Thinking of trading with Nuvama, but wondering how safe the platform really is? Nuvama complaints often reveal more than marketing claims.

Nuvama Wealth and Investment Limited (NWIL), formerly Edelweiss Broking Limited, is the securities broking arm of Nuvama Wealth Management Limited.

The company provides trading and investment services across multiple financial instruments and made its stock market debut in September 2023 following a restructuring.

Since 2022, Nuvama has offered investors opportunities to grow wealth. But in 2025, records show that out of 1,46,758 active users, 76 registered formal complaints.

While 72.37% of them were resolved, the nature of these issues deserves a closer look.

Nuvama Wealth Complaints

Looking at NSE grievance data, a clear pattern begins to emerge. Most Nuvama complaints are not random. They cluster around service-related issues, misappropriation, payment delays, and operational lapses.

If you’ve recently started using Nuvama, understanding these complaint categories can help you spot red flags early and avoid costly mistakes later.

Type I: Non-receipt or Delay in Payments

Payment-related concerns are among the least reported issues for Nuvama. In 2025, only 3 out of 76 complaints were linked to delayed or missing payments.

This category has steadily declined since 2022, largely due to faster internal resolution mechanisms. That said, from a trader’s standpoint, payment delays appear to be a low-risk area when trading with Nuvama.

Type II: Non-receipt or Delay in Securities

Issues related to securities delivery tell a slightly different story. The percentage of such complaints increased from 2.23% in 2024 to 5.23% in 2025.

While the absolute number remains small, a consistent upward trend indicates the need for caution. If delays continue to rise annually, traders may need to monitor settlements and holdings more closely.

Type III: Non-receipt of Documents

Document-related complaints are relatively rare. Each year typically records one or two cases at most, and the sole complaint reported in 2025 was fully resolved.

Based on historical data, the likelihood of facing documentation issues on Nuvama remains quite low.

Type IV: Unauthorised Trades or Misappropriation

This category deserves serious attention. In 2025 alone, 22 out of 76 complaints were related to unauthorized trading activities.

Although the absolute number hasn’t changed significantly over time, the percentage share has risen sharply—from 14.76% in 2022 to 28.94% in 2025. This suggests an increasing concentration of grievances in this category, making it one of the most critical risks for traders.

Type V: Service-Related Complaints

Service issues form the largest chunk of complaints. In 2025, nearly 50% of all Nuvama complaints were service-related.

While there has been a marginal decline compared to earlier years, this category consistently accounts for 50% to 53% of total grievances. In simple terms, if you don’t face service challenges, you’re among the lucky minority

Type VIII: IPO-Related Issues

IPO-related complaints currently remain limited, with 4 cases reported in 2025. However, the number could rise if platform or allocation-related concerns are not addressed proactively.

Traders planning to participate in upcoming IPOs through Nuvama should remain extra vigilant during applications and allotments.

Type IX: Other Complaints

Complaints falling under “other” categories account for 14.47% of total issues, with 11 complaints recorded in 2025.

Encouragingly, historical data show a gradual decline in this category from 2022 onwards. This reduces the likelihood of encountering unexpected or uncategorized issues.

When Complaints Escalate Further?

While many grievances are resolved internally, some cases escalate to arbitration. One such case involving Nuvama highlights how unresolved issues can lead to prolonged legal disputes.

Let’s take a closer look at that arbitration case in the next section.

Nuvama Arbitrations

Most broker-related disputes never reach arbitration and are resolved at the customer-service or regulatory level. However, when complaints remain unresolved or involve significant financial losses, arbitration becomes the final step for dispute resolution.

In Nuvama’s case, a limited number of complaints have escalated to arbitration, offering important insights into the risks traders may face and how such disputes unfold.

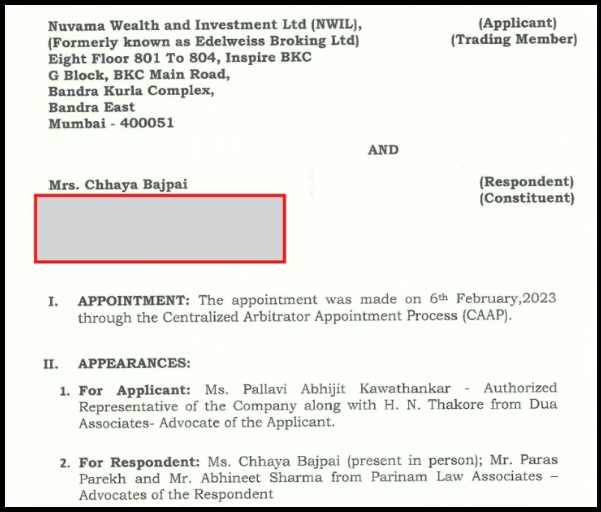

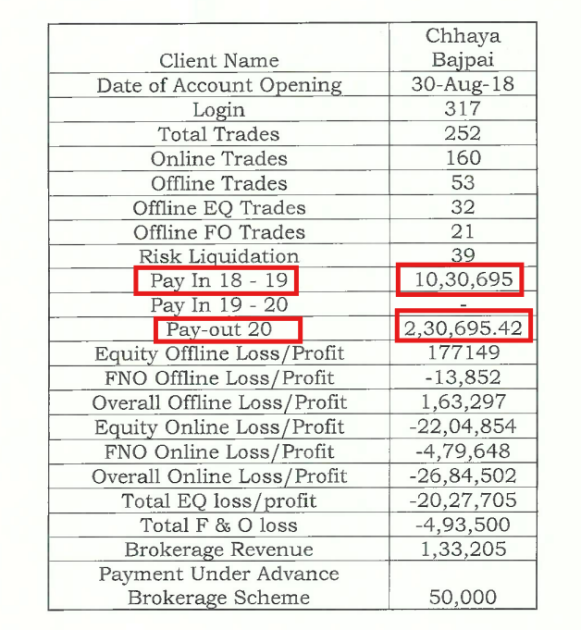

Arbitration Case: Nuvama Wealth and Investment Ltd V/s Chhaya Bajpai

Arbitration cases often arise when trust replaces oversight in trading relationships. This case clearly demonstrates how informal access, lack of communication, and unchecked authority can result in significant financial losses.

The dispute between Nuvama Wealth and Investment Limited and Chhaya Bajpai highlights how a series of decisions, by both the trader and the broker, ultimately led to arbitration.

Case Background

In November 2018, the respondent deposited INR 8 lakhs to trade in stocks and F&O and transferred an existing portfolio worth INR 47.24 lakhs to the broker.

She clearly instructed that the portfolio should not be used for trading and that only interest earned could offset losses.

Based on trust, she shared her User ID and password with two registered associates of the broker. Trades were executed without prior discussion, and she received SMS and email alerts only after transactions were completed.

Over time, these trades resulted in a loss of INR 26.84 lakhs, while the broker earned INR 11 lakhs in interest. Some trades were executed in offline mode, which complicated accountability.

Further analysis revealed multiple IP logins, for which the broker did not provide a satisfactory explanation. The trades executed were also found to be high-risk and generated substantial commissions for the broker.

What You Can Learn From This Case?

- Sharing trading credentials violates SEBI guidelines and increases personal risk.

- Brokers must inform and obtain consent before executing trades.

- High-risk trades without disclosure can indicate a conflict of interest.

- Portfolio liquidation may hide losses from routine alerts.

This case serves as a reminder that oversight is as important as trust when allowing anyone to trade on your behalf.

broker with many rules and regulations, along with a monetary penalty. Let’s have a look at it.

Nuvama SEBI Order

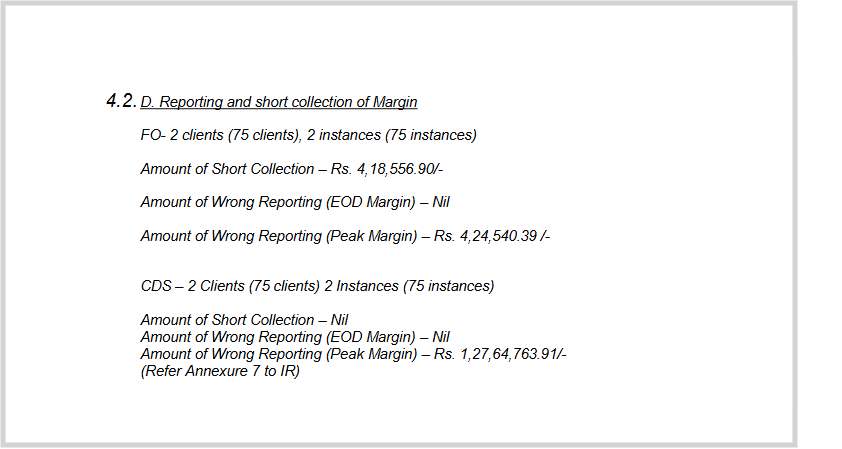

SEBI conducted a joint inspection of Nuvama covering the period from April 1, 2022, to November 30, 2023. Based on findings and replies, SEBI order on Nuvama Wealth concluded that the broker committed multiple regulatory violations.

Now these violations impact the trader community directly or indirectly.

So, if you are thinking of opting for Nuvama as your trading partner, then check the details of SEBI findings and major violations below.

SEBI Order Details & Key Violations

SEBI held that the broker violated multiple circulars due to:

- Inactive Client Settlement Issues: SEBI identified that Nuvama maintained an INR 8.41 lakh shortfall compared to the client-wise breakup. There was a gap in funds parked for inactive and untraceable clients

- Mismatch in Margin Reporting: There are errors in capturing margin requirements in daily margin statements, resulting in mismatches and extra margin being charged to a client.

- Cyber-Security Lapses: Nuvama continued to have high, medium, and low vulnerabilities from VAPT that remained unresolved beyond the permitted 3-month timeline.

- Other procedural compliance failures: These include reporting inaccuracies and delays to exchanges, wrong submissions, technical lapses, risk-based Supervision, logging issues, etc.

Based on the audit and investigation, SEBI imposed a penalty of ₹5 lakh penalty on Nuvama Wealth.

Impact of the SEBI order on other Traders

Although the order is against Nuvama Wealth and Investment Limited, it has indirect but important implications for all traders using any broker.

- Effective Management of Client Funds

SEBI highlighted issues around inactive client funds and unclaimed or unidentified balances. It will ensure that brokers will be proactive in returning idle balances. - Accurate Margin Reporting

SEBI found mismatches in margin collection and reporting. It will encourage brokers to maintain more transparency and accuracy while asking for margin requirements. Therefore, traders can expect fewer sudden margin demands and margin-related disputes. - Stronger Cybersecurity Provisions

SEBI penalised Nuvama for unresolved cybersecurity vulnerabilities. Therefore, traders may expect more secure trading platforms, stronger authentication, and fewer cybersecurity lapses. - More Vigilant Surveillance on Advance Brokerage Plans

SEBI found that Nuvama did not refund or correctly treat advance brokerage. The body also penalised the broker for that. Due to this, other brokers may modify or discontinue prepaid brokerage plans. Unused brokerage balances will likely be refunded more promptly. Thus, traders will get fairer and more compliant fee structures.

How to Report Nuvama Complaints?

When you experience any service issue, misappropriation of funds, or other problems, what will be the best step to report? Whom should you approach? What help can you expect? Let’s find those here.

You have to follow six basic steps to complain against Nuvama. Here are the key aspects you should care for.

- Document all Proofs: It is important to save the call recordings, chat transcripts, messages, and other information shared by Nuvama with you to present as proof for your complaint.

- Call Your Bank: In case you suspect any unauthorised trading or misappropriation of funds, call your bank to stop any transaction.

- Contact with the Broker: Call the helpline number or send an email to Nuvama to formally lodge a complaint against the authorised RAs or other employees who are responsible for monitoring your trading operations.

- File a SEBI SCORES Complaint: One of the mandatory tasks of raising Nuvama complaints is reporting to SEBI. You have to follow the instructions as mentioned in the SCORES portal to lodge a complaint with all the proofs.

- Smart ODR: If your issues remain unresolved after 30 days from raising a complaint to the broker, then only apply at Smart ODR. Smart ODR or Smart Online Dispute Resolution is a crucial stage to register the complaint.

- Arbitration: When you are not satisfied with the decision of the conciliator, who took charge due to Smart ODR initiation, you can apply for arbitration. In this stage, both the broker and trader have to present their complaints and evidence to prove their innocence.

Need Help?

If you need support while raising a complaint, handling documentation, or dealing with a broker dispute, you can register with us for guided assistance. Once you register with us, we arrange a call with a dedicated case manager who assesses your issue and explains the next possible steps.

How do We Help in Case Reporting?

Our support extends across every stage of the complaint and dispute-resolution process, including:

- Structuring your complaint clearly for submission to the broker, ensuring all facts and timelines are properly documented.

- Preparing and uploading evidence such as call recordings, emails, account statements, and transaction logs.

- Filing complaints on the SCORES portal, while ensuring compliance with SEBI’s reporting requirements.

- Guiding Smart ODR initiation if the broker fails to resolve the issue within the mandated timeframe.

- Assisting in arbitration preparation, including drafting submissions, organising proofs, and explaining procedural requirements.

- Clarifying technical and regulatory aspects, so you understand your rights before negotiations or hearings.

In cases involving complex regulatory or financial issues, our experience helps minimise errors that could weaken your claim for compensation or refund.

From the first complaint intake to arbitration outcomes, we support clients in navigating the process with clarity, caution, and confidence.

Conclusion

Therefore, make your choices wisely. The authorities give you enough time to collect all the information, negotiate with the broker, and develop the key arguments to fight for justice.

However, you have to break the clutter by adhering to the applicable norms within the given scopes and timeframe.

Failing to do that effectively can cost you a huge penalty. If you need expert assistance to win the case, choose the one who has solved similar cases.