In today’s world, financial independence isn’t a nice-to-have anymore; it’s a must-have.

And the choices you make today, such as the platforms you trust, the advice you follow, the strategies you apply, can either grow your portfolio or quietly drain it.

Chances are, you’ve heard the buzz. The name Wealth Trade Research keeps popping up in investor forums, WhatsApp groups, and trading discussions.

But what’s the real story?

Is it a genuine research-backed platform or just another name riding the market hype?

Could it actually sharpen your trading decisions? Or leave you more confused than confident?

So buckle up. Let’s cut through the noise, ask the right questions, and explore how you can navigate the fast-moving world of trading with clarity, confidence, and precision.

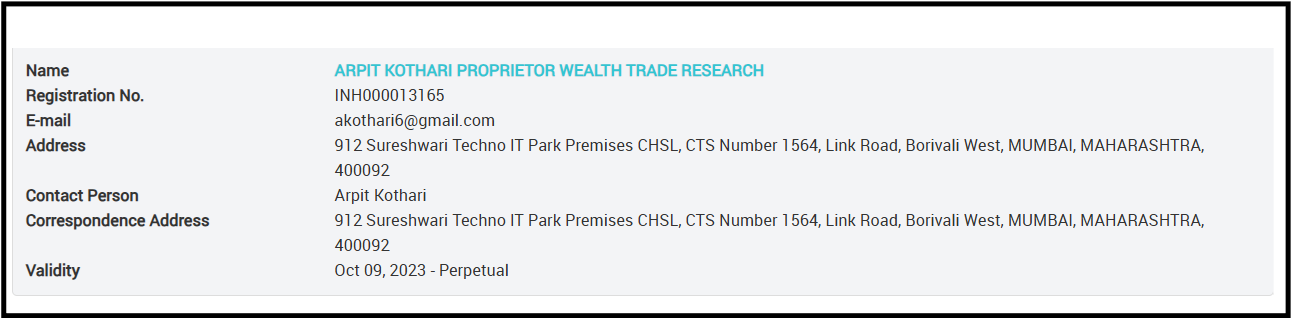

Is Wealth Trade Research SEBI-Registered?

Wealth Trade Research is a legal and SEBI-registered advisory firm (SEBI Registration No. INH000013165), committed to helping investors navigate the markets with clarity and confidence.

It isn’t about guesswork or hype; it’s about research-backed decisions.

Picture the stock market as a vast, turbulent ocean. Prices rise and fall like waves, news hits like sudden storms, and one wrong move can push you off course.

Wealth Trade Research acts as your experienced navigator, guiding you with a well-marked map and a reliable compass.

Their strength lies in data-driven insights, in-depth technical analysis, and solid fundamental research.

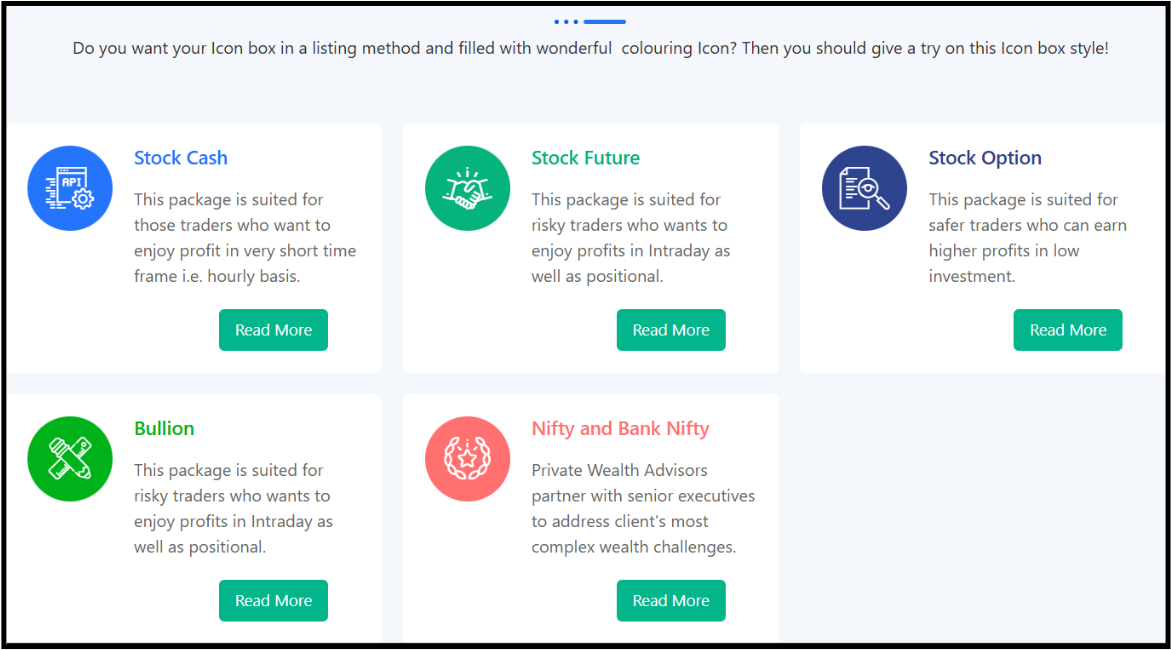

Whether it’s Equities, MCX Commodities, or Nifty and Bank Nifty options, the focus remains the same, turning complex market data into clear, actionable investment strategies.

Instead of drifting on tips or emotions, investors get structured guidance backed by research and discipline.

Whether markets are calm or volatile, Wealth Trade Research helps you stay on course, with confidence, clarity, and compliance at the core.

In short, it’s not just about trading the market. It’s about trading it wisely.

What SEBI Allows a Research Analyst to Do?

Imagine you’re scrolling through stock tips on social media, and you spot someone proudly calling themselves a SEBI-registered Research Analyst. It feels reassuring, right?

But before you start following their advice, it’s important to know exactly what SEBI allows them to do and can trust SEBI-registered RA.

Based on the latest SEBI regulations and insights, here is what RAs are allowed to do-

- Provide Stock Recommendations: They can give specific advice on whether you should buy, sell, or hold stocks, mutual funds, or derivatives.

- Publish Research Reports: They are authorised to create in-depth documents covering fundamental analysis (company health) and technical analysis (price action).

- Sector & Market Commentary: They can analyse entire industries (like IT or Banking) and explain how macroeconomic factors (like inflation or RBI rates) will affect your money.

- Educational Content: They can conduct webinars and seminars to teach you how the market works.

So the next time someone flashes a SEBI registration number at you, remember: that registration does give them authority to offer research and recommendations, but within strict limits designed to protect you.

It’s your job to stay curious, verify credentials independently, and decide how and whether to act on their advice.

What Is Not Permitted for a SEBI-Registered Research Analyst?

In the world of Indian stock markets, the “SEBI-registered” tag is often seen as a golden shield. Investors see it and think, “Okay, my money is safe here.”

But there is a catch. Just because someone is a registered Research Analyst (RA) doesn’t mean they have a free pass to do everything.

SEBI-registered Research Analyst is strictly prohibited from doing:

- Guaranteed Profit Promises: If an analyst tells you, “Invest in this, 20% profit is guaranteed,” run.

SEBI regulations explicitly forbid RAs from promising or guaranteeing returns. The market is inherently risky, and an analyst’s job is to provide an opinion based on data, not a magic crystal ball. - No Portfolio Management (PMS): A Research Analyst can not take control of your demat account and buy Stock for you.

- Handling Your Money: An RA should never ask you to transfer investment funds to their personal or business bank account. You pay them a fee for their research, but the capital for your investments must always stay in your own bank or brokerage account.

SEBI-Registered label is a mark of accountability, not a guarantee of honesty. The regulator provides the framework, but as an investor, you are the final auditor.

How to File a Complaint Against a Research Analyst?

If Broker is troubling you and you feel stuck, you don’t have to worry alone.

Register with us, and we will be the ones to help you convert your problem into a proper, trackable complaint.

Here’s How We Help with Broker Issues:

1. Initial Consultation & Case Assessment

We provide a confidential session with a dedicated Case Manager to:

- Listen carefully to your full experience with Wealth Trade Research

- Review your transaction records and communications

- Evaluate the strength of your case

- Clearly explain your legal options

No judgment, just clear, actionable solutions.

2. Professional Case Documentation & Drafting

We assist in preparing a well-structured, persuasive, and legally sound complaint that highlights SEBI violations, such as:

- Charging for overlapping services (double-billing)

- Receiving payments into personal accounts

- Ignoring or failing to resolve investor complaints

- Fraudulent misrepresentation and unfair trade practices

3. Direct Engagement & Escalation

Step 1: Formal Communication: Guidance on formally notifying Wealth Trade Research, before approaching SEBI.

Step 2: Lodge a complaint in SCORES

- File a complaint in SCORES on the SEBI SCORES portal.

- Monitoring SEBI complaint status in real-time

- Responding to SEBI queries professionally

Step 3: File a complaint in Smart ODR: Assistance in navigating the Online Dispute Resolution platform for quicker resolutions when eligible.

We handle the bureaucracy so you can focus on recovering your funds.

4. Advisory & Strategic Counselling

Our experts provide:

- Realistic evaluation of recovery prospects

- Timelines based on similar fraud cases

- Guidance on alternative remedies, including consumer forums or police complaints

- Advice on claiming refunds for unrendered services

Complete transparency from day one.

5. Arbitration & Legal Representation

If SEBI actions are insufficient, we support you in:

- Filing arbitration in share market disputes

- Pursuing civil recovery claims

- Lodging criminal complaints under IPC Section 420 (cheating)

- Representing your case professionally

- Exploring all possible remedies until resolution

We remain committed until justice is achieved.

Conclusion

Building a secure financial future isn’t about moving fast; it’s about moving with clarity.

Before committing your hard-earned capital to any advisory, such as Wealth Trade Research, a balanced and sceptical approach is your best defence.

Every financial decision deserves a moment of due diligence. To ensure you are making a smart, confident choice, here is a quick roadmap for your homework:

- Verify the Credentials: Don’t just take their word for it. Ensure they are currently registered with SEBI.

- Transparent Fee Structures: Legitimate advisors are crystal clear about how they get paid.

Taking the time to read every document and ask the tough questions isn’t just a precaution. It’s a sign of a sophisticated investor.

A little research today ensures that when you do invest, you do so with a sense of security rather than a leap of faith.

If an advisor pressures you, ignores your risk tolerance, or operates without proper SEBI registration, walk away. Because when rules are ignored, it’s usually the investor who pays the price.