If you open your trading app and see positions you don’t remember taking, your first reaction is usually confusion.

Then panic. Then anger.

And rightly so.

Unauthorised trades aren’t a “technical issue” or a “small mistake.”

They involve your money being put at unauthorised trading risk without your consent. Regulators treat this seriously, and so should you.

This blog explains what unauthorised trading actually means, how to identify it, what penalties brokers can face, real regulatory cases, and what you should do if this has happened in your account.

Unauthorised Trading Meaning

Unauthorised trading happens when a trade is executed in your account without your valid approval.

In simple terms, if your broker cannot prove that you placed or approved the trade, it is treated as unauthorised.

Regulators are very clear on this point. Brokers are required to maintain verifiable evidence of client consent before executing any trade.

That evidence can include:

- Order placement logs from apps or trading platforms

- recorded phone calls

- emails from registered email IDs

- written instructions

- SMS or OTP confirmations

If none of this exists or if the proof is weak, the trade does not stand as authorised.

SEBI Verdict on Unauthorised Trading

Unauthorised trading strikes at the core of investor protection.

If brokers are allowed to trade without consent, investors are exposed to risks they never agreed to, including leverage, margin shortfalls, forced square-offs, tax complications, and prolonged disputes.

That’s why the Securities and Exchange Board of India issued a dedicated circular focused on the prevention of unauthorised trading by stockbrokers.

It makes one thing clear: Client consent is not optional.

Beyond losses, unauthorised trades often trigger secondary damage:

- margin penalties

- forced liquidation of other positions

- blocked withdrawals

- months of grievance follow-ups

Regulatory penalties exist to deter this behaviour and enforce tighter internal controls at brokerages.

Unauthorised Trading Penalties By SEBI

When unauthorised trading is established, action can be taken at multiple levels.

1. Exchange-Level Financial Disincentives

Stock exchanges can impose monetary penalties.

One commonly reported structure includes:

- ₹50,000 per unauthorised trade case or

- 3% of the admissible claim value (whichever is higher)

- subject to a maximum cap

2. Operational Restrictions on Brokers

Repeated violations can attract stricter action, such as:

- enhanced inspections

- restrictions on onboarding new clients

- closer regulatory supervision

3. SEBI Monetary Penalties

SEBI can impose penalties through adjudication orders after inspections.

The amount depends on the nature and frequency of violations.

4. Non-Monetary Regulatory Action

SEBI can also issue warnings, censures, or directions under its intermediary regulations, depending on findings.

Real Cases Of SEBI Action On Unauthorised Trading

These are not theoretical risks.

Regulators have acted in real cases.

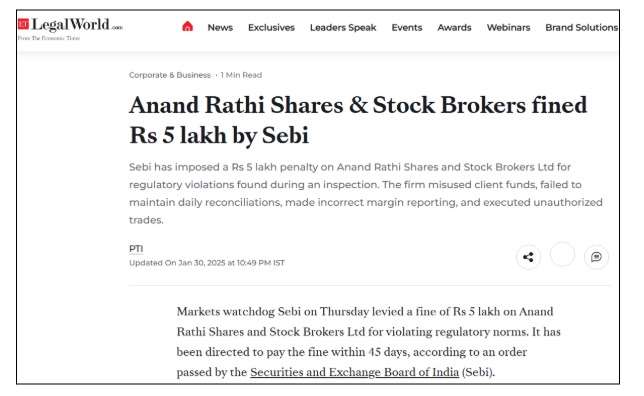

1. Anand Rathi’s Unauthorized Trading

SEBI imposed a penalty after inspection findings revealed unauthorised trades and improper order recording.

The broker acknowledged instances where trades occurred without proper client authorisation, attributing them to dealer errors.

Penalty imposed: ₹5 lakh

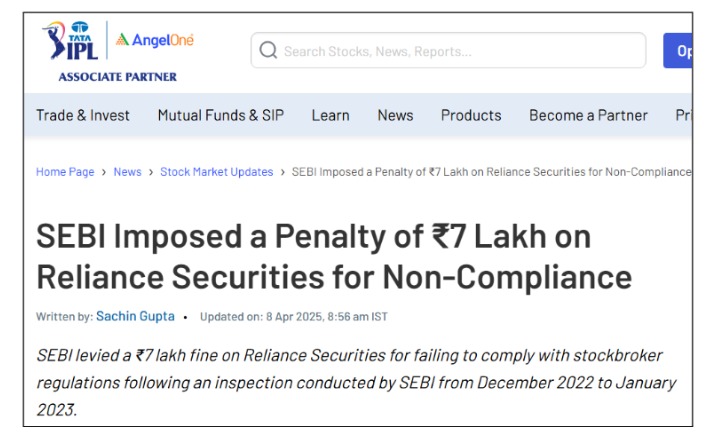

2. Unuauthorised Trading by Reliance Securities

SEBI penalised the broker for multiple regulatory lapses, including weak controls around terminals and record-keeping.

These operational gaps directly increase the risk of unauthorised activity.

Penalty imposed: ₹9 lakh

3. Unauthorised Trading by SMC Global Securities

SEBI imposed a penalty after finding that trading terminals were operating from unauthorised locations.

When infrastructure itself is off-record, client protection becomes questionable.

Penalty imposed: ₹2 lakh

These cases show one thing clearly: regulators do not treat unauthorised trading as a minor lapse.

How to Identify Unauthorised Trades in Your Account?

Not every unauthorised trade is obvious at first glance.

Here’s what to watch for:

- Trades or positions you don’t recall placing.

- contract notes showing unfamiliar instruments or quantities.

- sudden margin shortfalls or leverage exposure.

- SMS or email alerts for orders you didn’t initiate.

- frequent “dealer-assisted” trades without your instruction.

If something looks unfamiliar, don’t assume it’s a system issue. Verify immediately.

How to File a Complaint Against Unauthorised Trading in India?

If you suspect unauthorised trading, act fast.

Here are the steps that you should follow:

Step 1: Preserve Evidence

Save everything:

- contract notes

- trade confirmations

- app screenshots

- ledger and margin statements

- timestamps of alerts

Step 2: Raise It with the Broker

Email the broker’s grievance cell.

Clearly state:

- Which trades are disputed

- dates and contract numbers

- That you did not authorise them

Keep communication in writing.

Step 3: Escalate If Unresolved

If the broker’s response is delayed or unsatisfactory:

- Escalate through the exchange or ODR mechanism

- File a complaint in SCORES.

Track reference numbers and follow up consistently.

How to Prevent Unauthorised Trading in the Future?

While responsibility lies with the broker, you can reduce risk by:

- Avoiding blanket power of attorney unless necessary.

- Enabling all trade and margin alerts.

- Limiting dealer interaction unless explicitly required.

- Reviewing contract notes daily.

- Changing passwords and credentials periodically.

Prevention doesn’t replace regulation, but it reduces exposure.

Need Help?

Unauthorised trading cases often fail not because the claim is weak, but because documentation and escalation are mishandled.

We help investors to:

- Assess whether trades qualify as unauthorised.

- Organise evidence in the right sequence.

- Draft clear, regulator-aligned complaints.

- Escalate matters at the correct stage.

- Track timelines so cases don’t stall

If your money was put at risk without consent, the issue deserves structured action, not guesswork.

Conclusion

Unauthorised trading is not a service issue. It’s a consent violation.

The system recognises this. There are defined complaint paths and real regulatory consequences. You don’t have to accept it as “part of the market.”

If the trades weren’t yours, treat the matter as urgent.

- Document everything.

- Escalate on time.

- Stay consistent.

Your account. Your money. Your right to control it.