If you’ve been active in the trading space, you may have come across the name Aakanksha Lovely Gupta.

She is known for sharing stock market insights, trading ideas, and research-based recommendations with her audience.

Like many market experts today, she has built visibility through online platforms where traders look for guidance and analysis.

But whenever someone offers market advice, one common question naturally comes up: Is Aakanksha Gupta SEBI registered?

That’s an important point that investors often check before trusting any research analyst in India.

Beyond the online presence and trading discussions, it’s worth understanding her background, experience, and professional journey more closely.

Let’s take a calm, fact-based look at what’s publicly available.

Aakanksha Gupta Trader

Aakanksha Lovely Gupta is a SEBI-registered research analyst.

According to her official website, she specializes in discretionary options selling.

Her social media presence is strong on Instagram. Active on Twitter as @AakankshaLovely.

Multiple Telegram channels run in her name.

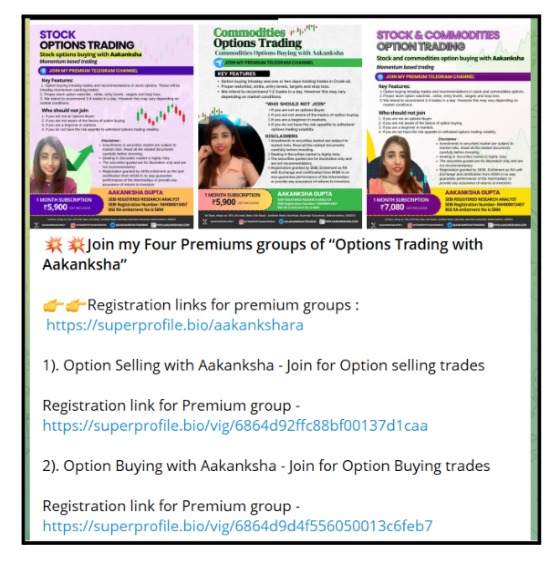

Her Business Structure:

- Free Telegram Channel: Approximately 60,000 subscribers for general market talk

- Premium Paid Channel: ₹5,900 per month with 800-1,000 monthly subscribers

Registration links go through his platform.

How Does Akanksha Gupta Operate?

Her operation runs in three layers.

First comes the free channel. General market discussions happen here.

Trust builds. Curiosity grows.

Then comes monetization. The premium channel costs ₹5,900 monthly. Inside, specific trading calls are shared.

Messages like “Sell 120 quantity at 19,700 call option” with exact entry and exit prices. Very specific. Very direct.

Moreover, she provides reasoning. Sometimes it’s basic. “Foreign institutions are selling today, so we sell too.” Anyone can track FII data themselves.

So why pay?

The third layer is the community group. Members discuss among themselves. Interestingly, better quality discussions happen here. Real macro reasons. Actual logic.

Things to Consider Before Trusting Aakanksha Gupta

The following points are shared for awareness and critical evaluation purposes only.

They reflect observed patterns, behaviors, or concerns that some individuals may perceive as warning signs based on personal experiences or publicly discussed interactions.

This is not intended to make definitive claims or judgments, but rather to encourage readers to stay informed, think critically, and form their own conclusions while engaging with or evaluating any individual or situation.

After all, many investors assume that once someone is registered, everything is automatically safe.

But a common and important question remains: can we trust SEBI-registered research analyst services blindly?

Registration certainly adds legitimacy, yet consistent compliance with regulations and ethical conduct is equally important.

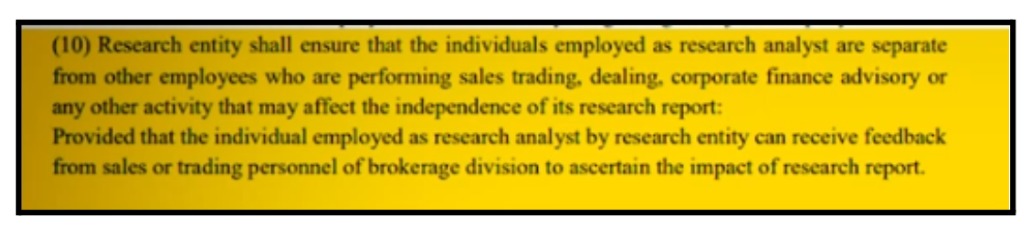

- Mixing Everything

According to SEBI Research Analyst Regulations, sales, marketing, and research must be separate. One person cannot do all three simultaneously.

But Aakanksha does all three. She markets on Twitter. She sells subscriptions. She gives research recommendations. This violates SEBI guidelines.

- Explicit Trading Instructions

Despite disclaimers, very specific instructions are given. “Sell 120 quantity at 19,700 call option.” Entry price mentioned. Exit price mentioned. Quantity clearly specified.

This happens even in the free group. They later claim, “Today, when the entire market was bullish, we were selling and making money.” This looks like proper advisory. Not just guidance.

- Illogical Reasoning

Sometimes the logic given is extremely basic. “Foreign institutions are selling today, so we sell too.” If that’s the case, why does anyone need them?

One could simply track FII data and trade accordingly.

They share screenshots and later add “For illustration purposes only.” This becomes questionable. Sounds concerning, right?

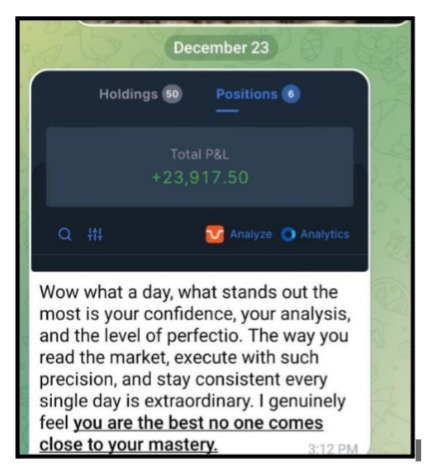

- Displaying Reported Profit Screenshots

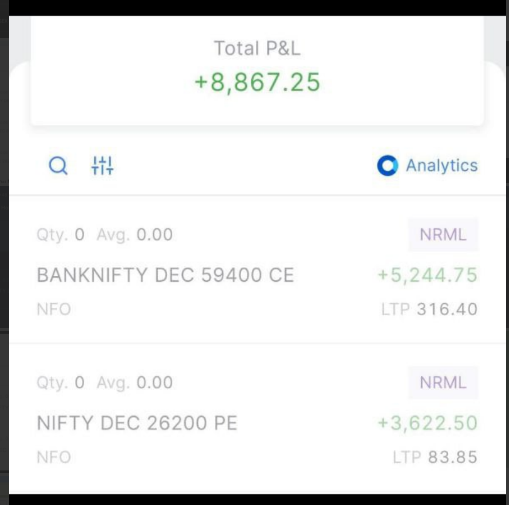

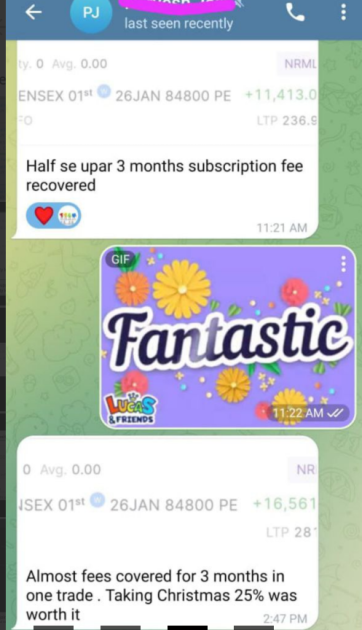

Here’s where things get concerning. After obtaining her SEBI license, something changed. Profit screenshots started flooding her Telegram channels.

Look at the pattern:

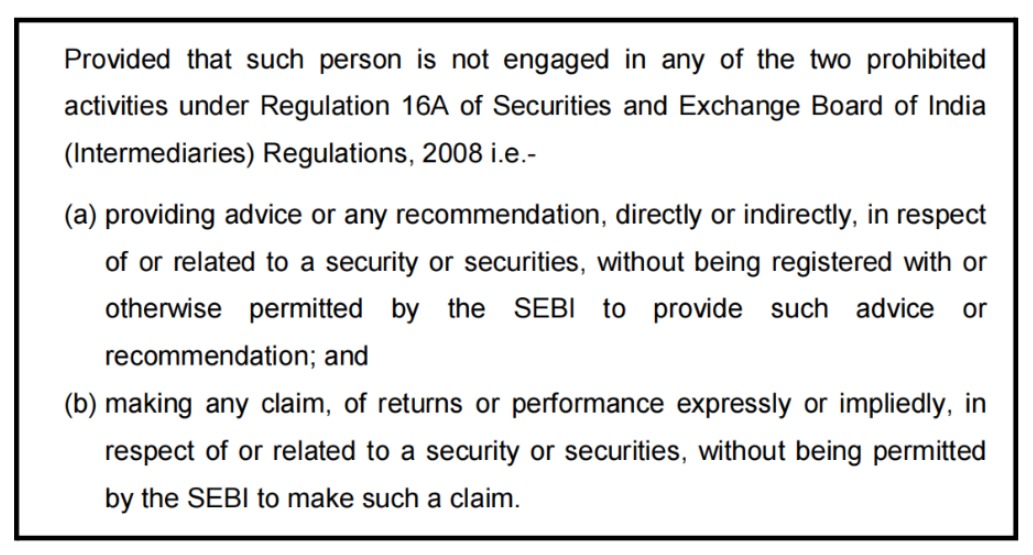

This provision prohibits any person from giving securities advice or making explicit or implied return claims unless they are duly registered and specifically permitted by SEBI.

Messages like “Half se upar 3 months subscription fee recovered” appear regularly. “Almost fees covered for 3 months in one trade.”

Only winning trades make it to the screen.

- Showing Students’ Performance

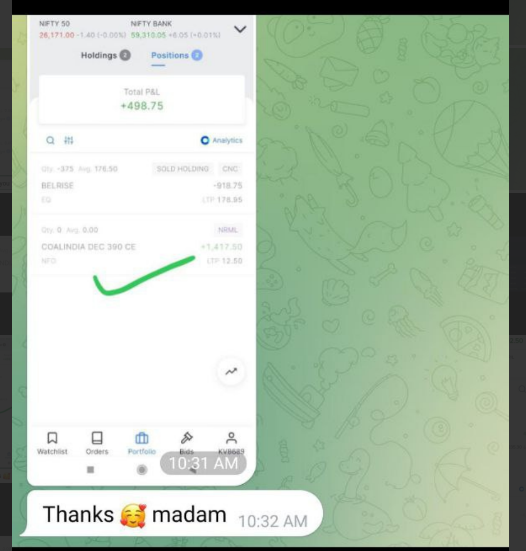

Beyond her own profits, she posts screenshots from her mentees. Student profit displays show only successful trades.

Testimonials like “I appreciate your point, thank you so much,” with green profit numbers attached.

But here’s the reality check. Where are the students who lost money? Where are the failed trades? The complete picture never appears.

Why This Matters:

According to SEBI guidelines on research analyst conduct, showing selective profitable trades without complete performance disclosure misleads investors.

Research analysts cannot showcase only winning trades while hiding losses.

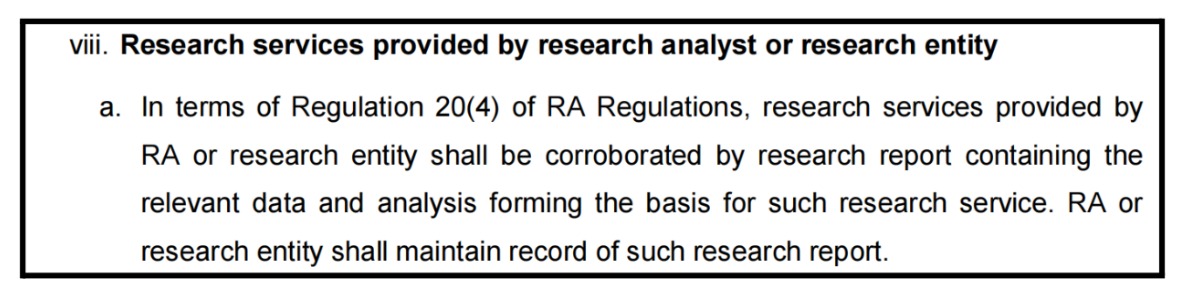

- Missing Documentation

SEBI regulations demand proper documentation for every recommendation. When was research done? What was the basis? All this must be recorded with timestamps.

If documentation wasn’t created on time, it cannot be backdated. SEBI checks document creation dates during audits.

Aakanksha Lovely Gupta Past History: Why It Matters?

Before her SEBI registration, complaints emerged.

According to investigation documents, multiple individuals filled out forms detailing the problems they faced.

They provided proof of the issues.

The Pattern:

Before registration, violations included giving specific trading advice without authorization and mixing sales and research. Not doing risk profiling.

After getting the SEBI license, violations evolved. Now, profit screenshots are posted openly. Selective mentee success stories are shared. An impression of guaranteed success is created.

The concerning part? Getting a license didn’t fix the behavior. It gave more confidence to continue problematic practices. Because now there’s official legitimacy.

Who is Actually Giving Advice?

A critical question emerges here.

Is someone named Chaitanya doing the research and giving advice? Or is Aakanksha Gupta doing the research herself?

According to investigation documents, she faced allegations of running an advisory in the name of another research analyst, Chaitanya.

This raises serious compliance concerns.

The customer base is hers. People come from Twitter. The free channel has approximately 80,000 users. Paid channel converts from there.

According to the document provided, she was only NISM-certified initially, not a registered Research Analyst.

This created legal risk. Now she has SEBI registration. But if others are involved in actual research, that’s problematic.

Why Her Past Matters for Investors?

Past behavior often predicts future patterns. If compliance issues existed before registration, those habits rarely disappear overnight.

For investors paying ₹5,900 monthly, this history matters significantly.

Moreover, understanding someone’s track record helps assess risk.

A SEBI license adds credibility.

But it doesn’t erase past allegations. Smart investors look at both the license and the conduct behind it.

What Can You Do in Such Cases?

Have you lost money following Telegram trading tips? Are you facing issues with a financial advisor or research analyst? Or are you simply wondering how to file a complaint against an RIA?

We’re here to assist you.

If you’re a client or investor who faced issues with Aakanksha Lovely Gupta or similar research analysts providing questionable recommendations without proper compliance, you are not alone.

Our dedicated team specializes in supporting investors in situations exactly like these.

We provide end-to-end guidance to ensure your grievance is clearly documented and effectively escalated to the right authorities.

How We Help Investors To File a Complaint?

1. Initial Consultation & Case Assessment

We arrange a confidential discussion with a dedicated Case Manager. They understand your specific situation. Your concerns are heard properly.

2. Professional Case Documentation & Drafting

We help you prepare a structured, persuasive, and legally sound complaint that outlines:

- The specific misconduct you experienced

- Any financial losses you incurred

- Specific SEBI rule violations, such as:

- Showing only profit screenshots without losses

- Mixing sales, marketing, and research activities

- No proper risk profiling before recommendations

- Missing financial interest disclosures

- Poor record-keeping practices

- Operating under another analyst’s name

3. Direct Engagement & Escalation

- Reaching out to the Research Analyst: We guide you in formally communicating your complaint to the analyst. This is often a required first step before approaching SEBI.

- Filing on SEBI SCORES: We assist you in filing a complaint on the SEBI SCORES portal. We help you track its status. We help you respond to any SEBI queries.

- Exploring SEBI Smart ODR: If your case is eligible, we can guide you through the SEBI Online Dispute Resolution platform. This often leads to a potentially faster resolution.

4. Arbitration & Further Legal Options

If responses from the analyst or initial SEBI actions are unsatisfactory, we help you explore further options, including:

- Arbitration: If your service agreement includes an arbitration clause, you can be connected with legal experts who specialize in arbitration in stock market to help represent your case effectively.

- Legal Action: We can refer you to lawyers experienced in securities law. They handle investor protection cases regularly.

Your Money & Complaint Matters,

Don’t let non-compliance go unreported. Every complaint helps SEBI take stronger action. Every voice matters in cleaning up India’s financial advisory space.

Take the First Step Today

Register with us today. Let our experienced team guide you toward a fair resolution.

Conclusion

Aakanksha Lovely Gupta has a SEBI license. She has a large following. She runs a profitable business. But questions remain about compliance.

The profit screenshots look attractive. The testimonials sound convincing. But SEBI regulations exist for a reason. Selective performance display misleads investors. It creates false expectations.

According to SEBI’s code of conduct, research analysts must maintain transparency. Only winning trades. They cannot claim assured returns. They must disclose complete performance.

Before subscribing to any paid channel, ask questions.

Where are the loss screenshots? What’s the actual win rate? Is proper risk profiling done? Is documentation maintained?

And most importantly, take a moment to independently verify details, understand how to check SEBI-registered research analyst status, review compliance history, and evaluate whether the conduct aligns with SEBI guidelines for Research Analyst standards.

Your hard-earned money deserves better than flashy Telegram messages. Stay informed. Stay cautious. Verify everything before you invest.