It happens to the best of us. You’re looking for a way to grow your hard-earned money, and suddenly you’re bombarded with calls promising “sure-shot” profits and “guaranteed” returns.

If you’ve been following the news lately, you might have come across a surge in Eqwires research analyst complaints from investors who feel they were led down the wrong path.

It’s a frustrating and often scary situation to be in, especially when you realize that the person you trusted with your financial future might not have been playing by the rules.

Eqwires Research Analyst Review

Before we dive into the mess, let’s keep it simple. Eqwires research analyst is a firm that is technically registered with SEBI (the stock market regulator in India) to provide research and stock recommendations.

However, there is a big difference between a “Research Analyst” and an “Investment Adviser.”

Think of a research analyst like a weather reporter, they can tell you it might rain, but they shouldn’t be driving your car for you.

Many people who have filed Eqwires research grievances say the firm crossed that line, acting more like advisors who promised specific profits rather than just providing data-backed reports.

Eqwires Research Analyst User Complaints

The seriousness of this isn’t just “unhappy customers.” Investors have reported some truly heartbreaking stories.

The most common complaint is the “guaranteed profit” trap.

For example, one client shared how they were promised a huge profit within a few months, only to see their capital drop by 80%.

When they asked for a refund, they were met with silence or told to “just wait a few more days.”

This pattern of high-pressure sales and broken promises is exactly why Eqwires complaints have been flooding the internet.

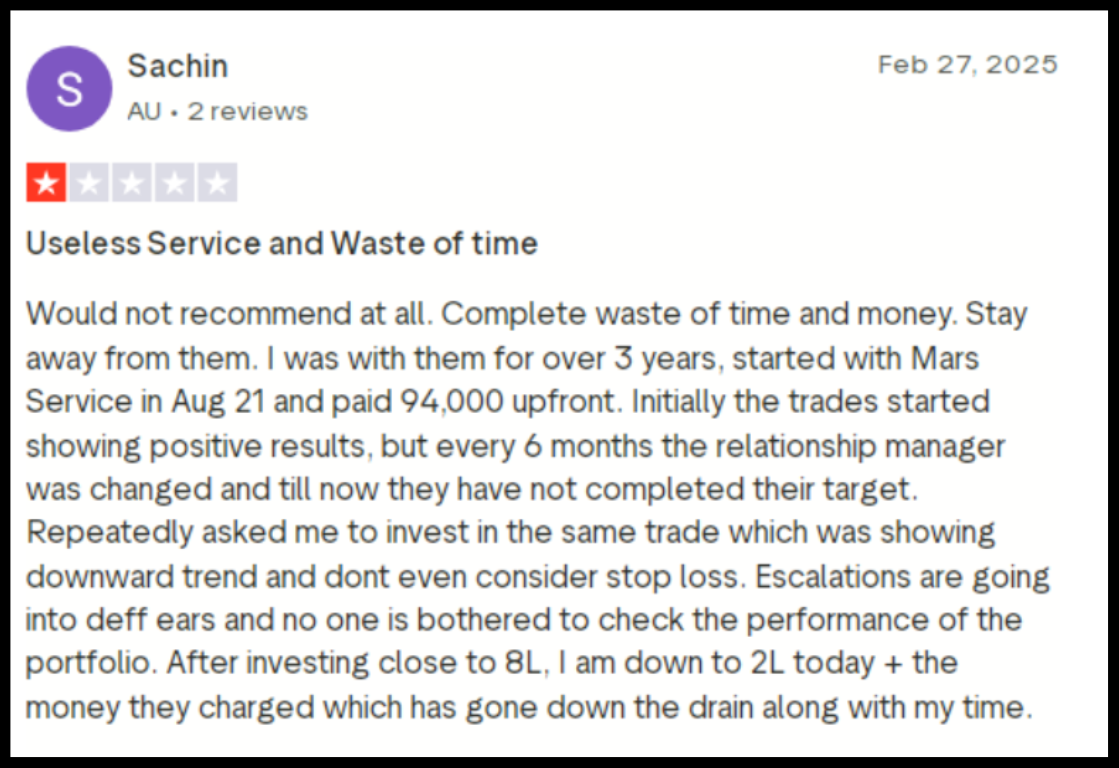

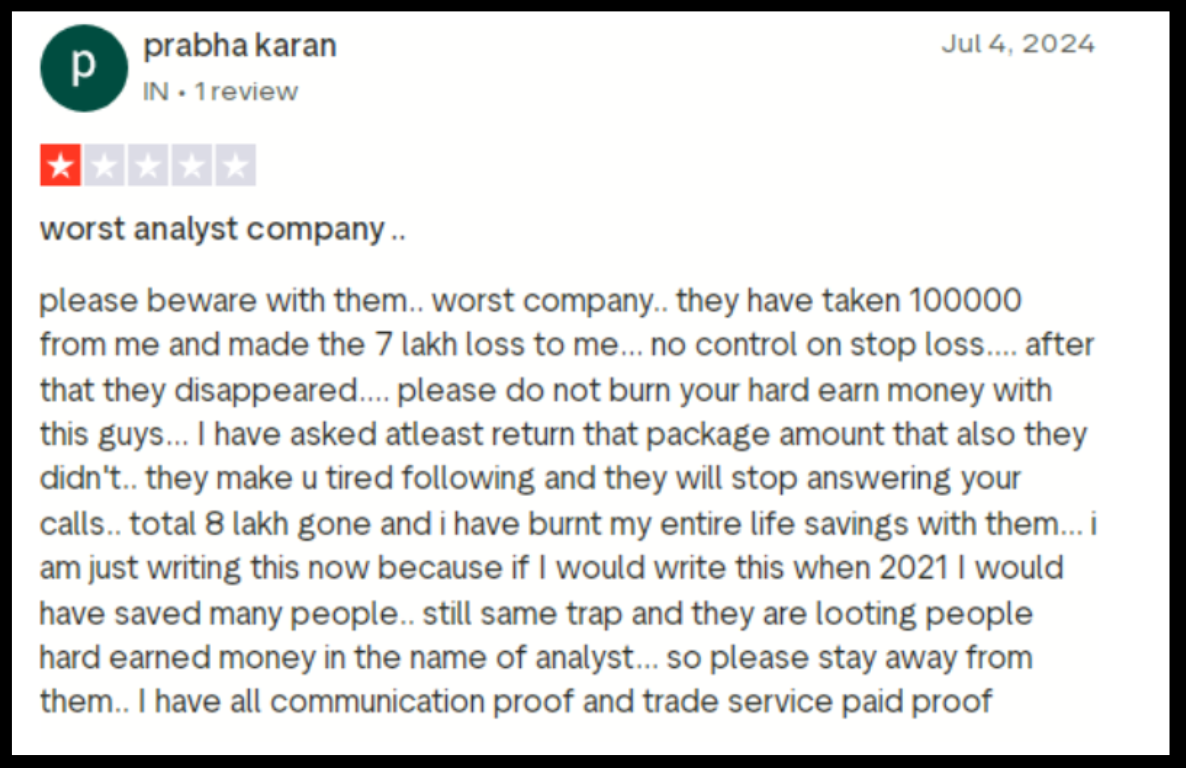

If you’re wondering if these are just a few isolated “unhappy” people, a quick look at public forums tells a very different story.

Platforms like Trustpilot are filled with stories of investors who say they were promised “sure-shot” profits only to watch their savings disappear.

Take, for example, this review from a user who felt they were lured into a trap:

One of the most common Eqwires research analyst reviews involves a pattern where a client is told they don’t need any knowledge of the market, the firm will “handle” everything.

This is a massive red flag.

Real research analysts are legally barred from managing your money; they can only give you the research to make your own choices.

Another common complaint involved “trading assistance.”

One specific case that caught SEBI’s attention was from a client named Mrs. Roy.

She was allegedly told that because she didn’t have time to trade, the firm would provide an “add-on service” where they would execute the trades for her using her own login credentials.

Eqwires Research Analyst: SEBI Findings

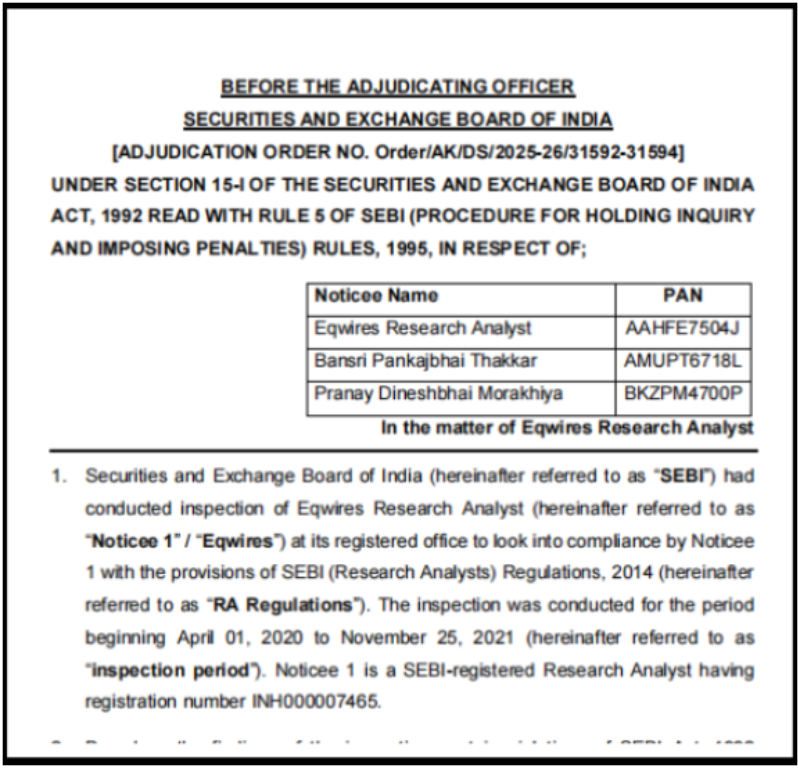

The Securities and Exchange Board of India (SEBI) stepped in with a formal Adjudication Order in August 2025 that confirmed the worst fears of many investors.

The Hard Facts: What were the Allegations?

SEBI’s investigation into Eqwires research analyst revealed several major violations:

- Operating as an Unlicensed Advisor: Despite being registered only as Research Analysts, they allegedly promoted themselves as “Investment Advisers” across their website and Telegram channels.

- Unauthorized Account Access: They were caught managing client trading accounts directly, a “service” that is strictly forbidden for research analysts.

- Fabricated Testimonials: SEBI found that Eqwires used paid marketing agents to create “fake” positive reviews on their website and Quora to trick new investors into trusting them.

The Verdict: The Penalty and Bans

In a decisive move to protect investors, SEBI handed down a heavy verdict:

- Financial Penalty: A total fine of ₹6,00,000 was slapped on the firm and its partners (Bansri Thakkar and Pranay Morakhiya) for regulatory violations and fraudulent practices.

- Market Bans: Earlier, the firm’s own Compliance Officer, Priyank Shah, was banned from the securities market for 2 years for his role in running illegal advisory schemes.

- Refund Orders: In related cases, the masterminds were ordered to refund lakhs of rupees to the affected clients.

This order proves that Eqwires research analyst fake testimonials and unauthorized services weren’t just mistakes; they were a pattern of behavior.

For you as an investor, this order is your strongest tool. If you have lost money to this firm, this regulatory verdict is the “smoking gun” you need to prove they were not following the law.

How to File a Complaint Against Eqwires Research Analyst?

If you’re reading this and looking at the evidence above, thinking, “That looks exactly like what happened to me,” please know that you don’t have to fight this battle alone.

Register with us, we, the FraudFree team, provide professional assistance to help victims navigate the legal recovery process.

We know how overwhelming it is to deal with legal jargon and government portals, so we make it smooth for you. Our step-by-step recovery process includes:

- Direct Complaint to the Research Analyst: We begin by drafting a detailed formal complaint to the Research Analyst. This often opens the door for a settlement before things even escalate.

- Lodge a Complaint in SCORES: If they don’t resolve the issue, our team files a formal grievance on the SEBI SCORES portal, ensuring all technical evidence is presented perfectly.

- File a Complaint in Smart ODR: We guide you through the Online Dispute Resolution platform for counseling and meetings between you and the broker to reach a mediated solution.

- Arbitration in Stock Market: If no settlement is reached, we support you in filing an Arbitration case in the SEBI-appointed court. This process results in a full and final legal decision regarding your refund.

Conclusion

Losing money to misleading promises is more than just a financial hit; it’s a breach of trust.

Whether you are dealing with Eqwires research analyst complaints or just trying to figure out if your advisor is legitimate, the most important thing is to act quickly and use the right legal channels.

You have rights as an investor, and there are systems in place to hold these firms accountable.