In India’s growing investment advisory industry, retail investors often seek professional guidance to navigate complex financial markets.

They trust registered advisors with their hard-earned money, expecting honest advice and ethical conduct.

The story of Capital Vraddhi Financial Services serves as a stark warning about the dangers lurking even within regulated spaces.

Capital Vraddhi Financial Services Review

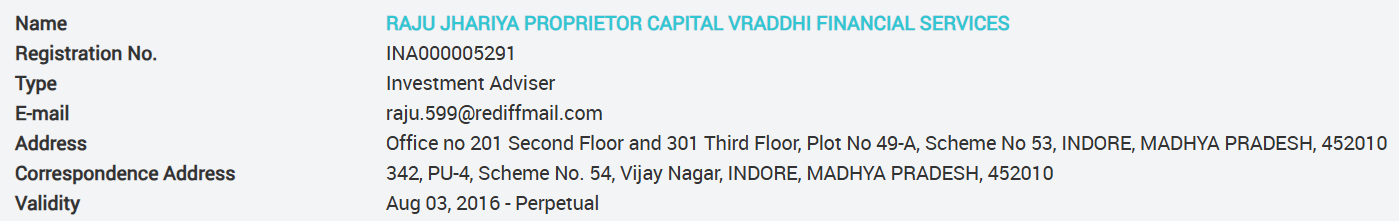

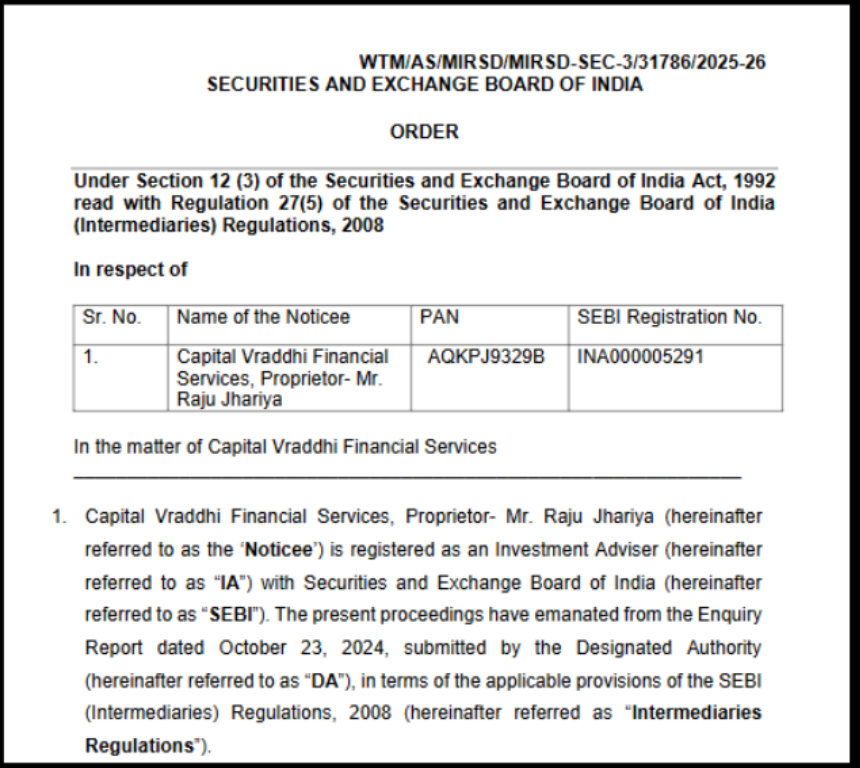

Capital Vraddhi Financial Services is a proprietorship firm owned by Mr. Raju Jhariya.

Key Details:

- Registration: SEBI-registered Investment Adviser (Registration No. INA000005291)

- Location: Operating across India through call centers and digital platforms

- Services Offered: Investment advisory services, primarily focused on stock market trading advice

- Business Model: Subscription-based advisory packages ranging from short-term (7-day) to long-term plans

The firm positioned itself as a research-based advisory service, promising clients expert guidance for their investment decisions.

How Capital Vraddhi Operates?

Under SEBI regulations, Registered Research Analysts (RAs) and Investment Advisers (IAs) are required to follow strict norms relating to marketing, client onboarding, fee structures, suitability assessment, and advisory conduct.

However, the sales process of Capital Vraddhi shows some red flags, raising concerns about the company’s operations:

Step 1: Aggressive Marketing

Used cold calls, online ads, social media, fake reviews, and prohibited free trials to attract clients.

Step 2: High-Pressure Sales

Made unrealistic profit guarantees like daily assured income, no-loss plans, and rapid money multiplication.

Step 3: Upfront Fee Collection

Charged ₹5,500–₹4,72,000 in fees before risk assessment, often exceeding the client’s investment amount.

Step 4: Questionable Advisory Services

Gave stock tips via calls/SMS without stop-loss and used unqualified staff for advisory interactions.

Vraddhi Financial Services Complaints

While only 52 clients formally complained on SEBI SCORES (out of 10,294 total clients), the actual damage was far more widespread. Here’s what investors faced:

| Type of Problem | Number Affected | What Happened |

| Excessive Fee Exploitation | 1,355 clients | Charged more than ₹1.25 lakh annual limit, some paid up to ₹18.22 lakh |

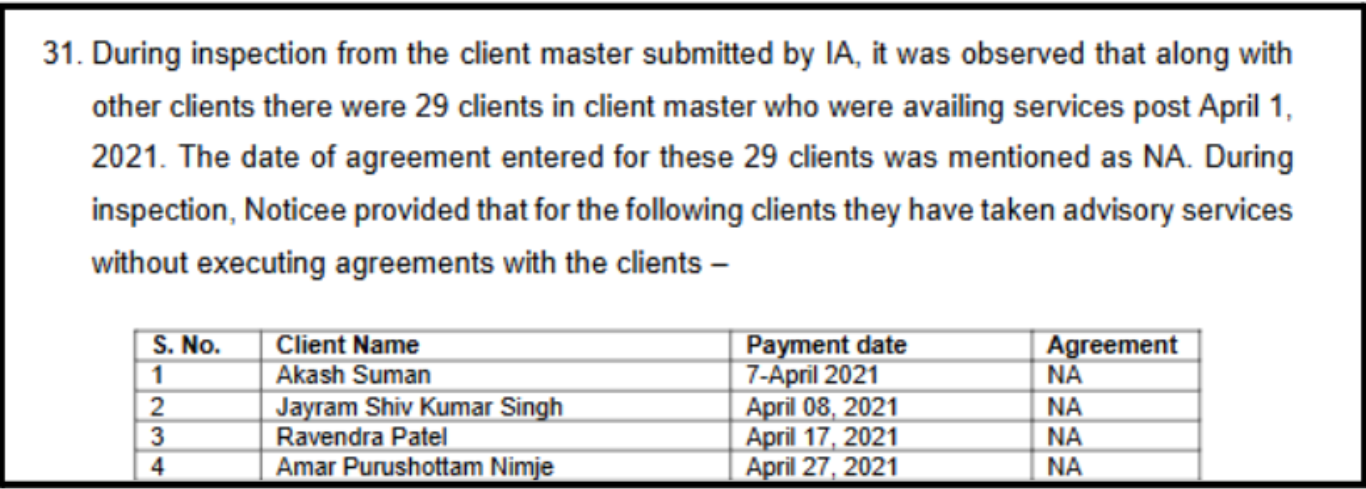

| No Legal Protection | 238 clients | Services provided without signed agreements (29 no agreements at all, 209 paid before agreements) |

| Unqualified Advice | All 10,294 clients | 36 out of 40 employees lacked required certifications, and received advice from unqualified staff |

| False Promises | Unknown number | Guaranteed profits that never materialized, “12-15 lakh profit in one year.” |

| Fake Marketing Victims | Unknown number | Deceived by fabricated positive reviews on a fake website |

| No Documentation Trail | All clients (2020-2022) | Call recordings not maintained, no proof of advice given or promises made |

| SEBI Name Misuse | 1+ client | Told “SEBI approved your risk profile”, false authority claim |

Vraddhi Financial Services User Reviews

- The Income Trap: Ms. Amiya Anand earned ₹1-5 lakh annually. Capital Vraddhi charged her ₹4,72,000 in fees. Her proposed investment was less than ₹1 lakh. She paid almost her entire annual income as fees, leaving nothing to actually invest.

- The Investment Paradox: Mr. Deepak Kumar Sharma wanted to invest ₹50,000-₹2,00,000. Capital Vraddhi charged him ₹2,91,500, more than his maximum investment capacity. The fees consumed the money meant for investing.

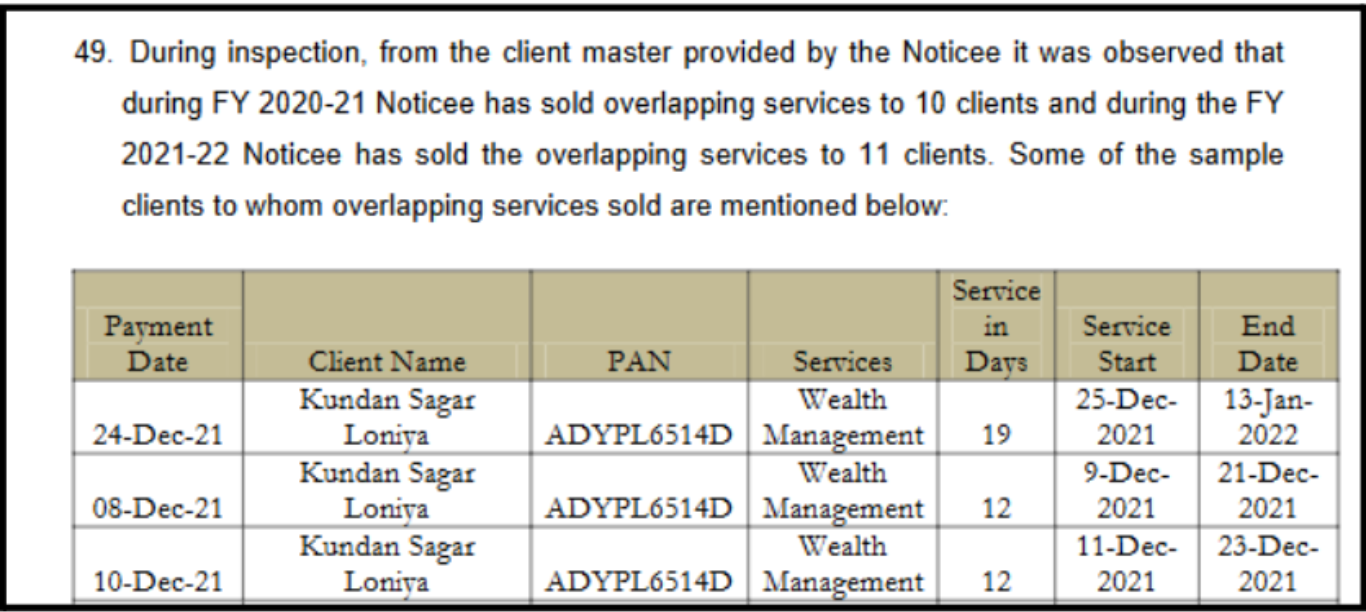

- The Overlapping Services Scam: Mr. Kundan Sagar Loniya was sold 10 overlapping “wealth management” subscriptions in just two months. He paid multiple times for the same period of advice.

- The Guaranteed Profit Lie: Clients heard: “₹10,000 will become ₹40,000 in one month guaranteed.” They invested believing these promises. When markets moved against them, without stop-losses, many lost their entire capital.

- The Agreement Trap: 209 clients paid fees first, then waited weeks or months for agreements. Mr. Govinda Kumar paid on April 13, 2021, but signed his agreement 74 days later on June 26, 2021. During this time, he had no legal protection.

Major Regulatory Actions on Vraddhi Financial Services

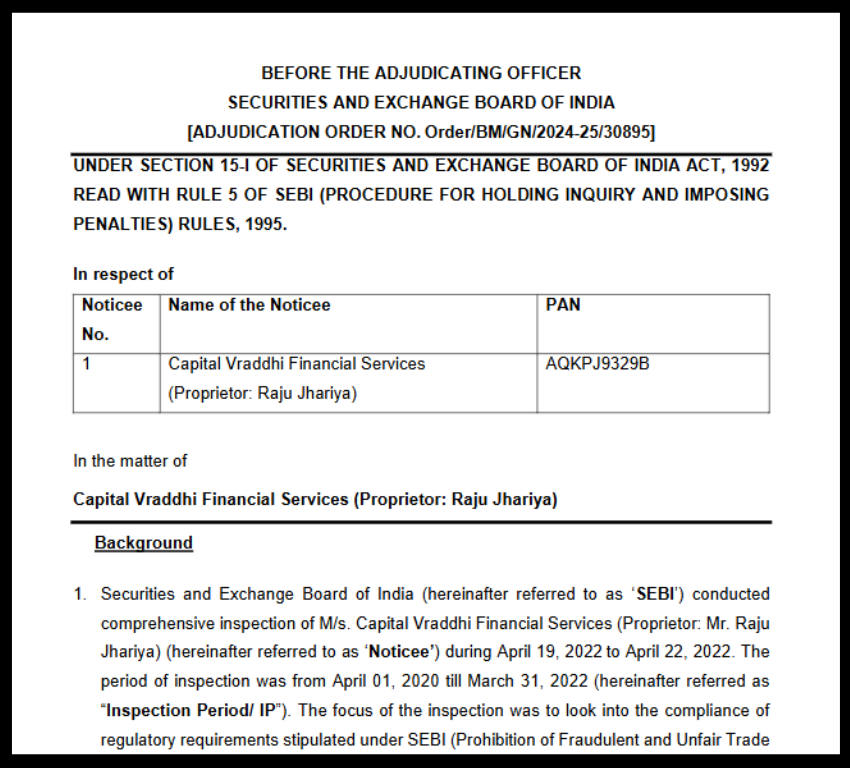

Vraddhi Financial Services came under regulatory scrutiny following multiple complaints and surveillance findings indicating potential violations of the SEBI Act, 1992, and regulations governing SEBI-registered Research Analysts (RA) and Investment Advisers (IA).

The entity’s business practices, particularly in relation to marketing, fee collection, and advisory conduct, raised concerns regarding investor protection, misrepresentation, and non-compliance with SEBI’s code of conduct.

In response, SEBI initiated enforcement proceedings under its adjudicatory and regulatory powers.

These actions were aimed at examining whether Vraddhi Financial Services and its associated persons had engaged in misleading practices, charged fees in contravention of prescribed norms, and provided investment advice without adhering to mandatory suitability and disclosure requirements.

The following section outlines the major regulatory actions taken by SEBI.

Order 1: Adjudication Order (October 22, 2024)

What makes this case particularly significant is not just the number of violations, seven major regulatory breaches were established, but what they reveal about the systematic failure to protect investor interests.

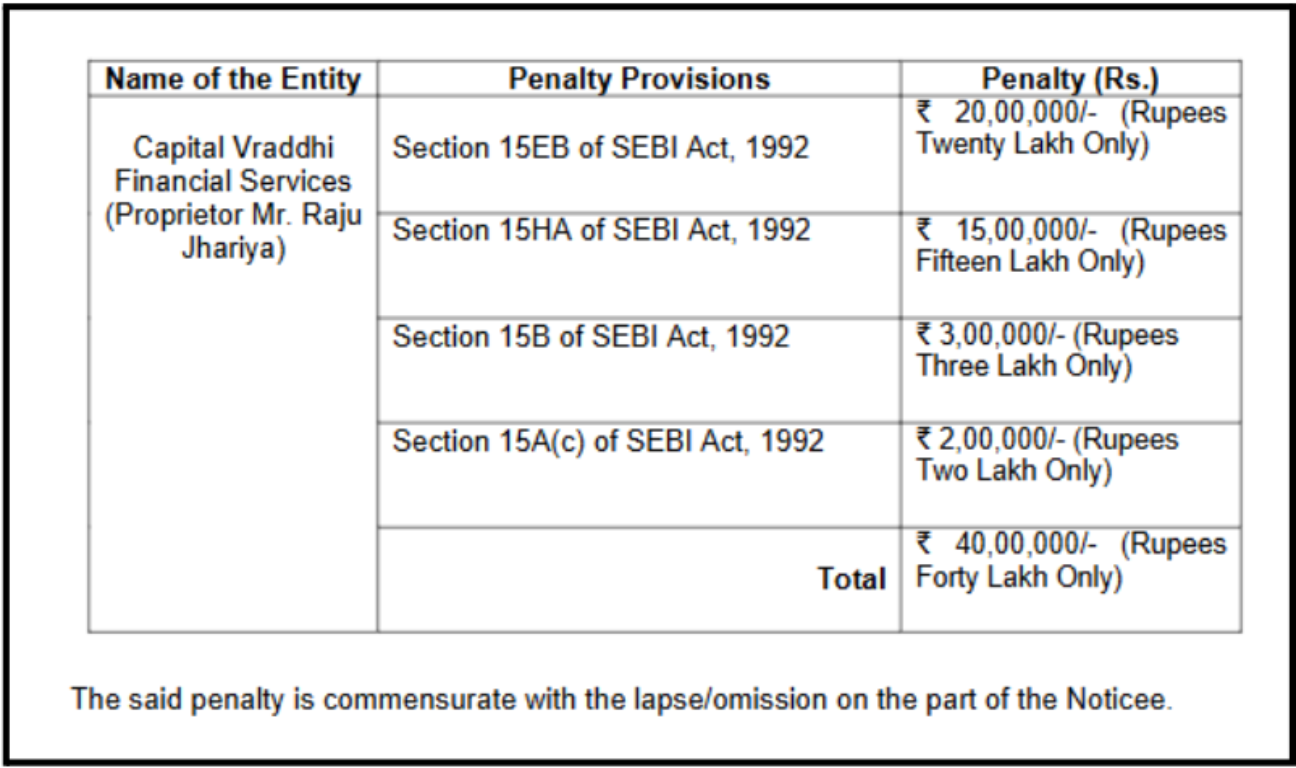

Penalty: ₹40 Lakh

SEBI’s Adjudicating Officer found Capital Vraddhi guilty on all 13 violations:

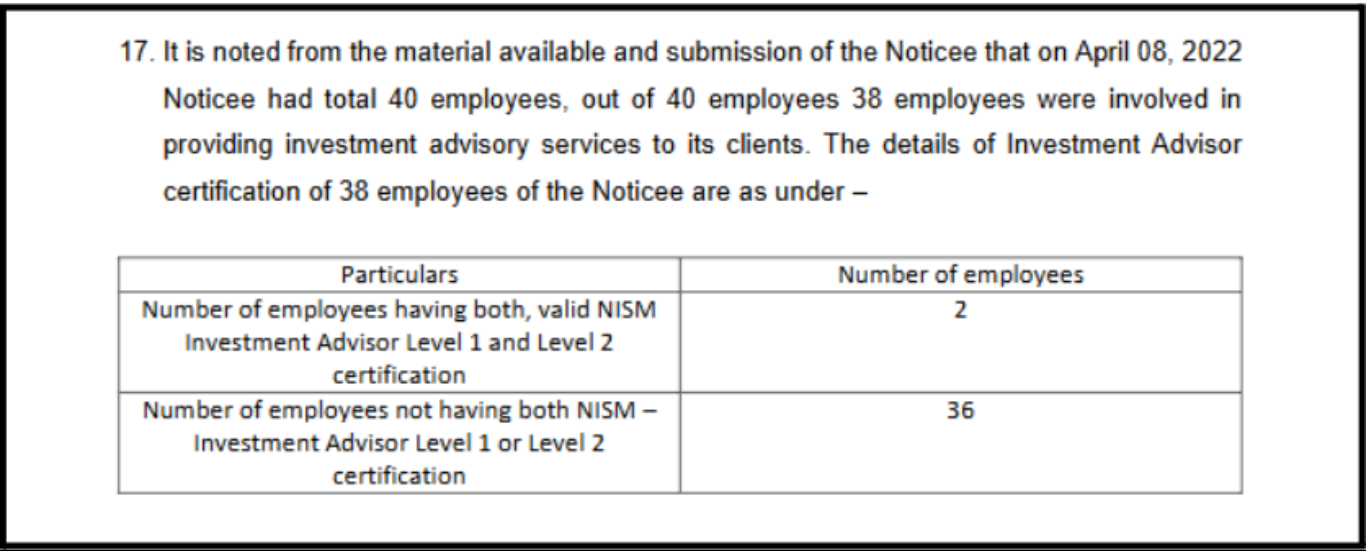

1. Unqualified Staff (36 employees)

Out of 40 employees, 36 lacked the required NISM certification to provide investment advice.

These unqualified staff were directly interacting with clients, conducting risk profiling, and procuring payments.

19 of these uncertified employees were still working during SEBI’s inspection.

Impact: Clients received advice from people with no formal training or credentials.

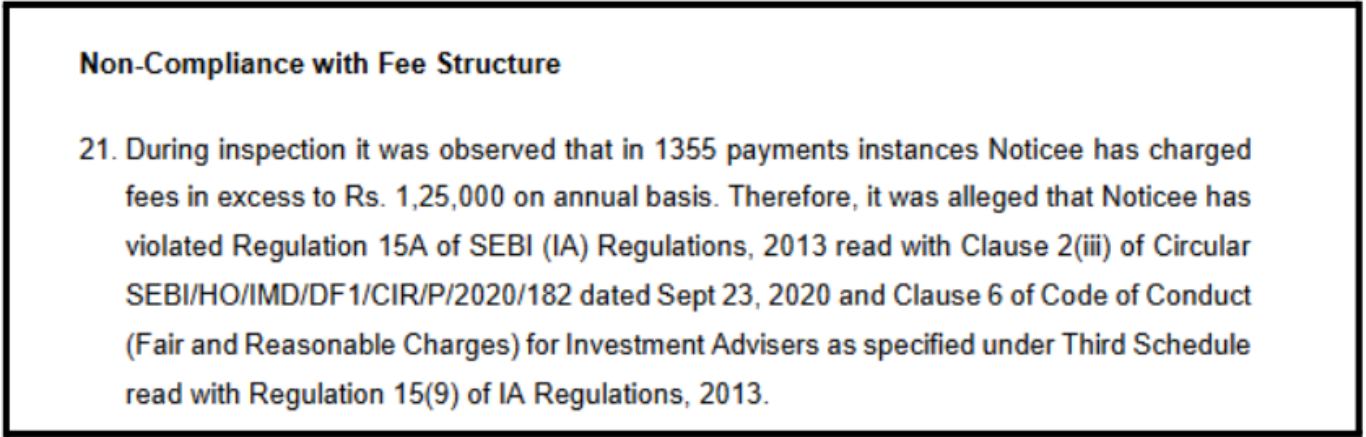

2. Excessive Fee Charges (1,355 instances)

- In 1,355 instances, the firm charged more than the ₹1.25 lakh annual limit

- One client was charged an astronomical ₹18.22 lakh

- Five clients were charged between ₹1.30 lakh to ₹1.47 lakh annually

Sample Cases:

- Tilak Raj: ₹1,30,500 (₹5,500 excess)

- Mr. Vicky: ₹1,47,000 (₹22,000 excess)

- Abbu Hasan Ansari: ₹1,47,700 (₹22,700 excess)

Impact: Clients’ investment capital was drained through illegal fees.

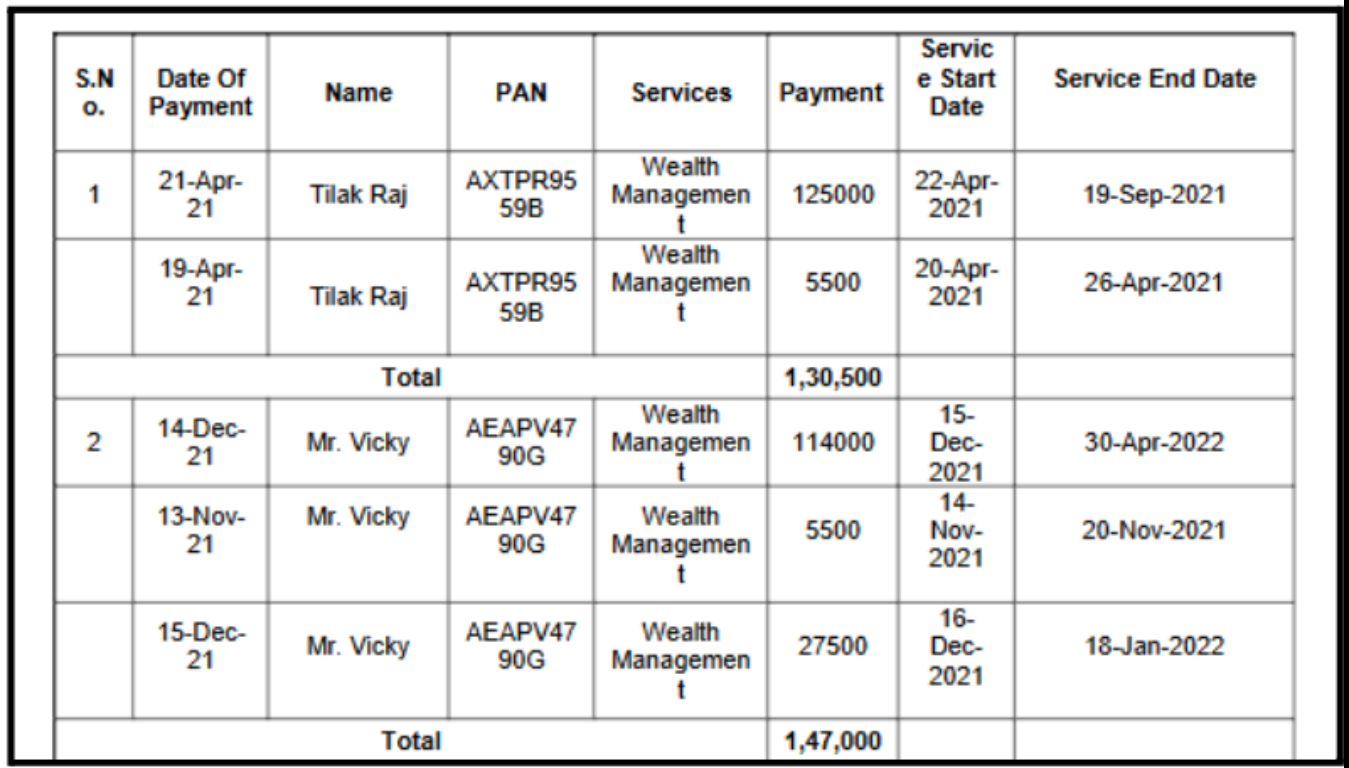

3. No Client Agreements (238 clients total)

29 clients were charged fees without any formal agreement. Services were provided without legal documentation from April to June 2021.

The firm blamed COVID-19 lockdowns, but continued collecting money anyway.

Impact: Clients had no legal protection or clarity on the services they were paying for.

4. No Call Records (April 2020 – March 2022)

No call recordings were maintained from April 2020 to March 2022. Critical documentation required by regulations was simply not kept.

This made it impossible to verify what advice was given or promises made.

Impact: No evidence trail to verify advice given or promises made.

5. No Risk Profiling (4 clients)

Four clients received services without proper KYC, risk profiling, or suitability assessment. No documentation existed to show whether investments matched client needs.

The firm provided financial advice blindly, without understanding the client’s circumstances.

Impact: Advisory services are provided without understanding the client’s risk capacity.

6. Overlapping Services (21 clients)

21 clients were sold the same “wealth management” service multiple times during overlapping periods.

- Mr. Kundan Sagar Loniya sold 10 overlapping services in just two months

- Mr. Sayyad Mohd Shabbir received 8 overlapping services

Impact: Double and triple charging for the same advice period.

7. Illegal Free Trials (116 clients)

- Free advice given before risk profiling

- Prohibited to protect consumers

Impact: Exposed prospective clients to unsuitable investments without safeguards.

8. Personal Phone Usage (19 employees)

Employees used 19 personal SIM cards to pitch advisory services. The firm admitted that employees gave personal recommendations outside official channels.

This created an untracked, unregulated parallel advisory operation.

Impact: Zero accountability for advice given through personal numbers.

9. Fake Website Reviews

The firm created a blog with fabricated positive reviews. Fake testimonials were posted to mislead prospective clients.

The firm admitted these reviews were “fake and created”.

Impact: Deceived prospective clients into believing the firm had satisfied customers.

10. Fees Exceeding Investment Capacity

Shocking Cases:

| Client | Annual Income | Fee Charged | Proposed Investment |

| Deepak Kumar Sharma | ₹2-5 lakh | ₹2,91,500 | ₹50,000-2,00,000 |

| Amiya Anand | ₹1-5 lakh | ₹4,72,000 | <₹1,00,000 |

| Muniya Aishpunani | ₹1-5 lakh | ₹2,28,000 | <₹1,00,000 |

Impact: Clients paid more in fees than they could afford to invest. Some paid fees equal to their entire annual income.

11. Profit Guarantees & No Stop-Loss Advice

Call Recording Evidence:

Call 1: “Daily ₹1,500-₹2,000 return on ₹10,000 investment, guaranteed.”

Call 2: “Single day profit guaranteed. Your profit won’t go anywhere.”

Call 3: Client asks about stop-loss

Executive: “Don’t put stop-loss. Trust me.”

Call 4: “You’ll get ₹12-15 lakh profit in first year itself.”

Call 5: “₹10,000 will become ₹40,000 in one month through our SIP plan. Not even ₹1 loss.”

Impact:

- False promises that can never be fulfilled in securities markets

- Trading without stop-loss can wipe out entire investment capital

- Clients invested based on lies, facing inevitable losses

12. Charging Fees Before Agreements (209 clients)

Sample cases where fees were collected months before agreements:

| Client | Fee Date | Agreement Date | Gap |

| Govinda Kumar | April 13, 2021 | June 26, 2021 | 74 days |

| Renuka Sumit Jain | May 29, 2021 | July 30, 2021 | 62 days |

| Vikas Jangra | July 31, 2021 | Sept 24, 2021 | 55 days |

Impact: Services started without legal documentation, leaving clients vulnerable.

13. False SEBI Approval Claims

- Employee told client: “Your risk profile is approved by SEBI”

- Used SEBI’s name to pressure client into paying

Impact: Exploited regulator’s credibility to deceive investors.

SEBI Verdict

SEBI imposed a total penalty of ₹40 lakh on Capital Vradhi Financial Services (Proprietor: Mr. Raju Jhariya) under multiple provisions of the SEBI Act, 1992, for regulatory lapses and omissions.

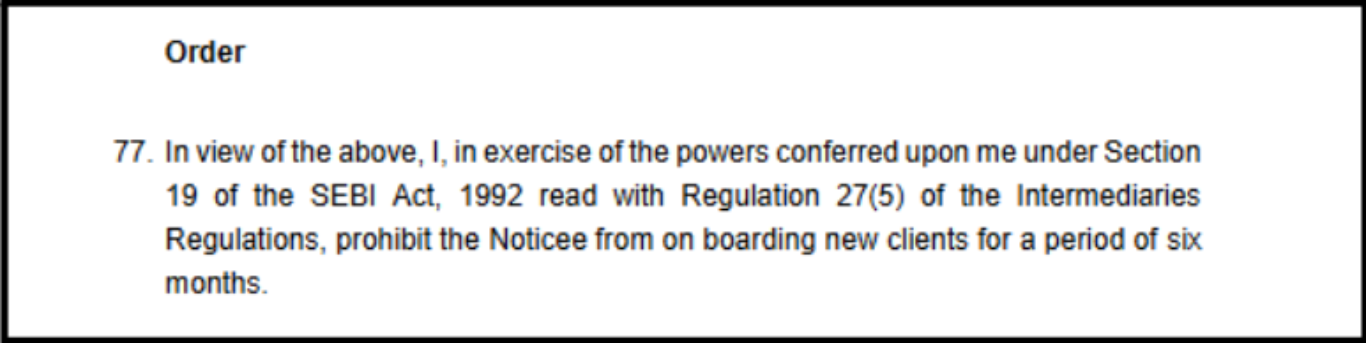

Order 2: The Pattern Continues (November 14, 2025)

Even after the penalty, the company keeps on operating unethically, violating multiple rules.

Another SEBI Order was then released around 13 Months Later

Even after the ₹40 lakh penalty, SEBI’s Whole Time Member issued a second order reviewing the same violations.

Capital Vraddhi is prohibited from onboarding new clients for 6 months.

This operational restriction came after a separate regulatory review process.

Out of 13 original charges, 7 were upheld again:

Repeated Violations Confirmed:

- Unqualified Staff

- 36 out of 40 employees lacked certification

- Continued using unqualified personnel for client-facing roles

- Excessive Fees

- Still no proper documentation showing GST breakdown

- Pattern of charging above ₹1.25 lakh continued

- Missing Agreements

- 29 clients served without any agreements

- COVID excuse rejected, firm should have stopped services if agreements couldn’t be signed

- No Call Records

- Claimed “data corruption” but provided no technical proof

- Failed basic regulatory requirement for 2 years

- Unreasonable Fee Structure

- Charged ₹4.72 lakh from client earning ₹5 lakh annually

- Violated fiduciary duty to act in client’s best interest

- Profit Guarantees

- Call recordings proved guaranteed return promises

- Advised trading without stop-loss

- Fees Before Agreements

- 209 clients charged before signing contracts

- Clear violation of investor protection norms

Cumulative Penalties

| Order | Date | Penalty Type | Amount/Duration |

| Adjudication Order | October 2024 | Monetary Fine | ₹40,00,000 |

| WTM Order | November 2025 | Operational Ban | 6 months (no new clients) |

Total Impact:

- ₹40 lakh must be paid to SEBI

- Cannot acquire new clients for 6 months

- Existing clients can continue (at their own risk)

- Severe reputational damage

Is It Safe To Invest In Vraddhi Financial Services?

This wasn’t accidental non-compliance. The violations show a deliberate pattern:

- Created fake reviews to build false credibility

- Made impossible promises to lure clients

- Hired unqualified staff to maximize commissions

- Charged illegal fees to maximize profits

- Operated without proper documentation to avoid accountability

Lessons for Investors

- Verify credentials: Always check if advisors and their staff have current NISM certifications

- Read agreements carefully: Never pay before signing a detailed agreement

- Question guarantees: Anyone promising assured returns is lying

- Check fee limits: Advisory fees should never exceed ₹1.25 lakh annually (under fixed fee mode)

- Demand documentation: Insist on written records of all advice and conversations

- Trust but verify: Check if reviews and testimonials are genuine

- Ensure suitability: Proper risk profiling must happen before any advice

What Can You Do In Such Cases?

If you are a client or investor who faced issues with Capital Vraddhi Financial Services or Raju Jhariya, you are not alone.

SEBI’s order has confirmed 7 serious violations including profit guarantees, excessive fee charging, lack of qualified staff, and services without signed agreements. Many investors have suffered financial losses and breach of trust.

Our dedicated team specializes in supporting investors in situations like these.

We provide end-to-end guidance to ensure your grievance is clearly documented and effectively escalated.

Our Step-by-Step Support Process:

1. Initial Consultation & Case Assessment

We arrange a confidential discussion with a dedicated Case Manager who will listen carefully to your full experience with Capital Vraddhi Financial Services, including:

- Services received without a proper agreement

- Fees charged before signing any contract

- Promised guaranteed returns or “no-loss” assurances

- Interactions with unqualified staff lacking NISM certifications

- Excessive fees relative to your income or investment size

- Advice to trade without stop-loss protections

- Any financial losses or damages incurred

2. Professional Case Documentation & Drafting

We help you prepare a structured, persuasive, and legally sound complaint that outlines:

- The specific misconduct you experienced (backed by dates, amounts, communications)

- Financial losses incurred with documentary evidence (bank statements, invoices, payment receipts)

- Specific SEBI rule violations, such as:

- Charging fees without a signed agreement (violation of SEBI IA Regulations)

- False promises of guaranteed returns or assured profits

- Services provided by uncertified employees (non-NISM staff acting as PAIA)

- Excessive fee charging beyond the ₹1,25,000 annual cap

3. Direct Engagement & Escalation

- Reaching out to Capital Vraddhi Financial Services / Raju Jhariya: We guide you in formally communicating your complaint to the advisor, which is often a required step before approaching SEBI. This includes sending a legal notice if necessary.

- Filing on SEBI SCORES: We assist you in how to lodge complaint in SCORES portal (SEBI Complaints Redress System) and help you:

- Track its status in real-time

- Respond to SEBI queries and requests for additional information

- Ensure all deadlines are met

- Exploring SEBI Smart ODR: If eligible, we can guide you through the SEBI Online Dispute Resolution (Smart ODR) platform for a faster, cost-effective resolution without lengthy litigation.

4. Advisory & Strategic Counselling

Our experts provide realistic advice on:

- Potential outcomes based on the nature and severity of your complaint

- Expected timelines based on similar cases against investment advisors

- Strengthening your case with additional evidence or witness statements

5. Arbitration & Further Legal Options

If responses from Capital Vraddhi Financial Services or initial SEBI actions are unsatisfactory, we help you explore further options, including:

- Arbitration in Stock Market for dispute resolution

- Civil recovery proceedings to claim damages

- Consumer forum complaints for unfair trade practices

- Coordination with SEBI’s recovery proceedings to ensure your claim is considered when the ₹40 lakh penalty is recovered

Your Money Matters. Your Complaint Matters.

SEBI’s strong order against Capital Vraddhi validates the concerns of affected investors.

The regulator has confirmed serious violations including:

- Fraudulent profit guarantees

- Exploitative fee structures

- Services by unqualified staff

- Lack of proper agreements and record-keeping

You deserve justice and recovery.

Take the First Step Today

Don’t let regulatory violations and financial misconduct go unaddressed.

Reach out to us today, and let our experienced team guide you toward a fair resolution.

Conclusion

The Capital Vraddhi case reveals a harsh truth: SEBI registration alone doesn’t guarantee safety. Despite being licensed, the firm systematically exploited over 10,000 clients through unqualified staff, illegal fees, fake promises, and dangerous advice.

Two separate SEBI orders, ₹40 lakh penalty and 6-month client ban, prove the violations were serious, repeated, and deliberate.

For investors, this case offers critical lessons. Never trust guaranteed returns. Always demand proper documentation before paying. Verify advisor qualifications independently. Question aggressive sales tactics.

The firm’s registration remains active, existing clients continue at risk, and many victims may never see justice.

This underscores an uncomfortable reality: in India’s investment advisory industry, protection comes not from licenses displayed on websites, but from informed, skeptical, and cautious investing.