without your consent, you can file a complaint by following the steps given below:

Step 1: Collect Your Proof

Save:

- Bank statements

- UPI receipts

- WhatsApp chats

- Emails

- Screenshots of account access issues

Step 2: Write to the Broker’s Grievance Cell

Ask for:

- Account access restoration

- Trade statements

- Authorised person details

- Internal investigation findings

Step 3: Lodge a Complaint in SCORES

In case you do not get any response from stock broker, then you can escalate it and file a complaint in SCORES:

- Register on the SCORES platform.

- Draft your complaint

- Attach evidence.

Need Help?

Cases involving unauthorised trading, account control loss, and off-platform payments require methodical handling.

Reach out to us; we help investors:

- Identify whether a case involves broker lapses or third-party misuse

- Structure stock market complaints with correct legal framing

- Understand SEBI rules on authorisation and liability

- Avoid recovery scams that target victims again

The focus stays on evidence, timelines, and process, not promises.

Conclusion

SMC Global Securities Ltd. operates as a SEBI-registered brokerage with formal systems and disclosures.

At the same time, individual misconduct, brand misuse, and off-platform fund handling continue to cause serious investor losses.

Unauthorised trading disputes rarely start with a single trade. They start when control, transparency, and documentation disappear.

In the market, access is authority. Once access leaves your hands, risk multiplies fast.