Most investors assume that if trades were “authorised,” the matter ends there.

But reality is messier.

In derivatives trading, especially when a client is inexperienced, the line between advice, suggestion, and pressure can blur quickly. Excessive trades may technically have consent, yet still feel wrong when brokerage charges explode and losses pile up.

And this is what Motilal Oswal complains that clients have mostly.

Yes, we are discussing brokerage churning by Motilal Oswal.

That grey zone is precisely what surfaced in a March 15, 2024, arbitration award issued by the National Stock Exchange of India in a dispute between a retail investor and Motilal Oswal.

This case matters because it doesn’t rely on social media outrage or generic accusations.

It is based on recorded calls, contract notes, regulatory rules, and a reasoned finding by a sole arbitrator.

Brokerage Churning by Motilal Oswal: A Case Study

The dispute arose from currency derivatives trading in November 2022.

The investor alleged that:

- Multiple intraday (MIS) trades were executed

- Risks were downplayed to a novice derivatives client.

- She was assured a limited downside (around ₹8,000)

- Brokerage charged crossed ₹1.2 lakh.

- She was influenced and misled into repeated trades.

Motilal Oswal denied wrongdoing and maintained that:

- Trades were executed with the client’s consent

- Contract notes, SMS alerts, and emails were sent.

- Brokerage was charged as per the agreed terms.

- The client had prior market experience.

The matter went through the exchange grievance process and eventually landed in arbitration under NSE bye-laws.

Based on the hearing and evidence, the arbitrator examined:

- Contract notes and ledger statements

- Call recordings between the dealer and the client

- Transcripts supported by an affidavit

- Email and SMS communication records

- KYC and account opening documents

- Written submissions from both sides

Two hearings were conducted (December 12, 2023, and February 21, 2024).

The broker was specifically directed to produce call recordings, which became central to the outcome.

Key Findings of the Arbitration

The arbitrator made three critical findings, each important on its own.

1. Trades Were Not Unauthorised

Based on call recordings and transcripts:

- The client did not instruct the broker to stop trading

- In most calls, she accepted the trading proposals.

- Post-trade communications were received.

So, the trades could not be treated as unauthorised.

This is important because many complaints fail at this stage.

2. Client was Influenced to Take More Trades

This is where the award becomes significant.

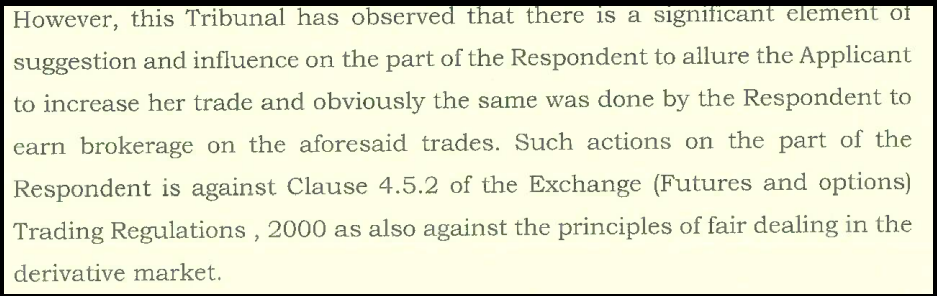

The arbitrator observed:

“There is a significant element of suggestion and influence on the part of the Respondent to allure the Applicant to increase her trade… obviously done by the Respondent to earn brokerage.”

This conduct was held to be:

- Against Clause 4.5.2 of the Exchange (F&O) Trading Regulations, 2000

- Against the principles of fair dealing in the derivative market

In simple terms:

Consent existed, but the manner in which it was obtained crossed a regulatory line.

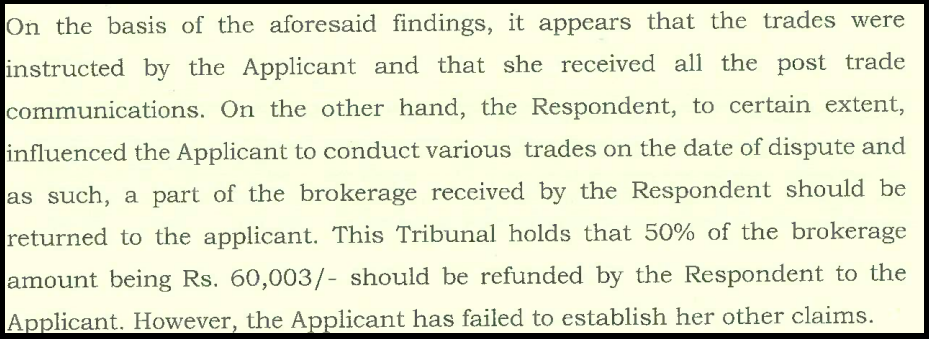

3. Brokerage Was Undisputed, And That Mattered

The brokerage amount of ₹1,20,006 was not disputed by Motilal Oswal.

While the investor failed to consistently quantify losses, the arbitrator focused on what was clear and provable:

Brokerage earned due to influenced trading.

The Final Verdict

The arbitrator ordered Motilal Oswal to refund 50% of the brokerage amount, i.e., ₹60,00,3 within 15 days.

This wasn’t a token award. It was a measured penalty tied directly to the broker’s conduct, not market losses.

What You Can Learn From This Case?

This award does not say:

- Motilal Oswal committed fraud

- Trades were illegal

- The client was completely misled about trading.

What it does say is more nuanced and more important:

- A broker cannot push repeated trades primarily to earn brokerage fees.

- Even with consent, influence, and allurement violate exchange rules.

- Fair dealing obligations apply especially in derivatives.

This is how brokerage churning issues usually surface, not as outright fraud, but as regulatory misconduct.

What You Can Do in Such Cases?

Not every loss is misconduct. But certain patterns should trigger action:

- Repeated trade suggestions in short timeframes

- Focus on “turnover” rather than strategy.

- Assurances of limited risk in derivatives

- Brokerage ballooning without a clear rationale

When this happens:

- Preserve call recordings and emails

- Download contract notes and ledgers

- Ask for written clarification on the strategy

- Stop trading if you’re uncomfortable.

And last but not least, how to complain against Motilal Oswal? Follow the regulatory ladder.

- Reach out to the Broker Grievance Cell

- Lodge a complaint in SCORES.

- File a complaint in NSE/BSE

- File for an arbitration in the stock market to get a recovery.

This award itself came only after grievance rejection and arbitration.

Need Help?

Cases like this are documentation-heavy and emotionally draining.

If you’re dealing with:

- Excessive brokerage

- Dealer-driven trading

- Pressure to trade derivatives

- Confusing explanations after losses

You don’t need outrage. You need records, timelines, and the right forum.

Register with us, our FraudFree team guidance can help you understand:

- Whether your case is grievance-worthy

- What evidence actually matters

- When arbitration makes sense and when it doesn’t

Conclusion

This NSE arbitration award doesn’t demonize the broker. It also doesn’t dismiss the investor.

Instead, it draws a clear line:

- Authorisation alone is not enough

- Influence for brokerage violates fair dealing.

- Relief will be proportionate, not emotional.

For investors, the lesson is simple: If something feels off, document early.