Most people don’t question a financial advisor until something goes wrong.

Returns don’t match promises. Risk shows up where it was never discussed.

And suddenly, the person who sounded confident stops responding.

That’s when the real question hits:

Was this person even regulated in the first place?

The answer is uncomfortable but important. Some financial advisors are regulated.

Many are not.

And that difference decides whether you’re protected or on your own.

Who Are Financial Advisors?

A financial advisor is anyone who gives advice about money.

That advice can involve:

- Stocks and derivatives

- mutual funds

- portfolio allocation

- risk management

- long-term financial planning

But here’s what most investors miss:

The title “financial advisor” is not automatically regulated.

Anyone can call themselves an advisor. Regulation depends on what they do, how they charge, and whether they are registered.

Who Regulates Financial Advisors in India?

In India, investment advice is regulated by the Securities and Exchange Board of India.

SEBI regulates Registered Investment Advisers (RIAs) under the SEBI (Investment Advisers) Regulations.

Only RIAs are legally allowed to:

- Provide investment advice

- Charge advisory fees

- Present themselves as regulated investment advisers.

SEBI prescribes:

- minimum qualifications

- experience requirements

- fee caps and fee structure

- disclosure norms

- conflict-of-interest rules

If someone is giving investment advice for a fee without SEBI registration, that is a regulatory violation.

However, Many investors assume:

“If someone works with a broker, bank, or big platform, they must be regulated.”

That assumption is often wrong.

There is a clear difference between:

- advice, and

- distribution or sales

Many people posing as advisors are actually:

- commission-based distributors

- relationship managers

- Telegram or WhatsApp tip providers

- unregistered “market experts.”

They may sound professional. They may show screenshots. They may promise consistency.

But none of that equals regulation.

How to Check if a Financial Advisor is Registered?

This is the most important step investors skip.

Before acting on advice, check whether the advisor is SEBI-registered.

Here’s how you do it:

Step 1: Ask for Their SEBI Registration Number

A genuine investment adviser will never hesitate to share this.

If they avoid the question or say it’s “not required,” that’s a red flag.

Step 2: Verify the Registration on SEBI’s Official Database

SEBI maintains a public list of registered investment advisers.

You can verify:

- Name of the adviser

- Registration number

- Validity status

- Whether the adviser is an individual or a firm

If the name does not appear, the person is not authorised to give investment advice.

Step 3: Check How They Charge Fees

SEBI-registered advisers must follow prescribed fee structures.

If someone:

- Earns commissions, secretly

- promises “free advice” but pushes products

- Avoids explaining how they are paid

You’re likely dealing with an unregulated operator.

Real Cases of Financial Advisor Scams and SEBI Action

These are not rare incidents.

Regulators have taken action repeatedly.

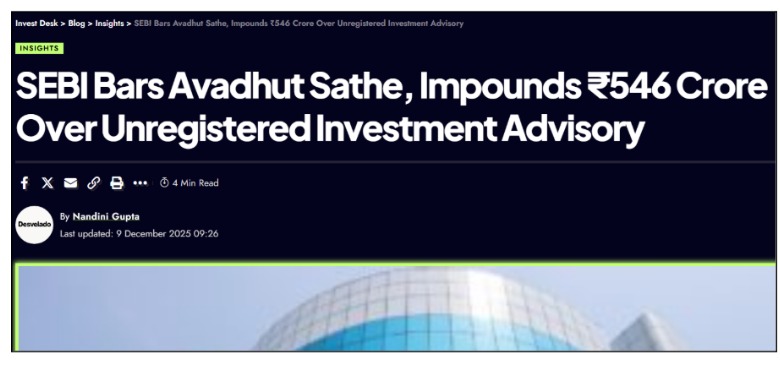

Case 1: Avadhut Sathe (ASTA) – Unregistered Advisory Scam

SEBI barred Avadhut Sathe and his trading academy from running unregistered investment advisory services.

The operation involved:

- Paid trading calls

- live sessions

- misleading profit claims

SEBI impounded ₹546 crore, calling it proceeds from unlawful advisory activity.

This case showed how large unregistered advisory operations can grow before collapsing.

Case 2: Rajiv Kumar Singh – Elite Investment Advisory

SEBI imposed a ₹35 lakh penalty after finding that the individual was operating as an investment adviser without proper registration.

The advisor exceeded permitted client thresholds and failed to comply with regulatory norms.

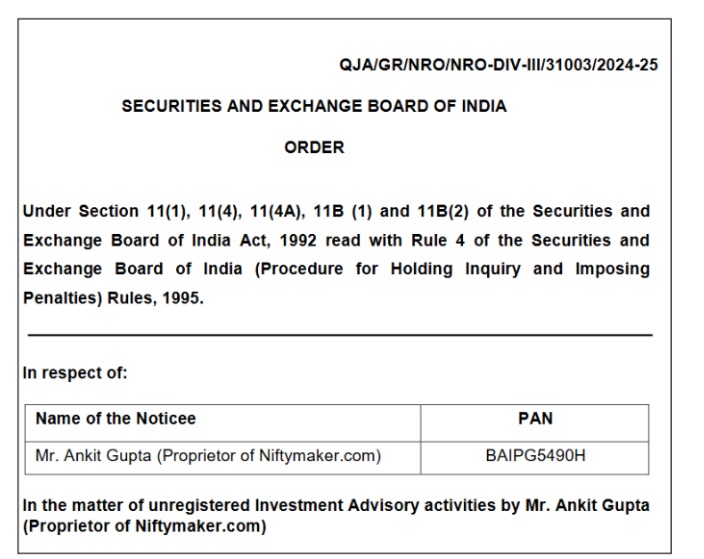

Case 3: Niftymaker.com – Unregistered Investment Advice

SEBI passed an enforcement order against the proprietor of Niftymaker.com for providing investment advice without registration.

Despite operating online, the advisory activity was still subject to regulation and penalised.

Case 4: Ravindra Bharti Education Institute

SEBI barred the entity and ordered ₹9.5 crore to be returned to investors.

The firm was found to be offering investment advice under the guise of education, without regulatory approval.

Case 5: Telegram and Social Media Tip Providers

SEBI has repeatedly warned investors against Telegram and WhatsApp groups offering stock tips for a fee.

Many such operators:

- are unregistered

- disappear after losses

- block users instead of responding

SEBI has frozen bank accounts and barred market access in multiple such cases.

Why Regulation Matters More Than Promises?

Unregulated advisors can:

- Promise guaranteed returns

- Hide conflicts of interest.

- Disappearing after losses

- Denies responsibility

SEBI-registered advisors, on the other hand:

- Are legally accountable for their advice.

- Must follow strict disclosure and conduct rules.

- Can be reported through an official complaint mechanism.

- Face penalties, suspension, or cancellation of registration for misconduct.

Regulation does not guarantee profits.

It guarantees accountability, transparency, and a clear path for recourse when something goes wrong.

How to File Complaint Against Financial Advisors?

If you want to file financial advisor complaints in India, there’s a clear legal and regulatory process.

Here’s a step-by-step guide to file a complaint against a registered financial advisor:

- Collect Evidence.

- Send a written complaint to the advisor.

- Lodge a complaint in SCORES.

- Check SEBI complaint status regularly.

- Escalate and file a complaint in SMART ODR.

In case the financial advisor is unregistered, then you can:

- File a complaint in cybercrime.

- File a complaint with SEBI by sending an email.

- Lodge an FIR at the local police station.

Need Help?

If you’ve already acted on advice and later discovered the advisor was unregistered, the situation can feel overwhelming.

You can register with us.

We help investors:

- Verify whether advice was given legally

- Assess whether regulatory violations occurred.

- Organise evidence and communication.

- Understand complaint and escalation options.

Many cases fail simply because investors don’t know where to start.

Structured action matters.

Conclusion

Yes, financial advisors are regulated in India, but only if they are properly registered.

The problem isn’t a lack of rules.

It’s a lack of verification.

- Before trusting advice, check registration.

- Before paying fees, check credentials.

- Before assuming protection, confirm the regulation.

Because confidence is easy to fake. Registration is not.

If someone is advising your money, make sure the law recognises them first.