Imagine logging into your trading or demat account one morning and noticing transactions you don’t remember approving.

At first, you wonder if you forgot to place the order.

Then the confusion turns into worry, ‘Did someone trade on my behalf without my consent?’ ‘Did my stockbroker trade without my permission?’

This situation is more common than many investors realise.

Individual and first-time investors, in particular, often feel lost when something like this happens because they are unsure of their rights or how to respond.

The uncertainty can be stressful, especially when real money is involved, and the unauthorised trading risk suddenly feels very real.

The good news is that Indian investors are not powerless.

SEBI regulations clearly protect you, and once you understand what unauthorised trading is and how to respond, the problem becomes far more manageable.

Unauthorised Trading Meaning

In simple terms, unauthorised trading refers to any trade executed in your account without your explicit consent.

That consent could be given digitally, verbally (with proper recording), or in writing. If a trade is placed without it, the broker is in violation.

This can happen in several ways. Sometimes trades are executed without the client’s knowledge. In other cases, confirmations are delayed or never shared.

There are also instances where brokers misuse their position or operate with weak internal controls, allowing unauthorised persons to access trading terminals.

SEBI regulations are very clear on this point: every trade must be authorised by the client. Anything else is not only unethical but also a regulatory breach that can attract serious unauthorised trading penalties, including fines, restrictions, or disciplinary action against the broker.

How to File a Complaint Against Unauthorised Trading?

The first thing to do is stay calm and verify the facts. Carefully go through your contract notes, trade confirmations, and account statements.

Look at the timing of the trades, the quantities, and the prices. Ask yourself honestly whether you placed those orders or gave consent in any form. If something doesn’t add up, make a note of it immediately.

Once you are certain that the trade was not authorised, then file a complaint following the steps below:

- File a Complaint to Your Stock Broker: Always communicate in writing; email is best. Clearly state that you did not approve the transaction and ask for an explanation.

Keep copies of emails, screenshots, and any responses you receive. Documentation matters more than most investors realise.

- Lodge a Complaint in SCORES: If the broker does not respond properly or tries to brush the issue aside, the next step is to raise a formal complaint through their grievance redressal mechanism.

All SEBI-registered brokers are required to have one, and they are bound to respond within a specified time frame.

- File a Complaint in SMART ODR: If this still does not resolve the issue, you can escalate the matter to the stock exchanges (NSE or BSE) or file a complaint on SEBI SCORES, the regulator’s official grievance portal.

These platforms are not symbolic; they are actively monitored, and unresolved complaints can trigger inspections and regulatory action.

- File an Arbitration in the Stock Market: For more serious disputes or financial losses, investors also have the option of exchange arbitration or approaching consumer courts.

These mechanisms exist precisely because broker-client disputes are not uncommon.

One important point many investors miss is timing. Ideally, suspicious trades should be reported as soon as you receive the contract note, preferably within a day or two.

Delays don’t automatically disqualify complaints, but acting quickly always strengthens your case.

Unauthorised Trading by Stock Broker: Real Case Studies

Many investors assume that complaining won’t lead anywhere, but SEBI’s enforcement history tells a different story.

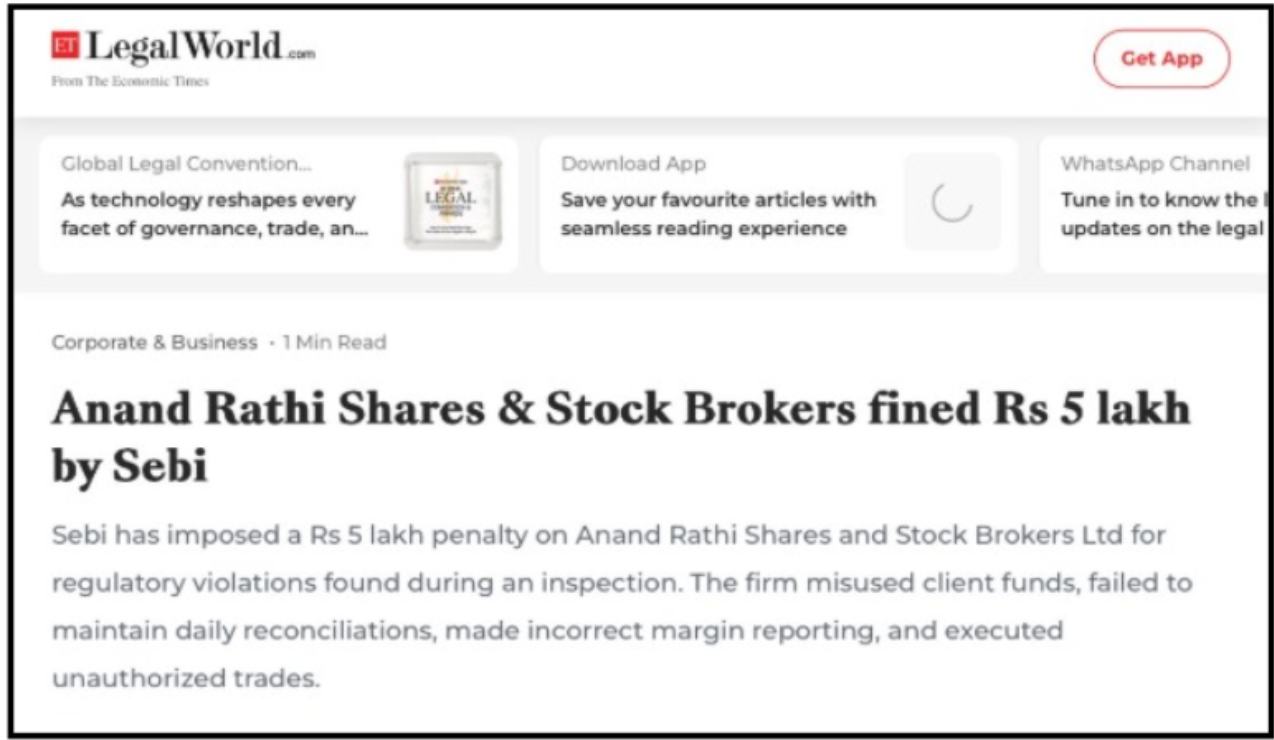

Anand Rathi Unauthorised Trading

In one case involving Anand Rathi Share and Stock Brokers, SEBI’s inspection revealed that certain trades had been executed without proper authorisation.

The broker argued that these were operational mistakes rather than deliberate wrongdoing.

SEBI rejected that defence, stating clearly that brokers are responsible for maintaining systems that prevent such lapses.

Since those systems failed, SEBI imposed a monetary penalty. The case reinforced an important principle: investor consent is non-negotiable, regardless of intent.

Unauthorised Trading by SMC Global

According to what’s described, an investor was approached by an individual claiming to be linked with SMC Global’s operations.

The pitch was simple and familiar: “Let us manage your trading account professionally with good returns.”

The investor was verbally assured of steady returns and agreed to proceed, even though no formal agreement, risk disclosures, or official documentation were ever shared.

Over time, the investor alleges several troubling developments:

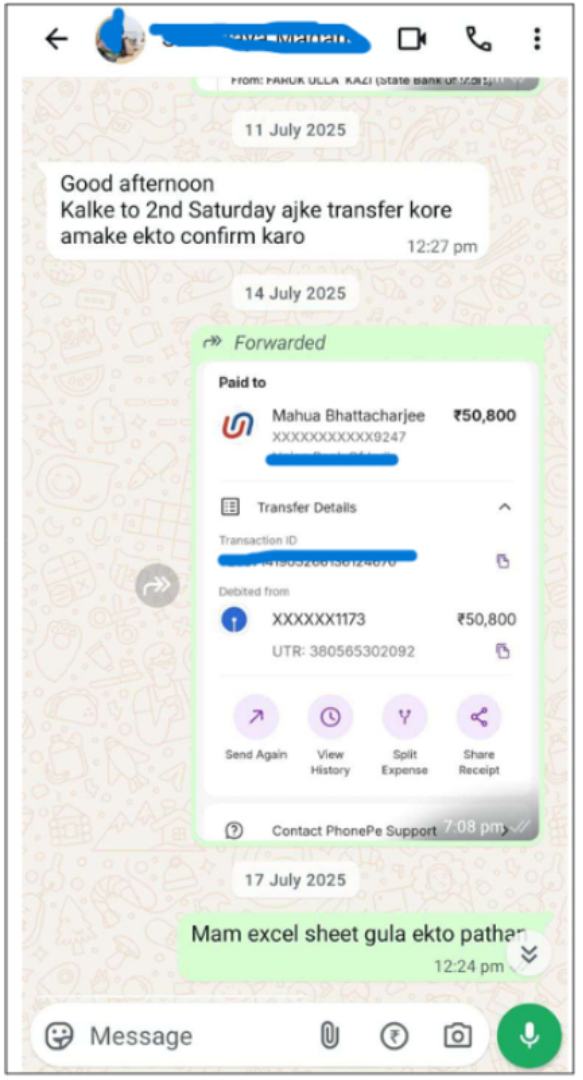

- Accounts were opened in the names of other individuals, supposedly as part of a sub-broking or associate setup.

- Login credentials, email IDs, and mobile numbers linked to those accounts were controlled by the people running the arrangement, not by the investor.

- The investor never actually retained access to their own login credentials. Instead, they were dependent on others to view or execute trades.

Despite repeatedly asking for transparency, the investor never received real-time access, regular account statements, or detailed transaction records.

As deposits (around ₹24 lakh) were made into these accounts, the investor was told that profits were being generated, but when they finally checked in person, only about half of the funds were there.

The remaining amount had been used in trading that the investor did not authorise or monitor.

Importantly, this specific blog case does not allege that SMC Global Securities Ltd. itself directly placed trades without consent or intentionally defrauded the client.

Rather, it highlights a situation where third parties claiming association with the broker gained effective control over client accounts and operated outside formal systems, leaving the investor exposed and confused.

What makes this kind of case tricky is that the brand name of a SEBI-registered broker like SMC Global appears to give victims a false sense of security.

Investors may assume they are still in a regulated environment even when key aspects, like account access and documentation, are being controlled unofficially by others.

This is one of the reasons why SEBI and exchanges emphasise strict processes, client consent, and transparent records for every trade and account access action.

How Investors Can Protect Themselves from Unauthorised Trading Practices?

While regulations offer protection, prevention is always better. Investors should regularly review their trade confirmations and account statements instead of checking them only during tax season.

Login credentials, passwords, and OTPs should never be shared, even casually.

Verbal permissions should be avoided unless they are properly recorded, and trade alerts via SMS or email should always be enabled.

Being alert does not mean being suspicious of everything; it simply means taking ownership of your investments.

Conclusion

Unauthorised trading is a serious issue, but it is not something investors have to silently accept.

Indian laws and SEBI regulations provide strong protection, and real enforcement actions show that complaints do lead to consequences.

By monitoring your account, maintaining proper records, and escalating issues through the correct channels, you can safeguard your investments and hold brokers accountable.

If something feels off, trust that instinct and act early.

When it comes to your money, asking questions is not overreacting; it’s being responsible.