Streetgains is a Bengaluru-based stock market research platform that offers paid trading calls for intraday, swing, and options traders.

It markets itself as a one-stop destination for traders seeking high-accuracy calls and profit-oriented strategies.

If you’re planning to subscribe to their services, it’s important to check not just their SEBI registration, but also their track record and regulatory history.

In this blog, we’ll examine whether Streetgains is safe or just another advisory service backed by strong marketing claims.

Streetgains Technologies Pvt Ltd

Streetgains claims to provide stock market advisory and research services to retail traders across India.

The firm offers recommendations via mobile app, SMS, WhatsApp, and Telegram, covering intraday trading, swing trading, and index options strategies.

The first question any investor should ask: Is Streetgains SEBI registered?

Based on publicly available information, the firm is owned by Kumar Venkataramegowda Santhosh and is registered with the Securities and Exchange Board of India (SEBI) as a Research Analyst under registration number INH000017082.

The company was founded in 2015 and is based in Bangalore. It claims to have served over 2 million users and provides stock market research services through subscription-based packages.

Services include:

- Intraday trading calls

- Swing trading recommendations

- Index and stock options strategies

According to Prime Insights, Streetgains introduced a “Pay for Successful Trades” model in 2016, yet many user experiences appear to contradict this claim.

The company operates through multiple channels:

- Mobile app (Android/iOS)

- Telegram channel (@Streetgains with 13.8K subscribers)

- WhatsApp groups

- SMS alerts

- Website

The business model involves subscription packages. Prices range from ₹15,000 to ₹18,000 plus GST.

At first glance, everything may seem structured, regulated, and compliant.

However, regulatory findings paint a different picture.

In August 2024, SEBI imposed a monetary penalty of ₹8 lakh on Streetgains for multiple violations of Research Analyst regulations.

The action raised concerns about its sales practices, suitability assessment, and performance representations.

So what exactly went wrong?

Let’s examine the SEBI order in detail.

Streetgains SEBI Order

The Securities and Exchange Board of India (SEBI) has issued a detailed adjudication order against Streetgains Research Services (Proprietor: Kumar Venkataramegowda Santhosh), a SEBI-registered Research Analyst (RA).

The order reveals several serious violations of regulatory norms, resulting in a total monetary penalty of ₹8,00,000.

This case underscores SEBI’s strict stance against malpractices in the securities market, especially those that mislead retail investors.

1. Guaranteed Returns Promises

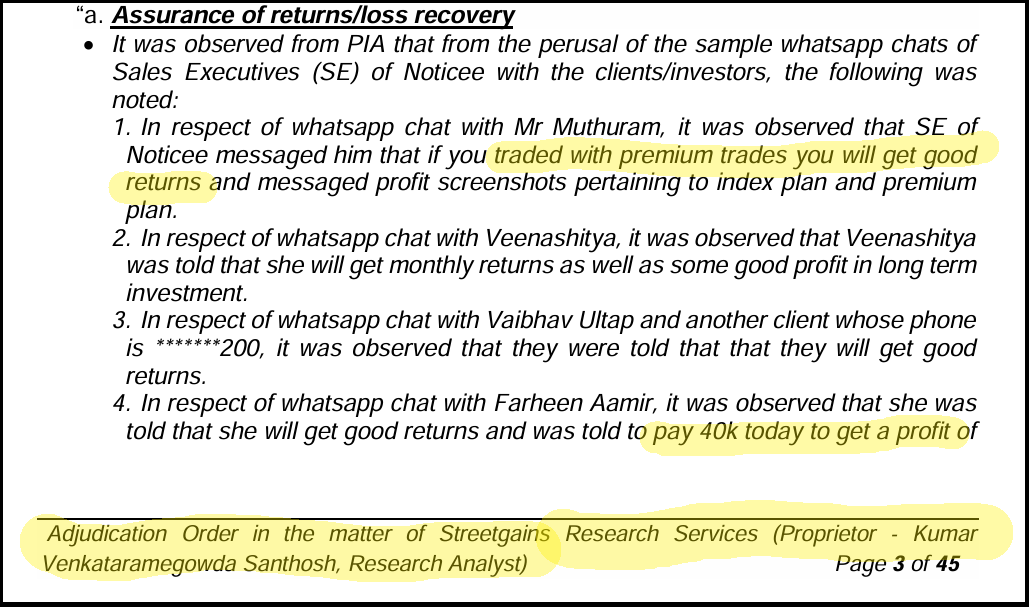

SEBI found sales executives making bold promises. Through WhatsApp messages, they assured:

- Guaranteed returns

- Loss recovery schemes

- Fixed profit percentages

These claims violated SEBI’s fraud regulations. Research analysts cannot promise guaranteed returns. Period.

2. Showing Past Performance

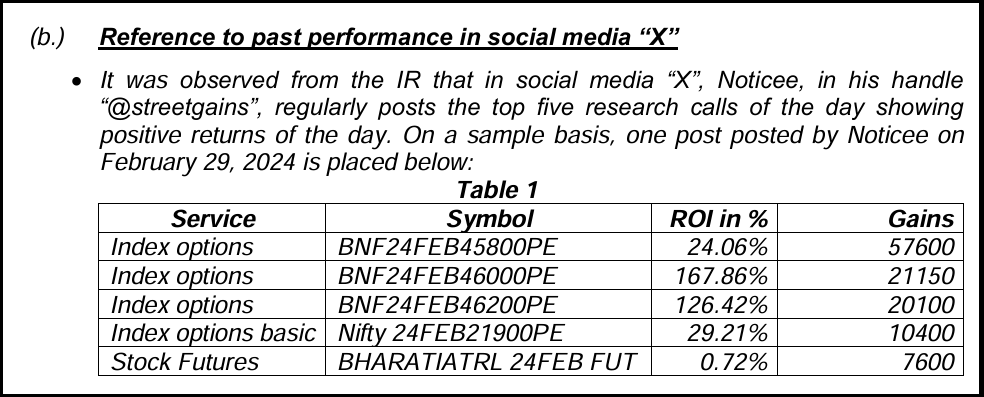

The regulator observed that the individual regularly showcased only the top-performing research calls on social media, creating a misleading impression of consistent high returns.

Key Points:

- The posts highlighted only the best five calls of the day, all showing positive ROI.

- No disclosure of losing trades or overall performance was provided.

- The sample post from February 29, 2024, included unusually high ROIs on index option trades, potentially influencing investors with selective performance reporting.

Such selective showcasing of only profitable calls is misleading and violates SEBI RA norms, which require fair, balanced, and complete presentation of research performance.

By highlighting exceptional ROIs without disclosing losses or overall track record, the Noticee creates a false impression of accuracy, contrary to SEBI’s standards on transparency and investor protection.

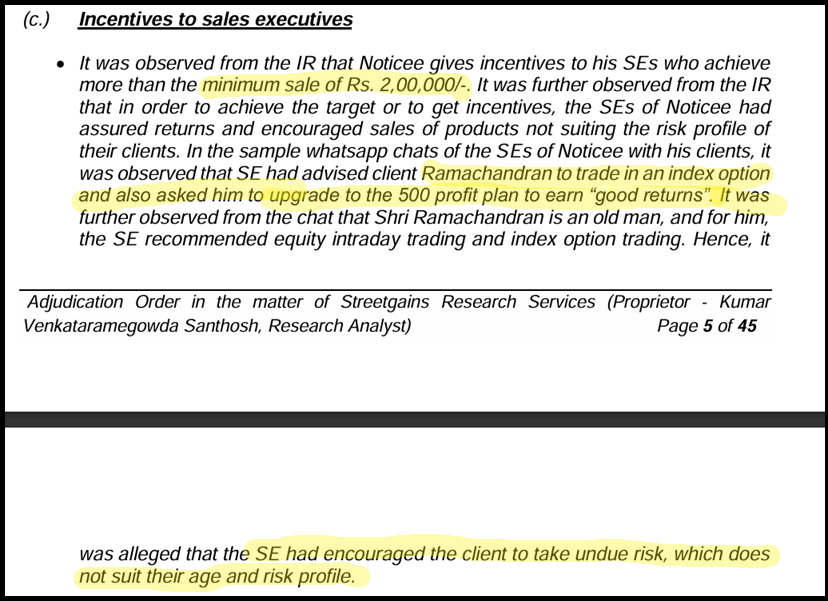

3. Incentive Program for Sales Executives

The Noticee’s sales executives were incentivised to push high-risk products. T

They were found advising an elderly client to trade in index options and upgrade to higher-priced plans to earn “good returns,” despite the client’s age and low risk profile.

Such behaviour violates suitability norms, as SEBI RA regulations require recommendations to match a client’s financial situation, age, and risk capacity.

Offering assured returns and pushing upgrades for incentives reflects conflicted advice driven by sales targets rather than client interest.

Encouraging an elderly client to take undue, unsuitable risk undermines investor protection and constitutes a serious breach of SEBI’s ethical and fiduciary standards.

4. Poor Research Quality

According to Moneylife, research recommendations lacked depth. Calls were based on generic templates. Justifications? Vague phrases like “intraday price volume breakout.”

Furthermore, reports weren’t digitally signed.

This breached Regulations 25(1)(i) and 25(2). Professional research requires specificity. Generic templates don’t cut it.

Streetgains Reviews

User reviews paint a troubling picture.

Let’s categorise complaints by issue type:

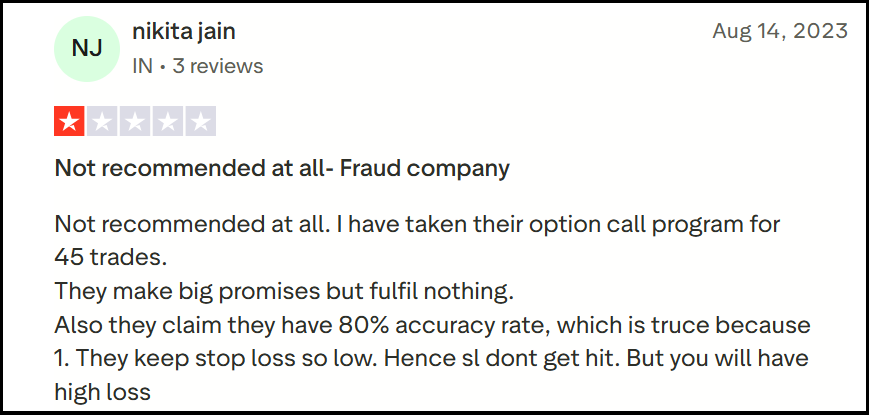

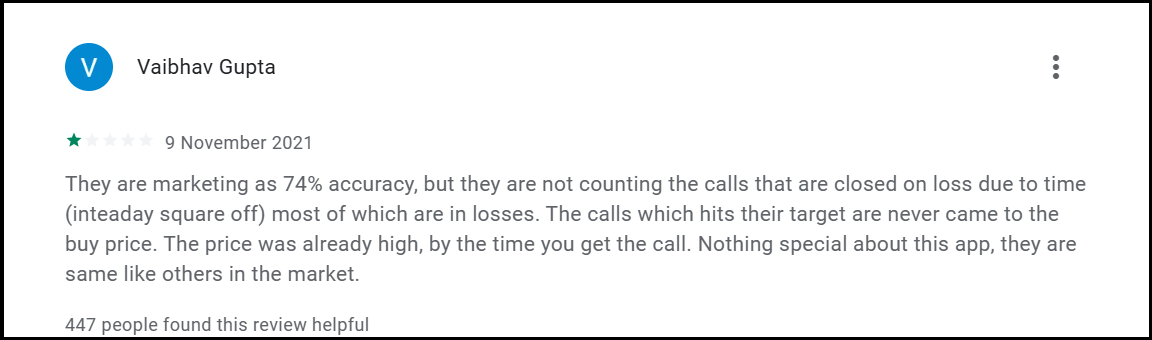

Category 1: Misleading Accuracy Claims

Problem: The Company claims 80% accuracy but excludes stop-loss hits from calculations.

Nikita Jain faced a situation in which the company’s claimed 80% accuracy rate was misleading because it set stop-losses so tight that they rarely triggered, artificially inflating the “accuracy” statistic while leading to disproportionately high losses on the few trades that failed.

Category 2: Delayed Call Execution

Problem: Trading calls arrive after price movement has already occurred

This shows users like Vaibhav Gupta discovered that the app’s high accuracy claims were misleading because profitable calls were sent after the optimal entry price had passed, while losing intraday trades were not counted, artificially inflating the success rate.

Category 3: Financial Losses

Users report substantial capital erosion despite paying high subscription fees

Real User Review (Mohd Sahil, Google Play): “They charged ₹15k+GST for swing trading, and in return, they gave me 5243 total loss.

I lost ₹15k+ fees & in addition to a loss of 5243, total I have lost ₹20k+.”

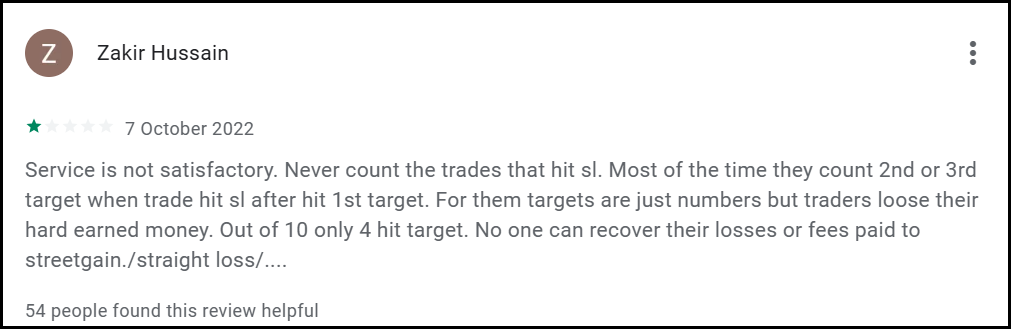

Category 4: Hidden Stop-Loss Trades

Losing trades are not shown on Telegram or public channels

Real User Review: “They don’t show their loss trade on Telegram and all… Most of the time they count 2nd or 3rd target when trade hit sl after hit 1st target.”

In Zakir Hussain’s review, he details how the company systematically hid their losing stop-loss trades from their public channels and dishonestly counted trades as hits even if they later reversed and hit a stop-loss, creating a false picture of their performance.

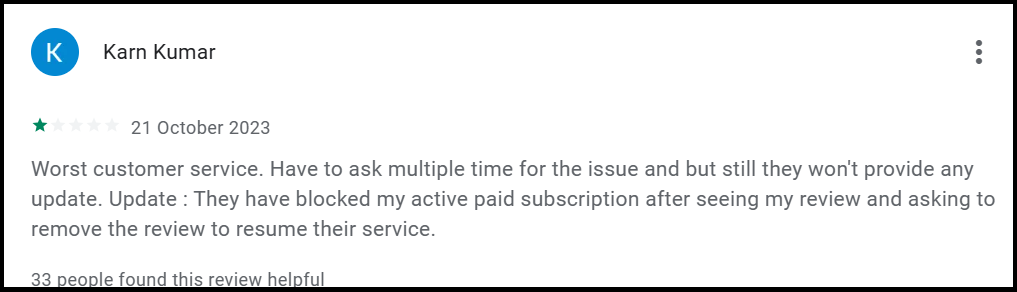

Category 5: Customer Service Issues

Poor responsiveness after subscription purchase

Many users expressed concerns about the lack of customer support and responsiveness after subscribing to the service.

What Investors & Traders Can Learn From This?

The SEBI order highlights how misleading claims, unsuitable recommendations, selective performance showcasing, and sales-driven advice can expose investors to significant risk.

These findings serve as an important reminder that investors must stay vigilant and verify the credibility and conduct of anyone offering market recommendations.

According to SEBI Guidelines for Research Analyst, traders should be aware of key compliance norms and ethical standards that registered research analysts must follow.

Keeping these guidelines in mind can help investors identify red flags and avoid risky advisory services.

Here are the takeaways you listed:

- Beware of assured return promises.

- Check SEBI registration & disciplinary history.

- Understanding past performance is not a guarantee.

- Report misleading communication to SEBI.

- Know that disclaimers do not override misconduct.

How to File a Complaint Against RIA?

Are you facing similar issues with Streetgains or any other SEBI-registered research analyst?

You are not alone, and you don’t have to navigate this complex process by yourself.

Our dedicated team specialises in assisting investors like you. We provide end-to-end support to ensure your grievance is documented effectively.

Our Step-by-Step Support Process

- Initial Consultation & Case Assessment:

We will arrange a confidential call with a dedicated Case Manager who will listen to your complete experience.

- Professional Case Documentation & Drafting:

We will help you draft a structured, compelling, and legally coherent complaint letter that clearly outlines the misconduct, the financial loss incurred, and the specific regulatory breaches.

- Direct Engagement & Escalation

-

- Reaching out to the Stockbroker/Research Analyst: Before escalating to regulators, we can guide you in formally communicating your complaint to the concerned entity, often a necessary step for the grievance redressal trail.

- File a SEBI SCORES Complaint: We provide detailed guidance on how to file your SEBI complaint on the SCORES portal. We help you track the SEBI complaint status and respond to any queries from SEBI.

- Lodge a complaint in Smart ODR: For certain eligible disputes, we can guide you through the SEBI Smart ODR platform, a faster, online mechanism for resolving conflicts with market intermediaries.

- Advisory & Strategic Counselling:

Our experts will counsel you on the realistic outcomes, possible recovery avenues, and the typical timelines involved in the regulatory process.

- Guidance on Advanced Recourse

If the response from the entity or initial regulatory action is unsatisfactory, our team will guide you on the next steps, which include arbitration in the share market. If your agreement with the research analyst/broker has an arbitration clause, we can connect you with resources or legal experts who specialise in securities arbitration to explore this route for recovery.

Your money matters. Your complaint matters.

By taking this step, you are not just seeking accountability for your loss; you are becoming a vital part of a cleaner, more transparent financial market.

Don’t let complexity deter you.

Register with us today to file your case, and let our experienced team help you take the first decisive step toward resolution and accountability.

Conclusion

Kumar Venkataramegowda Santhosh’s Streetgains holds SEBI registration. However, regulatory action tells a different story.

The ₹8 lakh penalty exposes serious operational flaws.

User reviews consistently highlight problems. Misleading accuracy claims. Delayed calls. Hidden losses. Poor customer service. These aren’t isolated incidents. They’re patterns.

Registration provides legitimacy. But ethical practices? Those require commitment. Transparency requires honesty. Client suitability requires diligence.

According to Moneylife, SEBI concluded Streetgains committed “serious operational lapses.”

The penalty serves as a warning. Compliance isn’t optional. Investor protection isn’t negotiable.

Before subscribing to any research analyst, verify their track record. Check SEBI’s website for penalties. Read independent user reviews.

Understand the fee structure. Ask about risk management.

Remember: Past registration doesn’t guarantee future performance. Due diligence protects your capital.