In India’s fast-changing capital markets, the role of a Research Analyst (RA) is both influential and highly regulated. Financial Advisor Complaints are coom in India. Investors rely on these professionals for objective, ethical, and well-researched insights, making regulatory compliance non-negotiable.

When an analyst deviates from these standards, the consequences extend beyond individual misconduct and directly undermine investor confidence.

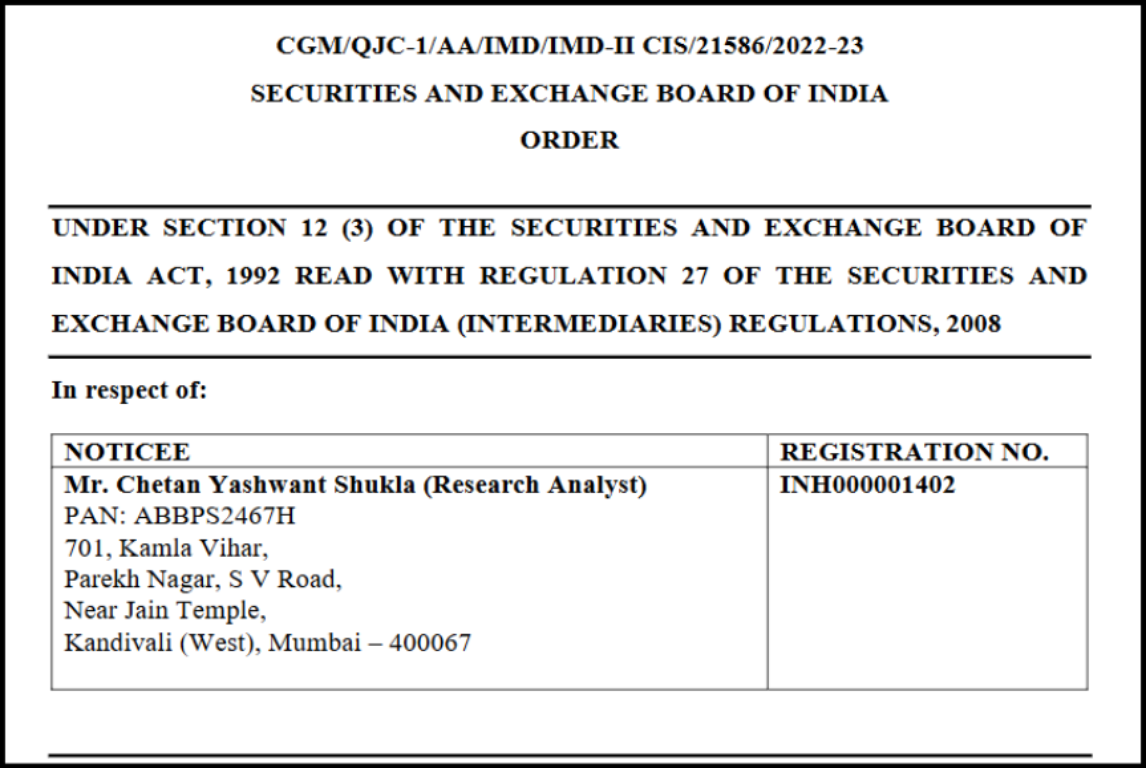

The case of Chetan Yashwant Shukla, a SEBI-registered Research Analyst, stands out as a stark reminder of how regulatory lapses can lead to serious enforcement action.

This detailed review examines the sequence of actions taken by SEBI against Chetan Yashwant Shukla, including interim cease-and-desist directions, market access restrictions, final prohibitory orders, and the issuance of recovery certificates.

It traces the regulatory timeline and highlights the key findings that shaped SEBI’s decisions, such as the provision of services beyond permitted limits, failure to comply with regulatory inspections, and non-adherence to statutory obligations.

By unpacking these developments, this blog aims to illustrate the legal and ethical boundaries governing market intermediaries clearly and to reinforce a crucial message for investors and professionals alike: regulatory registration is not merely a formality, but a continuing responsibility that demands transparency, cooperation, and strict adherence to SEBI’s framework.

Who is Chetan Yashwant Shukla?

Chetan Yashwant Shukla was registered with SEBI as an individual Research Analyst (Registration No. INH000001402) on August 14, 2015.

This registration permitted him to issue research reports and provide stock-related recommendations strictly in accordance with the SEBI (Research Analyst) Regulations.

However, the authorization came with clearly defined boundaries, and his lawful activities were limited to the scope allowed under the applicable regulatory framework.

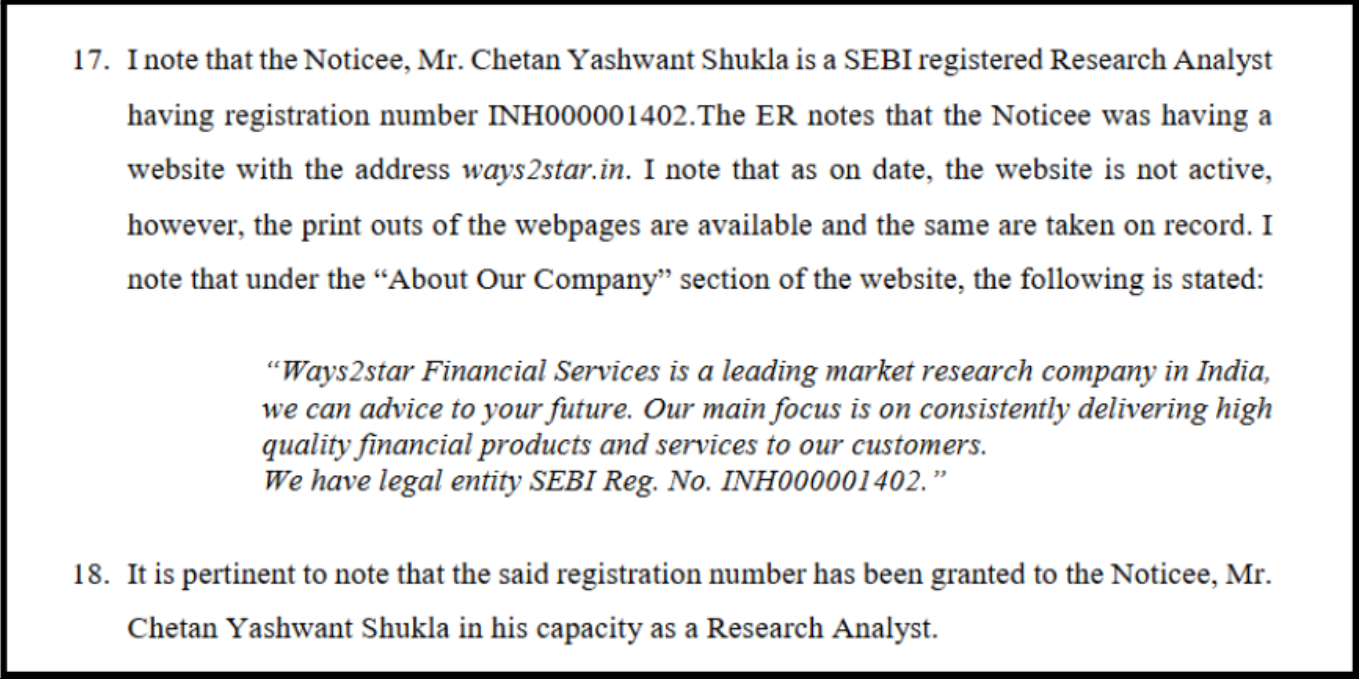

Additionally, investigations revealed that Shukla operated beyond these boundaries, primarily through his platform/website known as Ways2star.in (operating under the name Ways2star Financial Services).

Complaints Against Chetan Yashwant Shukla

The primary complaint against Chetan Yashwant Shukla was that he was acting as an unauthorized Investment Advisor. In India, “Research” and “Investment Advice” are governed by two distinct sets of regulations.

While an RA can analyze stocks and issue buy/sell reports, an Investment Advisor (IA) provides personalized financial planning and specific advice tailored to a client’s portfolio, a service that requires a much more stringent registration.

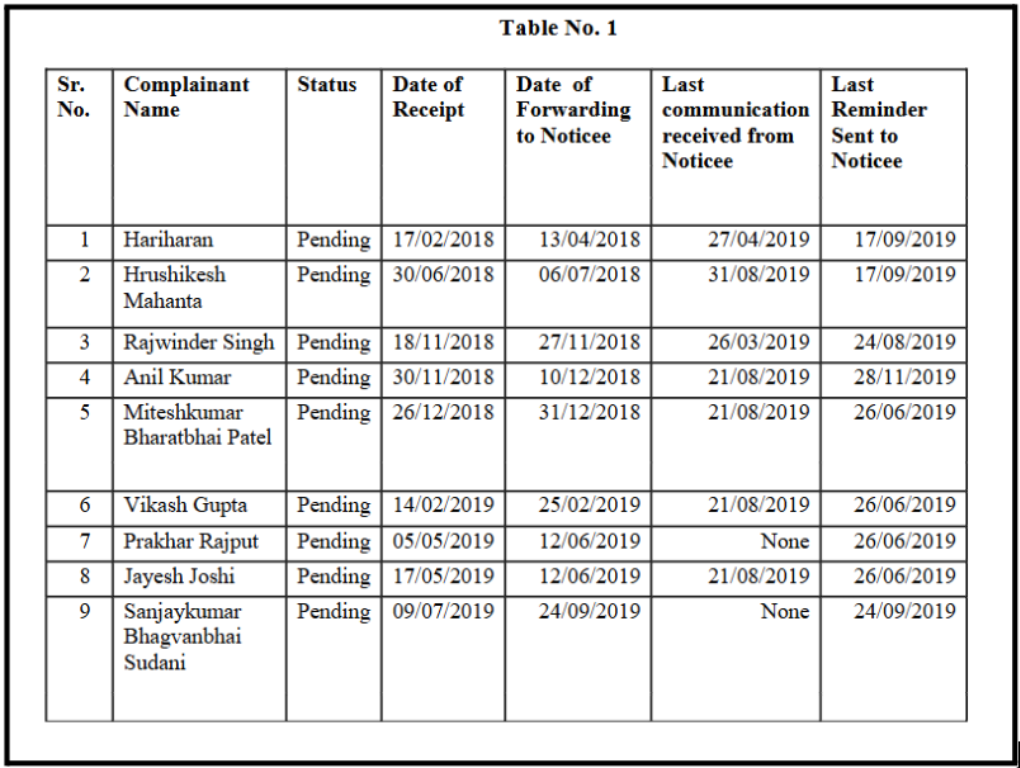

SEBI received multiple complaints against him: investors alleged that he provided “advisory/stock tips,” promised results, took money, and then failed to deliver.

Because of these complaints, SEBI launched an inspection and issued a “Show Cause Notice.”

When SEBI’s team visited his registered addresses (in Mumbai and later Indore), they found the office deserted and no evidence of operations.

SEBI Order Against Chetan Yashwant Shukla

The regulatory trajectory of Chetan Yashwant Shukla (SEBI Registration No. INH000001402) is marked by a series of increasingly stringent orders issued by the Securities and Exchange Board of India (SEBI). These orders range from initial cease-and-desist mandates to final debarments and large-scale recovery proceedings.

Interim Order (August 4, 2020): Following a surge of investor complaints on the SCORES portal

Following a surge of investor complaints on the SCORES portal, SEBI issued an ex parte interim order cum show-cause notice.

SEBI examined the conduct of Mr. Chetan Yashwant Shukla.

While he was legally authorised to provide research reports and stock recommendations, SEBI found that his activities went beyond the permitted scope under the SEBI (Research Analyst) Regulations.

The order records that he was involved in practices inconsistent with the regulatory framework governing research analysts, which are designed to ensure independence, transparency, and investor protection.

Allegations considered by SEBI

SEBI alleged that Mr. Shukla engaged in activities beyond the scope of a Research Analyst, despite holding valid registration.

The regulator found that he was involved in practices resembling investment advisory or portfolio-linked services, which are not permitted under the Research Analyst framework.

SEBI also examined allegations relating to assured or exaggerated profit claims, improper client inducement, and conduct that could mislead investors regarding the nature and risk of securities investments. These actions were viewed as inconsistent with the obligations of neutrality, transparency, and investor protection expected from a Research Analyst.

SEBI’s findings and verdict

After evaluating the material on record, SEBI concluded that registration alone does not authorize a person to carry out all market-related activities.

SEBI held that Mr. Shukla violated the Research Analyst Regulations by crossing regulatory boundaries and engaging in impermissible conduct.

Consequently, SEBI passed directions restricting him from continuing such activities and imposed regulatory sanctions in line with the violations established.

The verdict reinforced that even registered intermediaries are subject to strict ongoing compliance and can face action for misuse of registration status.

Regulatory and market implications

The order clarifies an important regulatory principle: being SEBI-registered does not provide blanket permission to offer all forms of market advice.

Research Analysts must strictly confine themselves to issuing unbiased research reports and recommendations without promising returns or managing client investments.

The case also signals that SEBI actively monitors not just unregistered entities, but also registered professionals who misuse their license, thereby strengthening market discipline and investor confidence.

Final takeaway

The Chetan Yashwant Shukla order serves as a strong reminder that regulatory compliance is continuous, not a one-time formality.

For investors, it highlights the need to understand the difference between a Research Analyst and an Investment Adviser and to be cautious of any market intermediary promising assured profits.

For market professionals, the key takeaway is that exceeding the permitted scope of registration can invite serious regulatory consequences, even if the entity is otherwise lawfully registered with SEBI.

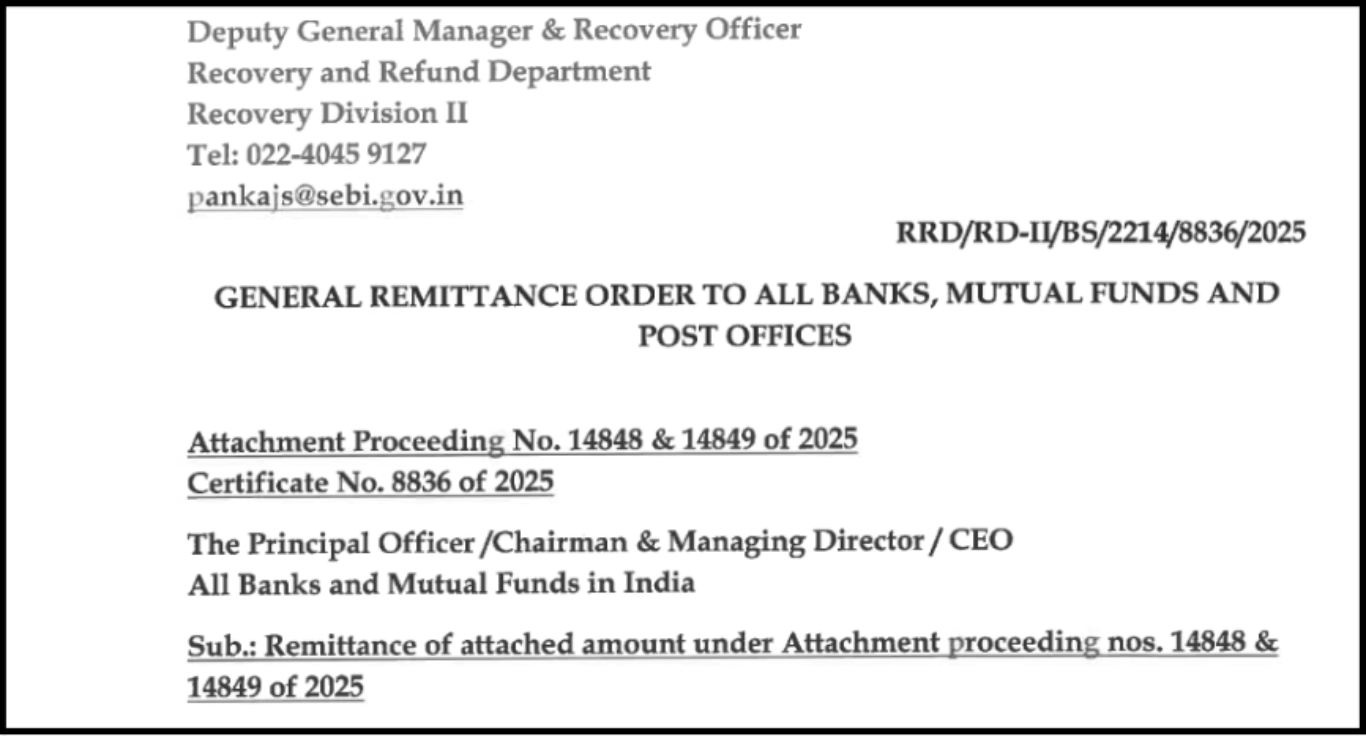

SEBI General Remittance Order Against Chetan Yashwant Shukla

The order examines whether Mr. Shukla, despite holding a valid RA registration, engaged in activities that effectively constituted unregistered investment advisory services, thereby undermining regulatory safeguards meant to protect investors.

SEBI’s findings ultimately led to enforcement action, followed by recovery proceedings due to non-compliance with monetary directions.

Main allegations examined by SEBI

SEBI’s main charge was that Mr. Shukla was operating as an investment adviser without registering as one, even though he knew the regulatory difference between a Research Analyst and an Investment Adviser.

The regulator mentioned that he gave personalized advice, helped connect to client portfolios, and went beyond providing mere research recommendations.

One more significant point against the firm was the misrepresentation of services.

SEBI inquired if clients were made to believe that they were getting advisory services that are legal and compliant under the supervision of SEBI, whereas in fact, these services were beyond the RA framework.

The regulator also looked into the allegations related to the inducement of investors, including the statements in promotions that could lead to the creation of unrealistic expectations of returns, and thus, it is incompatible with both RA conduct norms and the general investor protection principles.

SEBI also contended that these actions led to the obtaining of consideration/fees for services that Mr. Shukla was not authorized to provide.

This charging of fees for unregistered advisory activities was at the heart of the violation finding and monetary directions that followed.

Remittance and recovery proceedings

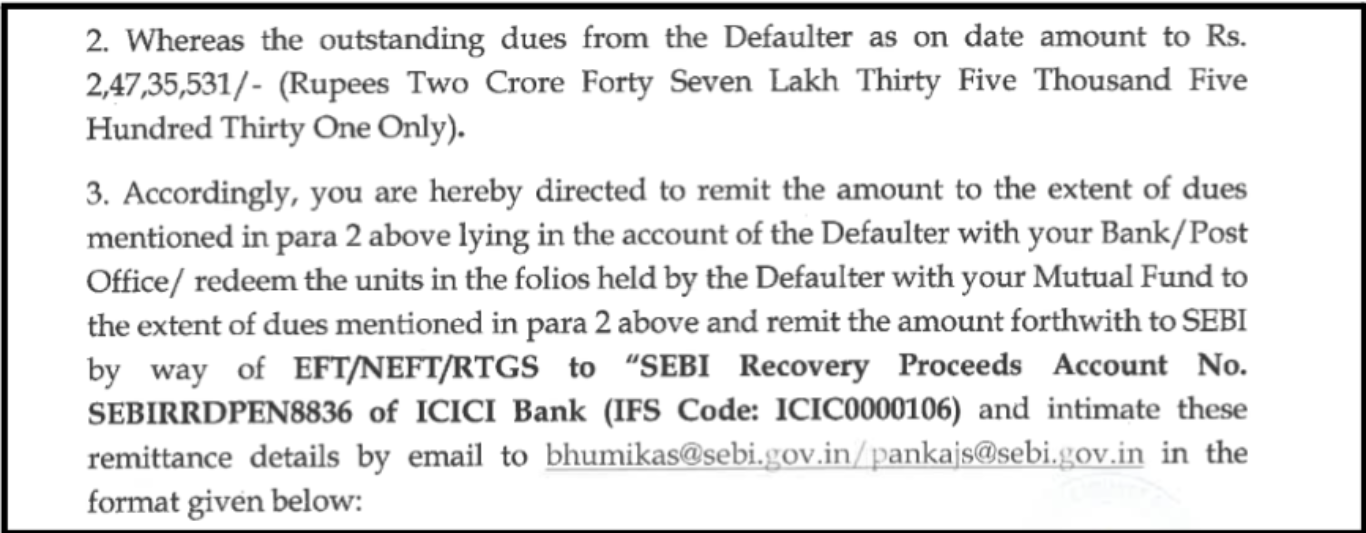

The Remittance Order issued under Recovery Certificate No. 8836 of 2025 demonstrates that Mr. Shukla did not comply with SEBI’s monetary directions within the prescribed time. As a result, SEBI initiated recovery proceedings under its statutory powers.

The amount owed is specified as Rs. 2,47,35,531/- (Rupees Two Crore Forty Seven Lakh Thirty Five Thousand Five Hundred Thirty One Only).

The recipient of the order is directed to attach accounts or redeem mutual fund units held by the defaulter and remit the specified amount to the designated SEBI bank account.

The recovery order authorizes enforcement mechanisms similar to the recovery of arrears of land revenue, including attachment of bank accounts, seizure of assets, and other coercive measures if required.

This stage of enforcement underscores that SEBI’s orders are not merely advisory but are legally binding and enforceable through strong statutory tools

How Chetan Shukla Violated Rules?

According to SEBI’s findings, there were the core issues:

- He held the status of Research Analyst (RA), which allowed him to prepare or publish research reports. But he crossed the line by acting as an Investment Adviser (IA) – i.e., giving personalised advice, portfolio suggestions, and tip packages. That needs a separate IA registration under SEBI rules.

- His website advertised “packages”, monthly/quarterly/annual plans, that promised market tips, equity + commodity services, MCX tips, etc. That was a clear advisory service, not just research.

- When SEBI inspectors asked for records, transaction history, client lists, bank statements, risk‑profiling forms, he failed to provide them. Then, when inspectors visited his registered offices, either the offices had shifted, or they were completely vacant / repurposed.

- He also failed to respond to show‑cause notices, failed to appear for hearings, and did not cooperate with SEBI’s process. Given these, SEBI treated silence as an admission of guilt.

In short, what looked like “tips & research” was actually an unregistered advisory business with fee packages, which is not permitted under the rules.

What This Means for Investors Who Trusted Him?

Here is the impact of these violations on investors:

- Mismatch Between Expectation and Reality

Investors who purchased premium plans reasonably expected ethical research, transparency, performance accountability, and regulatory protection. These expectations were undermined by the manner in which the services were operated.

- Financial Loss and Broken Promises

Many investors reportedly suffered losses due to poor-quality advice or misleading claims, with little clarity on performance tracking or responsibility for outcomes.

This case highlights a hard truth: SEBI registration alone does not guarantee ethical conduct. Even registered professionals can misuse their status by blending advisory services with research, charging fees illegally, promising returns, and disappearing when regulatory scrutiny begins.

Such conduct is not merely negligent. When proven, it qualifies as fraudulent activity under securities law and attracts strict regulatory and recovery action.

What Retail Investors Can Learn from This?

Whether you are an investor or just a reader, remember this:

- Always check SEBI’s active list for RAs / IAs before trusting advice.

- Never trust premium packages that promise fixed results or “multibagger” returns.

- Demand transparency: bank‑statement proofs, research reports, risk disclaimers.

- Avoid advisors who vanish under scrutiny — those are the real red flags.

- Regulators punish — but recovery is slow. So don’t assume “SEBI will save me.” Prevention is better.

Because the Chetan Shukla case proves that SEBI registration is not a magic shield. If you misuse that status or ignore compliance, you can be penalised, and your clients may be harmed.

So treat any such “financial guru” with strong scepticism. Ask tough questions. Demand proof. And never invest based solely on hype or fancy promises.

How to Report if You’ve Dealt with Similar Advisors?

If you have lost money to unauthorized stock tips, “guaranteed” profit-sharing schemes, or questionable WhatsApp/Telegram groups, taking immediate action is critical.

Here is how we simplify the recovery process for you through a structured, step-by-step approach:

- Evidence Compilation: We assist in gathering and organizing vital evidence, including payment receipts, bank statements, contract notes, call logs, and chat screenshots to build a robust case.

- Professional Complaint Drafting: Our team prepares precise, legally-grounded complaints tailored for submission to SEBI SCORES, NSE, BSE, and the SMART ODR portal.

- Submission Guidance: We walk you through the filing procedures step-by-step to ensure your application is error-free and submitted to the correct regulatory authorities.

- Escalation Management: If your initial complaint is rejected or ignored, we provide the necessary framework to escalate the matter to higher regulatory tiers.

- End-to-End Tracking: We manage your case timeline, ensuring all regulatory deadlines are met and providing consistent follow-ups with the concerned authorities.

- Arbitration in the Stock Market: Should your dispute be referred to formal arbitration, we assist in preparing your “Statement of Case” and organizing your defense documents for the hearing.

By regsiter with us, you eliminate the stress of complex paperwork and procedural delays. Our goal is to make your path to recovery faster, more accurate, and more effective.

Conclusion

The Chetan Shukla case is a stark reminder that SEBI registration is not foolproof. Even someone who holds an official title can misuse their position, mislead investors, and avoid accountability when things go wrong.

As investors, always verify the credentials, demand transparency, and beware of promises that sound too good to be true. Regulatory actions may come too late, so prevention is always better than a cure.

Stay informed, stay cautious, and never invest based solely on hype or empty guarantees.