Most investors trust SEBI-registered platforms. That trust makes sense. Regulation, exchange membership, and public disclosures reduce risk.

Yet disputes over unauthorised trading still surface even on large, regulated brokers.

This blog explains how such disputes arise on Groww, a SEBI-registered broker.

It starts with what Groww states on its own website, then walks through a reference case (paraphrased from a client complaint), adds a second research-based case from public forums, and finally explains SEBI’s rules.

The goal stays simple: clarity over blame.

What Groww’s Website and Footer Clearly State?

Groww presents itself as a full-service online brokerage and investment platform. Across its homepage, product pages, and footer, Groww states that it:

- Operates as a SEBI-registered stockbroker

- Holds membership with NSE, BSE, and MCX

- Acts as a Depository Participant with CDSL

- Offers execution services for stocks, F&O, commodities, mutual funds, IPOs, and ETFs

- Publishes risk disclosures, trust & safety pages, and grievance channels

Groww also makes two important points in its public content:

- It does not provide investment advice or guarantee returns.

- It warns users about scams that misuse the Groww name on WhatsApp and Telegram.

These disclosures matter because they set expectations: Groww positions itself as an execution platform, not an adviser or trade manager.

A Disputed Short-Sell Trade and Missing Audit Trail

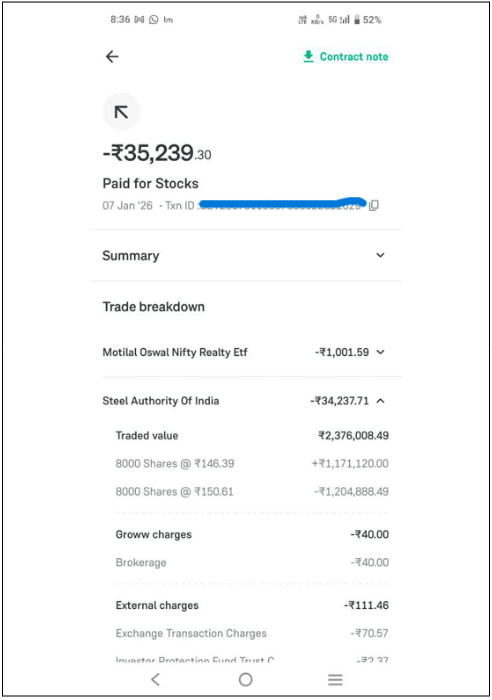

A registered Groww client raised a dispute over an intraday short-sell trade that appeared in the account without the client’s knowledge or approval.

According to the Groww complaint, the client trades only manually and does not use any third-party tools, automation, or external systems. The client also stated that no other person has access to the trading account.

What the Client Observed in the Account?

- The trade history showed an intraday short-sell order of 8,000 shares of SAIL.

- The order did not appear to have been manually placed by the client.

- The position was later auto-squared off by the system, converting it into a buy transaction.

- This sequence resulted in a loss of approximately ₹34,600.

Delay in the Discovery of the Trade

The client stated that they did not receive any immediate indication that such a trade had occurred.

They became aware of the loss only after checking the account days later, when the loss entry was reflected in the ledger and P&L.

Interaction With Groww Customer Support

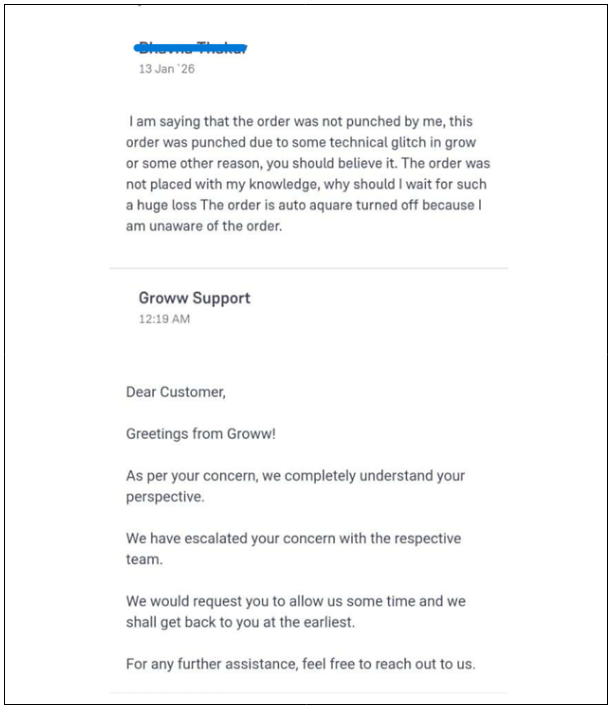

After noticing the loss, the client contacted Groww customer care to understand how the trade was placed.

- Groww’s response, as conveyed to the client, was that the order was executed by the user.

- The client disputed this explanation and maintained that no such order was placed knowingly or intentionally.

- The client requested supporting evidence to verify Groww’s claim.

Specifically, the client asked for:

- Login and IP address logs

- Order authentication records

- Device or session history linked to the trade

According to the complaint, this information was not provided.

Why This Became a Disputed Authorisation Case?

This case does not allege fraud or intent.

It raises a narrow but critical question:

Was the trade authorised by the client, and can the broker demonstrate that authorisation with verifiable records?

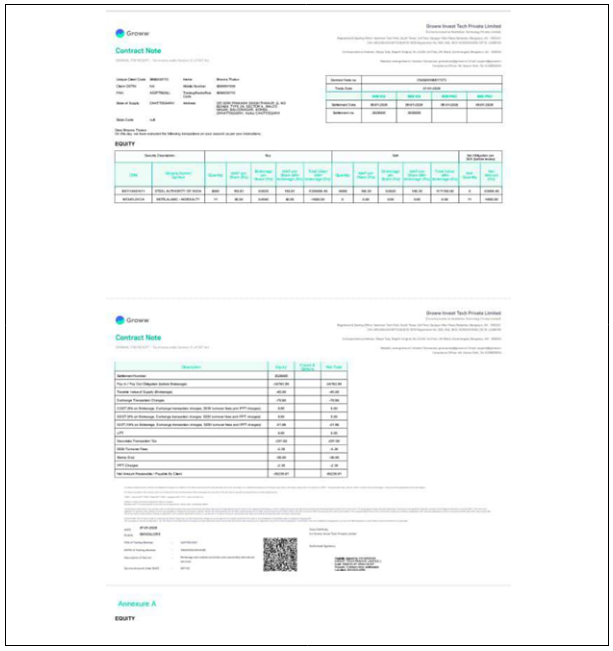

In unauthorised trading disputes, the issue is not whether the trade happened; the contract note already confirms execution. The issue is whether valid client consent existed and whether the broker can produce an audit trail to establish it.

That is what turns a trading loss into a disputed authorisation case.

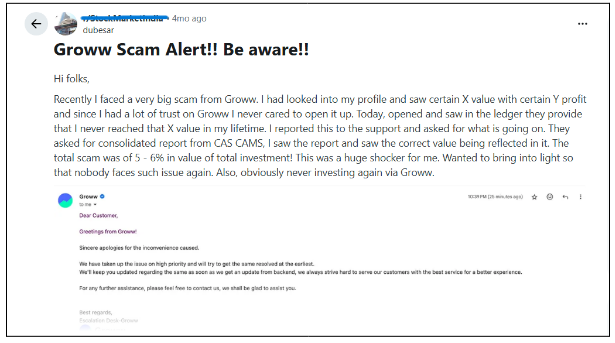

Second Similar Case

Beyond individual complaints, public forums show similar allegations involving Groww:

- Reddit threads where users claim trades or positions appeared unexpectedly, often during intraday windows or volatile sessions.

- Complaint aggregators that list categories such as “unauthorised trades/misappropriation” among Groww complaints.

- App-glitch narratives, where users say orders failed, positions auto-squared, or ledgers changed after market hours.

Important context:

- These are user-reported experiences, not findings by a regulator or court.

- They show patterns of concern, not proof of wrongdoing.

- Many posts also acknowledge market volatility, margin rules, and RMS actions as possible triggers.

Why include these? Because unauthorised-trade disputes rarely appear in isolation. They often surface during intraday trading, margin changes, or system-triggered square-offs, exactly the conditions users describe online.

How Unauthorised-Trade Disputes Happen on Regulated Platforms?

Even on SEBI-registered brokers, disputes arise due to a mix of technology and process:

- RMS / Auto Square-Offs

Brokers auto-square intraday positions near market close to manage risk. If users misunderstand margin rules or notifications, disputes follow. - Session Volatility and Latency

High volatility can create partial fills, delayed confirmations, or unexpected executions. - Account Access Issues

Compromised credentials, shared devices, or weak security hygiene can lead to disputed orders. - Communication Gaps

If the broker cannot quickly produce audit trails, trust erodes and disputes escalate.

None of these implies intent. They explain why proof and process matter.

What SEBI Rules Require in Unauthorised-Trade Disputes?

SEBI’s framework puts the burden of proof on the broker in disputed trades.

In practical terms, brokers must be able to produce:

- Order placement records

- Authentication logs (app/session)

- Call recordings or digital consent, where applicable

- IP/device details if relevant

A contract note alone does not prove consent. It proves execution.

When a client disputes authorisation promptly, evidence decides the outcome.

How To Complaint Against Groww App?

Step 1: Preserve Evidence Immediately

Save:

- Order history screenshots

- Contract notes

- App notifications

- Emails and support tickets

- Bank statements (if margins moved)

Step 2: Write to the Broker’s Grievance Desk

Ask specifically for:

- Order authentication proof

- Login/IP/device logs

- RMS trigger details (if auto-square off occurred)

Keep communication factual and dated.

Step 3: Escalate to the Exchange (IGRP)

If the broker response does not resolve the issue:

- File a complaint with the exchange

- The Investor Grievance Redressal Panel (IGRP) reviews documents and issues directions

Step 4: Arbitration in Stock Market

If either party disagrees with IGRP:

- Proceed to arbitration under the exchange bye-laws

- Evidence, timelines, and SEBI circulars drive outcomes

Step 5: Lodge a complaint with SCORES

File a complaint on the Securities and Exchange Board of India’s SCORES portal for regulatory oversight, especially when audit evidence remains unavailable.

Need Help?

Are u looking for how to File a Complaint Against Unauthorised Trading online?

Unauthorised-trade disputes succeed or fail on process, not volume.

Register with us; we provide practical guidance on:

- Identifying whether a case qualifies as unauthorised trading risks

- Requesting the right evidence from brokers

- Structuring complaints that stand up at IGRP and arbitration

- Understanding RMS, margin rules, and square-off mechanics

The focus stays on facts, timelines, and documentation, not assumptions.

Conclusion

Groww operates as a SEBI-registered broker with public disclosures and grievance channels. That matters.

At the same time, disputed unauthorised trades can still occur due to system triggers, access issues, or communication gaps.

When that happens:

- Avoid conclusions

- Demand evidence

- Follow the escalation path

In regulated markets, proof, not perception, resolves disputes.