Choosing the right trading advisory service can make or break your investment journey.

BlackAce Research has caught the attention of Indian traders, but what’s the real story of the marketing promises? The promises made behind the back.

Let’s take a closer look at what actual users are experiencing.

BlackAce Research Review

BlackAce Research positions itself as a premium trading advisory service offering index options recommendations.

According to their website, they provide a “High Risk, High Reward investment product” designed for bold investors seeking substantial returns through daily index option calls.

The service markets itself to ambitious traders looking for dynamic strategies. But here’s the critical question: does the reality match the marketing?

Let’s have a look at their operations.

BlackAce Research works through:

- Private Telegram channels for delivering trade recommendations

- Subscription-based model with fees ranging from ₹60,000 to ₹1,77,000

- Index options focus, specifically Nifty 50 and Bank Nifty

- Daily call frequency with 1-2 recommendations per day

Their business model promises minimal recommendations but maximum impact. But the reality?

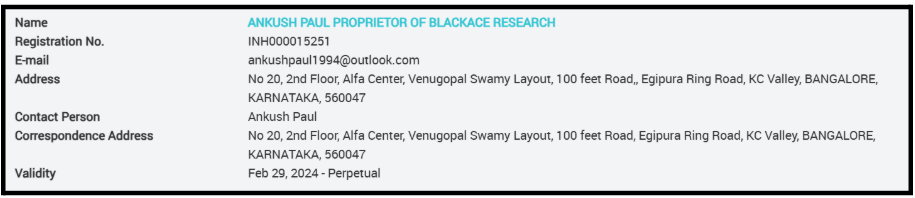

Is BlackAce Research SEBI Registered?

Yes, BlackAce Research is a SEBI-registered Research Analyst.

According to the company’s official disclosure, the firm’s proprietor Ankush Paul is registered with the SEBI as a Research Analyst.

SEBI (Securities and Exchange Board of India) guidelines clearly prohibit unregistered entities from providing trading tips or portfolio management services.

According to their own disclaimer, BlackAce Research doesn’t provide any guaranteed profit or profit-sharing services, and they explicitly state they don’t offer PMS Service or Demat account handling.

However, multiple user complaints suggest they’re operating in a regulatory gray area, providing trading calls while distancing themselves from accountability.

BlackAce Research Complaints

Based on the extensive user reports, the complaint pattern follows a manipulative cycle:

- Initial Deception: After purchasing an expensive subscription, users are directed to a private Telegram channel where unauthorized trading tips are shared.

- False Confidence Building: Manipulative daily calls and initial, small profits are shown to create trust and encourage further investment.

- Inevitable Loss & Extortion: Due to a complete lack of risk management, stop-loss orders, and legitimate analysis, users’ accounts are then wiped out through consecutive bad calls.

The service first recovers its hefty fees from these losses before eroding the user’s entire capital.

- Abandonment & Fraud: Once the capital is lost, no support or accountable service is provided.

Instead, users face excuses, pressure tactics, or are simply ignored, with many realizing they have been victims of outright financial fraud.

However, while there is no official notice or order against them, they do have some SEBI SCORES complaints.

Also, some of the user reviews look alarming

-

Complete Capital Loss and Account Wipeout

Multiple users report that they lost their entire investment capital, not just subscription fees.

This indicates a pattern where the service shows initial profits, followed by devastating losses that completely wipe out trading accounts.

Real User Reviews:

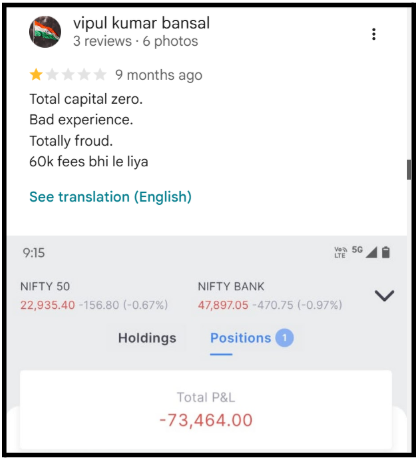

- Vipul Kumar Bansal faced complete capital erosion

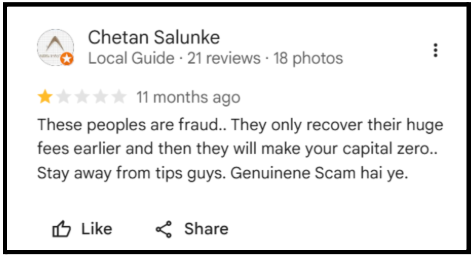

- Chetan Salunke experienced a systematic fraud pattern where fees were recovered first, followed by complete capital loss

Impact on Investors: Users are losing not just subscription amounts but their entire trading capital, with one user showing a total P&L of -₹73,464 in their trading account.

-

No Risk Management, No Stop Loss, No Analysis

Several reviewers highlight that the company follows no proper risk management protocols and provides no meaningful analysis.

Users emphasize that there’s no analytical foundation behind the calls.

Real User Reviews:

- Abhiraj Kaushik’s account was completely destroyed due to absence of stop loss and risk management

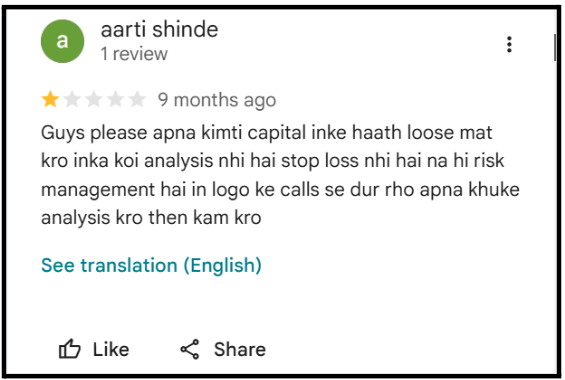

- Aarti Shinde warns that the company has zero analysis, no stop loss, and no risk management whatsoever

Impact on Investors: Without proper stop losses or risk management, traders are exposed to unlimited downside risk.

The absence of analysis means calls are essentially arbitrary, putting investor capital at extreme risk.

-

False Promises, Manipulative Tactics, and Initial Profit Display

Users describe experiencing pressure tactics, false assurances, and a deliberate pattern of showing initial profits to build trust before delivering consistent losses.

Real User Reviews:

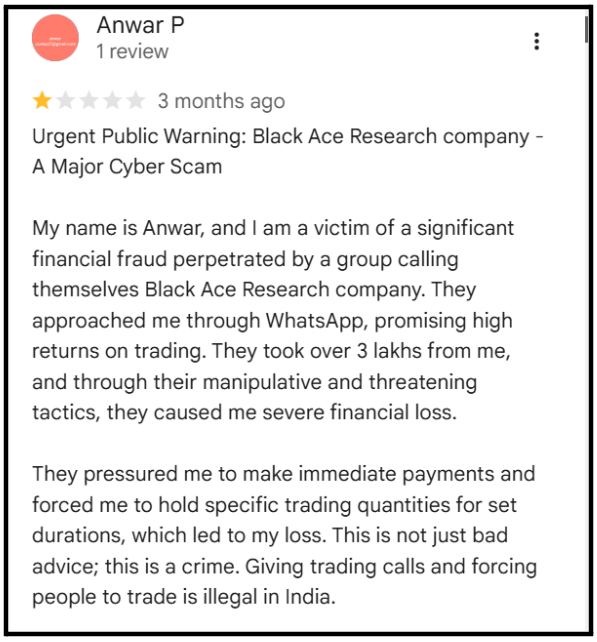

- Anwar P lost over ₹3 lakhs due to manipulative and threatening tactics employed by the company.

Anwar P was illegally forced to hold specific trading quantities for set durations.

Impact on Investors: The pattern suggests initial wins to build trust and encourage larger investments, followed by consistent losses.

Moreover, users report feeling manipulated into holding positions that result in significant financial damage.

-

Expensive Subscriptions with Unauthorized Tips

The subscription fees are substantial, ranging from ₹60,000 to ₹1,77,000, yet users consistently report poor or zero outcomes.

Real User Reviews:

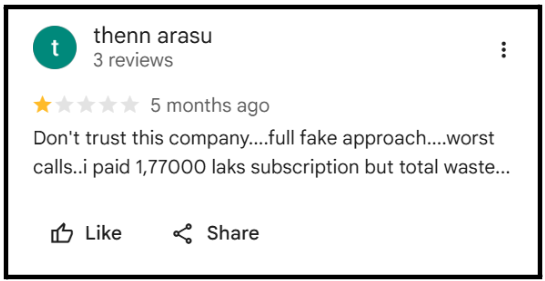

- Thenn Arasu paid the highest subscription fee of ₹1,77,000 and experienced complete waste with fake approach and worst calls

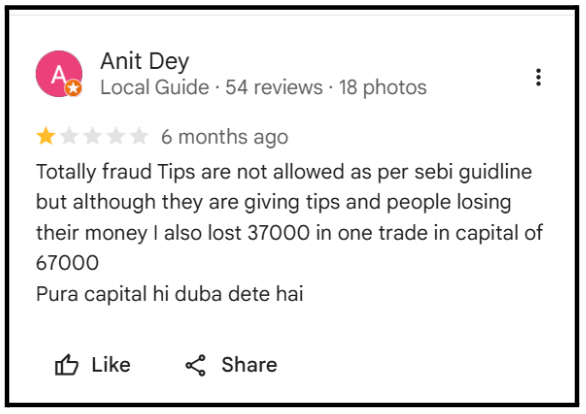

- Anit Dey lost ₹37,000 in a single trade out of ₹67,000 capital, highlighting that they wipe out entire capital despite SEBI guidelines prohibiting unauthorized tips

Impact on Investors: Users who paid premium amounts experienced the same devastating results as others, proving that higher fees don’t equate to better service or protection.

-

Fake Reviews and AI-Driven Positive Feedback

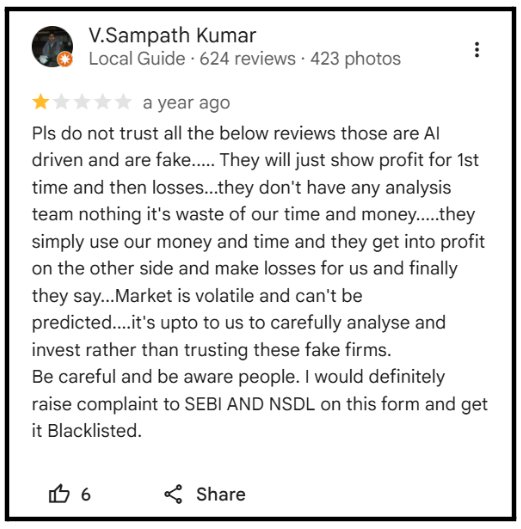

Multiple experienced reviewers warn that positive reviews about BlackAce Research may be artificially generated. V. Sampath Kumar, a Local Guide with 624 reviews, explicitly cautions about this deceptive practice.

Real User Review:

- V. Sampath Kumar, an experienced Local Guide, specifically warns that positive reviews are AI-driven fakes designed to mislead potential investors

Impact on Investors: Notably, fake positive reviews mislead potential clients into trusting the service, making it harder to identify genuine experiences.

What Can You Do in Such Cases?

Are you facing concerns with BlackAce Research or any other SEBI-registered Research Analyst?

You are not alone.

Several investors across the market report issues.

Issues like misleading performance claims, unclear risk disclosures, unsatisfactory advisory services, refund disputes, or service commitments not being met.

Even when an entity is SEBI-registered, grievances can still arise.

Our dedicated team assists investors in documenting, escalating, and pursuing their grievances through proper regulatory channels.

We provide end-to-end support to ensure your complaint is structured correctly and reaches the appropriate authorities.

- Initial Consultation & Case Assessment

We arrange a confidential call with a dedicated Case Manager.

Whether it’s misleading performance claims, inadequate risk disclosures, service delivery failures, or refund-related disputes, we understand the nuances of complaints.

2. Professional Case Documentation

We help you draft a structured, legally coherent complaint letter.

It clearly outlines the grievance, service-related impact, and the provisions under the SEBI (Research Analysts) Regulations, 2014 that may have been violated.

3. Direct Engagement & Escalation

Reaching the Research Analyst:

We guide you in formally communicating your complaint to BlackAce Research’s grievance redressal mechanism, as required before regulatory escalation.

Lodge Complaint in SCORES

We provide detailed guidance on filing your complaint through the SEBI SCORES portal. We help track the status and assist in responding to queries raised by SEBI.

File a Complaint in SMART ODR:

For eligible disputes, we guide you through SEBI’s SMART ODR (Online Dispute Resolution) platform, explaining the process and documentation involved.

- Advisory & Strategic Counselling

Our experts counsel you on realistic outcomes, possible recovery avenues, and expected timelines within the regulatory framework. - Guidance on Advanced Recourse

If the initial regulatory action is unsatisfactory, we guide you on the next steps:

Arbitration in Stock Market

If your agreement includes an arbitration clause, we connect you with legal experts specializing in securities and financial disputes.

Your money matters. Your complaint matters.

By taking this step, you’re not just seeking resolution, you’re contributing to a more transparent and accountable financial ecosystem.

Ready to take action? Register with us today and let’s fight for your rights.

Conclusion

BlackAce Research presents itself as a premium trading service for bold investors, but user experiences reveal a deeply troubling pattern.

From complete capital erosion and absence of basic risk management to manipulative pressure tactics and forced trading, the complaints are consistent, serious, and span multiple months.

The absence of clear SEBI registration details, combined with users filing cybercrime complaints and warnings about AI-generated positive reviews, raises significant red flags.

Remember, legitimate investment advisors are transparent about their regulatory status, employ strict risk management, never force trades, and don’t systematically produce the kind of universal negative outcomes documented here.

When in doubt, verify credentials, check SEBI registration status, and listen carefully to those who’ve already experienced what happens after the subscription is paid.