When it comes to choosing a financial services provider, trust is everything. But what happens when one of India’s prominent financial institutions, Motilal Oswal, repeatedly faces regulatory action?

Let’s dive deep into the details of Motilal Oswal complaints through multiple SEBI orders and uncover what it means for investors.

Motilal Oswal Review

Motilal Oswal Financial Services Limited (MOFSL) is one of India’s leading financial services companies. Founded in 1987 by Motilal Oswal and Raamdeo Agrawal, Headquartered in Mumbai.

The company started as a small sub-broking firm. Today, it’s a diversified financial services group.

What Services Do They Offer?

- Broking Services

- Wealth Management

- Asset Management

- Investment Banking

Their Business Model:

Motilal Oswal operates through multiple subsidiaries. Each handles a specific segment.

Key Subsidiaries:

Motilal Oswal Securities Limited (broking). Motilal Oswal Asset Management Company (mutual funds). Motilal Oswal Commodities Broker (commodity trading). Motilal Oswal Trustee Company (trusteeship services).

They earn through brokerage commissions. Distribution fees. Portfolio management fees. Advisory charges.

Motilal Oswal Complaint Types

Motilal Oswal faces complaints across three major categories:

- Type IV: Unauthorised Trading

-

- IV a – Unauthorized trades in the client account complaint

- IV b – Misappropriation of client’s funds/securities

-

Type V: Service Related Issues

-

V(a) Brokerage Churning

-

V(b) Non-Execution of Order

-

V(c) Wrong Execution of Order

-

V(d) Connectivity / System-Related Problems

-

V(e) Non-Receipt of Corporate Benefits

-

V(f) Other Service-Related Defaults

-

- Type IX: Others

-

- Account opening delays or rejections

- Documentation and KYC-related problems

- Margin calculation errors

- Annual maintenance charges disputes

- Account closure problems

- Transfer of securities issues

- DP charges disputes

Motilal Oswal Complaint Statistics & Analysis

Here are the stats of complaints registered against Motilal Oswal in the last 5 years

| Metric | 2025-26 | 2024-25 | 2023-24 | 2022-23 | 2021-22 |

| Total Active Clients | 923329 | 928,070 | 879629 | 879629 | 896851 |

| Total Complaints Received | 593 | 529 | 498 | 516 | 445 |

| Complaint Rate (%) | 0.064 | 0.057 | 0.05 | 0.05 | 0.04 |

| Resolution Rate | 90.56 | 90.93% | 100% | 99.61% | 100% |

| No. of arbitrations | 0 | 11 | 9 | 19 | 12 |

If we start with Total Active Clients, one thing becomes immediately clear: Motilal Oswal has managed to consistently serve close to 9 lakh clients over the past five years.

In 2021–22, the firm had 8.96 lakh active clients. There was a slight dip in 2022–23 and 2023–24, where the number hovered around 8.79 lakh, a period that coincided with market volatility and cautious retail participation across the industry.

What’s encouraging is the rebound. In 2024–25, the client base rose sharply to 9.28 lakh, and even in 2025–26, it stayed strong at 9.23 lakh.

This indicates that Motilal Oswal hasn’t just focused on acquiring new customers; it has successfully retained its existing ones, which is often a stronger sign of trust than rapid but unstable growth.

At first glance, the total number of complaints seems to be increasing: from 445 in 2021–22 to 593 in 2025–26. But here’s where context matters. When you are serving over 9 lakh clients, a rise in complaints does not automatically mean worsening service.

Another complaint by SEBI’s Adjudicating Officer Amit Kapoor issued the final order on June 09, 2025 is a penalty of ₹3,00,000 (Rupees Three Lakhs only)

- Complaint Rate

Instead, it often reflects higher platform usage, greater awareness of grievance mechanisms, and increased digital transactions.

Despite handling hundreds of complaints each year, the complaint rate has remained exceptionally low, moving from 0.04% in 2021–22 to 0.064% in 2025–26. In simple terms, fewer than 1 out of every 1,500 clients raises a formal complaint even in the latest year.

Such a low ratio strongly suggests that the vast majority of clients transact without issues, and that Motilal Oswal’s systems are generally functioning smoothly even at scale.

So, customer complaints are at the heart of the matter when we talk about customer centricity and how they are resolved. Motilal Oswal has, for three years in a row, almost perfectly recorded their resolution rate, reaching 100% in 2021-22 as well as in 2023-24, and 99.61% in 2022-23.

- Resolution Rate

How about we move on to the aspect that really gives meaning to customer-centricity, the way in which complaints are handled? Motilal Oswal recorded a near-perfect resolution rate, touching 100% in 2021–22 and 2023–24, and 99.61% in 2022–23.

Although the resolution rate lowered to approximately 90-91% in 2024-25 and 2025-26, it still indicates a robust grievance redressal system, especially considering the increasing client interaction volume and complexity. Instead of overlooking the problems, the company is, according to the data, still dealing with and resolving them.

Over the years, a big improvement has been noticed regarding arbitrations as well. From 12 cases in 2021–22 and a peak of 19 in 2022–23, the number fell to 9 in 2023–24, and finally to 11 in 2024–25.

This is significant. Arbitration usually means disputes that couldn’t be settled internally.

Reaching lower arbitrations shows that Motilal Oswal has likely strengthened its internal grievance handling, customer communication, and dispute resolution frameworks, preventing issues from escalating further.

Motilal Oswal User Reviews

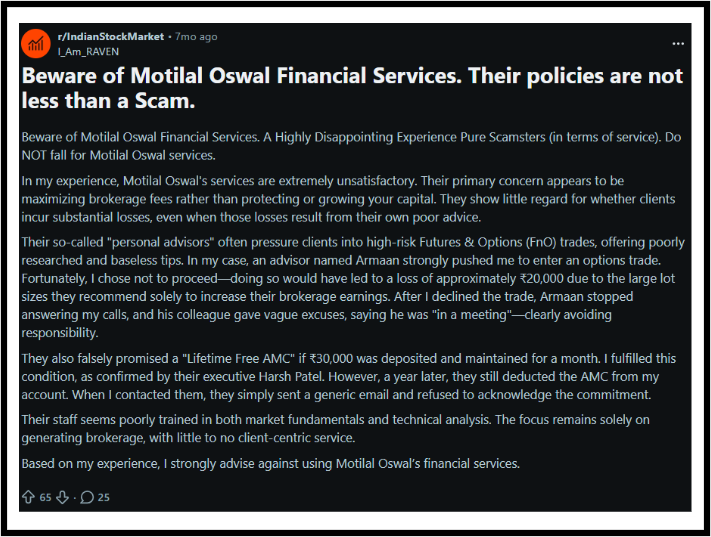

Now, not only on NSE and regulatory platforms, there are a few complaints that are raised by Motilal Oswal clients on different forums and platforms.

Here are some of the major concerns raised by users:

Complaint 1: One Reddit user shared a detailed account of their experience as a complete beginner, explaining how they were contacted soon after opening their account and encouraged to add more funds.

According to the user, the advisor repeatedly suggested trades and later pushed them toward riskier products, which resulted in significant losses within just a few weeks.

The user felt that little attention was given to their lack of experience or risk tolerance, leaving them frustrated and financially stressed.

Complaint 2: Another user described how they were repeatedly pushed into high-risk trades, particularly in segments they were not comfortable with.

The user also claimed that promises such as “lifetime free AMC” were made during onboarding, but later found unexpected charges being deducted, leading to disputes and a loss of trust in the advisory support.

NSE Arbitrations against Motilaal Oswal

Ever had a dispute with your broker over wrong trades, unauthorised transactions, delayed payouts, or margin issues and wondered, “Who will fix this?”

That’s exactly where NSE Arbitration steps in.

Arbitration is like a financial court outside the courtroom.

Instead of going to a civil court (which is slow and expensive), disputes are resolved by a neutral expert called an arbitrator.

Now add NSE (National Stock Exchange) to it, and you get a structured, legally recognised dispute-resolution system for stock market investors.

Let’s have a look at the arbitrations against Motilal Oswal-

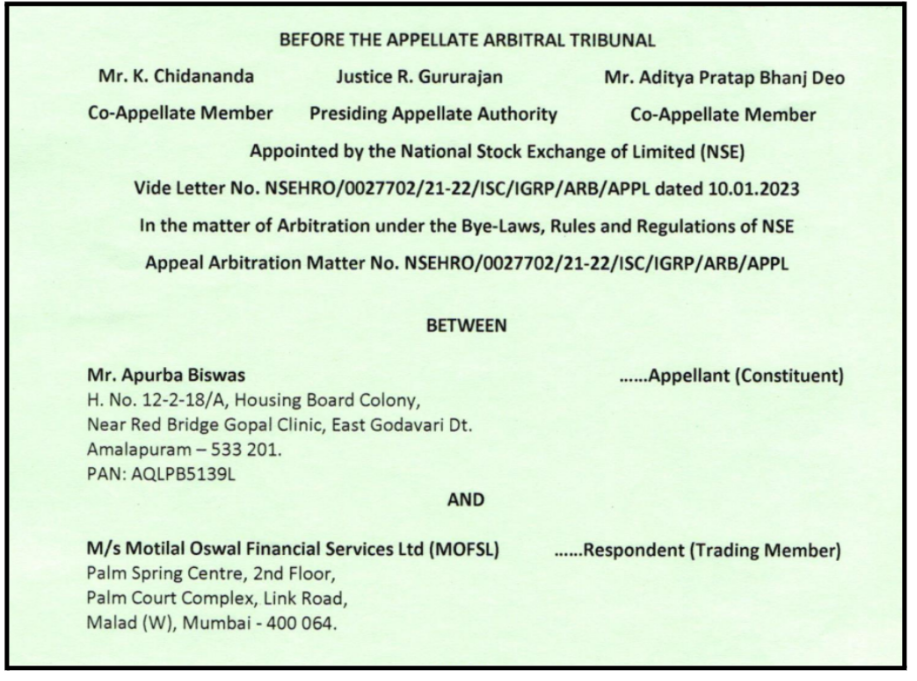

Case 1: Unfair Liquidation

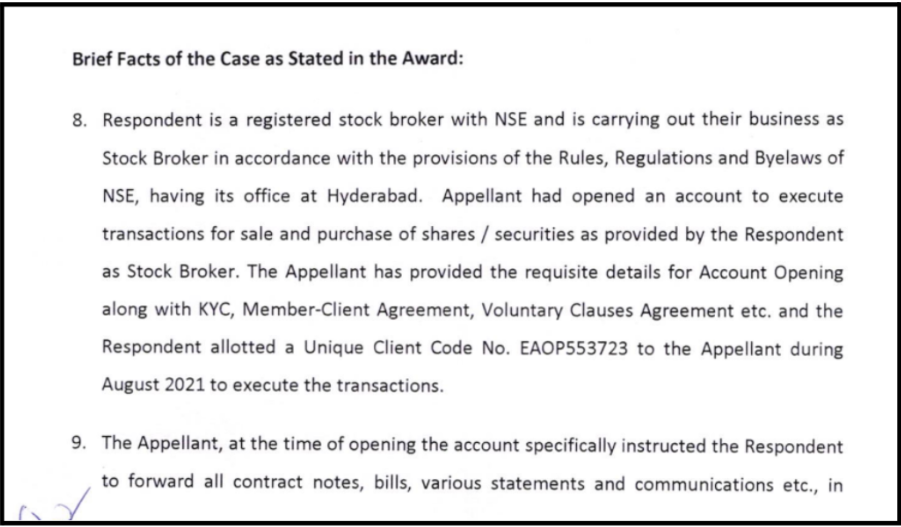

Navigating the stock market is complex, but the relationship between a trader and their broker is governed by clear rules.

A recent appellate decision by the National Stock Exchange (NSE) highlights a critical boundary: a broker’s right to sell a client’s shares to cover debts is not absolute, especially when the client has formally requested more time.

The appeal was heard by a three-member panel: Justice R. Gururajan (Presiding), Mr. K. Chidananda, and Mr. Aditya Pratap Bhanj Deo.

Allegations by the Applicant

The Appellant, Mr. Biswas, alleged that MOFSL acted fraudulently and cheated him by unauthorizedly selling his shares at a loss. His primary grievances were:

- Unauthorized Selling: The broker sold 13,669 Trident shares and an additional 72 shares despite his explicit request for 15 days of extension to clear his debit balance.

- Ignored Objections: He informed the broker he would clear the dues by obtaining a loan or selling other property, but the broker proceeded with the sale anyway.

- Financial Loss: He claimed the shares were sold at a lower price than they eventually reached, causing significant financial and mental agony.

While the initial arbitrator sided with the broker, the Appellate Tribunal partially reversed that decision.

The Tribunal found that although brokers have “Risk Management System” (RMS) policies to square off positions for non-payment, these clauses cannot be applied “mechanically”. Since the Appellant had asked for time and objected to the sale, the broker had a duty to consider that objection before acting. By ignoring the request, the broker violated the principles of Natural Justice.

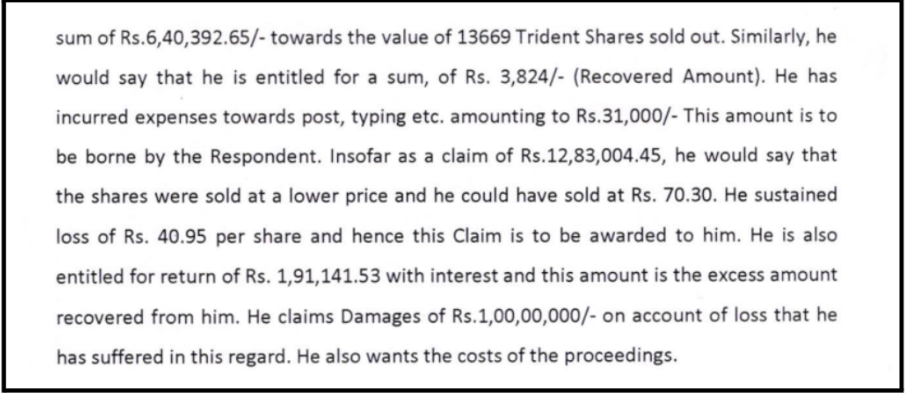

The Award:

The Appellate Tribunal ordered the following:

- Payment for Shares: The Respondent was directed to pay Rs. 6,40,392.65 to the Appellant (representing the value of the 13,669 and 72 Trident shares sold).

- Timeline: Payment must be made within 3 months of the order (dated April 11, 2023).

- Future Interest: If the broker fails to pay within the timeline, they must pay 10% p.a. interest from the date of the award until the realisation of the amount.

- Rejected Claims: The Tribunal rejected the Appellant’s larger claims for ₹1 Crore in damages and ₹1,000 Crore in fines, citing a lack of evidence and jurisdiction.

Hence, if you receive a margin call or a notice of debit, responding with a formal objection or a request for time is crucial. The Tribunal ruled that a broker cannot simply ignore a “no-sale” request if it results in civil consequences (financial loss) for the client.

Case 2: Unauthorised Trading and the Retail Investor

This case serves as a cautionary tale for retail investors regarding the complexities of the Futures and Options (F&O) segment and the critical importance of maintaining control over one’s trading account.

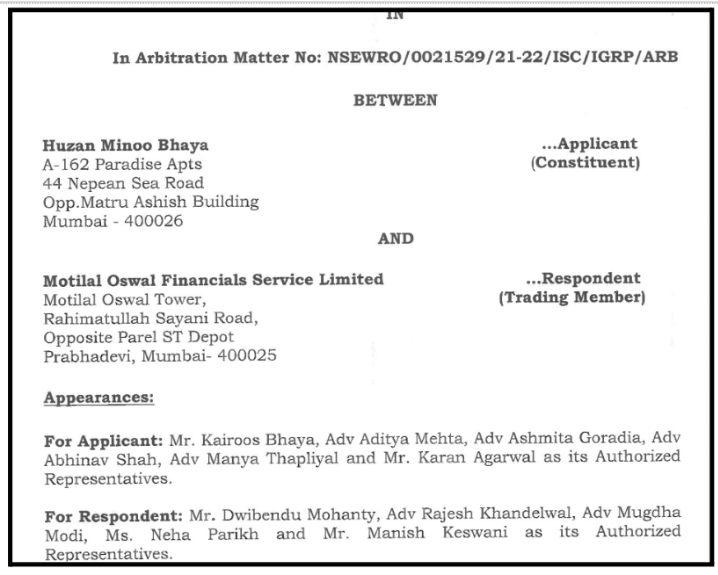

The arbitration matter (No: NSEWRO/0021529/21-22/ISC/IGRP/ARB) involved an elderly investor, Huzan Minoo Bhaya (the Applicant), and the prominent brokerage firm, Motilal Oswal Financial Services Limited (the Respondent).

The dispute was brought before an Arbitral Tribunal under the rules of the National Stock Exchange of India (NSE).

The core of the matter centred on trades executed between March 3, 2020, and March 19, 2020, a period of extreme market volatility due to the onset of the COVID-19 pandemic.

The Applicant, a conservative investor who inherited her portfolio, claimed that her account was mismanaged by an Authorised Person (AP) of the Respondent who engaged in high-risk F&O trading without her explicit consent.

Allegations by the Applicant

The Applicant’s primary grievance was that the trading was unauthorised and conducted without pre-trade confirmations, in violation of SEBI regulations. Key allegations included:

- Misrepresentation of Risk: The AP allegedly assured the Applicant that F&O trading was a “safe” way to generate monthly income, despite the Applicant’s conservative investment profile.

- Procedural Malpractice: It was alleged that the AP obtained signatures on blank forms and forged signatures to falsely indicate the Applicant had years of experience in derivatives.

- Ignoring Instructions: The Applicant claimed she repeatedly requested to square off positions and book a limited loss (around ₹20 lakhs), but the AP instead “rolled over” positions, leading to much deeper losses.

- Lack of Transparency: The AP was accused of providing incomplete information and being evasive during the market crash in February and March 2020.

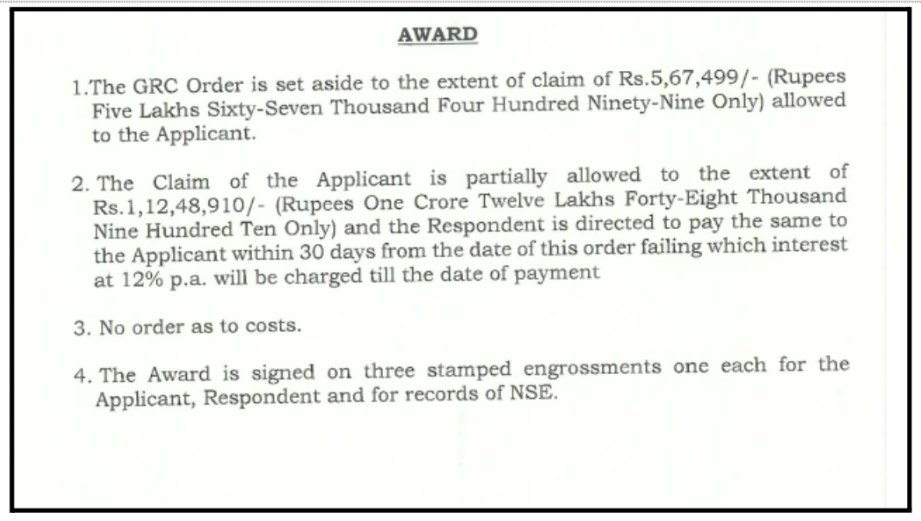

The final verdict in the arbitration case between Huzan Minoo Bhaya (Applicant) and Motilal Oswal Financial Services Limited (Respondent), issued on April 3, 2023, partially ruled in favour of the applicant.

The arbitral tribunal set aside a previous GRC (Grievance Redressal Committee) order that had awarded the applicant Rs. 5,67,499 in brokerage fees.

However, the tribunal partially allowed the applicant’s primary claim regarding losses from unauthorised trades in Futures and Options (F&O).

The respondent was directed to pay the applicant a sum of Rs. 1,12,48,910/- (Rupees One Crore Twelve Lakhs Forty-Eight Thousand Nine Hundred Ten Only) within 30 days of the order.

Failure to pay within this timeframe would result in an interest charge of 12% p.a. until the payment date.

The key takeaway from this case is that trading members (stockbrokers) are fully accountable for the unauthorized actions of their authorized persons (APs), especially concerning compliance with regulatory guidelines and client risk profiles.

A trading member cannot disown responsibility for the actions of its APs; the AP acts as their agent, and the trading member is held responsible for the AP’s failures to adhere to rules and regulations.

Motilal Oswal SEBI Orders

Between 2022 and 2025, Motilal Oswal group companies faced 7 separate SEBI orders. The penalties totalled over ₹77 lakhs. One registration was rejected outright.

These weren’t isolated incidents. They reveal a concerning pattern of compliance failures across different business segments.

Let’s start from the beginning:

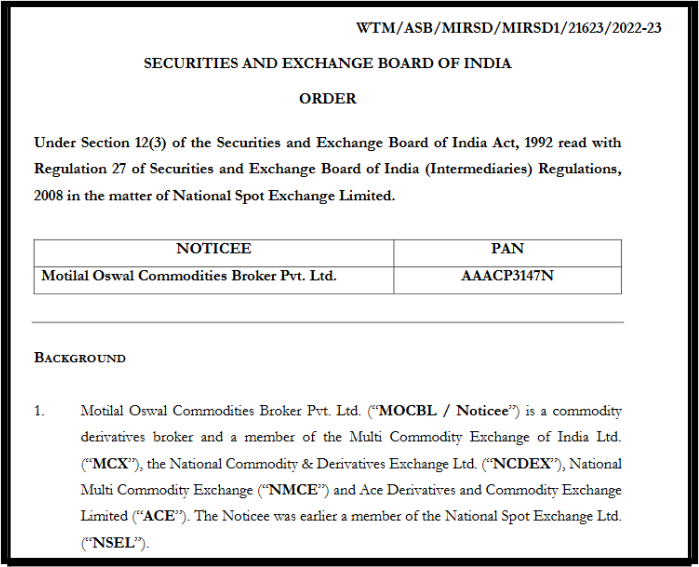

1. The NSEL Nightmare: A Registration Denied (2022)

In November 2022, SEBI took a serious step. They rejected Motilal Oswal Commodities Broker’s (MOCBL) application. MOCBL wanted to become a registered commodity derivatives broker.

This wasn’t just a delay. It was an outright rejection.

The Root Cause: NSEL’s “Paired Contracts” Scam

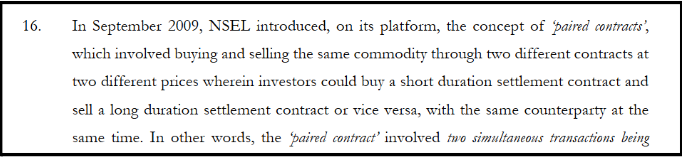

To understand this, we need to go back to 2009-2013. During this period, MOCBL facilitated client access to something called “paired contracts.” These were traded on the National Spot Exchange Limited (NSEL).

What were these paired contracts?

Think of them as a guaranteed-return scheme disguised as commodity trading.

Investors would simultaneously buy a short-term contract (2 days). They would also sell a long-term contract (25 days). Same commodity, same counterparty, guaranteed profit.

The promised returns were around 16% annually. They were marketed as an alternative to bank fixed deposits.

Sounds too good to be true? It was.

Why Were They Illegal?

The Supreme Court of India made it crystal clear.

These were financing transactions, not genuine commodity trades. They violated NSEL’s license, which only permitted spot trading. They breached the Forward Contracts Regulation Act.

The structure was essentially a Ponzi-like scheme. No actual commodity delivery ever happened.

The scheme eventually collapsed. It caused a ₹5,600+ crore crisis. Numerous investors were wiped out.

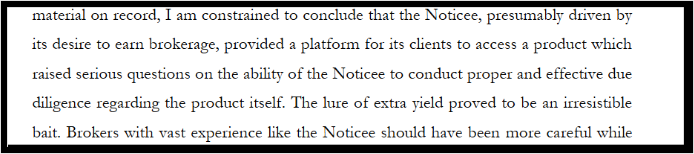

MOCBL’s Role & SEBI’s Verdict

SEBI argued that MOCBL should have known better. The red flags were obvious.

- Guaranteed 16% returns in a spot trading market

- Identical returns across different commodities

- Complex structure with no actual delivery

SEBI’s conclusion was harsh. MOCBL, “presumably driven by its desire to earn brokerage,” failed in its duty to protect investors.

The Final Penalty

Application rejected. Banned from reapplying for 3 months OR until a pending criminal FIR is resolved.

An FIR filed by SEBI’s Economic Offences Wing remains active.

Key Takeaway: Past conduct matters. Even events from 2009-2013 had consequences in 2022.

2. The ₹25 Lakh Penalty: Client Fund Misuse (2022)

Just months after the NSEL decision, in April 2022, SEBI hit Motilal Oswal Financial Services (MOFSL) with another serious order. This time for misusing client funds.

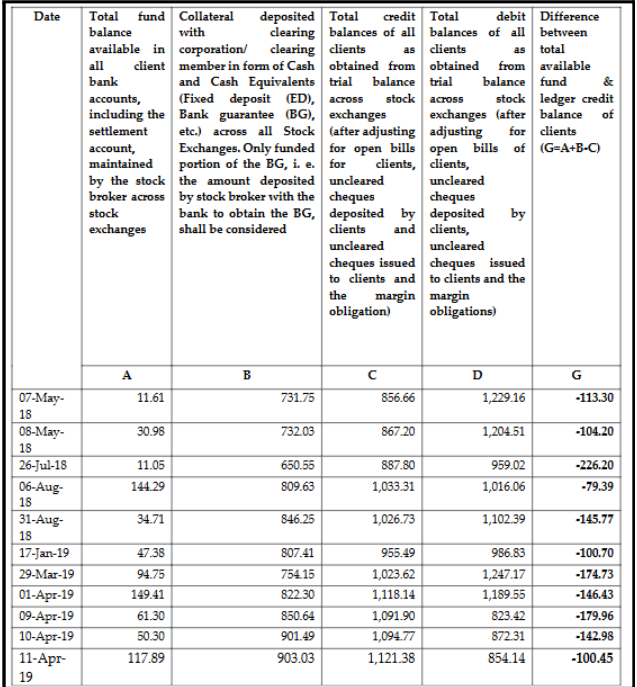

The Inspection That Uncovered Everything

SEBI conducted a comprehensive inspection from August to September 2019. They covered MOFSL’s stock broking and depository activities from April 2018 to August 2019.

They found six major categories of violations.

The Most Serious Issue: Client Fund Misuse

On 11 sample days, MOFSL’s client fund calculations showed a negative balance. The average was ₹137.65 crores.

This means client money was likely used for other clients’ settlements. Or for the broker’s own purposes.

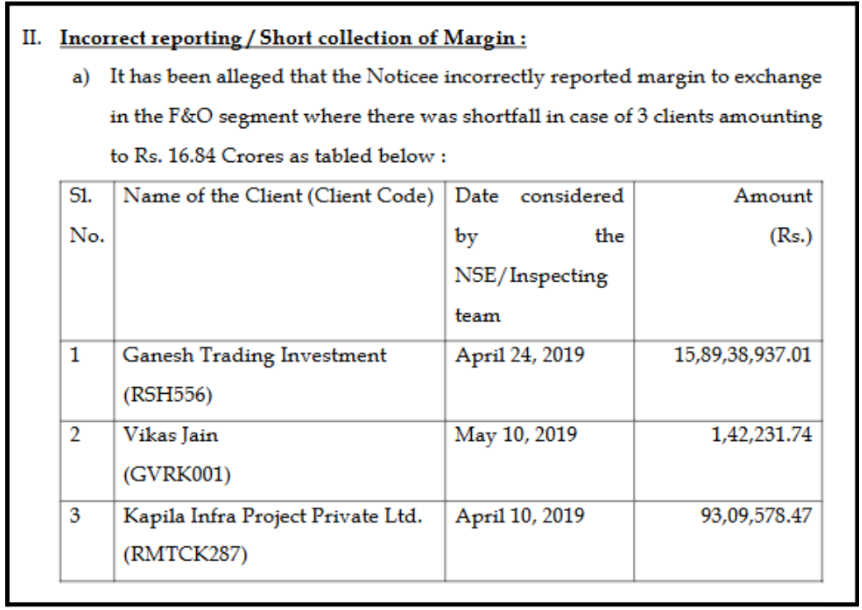

Other than this, there were 5 more violations uncovered by SEBI.

- Incorrect Margin Reporting

Under-reported margins for three clients. Shortfall of ₹16.84 crores.

Transferred funds between segments without sufficient balance.

- Funding Clients Beyond Permitted Time

Extended trading exposure to 9 clients despite unpaid debts beyond T+2+5 days. Total exposure was ₹24.52 crores.

Violation confirmed in 8 out of 9 cases.

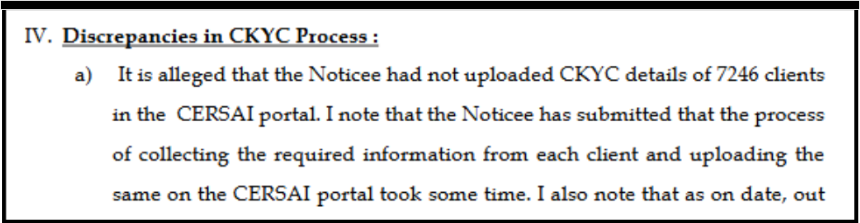

- KYC Compliance Failures

Failed to upload KYC details of 7,246 clients to the CERSAI portal. Later improved to 98%. But the damage was done.

- Missing Order Records

For 9 clients, no proper records of order placement. No call recordings.

MOFSL blamed their Authorised Persons. SEBI said the ultimate responsibility rests with the broker.

- Incorrect Weekly Reports

Submitted inaccurate data on collateral, margins, and balances. Attributed to “manual processes” and operational lapses.

Based on findings, SEBI imposed a penalty of ₹25,00,000 on Motilal Oswal.

| Violation | Amount | Legal Provision |

| Misuse of Client Funds | ₹20,00,000 | Section 23D of SCRA |

| Other Five Violations | ₹5,00,000 | Section 15HB of SEBI Act |

| TOTAL | ₹25,00,000 |

The ₹25 lakh penalty imposed on Motilal Oswal Financial Services (MOFSL) in 2022 sends a clear and cautionary message, even large, established brokers are not above regulatory scrutiny, especially when client trust and client money are involved.

In essence, this SEBI order was not just a penalty; it was a warning shot.

One that reinforced the regulator’s zero-tolerance stance on client fund misuse and underscored the need for robust governance as businesses scale.

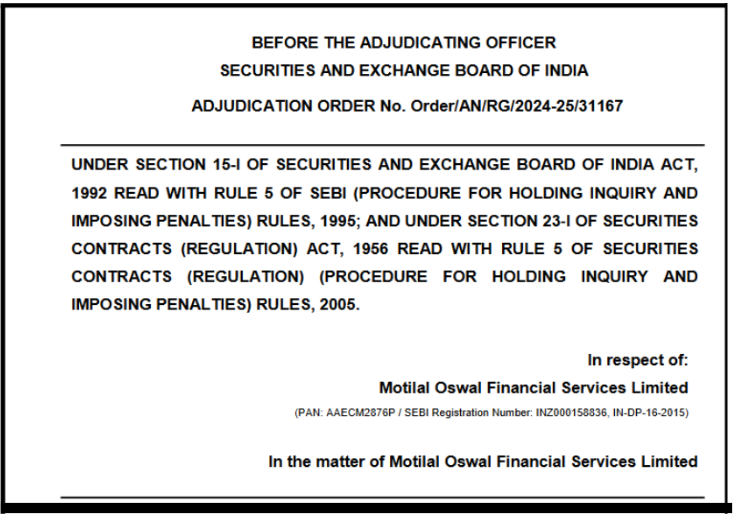

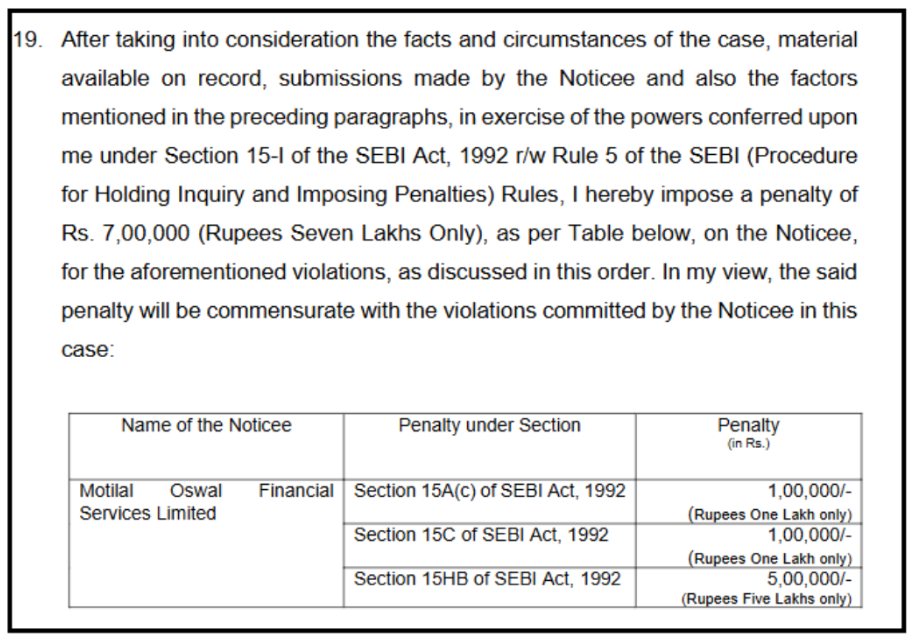

3. The ₹7 Lakh Penalty: Multiple Compliance Lapses

Fast forward to 2025. The problems continued.

SEBI inspected MOFSL’s operations from April 2021 to June 2022. They found violations across nine categories.

Based on the investigation, seven violations were confirmed.

- Margin Reporting Issues: Incorrect reporting across multiple segments.

- Wrong Data Upload: 57 instances of incorrect weekly submissions.

- Engagement in Non-Securities Business: Investments worth ₹1,719.94 crore in associate companies.

- MTF Collateral Errors: 5 instances involving ₹39.65 crore.

- Improper CUSA Transfers: Securities of 3,574 clients were wrongly transferred.

- Pending DP Complaints: 26 complaints beyond 30 days.

- Incorrect Settlement of Inactive Funds: 39 active clients were wrongly classified.

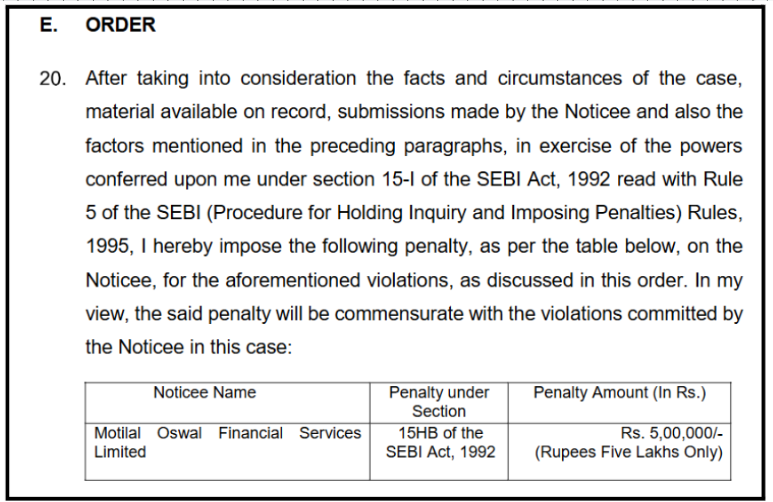

After examining all the facts, evidence on record, and submissions made by Motilal Oswal Financial Services Limited (MOFSL), SEBI reached a conclusive finding of regulatory violations and exercised its statutory powers to impose a monetary penalty.

The final verdict of the order is as follows:

SEBI held that Motilal Oswal Financial Services Limited violated multiple provisions of the SEBI Act, 1992.

Consequently, under Section 15-I of the SEBI Act read with Rule 5 of the SEBI (Procedure for Holding Inquiry and Imposing Penalties) Rules, the Adjudicating Officer imposed a total penalty of ₹7,00,000 (Rupees Seven Lakhs only) on the Noticee.

SEBI explicitly stated that the penalty imposed is commensurate with the nature and gravity of the violations. While the breaches were established, the regulator did not find it necessary to impose harsher sanctions such as suspension or cancellation of registration.

The order concludes that Motilal Oswal Financial Services Limited was regulatorily at fault, but the violations were addressed through a financial penalty rather than punitive restrictions. The verdict serves as a compliance warning and reinforces SEBI’s stance that even procedural and reporting lapses attract consequences, regardless of the size or reputation of the intermediary.

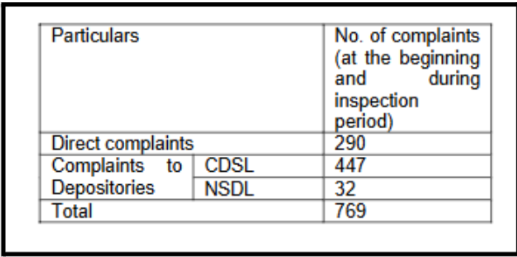

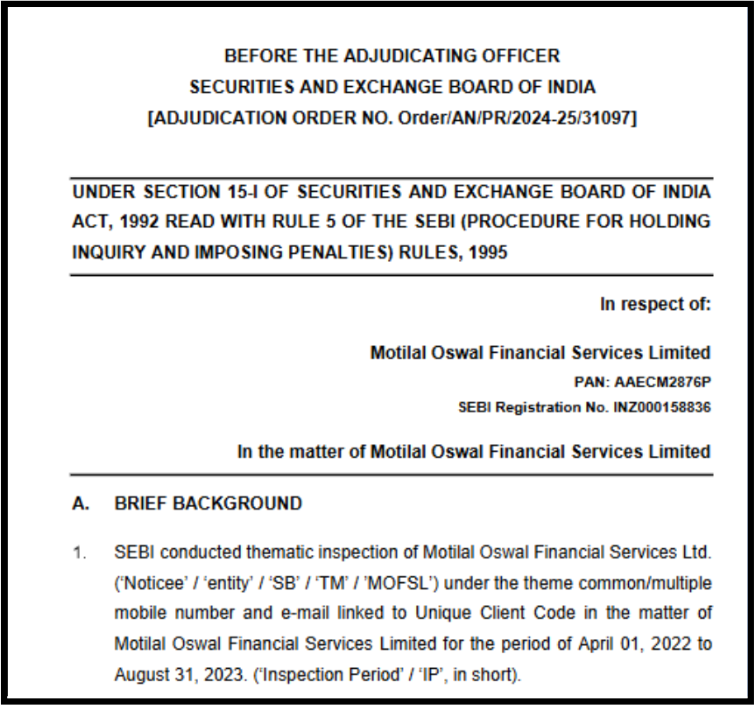

4. The ₹5 Lakh Penalty: KYC and Email Violations (December 2024)

Another inspection, another penalty.

The Focus: Client Data Integrity

The Inspection Period was April 2022 to August 2023.

Theme: Common or multiple mobile numbers and email IDs linked to client accounts.

Here are the details of key violations:

- Email and Mobile Mismatches:

-

- BSE: 67 email mismatches, 306 mobile mismatches

- NSE: 3,550 email mismatches, 3,753 mobile mismatches

Now this is concerning, as accurate contact details are critical for investor protection. Email and mobile numbers are used for trade confirmations, margin alerts, OTPs, and regulatory communication.

Mismatches raise concerns that investors may not be receiving important alerts or disclosures, increasing the risk of unauthorised trades, missed margin calls, or delayed awareness of account activity.

- Improper Use of AP Contact Details:

-

- 44 clients marked inactive internally but shown as active on BSE

- 836 instances where Authorised Person contact details were used for clients

- 5 cases where the client email matched the AP email without a declared relationship

Using AP contact details in place of a client’s own contact information weakens transparency and control.

Investors may be unaware of trades executed in their accounts or may not receive direct communication from exchanges.

Showing inactive clients as active can distort compliance records and raises questions about accurate client onboarding, consent, and monitoring.

- AP Terminal Issues:

-

- 55 instances of AP terminals mapped to multiple brokers.

AP terminals are meant to be uniquely linked for accountability and traceability.

Mapping the same terminal to multiple brokers increases the risk of misuse, data leakage, and difficulty in tracing responsibility if irregular trades or disputes arise.

For investors, this weakens audit trails and could complicate grievance resolution if something goes wrong.

Now this led to a Penalty of ₹5,00,000 on the Motilal Oswal. And the broker was penalised for the third time between 2020 and 2022 for the same violations.

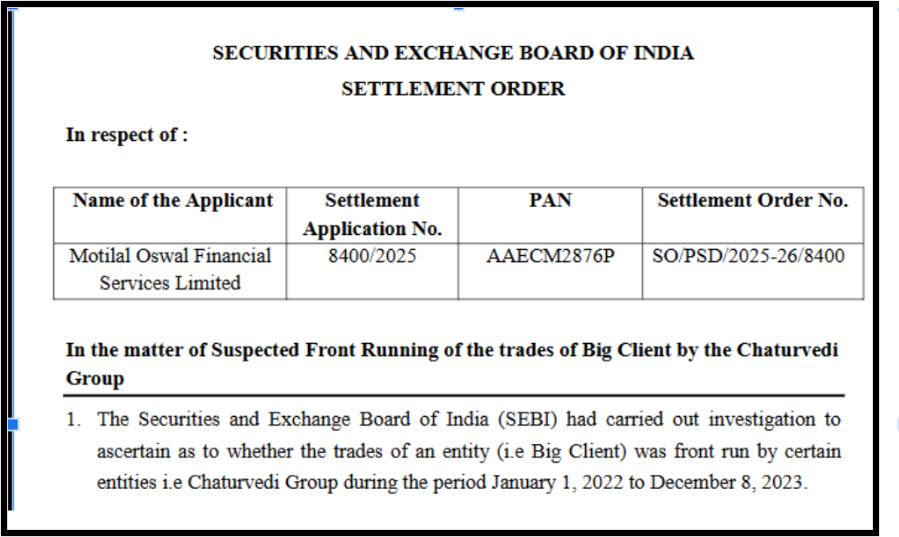

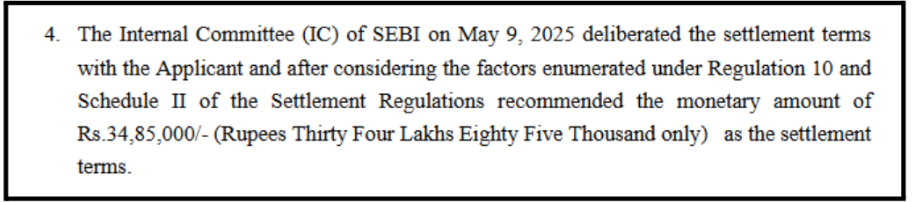

5. The ₹34.85 Lakh Settlement: Front-Running Investigation (September 2025)

This is the most serious case in terms of market integrity.

In this case, SEBI concluded its proceedings against Motilal Oswal Financial Services Limited (MOFSL) through a settlement order, without going into a full adjudication on merits. The investigation related to suspected front-running of trades of a big client by the Chaturvedi Group during the period from January 1, 2022, to December 8, 2023.

While SEBI did not directly accuse Motilal Oswal of front running, it alleged that the broker failed to exercise due skill, care, and diligence as required under securities laws.

The main suspect was the “Chaturvedi Group,” and Motilal Oswal was fond involved in executing trades for the client.

Specifically, SEBI found that MOFSL did not maintain proper evidence of client order instructions and allegedly attempted to create or regularise supporting documents after the execution of client orders, which is a serious compliance lapse for a registered stock broker.

Based on these allegations, a Show Cause Notice dated February 20, 2025, was issued, proposing inquiry proceedings and monetary penalties under relevant provisions of the SEBI Act and Stock Broker Regulations.

- Failure to maintain contemporaneous evidence of client order instructions

-

- Attempted post-trade creation of documents to justify executed orders

- Lack of due skill, care, and diligence expected from a registered broker

Why This Matters?

In front-running investigations, the broker’s records are crucial evidence.

If a broker can’t prove when and how orders were received, it undermines the entire investigation.

It raises questions about complicity. It suggests inadequate internal controls.

Instead of contesting the matter through prolonged enforcement proceedings, Motilal Oswal opted for settlement under the SEBI (Settlement Proceedings) Regulations. After evaluating the facts, the nature of violations, and mitigating factors such as cooperation and regulatory history, SEBI’s Internal Committee (IC) approved the settlement terms.

Consequently, SEBI accepted MOFSL’s settlement application and imposed a settlement amount of ₹34,85,000 (Rupees Thirty-Four Lakh Eighty-Five Thousand only).

The final verdict is that the matter stands settled without admission or denial of guilt. There is no finding of guilt or innocence on front running, and no suspension or restriction on Motilal Oswal’s business operations.

However, the order clearly reinforces SEBI’s position that failure to maintain proper audit trails and order records is a serious regulatory lapse, especially in cases involving potential market abuse.

How to Complaint Against Motilal Oswal?

Facing issues with Motilal Oswal? The complaint process can be overwhelming.

Register with us. We simplify the entire legal process for you.

Here’s how we support you at every stage:

- We assist you in collecting, organising, and presenting all essential documents such as trade statements, ledger reports, contract notes, call recordings, screenshots, and email communications, ensuring your case is supported by strong and complete evidence.

- We draft clear, precise, and well-structured complaints tailored to the specific requirements of NSE, BSE, SEBI SCORES, and SMART ODR. This reduces the risk of rejection or delays caused by incorrect formatting or incomplete submissions.

- We guide you through the filing process on platforms like SCORES and SMART ODR, making sure every field is filled accurately so your complaint is submitted smoothly and correctly the first time.

- If escalation becomes necessary, we advise you on the correct route, whether it involves approaching the exchange, responding to regulatory queries, or preparing for the next stage of proceedings.

- From the moment you register, we manage your case end-to-end. We track timelines, send reminders for important deadlines, and help you draft responses to any follow-up questions raised by regulators or exchanges.

- If your matter proceeds to counselling or arbitration, we support you in preparing your statements, documents, and submissions so you can approach the process with clarity and confidence.

Conclusion

So, can you trust a Stock Broker? Motilal Oswal remains one of India’s established financial services firms.

But this regulatory history cannot be ignored, especially when concerns extend beyond compliance to operational problems such as recurring Motilal Oswal login issue reported by clients.

The repeated nature of violations is concerning. Especially around client funds, record-keeping, and supervision. These raise legitimate concerns.

For investors, the lesson is clear: Trust, but verify.

Don’t blindly trust big names. Understand your broker’s regulatory history. Keep meticulous personal records. Stay informed about SEBI orders. Know your rights as an investor.

Remember: SEBI’s primary job is to protect investors. When they repeatedly penalise a firm, they’re sending a message. Investors should listen.

Stay Informed!