Consider opening a trading account with Aditya Birla Money. You should read this first.

While the name “Aditya Birla” carries weight in India’s corporate landscape, several investors are raising serious red flags about their money management services.

Let’s dig into what’s really happening and uncover the Aditya Birla Money review.

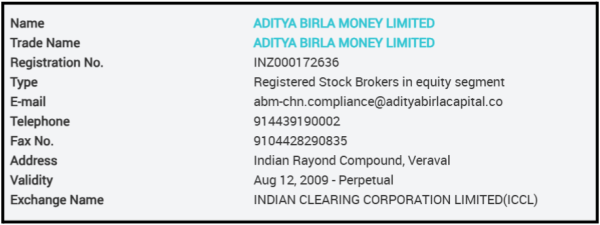

Aditya Birla Money Details

Aditya Birla Money Limited is a stockbroking and wealth management firm under the Aditya Birla Capital umbrella.

Operating since 1995, it offers trading in equities, derivatives, commodities, and mutual funds.

The company is registered with SEBI and operates as a full-service broker.

According to their official website, they serve over 6 lakh clients across India and claim to provide comprehensive financial solutions.

It functions as a traditional full-service brokerage house offering both online and offline trading services.

The platform provides multiple investment avenues through its digital ecosystem and physical branch network.

Key Services Include:

- Trading Platforms: Mobile app (Elevate), web-based trading terminal, and offline branch access for equity, derivatives, commodities, currency, and mutual fund investments

- Advisory Services: Research reports, market insights, portfolio management services, and dedicated relationship managers for premium accounts

- Account Types: Regular trading accounts, margin trading facilities, IPO applications, and systematic investment plans

The company charges higher brokerage fees compared to discount brokers but promises personalized support and comprehensive research.

However, user experiences suggest a significant gap between promised services and actual delivery.

Major Regulatory Actions on Aditya Birla Money

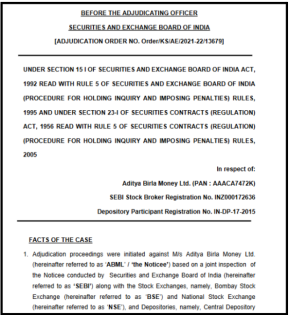

The Securities and Exchange Board of India (SEBI) conducted inspections and adjudication proceedings against Aditya Birla Money Limited (ABML) for multiple regulatory violations.

The order, dated October 4, 2021, reveals serious misconduct, including unauthorized trading, misleading clients, a lack of internal controls, and failure to comply with SEBI regulations.

The adjudicating officer imposed a total penalty of ₹1.02 crores on ABML under various sections of the SEBI Act and the SCRA.

Violations by Aditya Birla Money

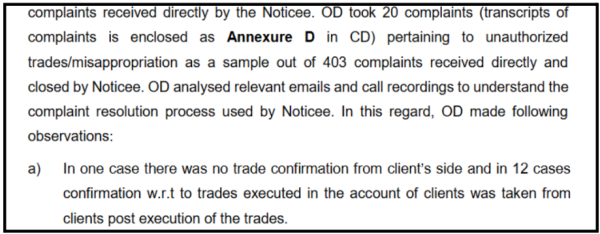

1. Unauthorized Trading & Unregistered Portfolio Management Services (PMS)

ABML managed client accounts and executed trades without PMS agreements, treating retail clients as PMS clients.

- Clients merely confirmed trades after execution

- Trades were initiated by ABML, not clients

- Post-trade confirmations were used to validate unauthorized trades

Impact: Clients were deprived of regulatory protections meant for PMS clients, including formal agreements, disclosures, and risk profiling.

2. Lack of Adequate Systems & Internal Controls

ABML used dedicated PMS terminals to execute trades for retail clients, violating internal segregation norms.

- 46 retail clients’ trades were executed through PMS-only terminals.

Impact: Weak internal controls increased the risk of unauthorized trading and client harm.

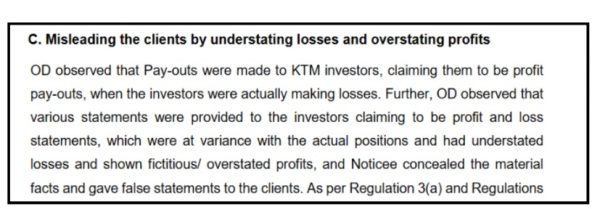

3. Misleading Clients by Understating Losses & Overstating Profits

ABML provided false profit & loss statements and paid out “profits” even when clients were incurring losses.

- Payouts labeled as “profit payouts” during loss-making periods

- Multiple conflicting P&L statements were provided to clients

Impact:- Clients continued trading under pretenses, incurring heavy losses while believing they were profitable.

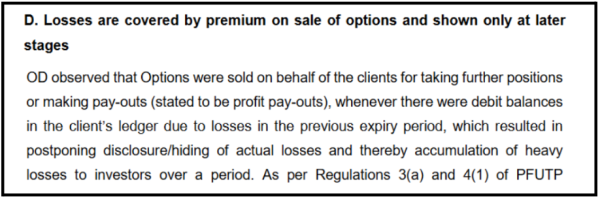

4. Hiding Losses Through Option Premiums

ABML sold options to generate credits, hiding actual losses and postponing their disclosure.

- Premiums from option sales used to cover debit balances

- Losses accumulated over time without client awareness

Impact: Investors suffered heavy, unrecognized losses, preventing them from making informed decisions.

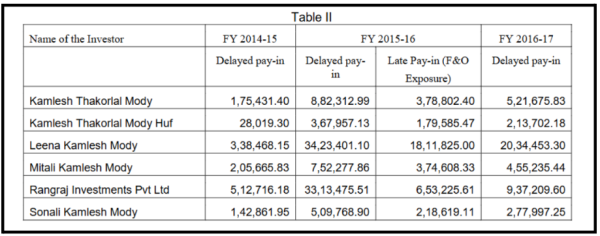

5. Unfair Charging of Delayed Pay-In & Late Fees

ABML charged excessive, delayed payment, and late pay-in fees without proper client consent.

- Charges exceeded the agreed annual interest rates

- Fees were levied even when trading decisions were made by ABML

Impact: Clients faced unexpected and unfair financial burdens, increasing their losses.

6. Failure to Settle Inactive Client Accounts

ABML did not settle funds and securities for inactive clients as required.

- Unsettled amounts totaling ₹64 lakhs across client accounts.

Impact: Client assets were improperly retained, violating trust and regulatory settlement norms.

7. Delay in CKYC Uploads

ABML delayed uploading the client KYC details to the Central KYC registry.

- 8 out of 8 sampled clients had delayed CKYC entries.

Impact: Non-compliance with anti-money laundering and client verification norms.

8. No Dedicated Grievance Email ID

ABML used general email IDs for complaints instead of dedicated grievance IDs.

Impact: Poor grievance redressal mechanism, reducing transparency and accountability.

9. SMS Alert Facility Not Enabled

ABML failed to enable SMS alerts for depository accounts and activated the Power of Attorney without the client’s mobile numbers.

Impact: Clients were not notified of account activities, increasing the risk of unauthorized transactions.

10. Unauthorized Transfer of Client Securities

ABML transferred client securities worth ₹5.41 lakhs to its own account. 160 instances of unauthorized transfers.

Impact: Breach of client trust and misappropriation of assets.

Regulatory Actions & Penalties Imposed

SEBI found ABML guilty of multiple violations and imposed the following penalties:

| Violation Category | Legal Provision | Penalty Imposed |

| Fraudulent & Unfair Trade Practices | Section 15HA, SEBI Act | ₹75,00,000 |

| General Contraventions | Section 15HB, SEBI Act | ₹25,00,000 |

| Failure to Segregate Client Securities | Section 23D, SCRA 1956 | ₹2,00,000 |

| Total Penalty | ₹1,02,00,000 |

Aditya Birla Money User Reviews

The user experiences follow the same pattern of the problems mentioned in the violations above.

Real users have shared feedback about Aditya Birla Money across multiple platforms.

Let’s break down the problems by category:

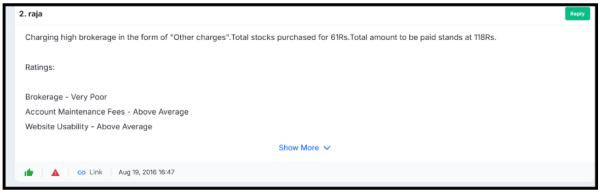

1. High Brokerage Charges

Users report shockingly high brokerage fees that don’t match advertised rates.

The charges appear unpredictable and often hidden under vague labels like “other charges.”

A user, Raja, paid almost double his trade value just in fees. Imagine buying ₹61 worth of stocks but paying ₹118 total.

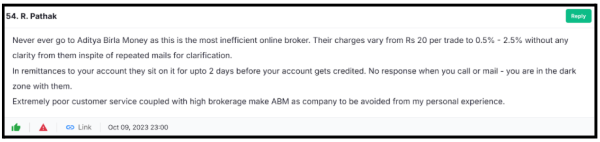

Even after multiple emails, R. Pathak couldn’t get clarity on the brokerage structure, and the charges kept changing randomly.

The lack of a transparent pricing structure leaves investors confused and potentially overcharged.

Without clear fee breakdowns, budgeting for trading costs becomes impossible. For small traders making frequent trades, this makes profitable trading nearly impossible.

2. Poor Customer Service

Getting help from customer support seems like an endless nightmare for many users.

The support team appears untrained, unresponsive, and often provides incorrect information.

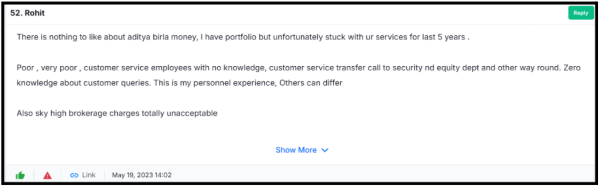

A user, Rohit, describes being transferred endlessly between departments with no one able to answer basic questions, a classic runaround.

Tripti’s case is particularly alarming; wrong documentation from the company directly caused her to miss trading opportunities and suffer financial losses.

The support team appears severely undertrained and unable to resolve even basic queries.

When staff provide wrong information that causes customer losses, it crosses from poor service into potential liability territory.

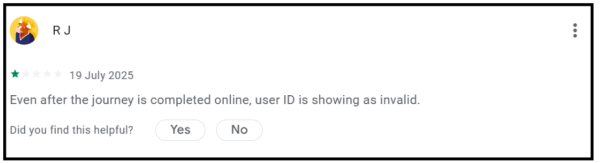

3. Technical Issues with the App

The mobile application faces frequent bugs, crashes, and functionality problems. Users report outdated software that fails during critical trading moments.

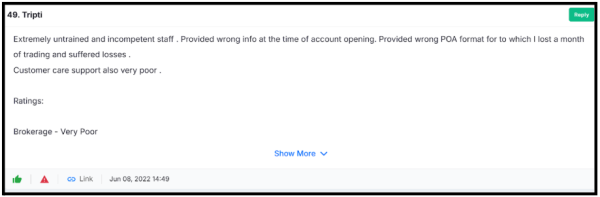

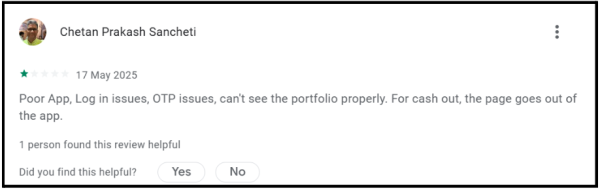

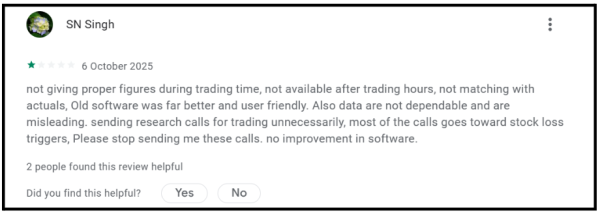

Chetan couldn’t even complete basic functions, login failed, portfolio display malfunctioned, and withdrawal attempts crashed the app entirely.

SN Singh highlights a dangerous issue: inaccurate trading data during market hours can lead to costly mistakes based on wrong information.

The technology infrastructure appears severely outdated and unreliable.

From login failures to inaccurate data display, the app fails on multiple critical fronts.

When multiple users across different time periods report the same issues, it indicates the company hasn’t prioritized fixing fundamental technical problems.

4. Withdrawal and Fund Access Problems

Investors report serious difficulties accessing their own money. Withdrawal requests take weeks or months, and some users suspect fraudulent practices.

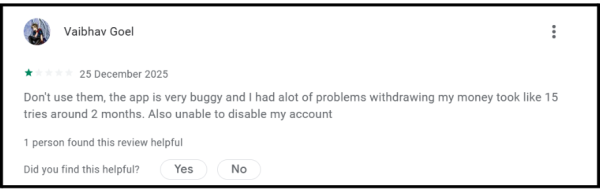

Vaibhav‘s money was essentially held hostage for two months, and repeated withdrawal attempts kept failing.

Amarendu couldn’t redeem his mutual fund investments despite multiple attempts; money goes in easily, but coming out seems impossible.

Multiple users facing withdrawal issues suggest systematic problems, not isolated incidents.

Taking months to access your own funds is unacceptable for any financial service, and the lack of communication makes it worse.

5. Account Management Issues

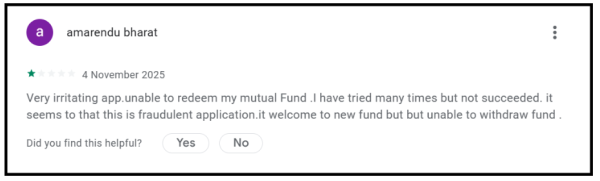

Basic account operations like login, verification, and account activation face persistent problems. Users complete onboarding but still can’t access their accounts.

R J went through the entire account opening process successfully, only to find that the account credentials didn’t work, a complete time waste.

Even after completing the entire onboarding process, users can’t access their accounts.

This points to serious backend system failures and poor integration between registration and account activation systems.

6. Misleading Marketing

The actual service experience doesn’t match what’s advertised. Promises made in marketing materials don’t reflect ground reality.

Vijay‘s brief but pointed complaint suggests the company’s marketing promises don’t match actual service delivery.

When customers feel misled, it indicates the company is overselling capabilities it doesn’t actually deliver.

Making investment decisions based on false promises leads to disappointment and potential financial losses.

How To File a Complaint Against Stock Broker?

Are you experiencing similar problems with Aditya Birla Money or any other SEBI-registered broker?

You are not alone.

Multiple investors have reported excessive charges, withdrawal difficulties, technical failures, and poor customer service with Aditya Birla Money.

These aren’t isolated incidents; they’re part of a disturbing pattern that’s been ongoing for years.

Our dedicated team specializes in assisting investors like you. We provide end-to-end support to ensure your grievance is documented effectively and reaches the right authorities who can actually make a difference.

Our Step-by-Step Support Process

- Initial Consultation & Case Assessment

We arrange a confidential call with a dedicated Case Manager who understands broker-related complaints inside out.

Whether it’s hidden brokerage charges, withdrawal blockages, incorrect account information, or technical failures causing losses, we’ve seen it all.

- Professional Case Documentation

We help you draft a structured, legally coherent complaint letter that regulators take seriously.

It clearly outlines the misconduct, quantifies your financial loss, identifies specific regulatory breaches, and presents evidence systematically.

- Direct Engagement & Escalation

- Reaching the Broker: We guide you in formally communicating your complaint to Aditya Birla Money’s grievance redressal cell with proper documentation and timelines.

- Lodge a complaint in SCORES: We provide detailed, step-by-step guidance on filing through the SEBI Complaints Redressal System (SCORES) portal. We help you track status updates and respond appropriately to SEBI queries or broker responses.

- File a complaint in Smart ODR: For eligible disputes under specific monetary limits, we guide you through SEBI’s Smart ODR (Online Dispute Resolution) platform, which can resolve cases faster than traditional channels.

- Advisory & Strategic Counselling

Our experts provide realistic counsel on expected outcomes, potential recovery amounts, and typical timelines in the regulatory process.

- Guidance on Advanced Recourse

If initial regulatory action doesn’t deliver satisfactory results, we guide you on escalating further:

- Pursuing Arbitration: If your broker agreement includes an arbitration clause, we can connect you with experts who handle arbitration in stock market cases and can provide guidance throughout the process.

- Stock Exchange Complaints: We help you file parallel complaints with BSE or NSE investor grievance cells, adding another layer of regulatory pressure on the broker.

- Consumer Forum: For quantifiable financial losses, we guide you on approaching consumer forums for compensation claims, where you can seek damages beyond just refunds.

- Legal Action: In severe cases involving fraud or significant losses, we can connect you with securities law practitioners who can advise on civil or criminal proceedings.

Your money matters. Your complaint matters.

By taking action, you’re not just seeking personal accountability; you’re contributing to a cleaner, more transparent financial market.

The longer you wait, the harder recovery becomes. Regulatory complaints have better outcomes when filed promptly with fresh evidence.

Ready to take action?

Register with us today, and let’s fight for your rights together.

Conclusion

While Aditya Birla Money operates under a reputable corporate umbrella and holds proper SEBI registration, user experiences paint a deeply troubling picture.

The combination of high and unclear brokerage charges, terrible customer service, buggy applications, and, most concerningly, severe withdrawal difficulties creates a pattern that’s hard to ignore.

When multiple investors across several years report similar problems, it suggests systemic issues rather than isolated incidents.

The gap between the Aditya Birla brand name’s reputation and actual service delivery is significant and disappointing.

For potential investors, these reviews serve as serious warning signs. If you’re already invested with them, document all interactions meticulously and keep records of every transaction and complaint.