You saw “Eqwires Research Analyst” online. Maybe on Telegram, maybe on ads. And now you’re thinking, “Fake or legit?”

Fair. This space is messy, right?

So this blog sticks to what’s public.

SEBI records, the firm’s own disclosures, and reviews. No wild claims. No guesswork.

What is Eqwires Research Analyst?

At its core, Eqwires Research Analyst is an Indian stock advisory firm based in Ahmedabad.

They are registered with the Securities and Exchange Board of India (SEBI) under registration number INH000007465.

Unlike a traditional broker who simply executes your trades, a Research Analyst (RA) is designed to be the “brains” of the operation. They provide the data-driven insights, fundamental analysis, and technical “calls” that tell you what to buy, when to buy it, and, most importantly, when to get out.

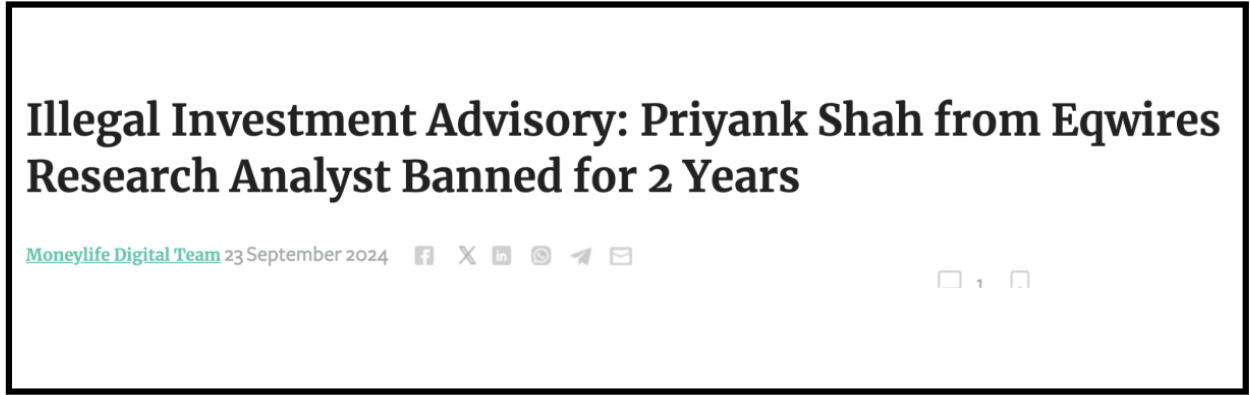

However, Eqwires is described as a proprietorship online. Also, SEBI’s 2024 order matter involves Priyank Dineshbhai Shah.

He is described in media coverage as Equires’ compliance officer.

Important nuance: “Compliance officer” is not always “owner.” But it is still a key accountability role.

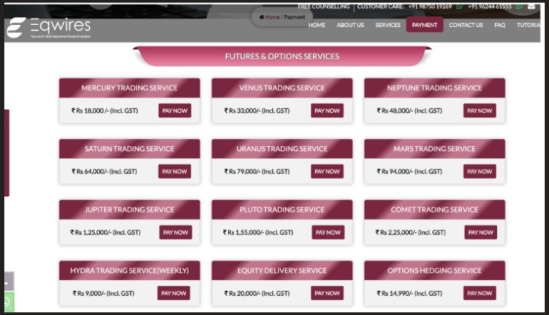

Eqwires Research Analyst Charges

If you’re paying for research, you should know the fees upfront. Eqwires has a public Payment page listing service prices.

Here’s a quick look:

High fees aren’t a “scam” by default. But high fees, plus pressure selling, are red flags.

Is Eqwires Research Analyst Fake or Real?

At first glance, Eqwires Research Analyst looks impressive. A quick search on Google or Justdial throws up a shiny 4.6-star rating, giving the impression of a trusted and successful research firm.

But here’s where the story takes a sharp turn because those stars don’t tell the whole truth.

Dig a little deeper, and the picture changes dramatically. In August 2025, SEBI officially flagged Eqwires after finding that several so-called “client testimonials” were fabricated.

The investigation revealed that many of the glowing success stories weren’t written by real investors at all; they were generated by paid marketing agents to create an illusion of credibility and performance.

Now contrast that polished online image with what actual investors are saying. On consumer complaint platforms like Voxya and financial forums such as Moneylife, the tone is strikingly different.

Instead of profits and success, users talk about heavy trading losses, aggressive upselling, and refund requests that were flatly denied once the money was paid.

So, while Eqwires may look trustworthy on the surface, the deeper you go, the more cracks appear. This is a classic reminder that in the financial world, star ratings can be bought, but investor losses are very real.

Before trusting any research analyst, always look beyond the stars and check what real investors, regulators, and complaint forums are saying.

Eqwires Research Analyst SEBI Case

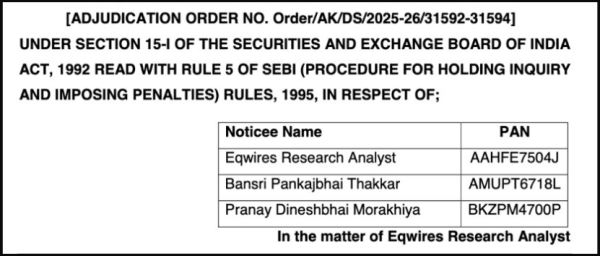

On August 13, 2025, the Securities and Exchange Board of India (SEBI) issued a significant adjudication order against Eqwires Research Analyst (Registration No. INH000007465) and its partners, Bansri Pankajbhai Thakkar and Pranay Dineshbhai Morakhiya.

The Key Allegations and Findings

-

Misrepresentation as “Investment Advisors”: Despite holding only a Research Analyst (RA) registration, Eqwires allegedly branded itself as a “SEBI Registered Advisory Company” on its website and Eqwires Research Analyst Telegram channels.

-

Unauthorized Account Management: In a blatant breach of the Code of Conduct, the firm was found to be operating a client’s trading account using their login credentials—a practice strictly forbidden for Research Analysts.

-

Fabricated Testimonials: The investigation revealed that the firm used “paid marketing agents” to create fake success stories and inflated profit reviews on platforms like Quora to lure unsuspecting investors.

The Eqwires case goes deeper than just the firm. In a separate but related development, Priyank Dineshbhai Shah, the Compliance Officer of Eqwires, was slapped with a two-year ban from the securities market.

Eqwires Research Analyst Complaint

Reviews are never perfect evidence. But they show patterns. And patterns matter, right?

Trustpilot has a listing for Eqwires. It includes both praise and criticism.

What this usually indicates: Some users feel satisfied. Others had a rough experience.

The common theme in such complaints is familiar. People say they paid, then felt let down. Some mention refund conflicts or service dissatisfaction.

MouthShut has an Eqwires reviews page too. You’ll notice a mixed tone there as well.

A few reviews read like strong anger. Those should be read carefully. Look for specifics: refunds, service mismatch, pressure.

This doesn’t prove wrongdoing.

But it does tell you where users feel pain.

How To Report Against Eqwires Research Analyst?

If you faced mis-selling, pressure tactics, or refund trouble, start with the firm’s grievance and complaint channels.

- If unresolved, lodge a complaint in SEBI SCORES.

- If it becomes a dispute, file a complaint against SMART ODR.

- If you suspect fraud or impersonation, use Cyber Crime.

- If needed, proceed to arbitration in stock market.

Save proof first: Payment receipts, chat logs, call records, and screenshots. These are what make your complaints actionable.

Need Help?

Feeling stuck after paying for “research”?

Not sure whether you were misled or confused about what to report and where to report it? You’re not alone, and you don’t have to figure it out by yourself.

If something doesn’t feel right, that instinct matters.

Register with us, and let’s take it one step at a time. We’ll help you sort through your documents, organise the evidence, and clearly draft your complaint so your story is properly heard.

No jargon. No pressure. Just clear support to help you move from confusion to confidence.

Conclusion

So, is Eqwires Research Analyst fake? Not in the sense of being some faceless or anonymous operation. It does carry a visible SEBI registration number, which means it has a regulatory footprint and isn’t operating entirely in the shadows.

That said, a SEBI number alone doesn’t turn stock market advice into a magic wand. If you’re being tempted by promises of “guaranteed returns,” “sure-shot intraday calls,” or “risk-free profits,” it’s time to pause.

The stock market simply doesn’t work that way. When something sounds too perfect, it usually hides the fine print, or worse, the risk.

Real wealth creation is far less glamorous. It’s about clear disclosures, understanding risks, realistic expectations, and disciplined decision-making.

Not loud marketing, not urgency-driven pitches, and definitely not guarantees.

As an investor, the smartest move isn’t chasing certainty—it’s asking the right questions before trusting anyone with your money.