Imagine logging into your Angel One account to review your portfolio and finding trades you never placed. The orders show as executed, complete with quantities, prices, and timestamps, yet you don’t recognize them and never gave consent.

For a retail investor, this moment can be unsettling. Online trading moves fast, real money is involved, and even small unauthorised trading can lead to losses if not addressed immediately. Questions arise quickly: Who placed these orders? Was the account accessed without permission? Were proper approvals taken?

Most investors rely on digital platforms like Angel One with the expectation of secure access, clear confirmations, and full control over every transaction. When that control appears compromised, trust in the system is shaken.

In cases of suspected unauthorised trading, investors need more than assumptions. They need clear records, transparent explanations, and a defined process to investigate and resolve the issue, without delay.

Angel One Unauthorized Trading Complaint

Unauthorized trading can lead to unexpected changes in their money and their investment portfolio. They might also be worried about the safety of their account and their personal information.

Even a short delay in finding out about these trades can result in bigger losses. For that reason, clear responsibility and quick solutions are important for those who are affected.

Reports in the public domain and regulatory disclosures have highlighted instances where brokerage processes and account controls came under regulatory review.

Unauthorised Trading by Angel One User Complaint

Like many individual investors, Pramod had opened his account with Angel One with the goal of investing wisely and growing his savings over time. He believed that every trade in his account would follow his instructions, match his risk tolerance, and have his approval.

That belief started to fade when Pramod noticed something strange in his trading statements.

There were transactions in his account that he did not remember authorizing. At first, he thought it might be a mistake or a delay in the account reconciliation process.

However, as he looked more carefully at his contract notes and transaction history, the situation became more troubling. Several trades had been made without his clear permission, and some positions involved risks he was not comfortable with.

As time went on, these unauthorized trades started to cost him a lot financially.

The losses added up, and Pramod found himself in a situation he hadn’t anticipated. After calculating the total impact of these unauthorized trades, he estimated his financial loss to be around ₹8,00,000.

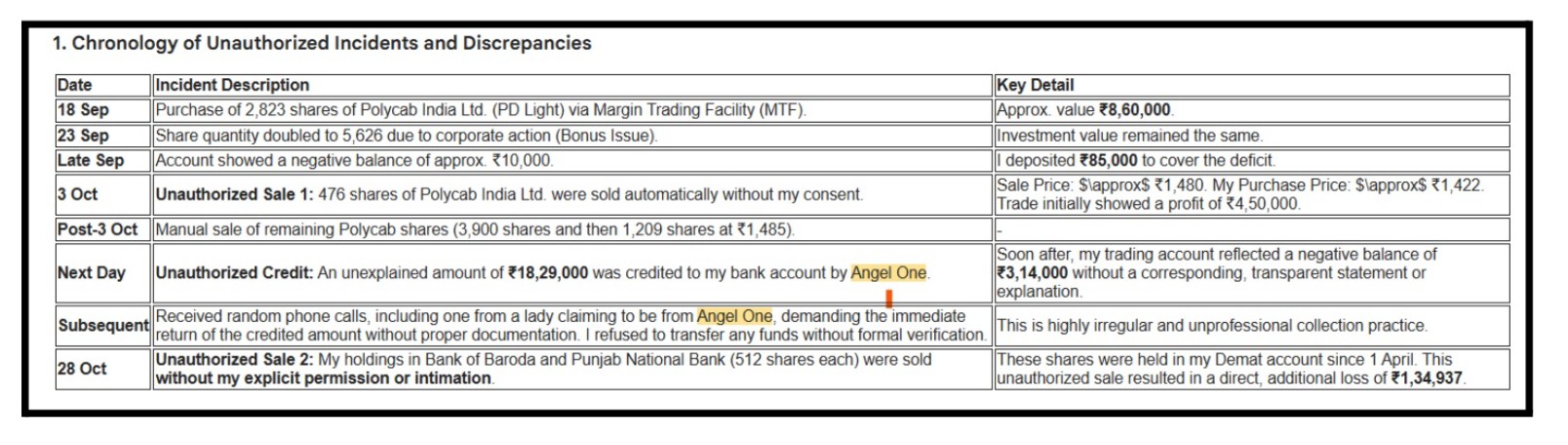

(Image 3)

For an individual investor, this wasn’t just a number; it represented years of savings and careful planning. What made the situation even worse was the lack of clear answers about how these trades were executed.

Pramod insisted he had not given any verbal or written consent for these transactions, nor had he approved any high-risk strategies in his account.

The absence of clear explanations and timely help only increased his anxiety. Every unanswered question and delayed response made him more worried about the safety of his account and the controls in place.

With the losses mounting and uncertainty growing, Pramod decided to formally file complain Against Angel One about the unauthorized trades.

His main goal was to get answers, understand how these trades happened, and request a fair review of the losses he had suffered due to trades that were made without his consent.

Like many investors in similar situations, he was not looking for conflict; he just wanted transparency, a proper investigation, and compliance with the regulatory protections meant to safeguard clients.

This case shows a reality that many investors may not want to face at first.

Unauthorized trading doesn’t always happen dramatically; it often appears quietly through account statements, unexpected margin calls, or unexplained losses.

Pramod’s experience is a reminder of how important it is to monitor your account regularly, report any issues quickly, and keep good records when something doesn’t feel right.

What You Can Do In Such Case?

When an investor finds out about trades that weren’t clearly approved, the best approach is to think carefully and not act out of fear.

Disputes about unauthorized trades usually depend on keeping good records and knowing the timeline of events, so staying organized and clear helps figure out exactly what happened.

- Investors should start by carefully checking their account activity.

- Documents like contract notes, margin statements, trade confirmations, and communication logs can show when and how the disputed trades were made.

- Looking at these documents early on makes it easier to see if proper consent was given and whether any internal control measures failed.

- If the issue isn’t resolved, investors can use formal options provided by market rules.

There are complaint processes in place to handle such matters, but they work best when concerns are raised quickly and backed by complete records. Putting things off or not following up formally can weaken the case and make it harder to get a resolution.

Important steps investors should take:

- Review account activity regularly: Check contract notes, trade alerts, and email confirmations as soon as they are received. Checking early helps spot unusual activity before losses grow.

- Confirm account settings: Make sure only the necessary products and segments are enabled. Turning off unused features can help prevent unnecessary risk.

- Maintain written communication: Use registered email addresses and official support channels for all messages. Written records are helpful if any disputes come up later.

- Raise concerns without delay: Let the broker and, if necessary, the exchange or grievance platform know about any irregularities as soon as they are noticed. Filing a report quickly helps keep evidence strong and follows regulatory deadlines.

If an investor sees trades they didn’t make or approve of, acting quickly can help reduce the damage.

When there’s suspicion of unauthorized trading, it’s important to have clear records and report the issue promptly through the right official channels.

Going through a set process ensures the matter gets properly reviewed and resolved. Investors should only use recognized platforms and follow official procedures when raising these concerns.

Steps to Report:

- Contact the broker’s customer support and write about the issue formally.

- Ask for detailed trade logs and account statements to check.

- File a complaint with the stock exchange BSE/NSE using their investor complaint system.

- If the problem isn’t solved, lodge a complaint in SCORES.

- Save all emails, call records, and any responses you get for future use.

Need Help?

We know how upsetting it can be to find unauthorized activity in your trading account. These situations can cause confusion, worry, and the feeling that you’re losing control.

Investors rely on systems to follow their instructions exactly. When that trust is broken, the effects go beyond just money.

We’re here to help you every step of the way.

We’ll assist you in recording the problem, filing a complaint with the broker, and contacting the right exchange and regulatory body.

Our support doesn’t stop there, we’ll follow up and respond until the issue is fully resolved. Our goal is to provide clear information, good communication, and a proper way to fix the problem.

Conclusion

In situations involving unauthorized trading, investors often want to understand how the trades happened and how the system managed access to their accounts.

The issues raised with Angel One show the need for strong internal controls, proper oversight, and quick communication with investors.

Both regulatory inspections and complaints from investors emphasize the importance of following proper procedures. Clear reporting and proper documentation are key in resolving these kinds of problems.

Investors should stay vigilant and take steps to protect their trading accounts.

Use strong, unique passwords and change them often. Always log out after each session, especially if using a shared device.

Be careful of suspicious calls, emails, or messages that ask for your login details. Enable two-factor authentication whenever possible to add an extra layer of security.