If you are searching for “trading scams recovery” after you have already lost money, you are at the right place.

When people get scammed, it is natural to get the feeling when your heart sinks, the screen shows a red loss, and suddenly the “expert” who was calling you 10 times a day stops picking up your calls.

It feels like the end of the story, but actually, this is the start of your fightback if you know what to do next.

This blog walks you through common stock market trading scams in simple language and then shows you, step by step, how real people have used complaints, counselling, and arbitration to get their money back.

Some victims have recovered amounts like 73,000, 83,000, 1,50,000 and even more, simply because they acted fast, collected proof, and used the right complaint platforms instead of just arguing on phone calls.

If you are stuck in a fraud or “too-good-to-be-true” trading scheme, keep reading carefully, as this is exactly what you were searching for.

Types of Trading Scams

Common people usually get trapped in a few repeat patterns of stock market trading frauds in India. Understanding these helps you quickly recognise what happened in your own case.

- Fake “profit-guarantee” advisors and Telegram/WhatsApp tip groups that promise fixed daily returns from intraday, options, or forex but are not registered with SEBI. They push you to pay fees or transfer funds to personal accounts and then vanish or keep churning trades until you lose everything.

- Unauthorized trading by brokers or sub-brokers, where high-risk F&O positions are punched in your account without your clear consent, is often justified later as “market opportunity” or “system error”, leaving you with huge losses while they earn brokerage.

- Fake trading apps or websites that show artificial profits on the screen, ask you to “add margin” or “pay tax/processing fee” to withdraw money, and then block your login once you stop paying. These setups often fall under cyber and online financial fraud.

- Misuse of client funds and shares by intermediaries, such as delaying withdrawals, refusing to release your balance, or diverting your money to some “managed account” or unauthorized strategy without proper agreement or risk disclosure.

- Manipulated contract notes and statements where extra charges are added, trades are back-dated, or important entries are hidden, making it hard for a common person to understand what actually happened until the loss becomes very big.

How did Recovery Work in Real Cases?

In many real-life trading scams recovery stories, the turning point was not a “kind” broker but a strong written complaint, proper escalation and a trusted advisor.

We are a firm that specializes in money lost to scammers. We have helped hundreds of people with their arbitration cases and represented them in counselling sessions.

NiftyPro Profit Sharing Scam

A trader fell for a “profit-sharing” model from NiftyPro Trading Research, a SEBI-registered advisory that promised big gains if he shared a chunk of profits with them.

Months later, he was deep in losses and stuck in an illegal fee structure that SEBI rules clearly do not allow for Research Analysts.

In arbitration, it came out that the firm had violated SEBI RA Regulations and PFUTP norms with profit guarantees and misleading promotions.

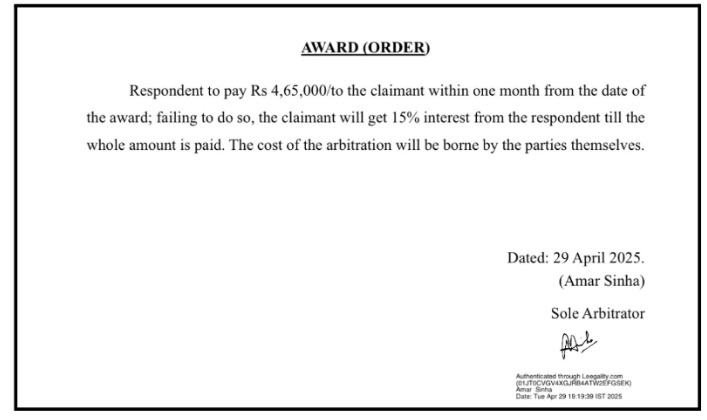

The arbitrator finally ordered NiftyPro to refund ₹4,65,000 to the client, with 15% yearly interest if they delayed payment.

Dealwise Penalised for “Guaranteed Profit” Pitch

In the Dealwise Pro complaint on the Research Analyst case, the advisory allegedly lured a retail trader with claims of assured returns and a structured plan to “recover all past losses”, something SEBI clearly warns RAs not to promise.

Once the trader lost money following their aggressive calls, he approached our team, who helped him document the false promises, payment trail and chat proofs and then guided him through arbitration.

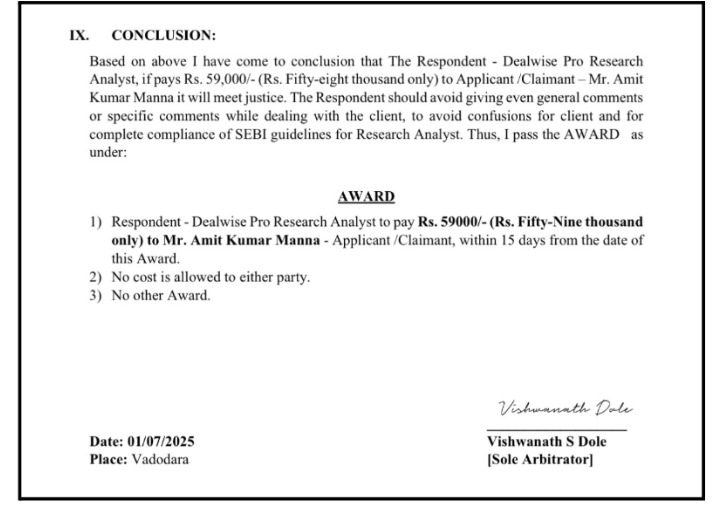

The arbitrator held Dealwise accountable for misleading “guaranteed profit” claims and ordered a monetary award against them.

They were advised to pay ₹59,000 to the client. This sends a clear message that such marketing tactics can backfire badly in a legal forum.

IIFL Securities Penalised for Brokerage Churning

Two individuals, allegedly linked to the AP, induced the investor with profit assurances, obtained his login credentials, and heavily churned F&O trades.

This caused a loss of ₹14.40 lakh, while the broker denied any association with them.

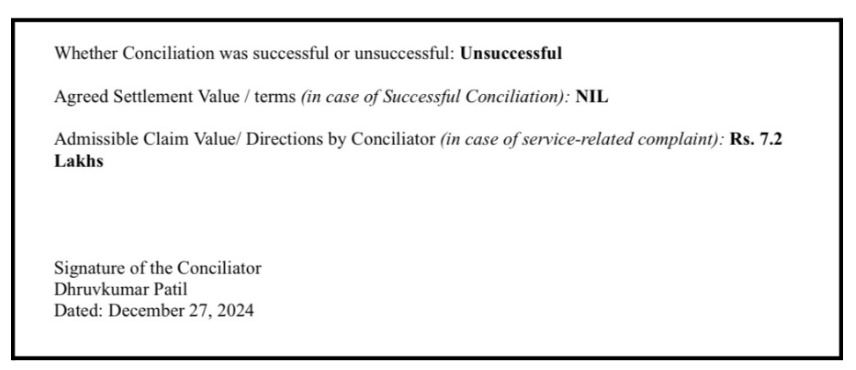

The conciliator found lapses in IIFL’s supervisory controls and possible churning, concluded both sides contributed to the loss, and recommended IIFL bear 50% of the loss by paying ₹7.2 lakh.

However, conciliation remained unsuccessful.

Motilal Oswal for Misleading Trading Practices

The RM allegedly induced the investor, who wanted only long-term investments, into intraday, MTF, and F&O trades and into subscribing to the Trade Guide Signal (TGS) service.

It resulted SEBI Penalty Against Motilal Oswal for huge losses and heavy brokerage fees.

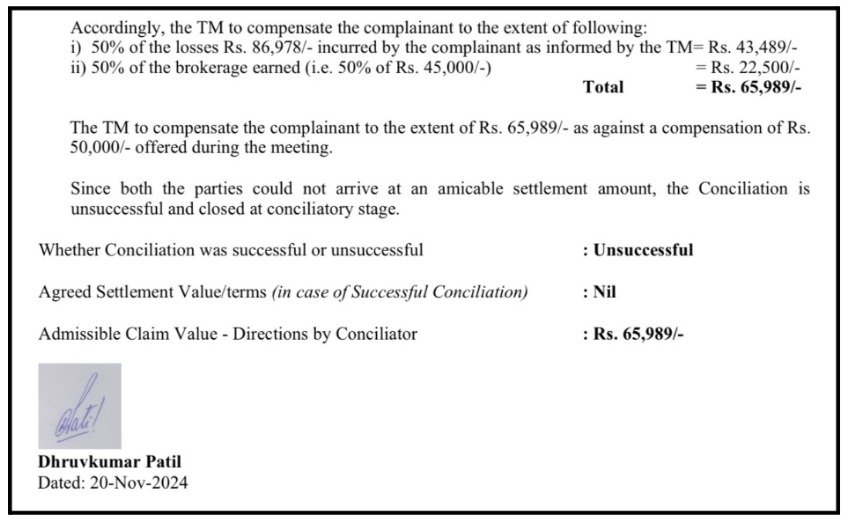

The conciliator held Motilal Oswal responsible for its RM’s inducement and assurances, and directed it (at the conciliation stage) to pay ₹65,989, representing 50% of the trading loss acknowledged by the broker and 50% of brokerage.

Supreme Investrade for Misleading Research Services

The research analyst took ₹70,000 from the investor for tip services and, by advising him to hold a BANKEX option instead of exiting.

This caused his loss to widen from about ₹15,000 to ₹40,000.

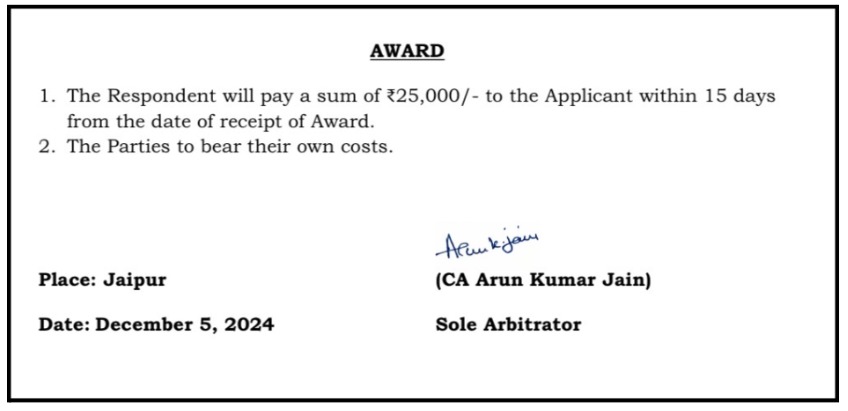

The arbitrator held that only the excess loss due to this advice was compensable and directed the research analyst to pay ₹25,000 to the investor within 15 days, with no refund of service fees.

Trading Scam Recovery Process

If you are stuck in such a scam right now, follow these steps to report trading scams for recovery:

1. Stop and collect all evidence

Immediately stop sending more money, paying “charges”, or sharing OTPs and passwords, even if they say it is “last payment to unlock profit”.

Save everything: app screenshots, profit/loss pages, payment receipts, bank statements, WhatsApp chats, emails, recorded calls, and contract notes; these will become your strongest weapons in complaints, counselling, and arbitration.

2. Inform your bank and freeze the flow

Contact your bank’s customer care and branch in writing, mention that you are a victim of an online trading/investment scam, and request them to mark the transactions and try to recall or hold funds if still possible.

When money has gone through UPI or net-banking to a fraudster’s account, fast reporting gives authorities a better chance to freeze some part of the amount before it moves further down the chain.

3. Complain to the broker or advisor in writing

If your loss involves a registered stock broker, sub-broker, or SEBI-registered advisor, first raise a written complaint on their official email or grievance portal, clearly stating the issue, dates, amount and attaching evidence.

Request a written response and keep a record of their ticket ID or email acknowledgement.

This shows that you tried to resolve the matter directly before going to SEBI or the exchange, which is usually required.

4. File a complaint in SEBI

If the broker/advisory does not respond properly within 30 days, lodge a complaint in SCORES with PAN, mobile, and email and then file a complaint selecting the right category (stock broker, investment adviser, etc.).

Describe your issue in simple language, upload your documents, and track the complaint status.

SEBI forwards it to the entity and monitors their reply, which often pushes them to negotiate or resolve faster.

5. Approach stock exchange grievance and arbitration

For disputes with registered brokers that remain unresolved, you can escalate the matter to the concerned stock exchange (like NSE or BSE) grievance cell, and if needed, file for arbitration in stock market where an independent panel examines your case.

In past cases, investors have managed to recover a significant part of their trading losses when they could show that trades were unauthorized, risk was not explained, or contract notes and margins were mishandled, especially when their story and documents were consistent.

6. Get counselling or expert help if needed

Many victims feel confused by legal terms, forms, and online portals, so taking structured counselling or support from experts experienced in cyber and trading scams recovery can make the process smoother and less stressful.

Proper guidance can help you choose which battles to fight, how to prioritise timelines, and how to draft a strong, clear complaint instead of emotional paragraphs.

Need Help?

If you are staying confused about what you have to do and how the process will go smoothly, you can register with us.

Our team will guide you from the start to the end. We help you collect evidence, assemble it properly, file the right complaint and represent you in counselling sessions.

If you reach out to us, your headache is on us!

Conclusion

Falling into a trading scam is painful, but it does not mean you were “stupid” or “careless”; these fraudsters are professionals who study human behaviour, design fake apps, and script convincing calls to trap even cautious people.

What separates those who recover from those who silently accept loss is not intelligence, it is action: reporting on time, collecting proof, and using the proper complaint channels consistently until the matter is resolved.

If you searched for “trading scams recovery”, remember this: your story is not over just because the scammer stopped answering your calls.

Start with evidence, move to bank and cyber complaint, then push your fight through SEBI, exchanges, and, where needed, arbitration and counselling.

With patience, right guidance, and strong documentation, many ordinary investors have already turned a “total loss” into a partial or full recovery, and you can be the next one to bring your money back home.