Sometimes, even serious compliance failures don’t result in penalties. This is one of those cases.

SEBI found Nuvama Wealth and Investment Limited violating multiple regulations. Contract notes not delivered.

Invalid email IDs. Missing consent forms. Yet the final order? Zero penalty.

Here’s what really happened and what it means for investors.

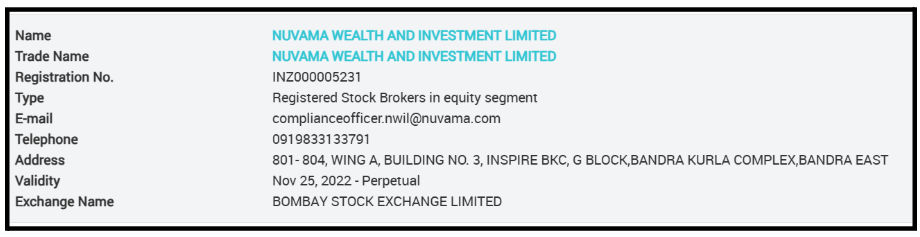

Who is Nuvama Wealth and Investment Limited?

Nuvama Wealth and Investment Limited operates as a SEBI-registered Stock Broker with registration number INZ000005231.

The company handles thousands of client accounts. They offer trading services across equity, derivatives, currency, and commodity segments.

Being a large, reputed organization, you’d expect strict compliance. But SEBI’s inspection revealed a different picture.

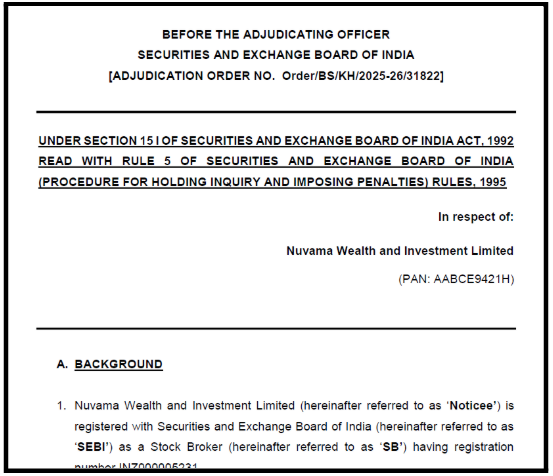

SEBI order on Nuvama Wealth and Investment Limited

SEBI conducted a comprehensive inspection from August 04 to August 10, 2023.

The inspection verified whether Nuvama maintained proper books of accounts as required under Stock Broker Regulations.

It checked compliance with securities laws. It examined client documentation and service standards.

However, some violations came into the picture:

Violations by Nuvama Wealth

What SEBI discovered raised serious compliance concerns across multiple areas.

-

Contract Notes Not Delivered to 63 Clients

Contract notes are crucial documents. They provide official proof of your trades. Details like price, quantity, brokerage, taxes, and everything appear on contract notes.

SEBI found that 63 client codes never received physical contract notes. The broker simply didn’t dispatch them.

Imagine trading regularly. You execute buy and sell orders. Money moves from your account. But you never receive official confirmation of those trades.

How do you verify the broker executed trades at the correct prices? And if the brokerage charge was accurate? How do you maintain records for tax filing?

Impact on Investors

Without contract notes, clients lose critical transaction proof. Disputes become impossible to resolve. You have no documentation showing trade details.

-

Electronic Contract Notes Not Sent to 27 Clients

Modern broking happens digitally. Most clients receive Electronic Contract Notes (ECN) via email.

But there’s a catch. Each client must have their own unique email ID.

Regulations prohibit mapping one email to multiple clients, unless they’re family members as defined in SEBI circulars.

SEBI discovered 27 client codes where single email IDs were mapped to multiple clients who weren’t family members.

This means multiple unrelated clients supposedly received ECNs at the same email address. But did those clients actually receive their contract notes? Unlikely.

Person A receives an email. But it contains transaction details for Person B and Person C, too. Privacy is compromised. Individual clients can’t access only their own trading records.

Impact on Investors

Shared email IDs for unrelated clients create massive privacy violations. Your trading activity becomes visible to strangers.

They see what stocks you bought. What prices did you pay? How much did you invest?

-

Bounce Logs Not Maintained for 322 Instances

When brokers send emails, sometimes they bounce. Invalid email addresses. Full mailboxes. Server issues. Emails fail to deliver.

Responsible brokers maintain bounce logs. These logs track which emails failed. They help identify delivery problems. They trigger corrective action.

SEBI found 322 instances across 63 client codes where email IDs were invalid. Emails bounced. But Nuvama’s ECN logs didn’t capture these bounces properly.

Even worse, Nuvama didn’t take steps to ensure clients got notified about bounced emails. No alternative communication method was used.

So clients never received contract notes. Nuvama knew emails were bouncing. Yet nothing was done to fix the problem.

-

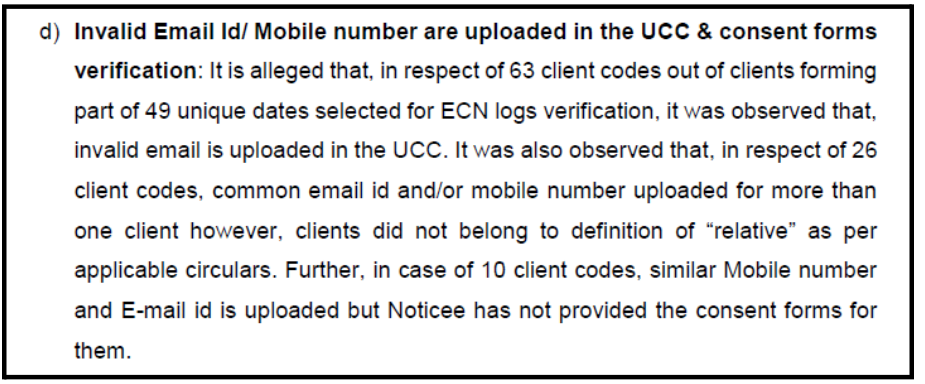

Invalid Email IDs and Mobile Numbers Uploaded

KYC (Know Your Customer) processes require accurate client information. Valid email addresses. Working mobile numbers. Correct residential addresses.

SEBI examined consent forms and UCC (Unique Client Code) details. The findings were troubling.

63 client codes had invalid email IDs uploaded in their UCC.

26 client codes shared common email IDs or mobile numbers with other clients. But these clients didn’t qualify as “relatives” under SEBI’s definition.

10 client codes had similar mobile numbers and email IDs but Nuvama couldn’t provide consent forms proving clients agreed to share contact details.

These aren’t minor data entry errors. These are systematic failures in client onboarding.

Invalid emails mean clients never received any communication. Market alerts, contract

-

Trade Exposure Not Matching Declared Income

Brokers must ensure client trading activity matches their financial capacity. Someone declaring ₹5 lakh annual income shouldn’t be taking ₹50 lakh trading positions.

SEBI found one client (UCC: 50074875) whose trade exposure didn’t match their declared income in the Exchange UCC Database.

This indicates the broker didn’t verify whether the client could afford the trading positions being taken. Risk management failed completely.

Allowing clients to trade beyond their means creates dangerous situations. Margin calls, they can’t meet. Losses they can’t absorb. Potential defaults that harm market integrity.

Impact on Investors

When brokers ignore income verification, vulnerable clients get exposed to excessive risk.

Someone might take huge positions, thinking they can handle it. But when losses mount, they face financial ruin.

SEBI’s Verdict

Despite all these violations, the Adjudicating Officer Biju S. decided on December 01, 2025: No monetary penalty.

The order noted that no allegations of fraud existed. The matter arose from inspection, not investor complaints.

The lapses may not be serious enough to warrant Section 15HB penalties.

What Retail Investors Should Learn From This Case?

Even though SEBI chose not to impose a penalty on Nuvama Wealth, this order should still make every retail investor pause.

Because the real story here is not about whether the broker paid a fine, it’s about how easily serious compliance failures can quietly affect everyday investors.

This case shows that just because a broker is large, well-known, and SEBI-registered does not mean everything is being handled properly behind the scenes.

Sixty-three clients did not receive contract notes. Dozens had invalid or shared email IDs.

Consent forms were missing. These aren’t technical glitches; these are the very systems that protect your money, your privacy, and your ability to prove what you traded.

One of the biggest lessons is this: never assume your broker is sending you everything just because they are supposed to.

You should always check whether you are receiving:

- daily contract notes,

- trade confirmations,

- margin statements,

- and monthly or quarterly account statements.

If you don’t see them, something is already wrong, even if the broker says everything is fine.

Another important takeaway is how critical your contact details are. If your email ID or mobile number is wrong in your broker’s records, you might never receive contract notes, margin calls, or regulatory alerts.

That means you could be trading blind, without knowing what prices you got, what charges were applied, or whether your trades even went through correctly.

This case also highlights why documentation is powerful. When disputes arise, contract notes and email records are what protect you.

If they are missing, your ability to prove your case becomes weak, even if the broker made mistakes.

Finally, this order is a reminder that regulatory action does not always equal investor compensation or protection.

SEBI may observe violations and still decide not to impose penalties. That doesn’t undo the harm to investors who were affected. So you cannot rely only on regulators to keep you safe; you must actively monitor your own account.

In short, the Nuvama complaints case teaches one clear lesson: Your safety in the stock market depends not just on rules, but on your awareness, your records, and your willingness to question anything that doesn’t look right.

What You Can Do to File Your Complaint Against Nuvama Wealth?

Facing issues with Nuvama Wealth? Contract notes missing? Invalid contact details causing problems? The complaint process doesn’t have to be complicated.

Register with us. We handle the complexity so you can focus on recovery.

Here’s how we support you at every stage:

Step 1: Evidence Collection and Documentation

We help you gather trading statements, ledger reports, contract notes, email correspondence with Nuvama, SMS alerts, screenshots showing invalid email IDs or shared contact details, bank statements, and KYC documents.

We organize these systematically so your complaint has solid backing.

Step 2: Complaint Drafting for Multiple Platforms

We prepare clear, precise complaints customized for SEBI SCORES, NSE, and BSE investor cells, and SMART ODR proceedings.

Our experience with these platforms means your complaint gets accepted quickly without formatting issues or missing information.

Step 3: Filing Process Guidance

We walk you through submitting complaints on SCORES and SMART ODR portals.

You’ll know which category to select, how to upload documents, what reference numbers to note, and how to check status updates. We ensure every field is filled accurately.

Step 4: Response Management and Follow-Up

We help you analyze the broker’s response and draft counter-responses when needed.

When regulators ask for clarifications or additional documents, we ensure you provide exactly what’s needed within deadlines. We track timelines and send reminders.

Step 5: Escalation Strategy

If your complaint doesn’t get resolved at the first level, we advise on escalation routes, whether approaching the exchange’s appellate mechanism, filing with SEBI, or preparing for arbitration. We explain each option clearly.

Step 6: End-to-End Case Management

From registration to resolution, we manage your entire case.

We maintain complete timelines, coordinate before deadlines, prepare you for hearings or counselling sessions, and provide a dedicated point of contact who understands your case.

Step 7: Arbitration and Hearing Support

If your matter proceeds to arbitration in stock market, we help prepare written statements, organize documents, draft submissions responding to the broker’s defense, and prepare you for proceedings so you can present your case confidently.

Don’t let broker negligence go unchallenged. Register with us today.

Conclusion

The Nuvama Wealth case leaves a bitter taste. Multiple violations were proven. Sixty-three clients didn’t receive contract notes. Invalid emails. Missing consent forms. Poor documentation.

Yet the outcome was zero penalty. Just an observation that they should do better next time.

This isn’t encouraging for retail investors. Regulations exist to protect you. But protection without enforcement is just words on paper.

The lesson here isn’t that Nuvama got away with violations. The lesson is that you can’t depend entirely on regulatory oversight. Your vigilance is your primary protection.

Check your contract notes. Verify your contact details. Maintain proper documentation. Question anything suspicious. Report violations immediately.

Because in India’s investment landscape, sometimes the best protection is self-protection. Stay informed. Stay alert.

And never assume that just because a broker is large and reputed, everything is automatically fine.

Your money deserves better. Your investments deserve proper documentation. And you deserve a broker who treats compliance as mandatory, not optional.