Imagine you invested Rs. 88,500 in premium stock tips from an advisor. The advisor promises 6 months of personalised guidance.

You’re excited because finally, someone with experience will help you make money in the stock market.

But after three months, the service abruptly stops, calls go unanswered, and emails get no response. You have no documented proof of what was promised, and there’s no official grievance mechanism to complain through.

This isn’t a hypothetical scenario. This actually happened to investors of Amit Guruh Sachdeva’s Stock Benefits Financial Services in Lucknow.

When a regulatory agency decided to investigate how he ran his business, they discovered something alarming: the system wasn’t broken by accident, but it was designed that way.

Records weren’t missing, but they were never kept. Website disclosures weren’t incomplete, but they were deliberately hidden.

The question isn’t whether rules were broken. The question is how long this was allowed to continue. In this blog, we will disclose the truth behind Amit Guruh Sachdeva.

Who is Amit Guruh Sachdeva?

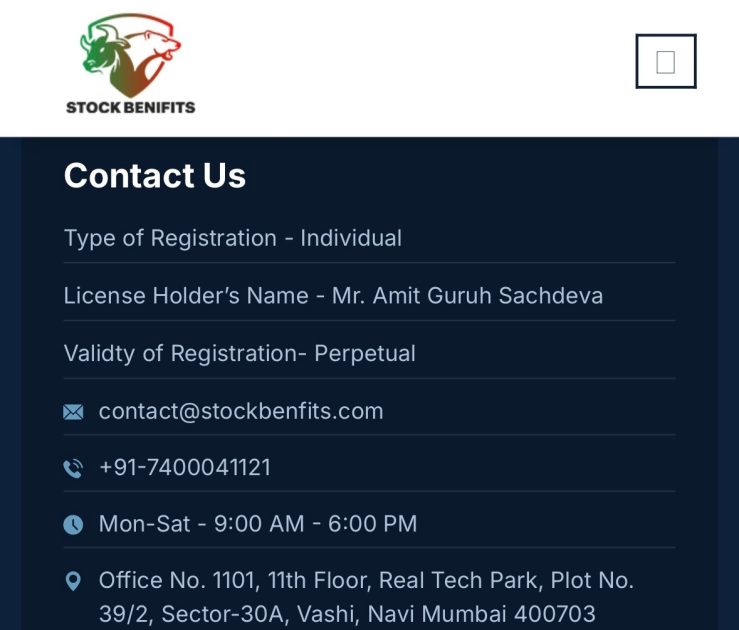

Amit Guruh Sachdeva runs Stock Benefits Financial Services from Lucknow. He has 17 years of experience in helping people with stock market tips. His website looks pretty professional.

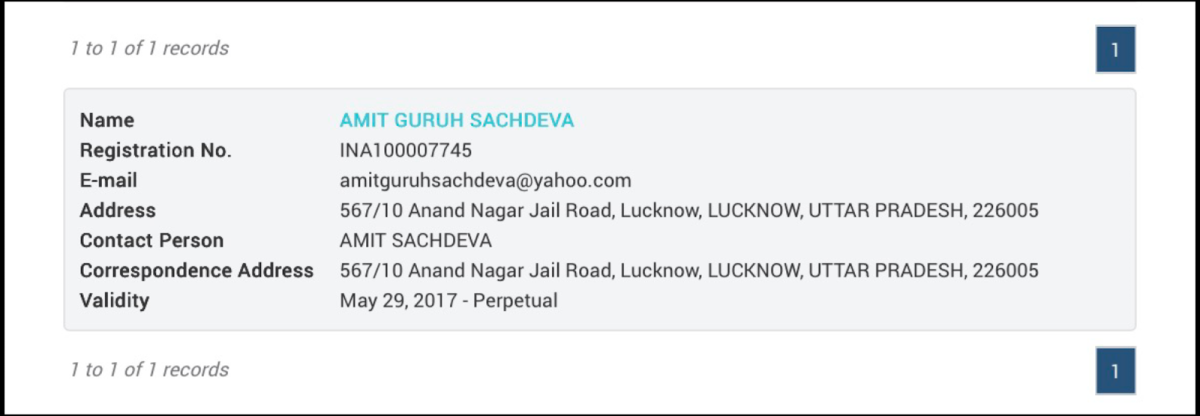

He is a SEBI-registered Research Analyst with registration number that is, INH100005190. Sounds good so far, right?

But here’s what makes you wonder. He also has another SEBI registration as an investment adviser (INA100007745). So he’s doing two types of financial advice from the same place.

During the time regulators checked him, he only had TWO corporate clients for research analyst services. Just two!

But his website?

It’s talking about stock tips, F&O trading, and commodity advice. Makes you curious what he’s really focusing on, doesn’t it?

He claims to be an expert in Bank Nifty predictions and derivative trading. Investors pay big money, like Rs 1.5 lakh for annual packages.

Everything looks smooth. But when someone pays that much, you expect everything to be perfect, right? What if the basic paperwork that protects you isn’t even there?

Think about it. You give someone lakhs of rupees for stock advice. They promise daily tips and analysis. But if something goes wrong, can they even show what they told you?

Or is there a proper way to complain?

This is where things get interesting with Sachdeva. Regulators found some real gaps when they looked closer. Gaps that make you question if that shiny SEBI registration really means what you think it does.

Keep reading, as you won’t believe what they discovered.

Amit Guruh Sachdeva User Reviews

When you start looking at public feedback about Amit Guruh Sachdeva and his advisory services, a clear pattern begins to appear.

Across different platforms, many users say the service did not match what was promised and that they ended up losing money instead of gaining from the “expert” calls.

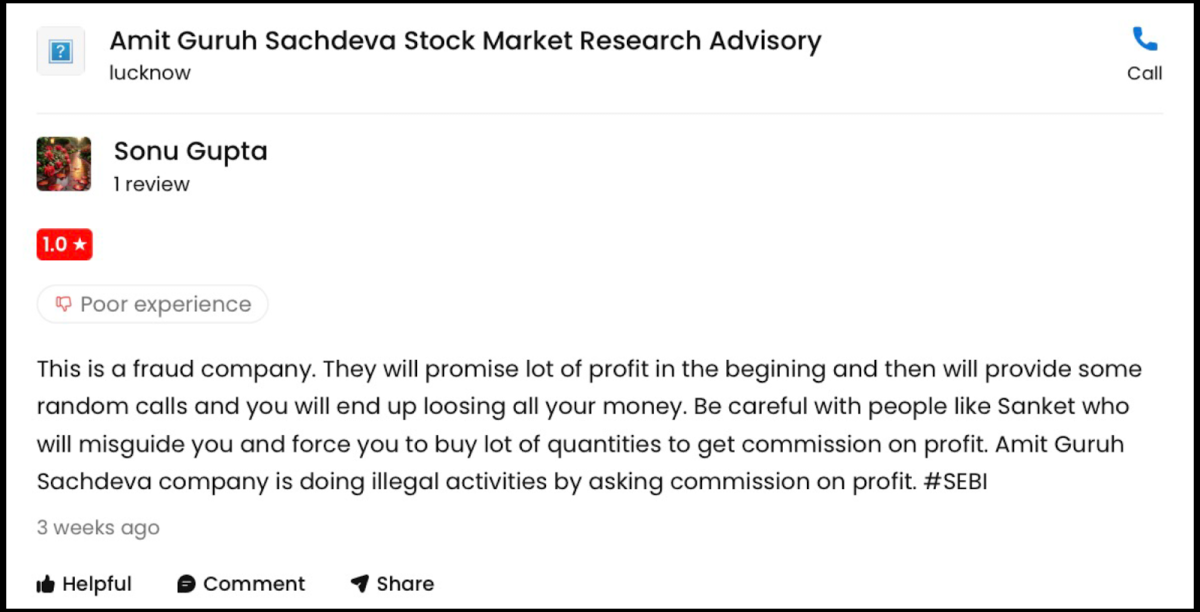

On JustDial, users have given very low ratings and describe the firm as highly disappointing.

One reviewer says the company first builds big expectations of high profits, then sends random trading calls that don’t seem backed by solid research.

According to them, this leaves investors with losses and a feeling that their trust was misused.

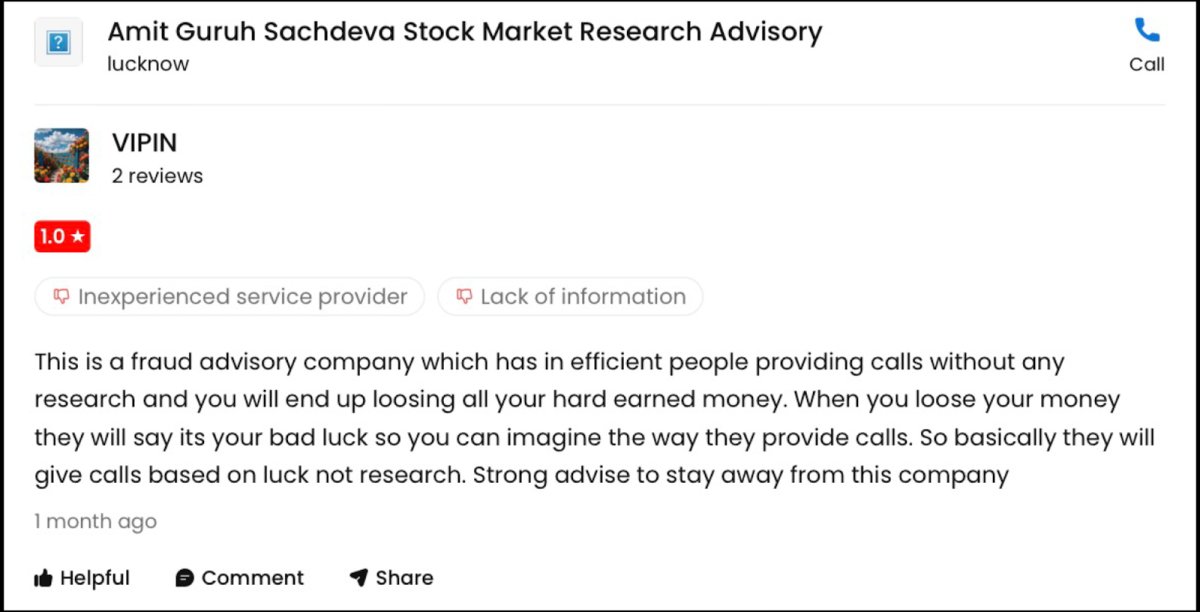

Another JustDial review mentions that the advisory team appears inexperienced and unprofessional.

The reviewer alleges that the calls look more like guesswork than researched recommendations and warns that following these tips can wipe out hard-earned savings.

They also highlight that when trades go wrong, the blame is shifted back onto the client instead of the service taking responsibility.

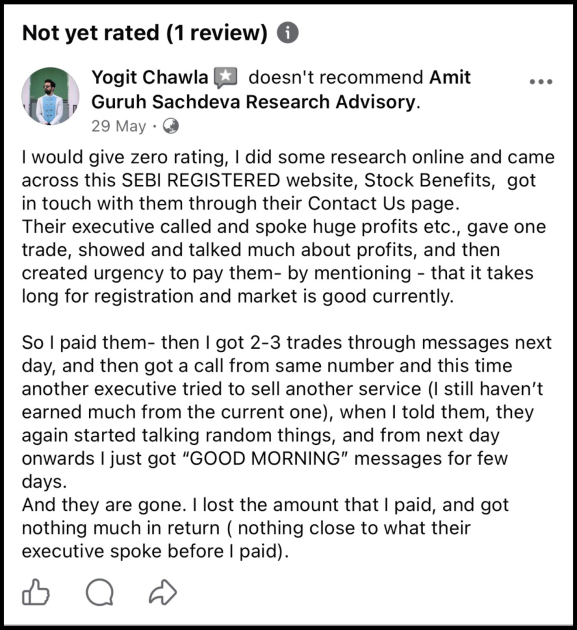

On Facebook, a user who contacted the firm after seeing it marketed as a SEBI-registered website explains that the pitch started with very high profit claims and urgency to pay quickly.

After paying, they say they received only a few trades, followed by repeated attempts to upsell new plans rather than focusing on existing services.

Eventually, according to the review, the communication dropped to just generic “good morning” messages and then stopped, while the money paid was never recovered.

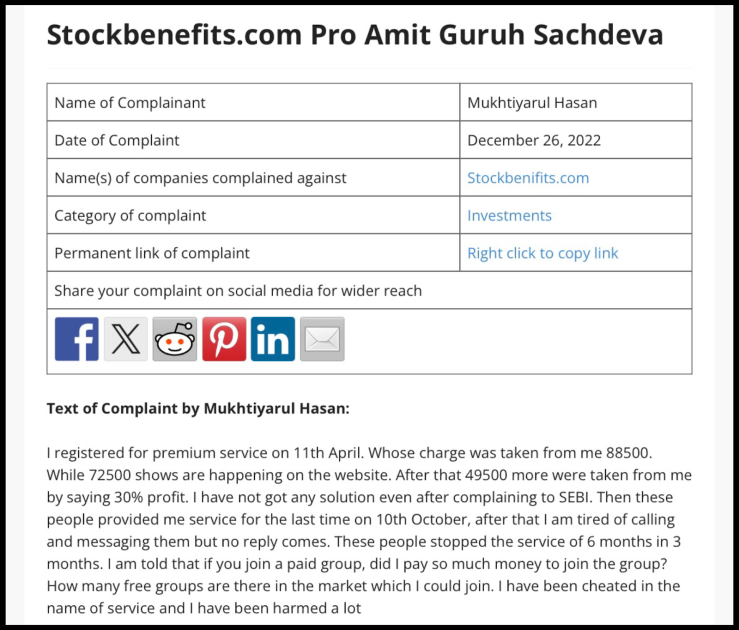

The complaints posted on ConsumerComplaints platforms tell a similar story. One user explains that they signed up for a premium package for several months, paying a large amount upfront, but the service allegedly stopped midway without any proper closure or refund.

Despite trying to reach the team through calls and messages, they say there was no meaningful response, and they felt completely cheated after also trying to complain at the regulator level.

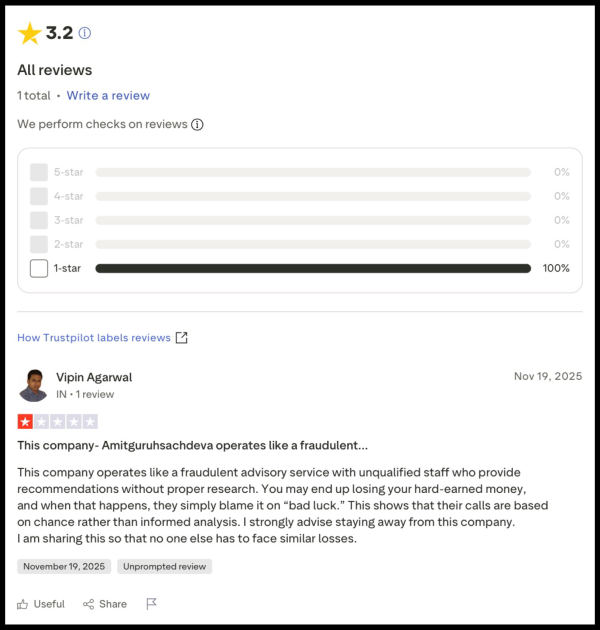

On Trustpilot, a reviewer also characterises the set-up as operating like a fraudulent advisory model.

They mention that recommendations appear poorly researched, that investors can quickly lose money, and that the company refuses to accept responsibility when trades fail.

Their message is clear: they are sharing their experience so that other small investors don’t repeat the same mistake of trusting glossy promises over transparent processes.

Amit Guruh Sachdeva Complaints

Complaints about Amit Guruh Sachdeva act as a reality check for investors who only saw the polished marketing side.

In this section, SEBI orders, violations, and user reviews reveal what actually went wrong.

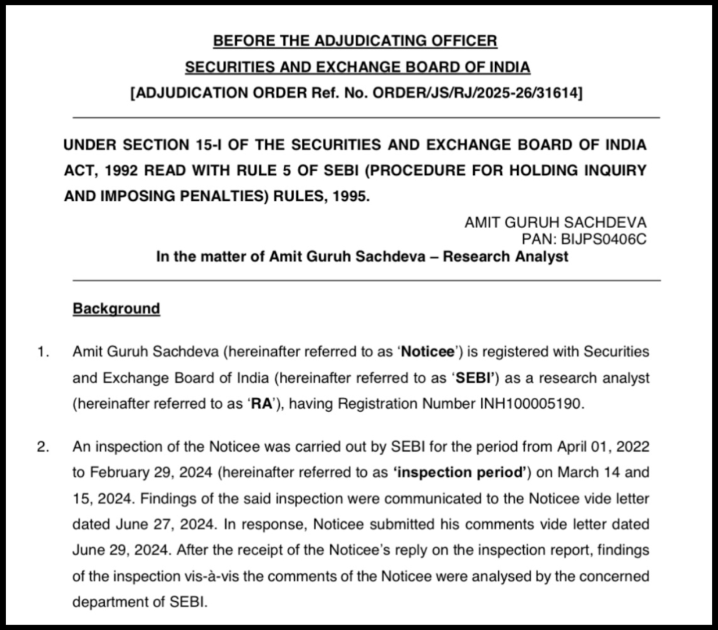

Amit Guruh Sachdeva SEBI Orders

SEBI passed this order after inspecting how Amit Guruh Sachdeva was running his research and advisory activities. During an inspection of his work between April 2022 and February 2024, SEBI found that he was not keeping basic mandatory records, like:

- signed research reports

- recommendations he gave

- reasons behind the calls

- proper client details

SEBI also noted that while he claimed he had no website as a research analyst, he was in fact using his “Stock Benefits Financial Services” website to project himself as a research analyst and offer advisory services.

He did not show clients their rights, did not give a link to SEBI’s SCORES complaint portal, did not display grievance redressal details at his office, and did not prove that he was sharing the required Investor Charter with clients.

Imagine being betrayed by your advisor and then being stuck because there’s no grievance cell or complaint portal available. That’s exactly the risk these violations created for investors.

SEBI concluded that he violated several provisions of the Research Analysts Regulations, the Code of Conduct, and SEBI’s 2021 circular on Investor Charter and complaint disclosure.

What SEBI Did?

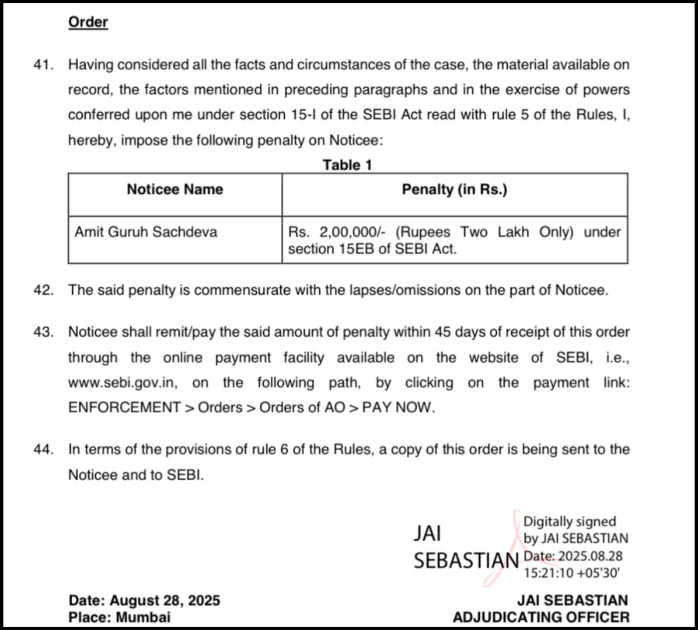

Because of these lapses, SEBI decided to impose a monetary penalty under Section 15EB of the SEBI Act. The Adjudicating Officer, Jai Sebastian, fixed the penalty at Rs. 2,00,000 (two lakh rupees).

It mentioned clearly that although there was no clear data on investor loss or unfair gain, the violations were serious and directly related to investor protection.

Sachdeva has been directed to pay this amount within 45 days through SEBI’s online penalty payment system.

Why Does This Matter?

This order matters because it shows that just having an SEBI registration number is not enough. Research analysts must also follow the rules that protect investors.

It highlights how important proper records, clear disclosures, and easy complaint options are for anyone taking paid stock advice.

For common investors, it is a reminder to always check whether an adviser is transparent about rights, grievance channels, and SEBI’s SCORES link, not just about returns and “expertise.”

Major Violations Done By Amit Guruh Sachdeva

SEBI didn’t just issue a penalty; they documented clear violations that Sachdeva couldn’t explain away. Here’s exactly what went wrong with his research analyst operations.

1. Failure to Maintain Proper Records

The most serious violation was Sachdeva’s failure to maintain proper records. SEBI regulations require research analysts to keep detailed documentation of every recommendation they make.

Specifically, Sachdeva failed to maintain:

- Research reports that were properly signed and dated

- Research recommendations provided to clients

- The rationale explaining how he arrived at his recommendations

- A proper client master list for his RA clients

When inspectors asked him to produce these records during the inspection, what did he provide?

Just a screenshot of an email mailbox with a single chart. This wasn’t proper documentation, but it was a desperate attempt to create the illusion of records.

2. The Website Deception

Here’s where Sachdeva’s violation becomes particularly troubling. He claimed he had no website and therefore couldn’t comply with certain disclosure requirements.

But SEBI found his website stockbenifits.com prominently displaying his research analyst registration number.

Not only that, the website’s user agreement specifically mentioned: “Amit Guruh Sachdeva (Proprietor STOCK BENEFITS FINANCIAL SERVICES) SEBI Registered Research Analyst No. INH100005190”.

The site repeatedly promoted “Research Advisory Services” and positioned him as a “leading Research Analyst.” This directly contradicted his claim that the website was exclusively for investment advisory services.

SEBI concluded this was deliberate deception designed to market his RA services.

3. Hiding the Investor Charter

SEBI’s December 13, 2021, circular mandates that all research analysts must provide an “Investor Charter” to clients. This document outlines your rights as an investor and the protection measures available to you.

Sachdeva claimed he provided this through client agreements, but SEBI found:

- He never displayed the charter on his website

- No evidence showed that he sent it via email to corporate clients

- He didn’t provide a link to SEBI SCORES (the official investor grievance platform)

- At his registered office, he failed to display the grievance redressal mechanism details

When asked about missing display boards, Sachdeva blamed office renovations. But inspectors found no evidence of renovations.

This was another example of prioritising convenience over investor protection.

4. Not Providing SEBI SCORES Access

Research analysts must give investors a direct link to SEBI’s SCORES system. It is the platform where complaints can be lodged against them.

Sachdeva admitted he didn’t provide this crucial link to his two corporate clients. For investors, this meant they had no easy way to escalate complaints to the regulator if something went wrong.

How To File a Complaint Against Research Analyst?

If you encounter problems with Amit Guruh Sachdeva or any other research analyst, follow these straightforward steps to seek a resolution.

Step 1: Register Your Complaint With Us

Contact us right away and provide all the details of your issue with the research analyst. We take care of documenting your case thoroughly and accurately from the start.

Step 2: Consult Our Case Manager

We set up a dedicated call with one of our experienced case managers. They review your unique circumstances, assess the strength of your complaint, and walk you through the full path to resolution.

Step 3: Draft a Strong Complaint

Our experts assist in preparing a detailed and well-structured complaint letter. Every key fact, evidence, and supporting document gets included to make your case compelling.

Step 4: Engage the Research Analyst

We support you in reaching out to the research analyst directly. This ensures clear communication and opens the door for an amicable solution.

Step 5: Submit via SEBI SCORES

We provide hands-on guidance for filing on the SEBI SCORES platform. All details are verified for accuracy, with proper attachments and submission protocols followed.

Step 6: File a complaint in SMART ODR

Should SCORES not yield results, we step in for SMART ODR support. This includes helping you sign up on the ODR portal, gathering required documents, aiding in conciliation sessions, and advocating strongly on your behalf.

Step 7: Navigate Arbitration if Needed

For cases requiring arbitration in stock market, we offer complete support. This covers preparing the application, assembling solid evidence, and accompanying you through every phase until closure.

To date, we have represented victims in more than 300 arbitrations and helped them to get recovery for their losses.

So, if you are facing issues with any registered entity, then register with us without any further delay.

Conclusion

The case of Amit Guruh Sachdeva teaches an important lesson: being registered with SEBI doesn’t guarantee trustworthiness.

When SEBI imposed a Rs. 2 lakh penalty in August 2025, it wasn’t just about enforcing rules but about protecting investors like you.

Sachdeva’s violations reveal a pattern of cutting corners. No proper records, hidden website operations, missing disclosure documents, and ignored investor links to the regulator.

These aren’t small administrative oversights. They’re systematic failures that prevent you from verifying what was recommended, what was promised, and what went wrong.

Before trusting anyone with your money, verify their SEBI registration, search for public complaints, confirm they’ve sent the Investor Charter, and ensure they provide access to SEBI SCORES.

Regulatory actions like this one show the system is working, but the responsibility to choose wisely remains yours. Don’t let the next cautionary tale be yours.