Ever wonder if your broker is playing by the rules? When regulatory bodies issue multiple penalties, it’s time to dig deeper.

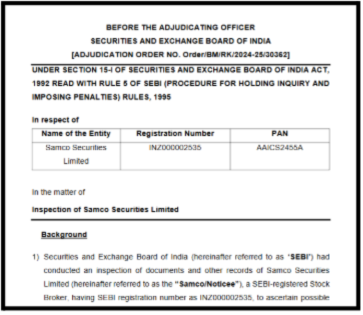

Let’s talk about Samco Securities, a name that’s raised some eyebrows at SEBI.

Samco Securities Review

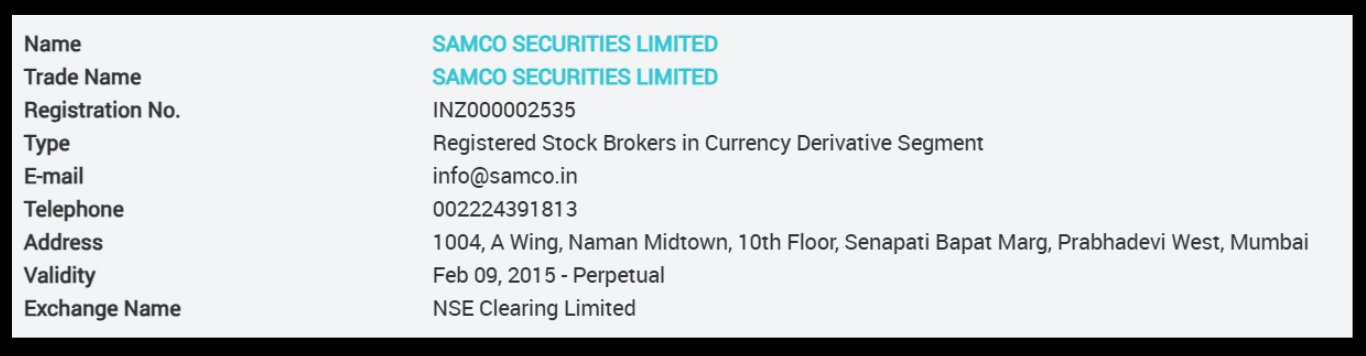

Samco Securities Limited is a SEBI-registered stockbroker in India. It operates under SEBI regulations.

The company offers online trading services. Clients can trade in equities and derivatives.

Samco Securities provides digital platforms for trading and investing in Indian financial markets.

It functions through web and mobile applications that allow clients to place and manage trades.

- Enables trading in equities, derivatives, commodities, currencies, mutual funds, ETFs, and IPOs

- Offers research tools, market data, and account-related services

Overall, Samco operates as an online intermediary connecting retail clients to stock exchanges under SEBI regulations.

However, the real question is: How clean is their track record? That’s where things get interesting.

Major Regulatory Actions on Samco Securities

But here’s the catch. Multiple SEBI inspections have revealed serious compliance failures.

Not once, not twice, but repeatedly over several years. Sounds concerning, right?

| Adjudication Order & Date | Violations Committed |

|

May 2024

|

Common mobile/email IDs linked to multiple client accountsMissing KYC forms Auto-population of client choices Signatures auto-populated across all segmentsNon-cooperation with SEBI inspection |

| August 2023 |

Non-settlement of client accounts – 40 out of 100 active clients unsettled; 55,745 inactive clients’ accounts not settled (₹2.28 crore)Incorrect data submission to exchanges Failure in stock reconciliation Client funding beyond permitted period Mismatch in retention statementsKYC violations – didn’t capture live client photographs |

| May 2020 |

Alleged misuse of client funds – cash shortfalls on 39 datesFailure to settle accounts of 2 active and 13 inactive clients |

Violations By Samco Securities

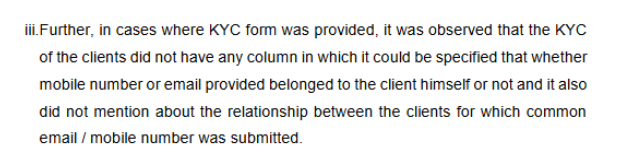

Violation 1: Playing with Client Data

What happened? Samco linked one mobile number or email to multiple accounts. They didn’t check if clients were family members.

Consent letters were incomplete or missing entirely.

Why it matters: Your personal contact details could be mixed with strangers’ accounts. This is a basic privacy and security failure.

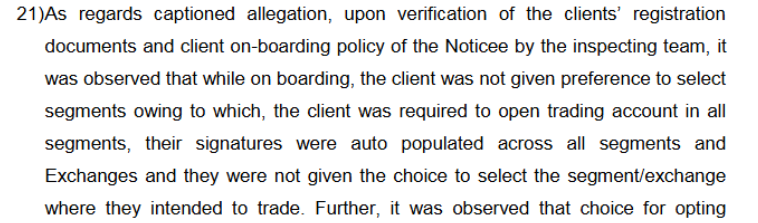

Violation 2: Forcing Choices on Clients

What happened? When you opened an account online, Samco’s system pre-selected everything for you.

You couldn’t choose your trading segments. Your signature was auto-filled across platforms.

Why it matters: You had zero control during account setup. The system decided for you, not exactly client-friendly, is it?

Violation 3: Hiding Your Money

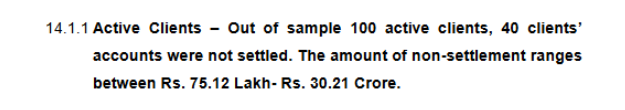

What happened? According to SEBI documents, 40 active clients’ accounts weren’t settled properly.

Over 55,000 inactive accounts held ₹2.28 crore that wasn’t returned. Delays ranged from days to months.

Why it matters: Your funds could be stuck without proper settlement. That’s your hard-earned money sitting in limbo.

Violation 4: Reporting Wrong Numbers

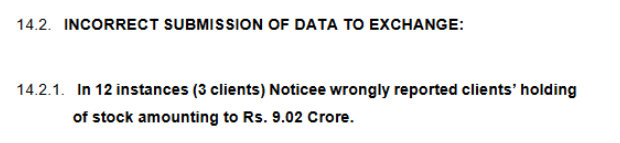

What happened? Samco submitted incorrect data to stock exchanges repeatedly. Stock holdings worth ₹9.02 crore were wrongly reported.

Collateral reporting was off by ₹60.18 crore.

Why it matters: Wrong data means wrong decisions. When exchanges don’t have accurate info, market integrity suffers.

Violation 5: Ignoring Reconciliation

What happened? Samco didn’t match their back-office holdings with actual demat account holdings. This happened in 13 instances.

Why it matters: If they don’t track what you actually own, how can you trust your account balance?

Violation 6: No Live Photos for KYC

What happened? Out of 985 online accounts opened, 931 didn’t capture live client photographs as mandated.

Why it matters: Without proper identity verification, anyone could open accounts. This is a serious security loophole.

Violation 7: Stonewalling SEBI

What happened? When SEBI inspectors asked for documents, Samco delayed submissions repeatedly. They blamed monsoons and physical record retrieval issues.

Why it matters: If a broker can’t cooperate with regulators, what does that say about transparency?

Penalties on Samco Securities

| Order Date | Penalty Amount | Reason for Penalty |

| May 2024 | ₹2,50,000 | • ₹1,50,000 for common mobile/email violations• ₹1,00,000 for non-submission of data to SEBI |

| August 2023 | ₹7,00,000 | Multiple violations under SEBI Act & Depositories Act including settlement failures, data reporting errors, and KYC compliance issues |

Samco Securities User Reviews

Real users paint a troubling picture. Let’s break down the complaints by category. These aren’t isolated incidents, they’re patterns.

Problem 1: Hidden Charges & Undisclosed Fees

Users report unexpected deductions. Charges appear without prior notice. The transparency promised during onboarding mysteriously disappears.

A user Amol faced hidden charges that weren’t mentioned anywhere in the app.

He paid research subscription fees for 30 months but his stock baskets were never rebalanced, essentially paying for a service he never received.

Another user Abhash experienced direct fund deductions without any notification.

When he raised a ticket for clarification, customer support responded with confusing technical terms instead of clear explanations about the charges.

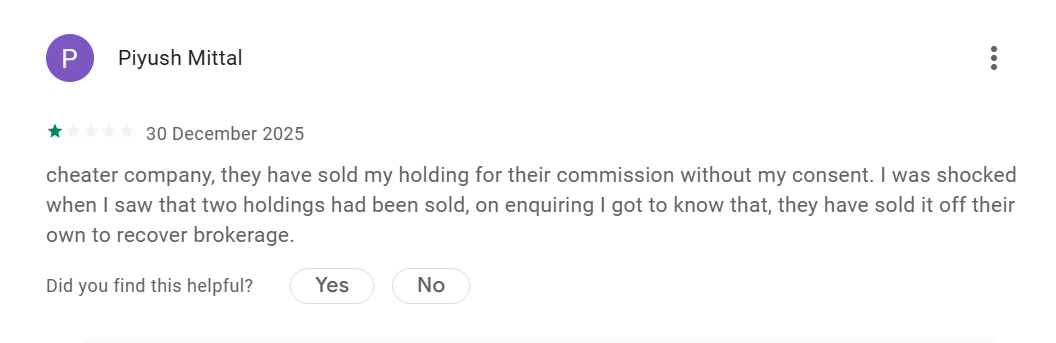

Problem 2: Unauthorized Sale of Holdings

Clients discover their stocks sold without consent. Brokers allegedly liquidate holdings to recover their own brokerage fees.

A user Piyush was shocked to discover that two of his holdings had been sold.

Upon investigation, he found out that Samco sold his stocks without his permission just to recover their own brokerage charges, a clear violation of client consent.

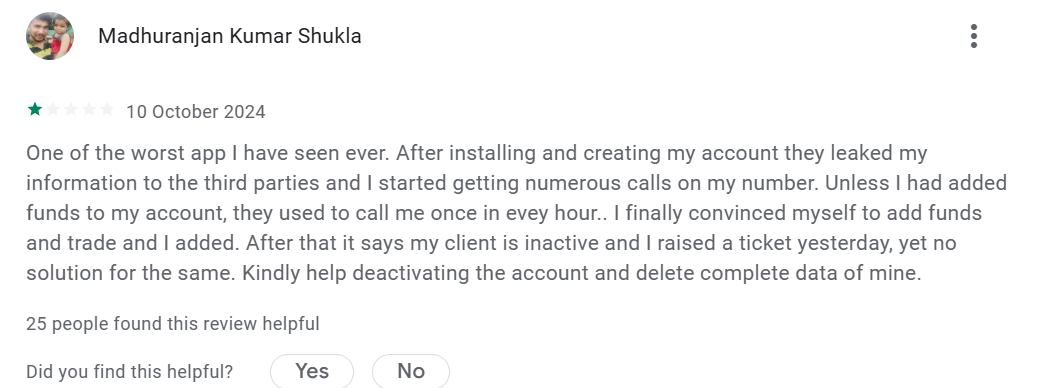

Problem 3: Data Leakage & Privacy Violations

User information allegedly shared with third parties. Clients receive spam calls immediately after registration. Personal data security appears compromised.

A user Madhuranjan faced aggressive spam calls immediately after creating his account.

His personal information was allegedly leaked to third parties, and he received calls every hour until he added funds

Even after funding his account, it showed as inactive with no resolution to his support ticket.

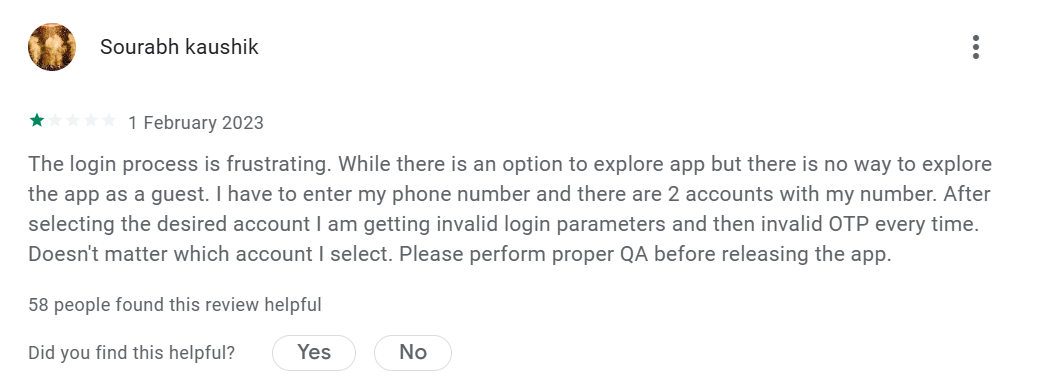

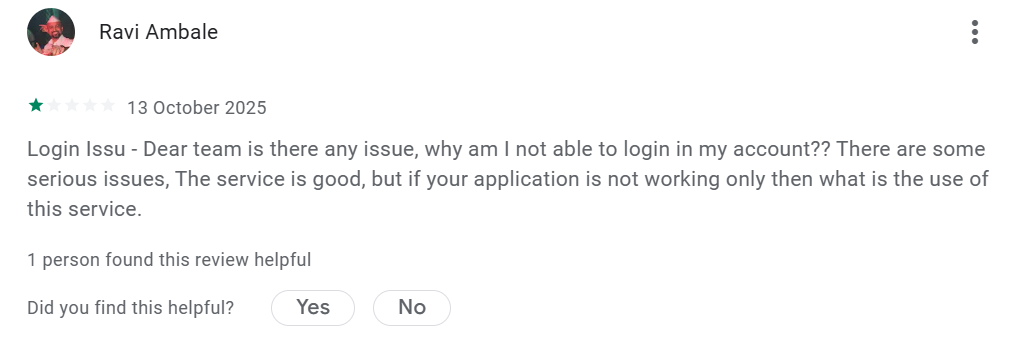

Problem 4: Account Login & Technical Issues

Multiple accounts linked to single phone numbers. Invalid OTP errors. Login parameters fail repeatedly. Basic app functionality doesn’t work.

Sourabh encountered constant login failures because two accounts were linked to his single phone number.

Regardless of which account he selected, he kept getting invalid login parameters and OTP errors, preventing him from accessing the platform entirely.

Another user Ravi couldn’t login to his account at all and says the Samco App not working.

Despite acknowledging that the service itself is good, he highlighted the fundamental problem, if you can’t access your account, the quality of service becomes irrelevant.

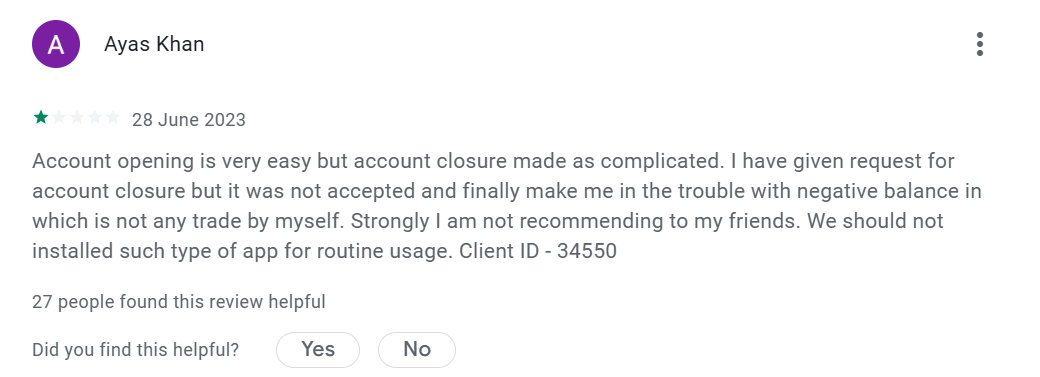

Problem 5: Account Closure Difficulties

Simple account closure requests ignored. Users trapped with negative balances they didn’t create. Support tickets go unanswered for days.

Ayas faced deliberate roadblocks when trying to close his account.

His closure request was rejected, and mysteriously, a negative balance appeared in his account, despite him not making any trades.

This trapped him with an outstanding amount he didn’t create.

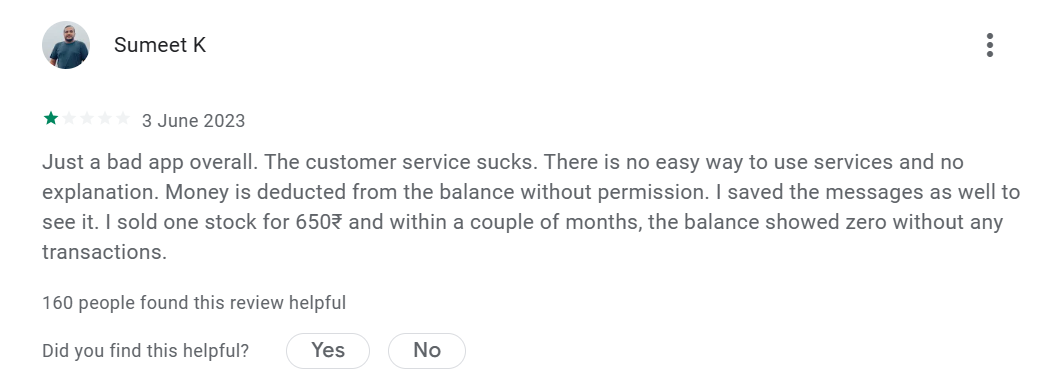

Problem 6: Disappearing Funds & Balance Discrepancies

Money vanishes from accounts. Balances show zero without any transactions. Support provides no resolution.

Sumeet sold a stock for ₹650 and kept records of all messages as proof. Within a couple of months, his entire balance showed zero, without any transaction history to explain where the money went.

Customer service provided no resolution despite his documented evidence.

Impact on Investors of Samco Securities

What does this mean for you? Multiple regulatory penalties show a pattern. It’s not just one mistake. Samco has been caught violating rules across different years.

Your money is at risk when:

- Account settlements are delayed

- Data reporting is inaccurate

- KYC processes are incomplete

- The broker doesn’t cooperate with regulators

According to SEBI documents, while no quantifiable investor loss was proven in the 2024 case, the violations were serious enough to warrant penalties.

The repetitive nature of defaults was specifically highlighted.

Trust is everything in trading. When a broker faces repeated regulatory actions, it raises red flags.

What Can You Do in Such Cases?

Are you facing similar issues with Samco Securities or any other SEBI-registered broker?

You are not alone.

Multiple investors have reported losses, unauthorized transactions, and account discrepancies with Samco.

Our dedicated team specializes in assisting investors like you. We provide end-to-end support to ensure your grievance is documented effectively and reaches the right authorities.

Our Step-by-Step Support Process

1. Initial Consultation & Case Assessment

We arrange a confidential call with a dedicated Case Manager.

Whether it’s hidden charges, unauthorized stock sales, or disappearing funds, we understand the nuances of broker-related complaints.

2. Professional Case Documentation

We help you draft a structured, legally coherent complaint letter. It clearly outlines the misconduct, financial loss, and specific regulatory breaches.

3. Direct Engagement & Escalation

- Reaching the Broker: We guide you in formally communicating your complaint to Samco Securities’ grievance cell.

- Filing on SEBI SCORES: We provide detailed guidance on how to lodge complaint in SCORES portal. We help track status and respond to SEBI queries.

- Smart ODR: For eligible disputes, we guide you through SEBI’s Smart ODR (Online Dispute Resolution) platform.

4. Advisory & Strategic Counselling

Our experts counsel you on realistic outcomes, recovery avenues, and typical timelines in the regulatory process.

5. Guidance on Advanced Recourse

If initial regulatory action is unsatisfactory, we guide you on the next steps:

- Pursuing Arbitration: If your agreement has an arbitration clause, we connect you with legal experts specializing in securities arbitration.

- Stock Exchange Complaints: We help you file complaints in BSE or NSE investor grievance cells, adding another layer of pressure.

- Consumer Forum: For financial losses, we guide you on approaching consumer forums for compensation claims.

Your money matters. Your complaint matters.

By taking this step, you’re not just seeking accountability. You’re becoming part of a cleaner, more transparent financial market.

Ready to take action? Register with us today, and let’s fight for your rights.

Conclusion

According to SEBI adjudication orders, Samco Securities has faced penalties totaling ₹9,50,000 across multiple inspection periods. The violations range from KYC failures to client fund settlement issues to data reporting errors.

SEBI imposed a penalty of ₹2.5 lakh on Samco for discrepancies in client onboarding and usage of common contact details for multiple accounts as recently as May 2024.

While Samco offers competitive brokerage rates, the regulatory track record raises legitimate concerns. The repetitive nature of violations, particularly around client data handling and settlement processes, suggests systemic issues rather than isolated incidents.

Bottom line? If you’re considering Samco, weigh the low brokerage costs against the documented compliance failures. Your money’s safety should always come first.

Stay informed. Trade safely. Choose wisely.